- Overview of Bankruptcy in Michigan

- Filing for Bankruptcy Without an Attorney

- Advantages and Disadvantages of Self-Representation

- Resources for Self-Representation

- Common Mistakes to Avoid

- When to Seek Legal Advice

- End of Discussion: Filing Bankruptcy In Michigan Without An Attorney

- Essential Questionnaire

Filing bankruptcy in Michigan without an attorney can seem daunting, but it’s possible. This guide will walk you through the process, outlining the different types of bankruptcy available, the steps involved, and the potential benefits and risks of self-representation.

We’ll cover everything from the necessary forms and documents to the deadlines and court appearances. We’ll also provide resources to help you navigate this complex process, empowering you to make informed decisions about your financial future.

Overview of Bankruptcy in Michigan

Bankruptcy is a legal process that allows individuals and businesses to get relief from overwhelming debt. In Michigan, there are several different types of bankruptcy that individuals and businesses can file for, each with its own eligibility requirements and consequences.

Types of Bankruptcy in Michigan, Filing bankruptcy in michigan without an attorney

Bankruptcy in Michigan is governed by federal law, but there are certain state-specific laws that may apply. The three main types of bankruptcy available in Michigan are Chapter 7, Chapter 13, and Chapter 11.

- Chapter 7 Bankruptcy is often referred to as “liquidation bankruptcy.” In Chapter 7, a trustee is appointed to sell the debtor’s non-exempt assets to pay creditors. The debtor is then discharged from most of their debts, and they are able to start fresh financially. Chapter 7 is generally the best option for debtors who have few assets and are unable to repay their debts through a Chapter 13 plan.

- Chapter 13 Bankruptcy is a “reorganization” bankruptcy. In Chapter 13, the debtor proposes a plan to repay their creditors over a period of three to five years. The debtor’s income and expenses are reviewed, and the plan is designed to be affordable for the debtor. Chapter 13 is often a better option for debtors who have a steady income and are able to make monthly payments.

- Chapter 11 Bankruptcy is a “reorganization” bankruptcy for businesses. In Chapter 11, the debtor proposes a plan to restructure its debts and continue operating. The debtor’s creditors must vote on the plan, and the plan must be approved by the bankruptcy court. Chapter 11 is often used by businesses that are experiencing financial difficulties but are still viable.

Eligibility Requirements for Bankruptcy in Michigan

The eligibility requirements for each type of bankruptcy vary.

- Chapter 7 Bankruptcy requires that the debtor pass the “means test.” This test compares the debtor’s income to the median income for their state. If the debtor’s income is below the median income, they are generally eligible for Chapter 7. However, there are some exceptions to this rule.

- Chapter 13 Bankruptcy requires that the debtor have regular income and be able to make monthly payments. The debtor’s debt must also be within certain limits.

- Chapter 11 Bankruptcy is available to businesses of all sizes. However, the debtor must be able to propose a plan that is feasible and will allow the business to continue operating.

Consequences of Filing for Bankruptcy in Michigan

Filing for bankruptcy can have a number of consequences, both positive and negative.

- Positive consequences of filing for bankruptcy include:

- Relief from overwhelming debt

- A fresh start financially

- Protection from creditors

- Negative consequences of filing for bankruptcy include:

- A negative impact on your credit score

- The loss of some assets

- The potential for a bankruptcy discharge to be revoked

Filing for Bankruptcy Without an Attorney

Filing for bankruptcy in Michigan without an attorney can be a complex and challenging process. While it is possible to file pro se, it is highly recommended that you consult with an attorney to understand your options and ensure that you are filing correctly.

