ERISA attorney jobs offer a unique and challenging path for legal professionals, specializing in the complex world of employee retirement income security. These attorneys play a crucial role in ensuring the proper administration and enforcement of ERISA, the federal law governing employee benefit plans.

From advising employers on plan design and compliance to representing individuals in disputes over benefits, ERISA attorneys navigate a multifaceted legal landscape. Their work often involves interpreting intricate regulations, analyzing complex legal arguments, and advocating for their clients’ interests in a variety of settings, including courts, administrative agencies, and negotiation tables.

Educational Requirements and Licensing

ERISA attorneys require a strong foundation in legal principles and specialized knowledge in employee benefits law. They must possess a Juris Doctor (JD) degree and pass the bar exam in the state where they intend to practice.

Educational Background

ERISA attorneys typically have a JD degree from an accredited law school. This rigorous legal education equips them with the fundamental legal principles and analytical skills necessary to practice law. During law school, they may take elective courses in employee benefits law, labor law, or tax law, which provide a specialized foundation in ERISA.

Licensing Requirements

To practice law in the United States, attorneys must pass the bar exam in the state where they intend to practice. The bar exam is a comprehensive test that assesses an attorney’s knowledge of legal principles, legal writing, and professional ethics. Passing the bar exam is a prerequisite for obtaining a license to practice law and is a crucial step in becoming an ERISA attorney.

Specialized Training and Certifications

While not mandatory, specialized training and certifications can enhance an ERISA attorney’s career prospects. These programs provide in-depth knowledge of specific areas within ERISA, such as retirement plans, health insurance, or disability benefits. Some examples include:

- Certified Employee Benefits Specialist (CEBS): This certification demonstrates expertise in employee benefits law, including ERISA compliance, plan design, and administration. It is offered by the International Foundation of Employee Benefit Plans (IFEBP).

- Qualified Pension Administrator (QPA): This certification focuses on retirement plan administration, including compliance with ERISA regulations and plan design. It is offered by the American Society of Pension Professionals & Actuaries (ASPPA).

- ERISA Compliance Specialist: This certification is offered by various organizations and focuses on specific aspects of ERISA compliance, such as fiduciary responsibilities, plan audits, and reporting requirements.

These certifications demonstrate a commitment to specialized knowledge and can enhance an attorney’s credibility and marketability in the field of ERISA law.

Job Market and Career Paths

The field of ERISA law is a specialized area of practice that offers a variety of career paths and advancement opportunities. While the demand for ERISA attorneys is generally stable, competition for positions can be fierce, particularly in major metropolitan areas.

Job Market Trends

The demand for ERISA attorneys is influenced by several factors, including the overall health of the economy, changes in legislation, and the growth of employer-sponsored retirement plans. While the demand for ERISA attorneys is generally stable, competition for positions can be fierce, particularly in major metropolitan areas.

- Growing Demand: The increasing complexity of employee benefit plans and the rise of new retirement savings programs, such as 401(k) plans, have contributed to an increase in the demand for ERISA attorneys. This trend is expected to continue as more employers adopt these plans.

- Competition: Despite the growing demand, competition for ERISA attorney positions can be intense, especially in major cities. This is due to the specialized nature of the field and the relatively small number of attorneys who specialize in ERISA law.

Career Paths and Advancement Opportunities

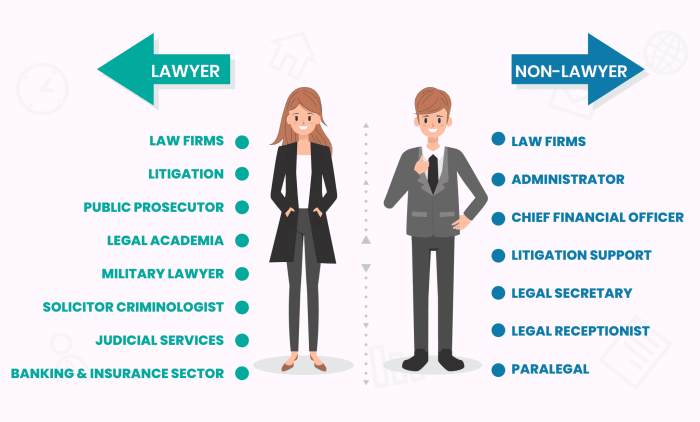

ERISA attorneys can pursue a variety of career paths, from working in large law firms to serving as in-house counsel for corporations.

- Law Firms: ERISA attorneys can work in large law firms, where they typically specialize in representing employers, plan administrators, and other fiduciaries in ERISA litigation and compliance matters.

- In-House Counsel: ERISA attorneys can also work as in-house counsel for corporations, where they provide legal advice and guidance on employee benefit plans and compliance with ERISA.

- Government Agencies: ERISA attorneys can also work for government agencies, such as the Department of Labor, where they investigate and enforce compliance with ERISA.

- Academia: Some ERISA attorneys choose to pursue careers in academia, teaching and researching ERISA law.

Salary and Benefits

The salary for ERISA attorneys varies depending on factors such as experience, location, and employer.

- Salary Range: According to the U.S. Bureau of Labor Statistics, the median annual salary for lawyers in 2022 was $127,990. ERISA attorneys with significant experience and expertise in the field can earn salaries well above this median.

- Benefits: In addition to salary, ERISA attorneys typically receive a comprehensive benefits package, which may include health insurance, dental insurance, vision insurance, retirement plans, and paid time off.

Resources and Networks

ERISA attorneys need access to a wide range of resources and networks to stay informed, build their expertise, and connect with other professionals in the field. These resources are crucial for staying up-to-date on legal developments, navigating complex cases, and expanding their professional reach.

Professional Organizations and Associations

Professional organizations and associations provide ERISA attorneys with valuable opportunities for networking, professional development, and access to resources. These organizations offer a platform for sharing knowledge, staying current on legal trends, and advocating for the interests of the ERISA legal community.

- American Bar Association (ABA): The ABA’s Section of Labor and Employment Law offers resources, publications, and events specifically for ERISA attorneys. It provides a forum for legal professionals to discuss complex issues, network with peers, and stay abreast of legal developments.

- American Society of Pension Professionals & Actuaries (ASPPA): ASPPA is a leading organization for professionals involved in retirement plans, including ERISA attorneys. It offers educational programs, publications, and networking opportunities, fostering collaboration between attorneys and other professionals in the field.

- National Conference of Bar Presidents (NCBP): The NCBP provides a platform for state and local bar presidents to share best practices and address common challenges. It offers valuable resources for ERISA attorneys seeking to engage with their local bar associations and contribute to the legal community.

Online Resources, Legal Databases, and Publications, Erisa attorney jobs

ERISA attorneys rely on a variety of online resources, legal databases, and publications to stay informed and conduct their legal research. These resources provide access to legal precedents, statutes, regulations, and expert analysis, supporting their ability to navigate complex ERISA issues.

- Westlaw and LexisNexis: These legal databases offer comprehensive collections of legal materials, including case law, statutes, regulations, and legal articles, providing ERISA attorneys with a wealth of information for research and analysis.

- ERISA Litigation Reporter: This specialized publication provides in-depth coverage of ERISA litigation, offering analysis of key cases, legal developments, and practical insights for attorneys handling ERISA disputes.

- Employee Benefits Security Administration (EBSA): The EBSA website offers a wealth of information on ERISA regulations, compliance guidance, and enforcement actions. It is a valuable resource for attorneys seeking to understand the nuances of ERISA compliance and navigate potential legal issues.

Networking Opportunities and Career Development Resources

Networking and career development are essential for ERISA attorneys to build their professional network, gain new skills, and advance their careers. Attending industry conferences, joining professional organizations, and participating in online forums offer opportunities to connect with peers, learn from experts, and explore new career paths.

- Conferences and Events: Industry conferences such as the ABA’s Annual Meeting, the ASPPA Annual Conference, and the ERISA Litigation Conference offer valuable networking opportunities, educational sessions, and insights into current trends in ERISA law.

- Professional Organizations: Joining professional organizations such as the ABA’s Section of Labor and Employment Law, ASPPA, and the National Conference of Bar Presidents provides opportunities to network with peers, attend events, and access valuable resources.

- Online Forums: Online forums and discussion groups dedicated to ERISA law offer a platform for attorneys to connect with peers, share insights, and seek advice on complex legal issues.

Final Thoughts: Erisa Attorney Jobs

The field of ERISA law continues to evolve, presenting both challenges and opportunities for attorneys. By understanding the complexities of ERISA, its impact on employers and employees, and the unique skills required to navigate this legal terrain, aspiring ERISA attorneys can carve out a fulfilling and impactful career path.

Commonly Asked Questions

What is ERISA?

ERISA stands for the Employee Retirement Income Security Act of 1974. It is a federal law that sets minimum standards for most voluntarily established retirement and health plans in private industry.

What are the typical salary ranges for ERISA attorneys?

Salary ranges for ERISA attorneys vary based on experience, location, and employer. Entry-level positions typically start in the $70,000 to $100,000 range, while experienced attorneys can earn significantly more.

What are some of the challenges faced by ERISA attorneys?

ERISA attorneys often face complex legal issues, demanding clients, and tight deadlines. They must stay abreast of constantly evolving regulations and case law, while also navigating the intricacies of benefit plan administration.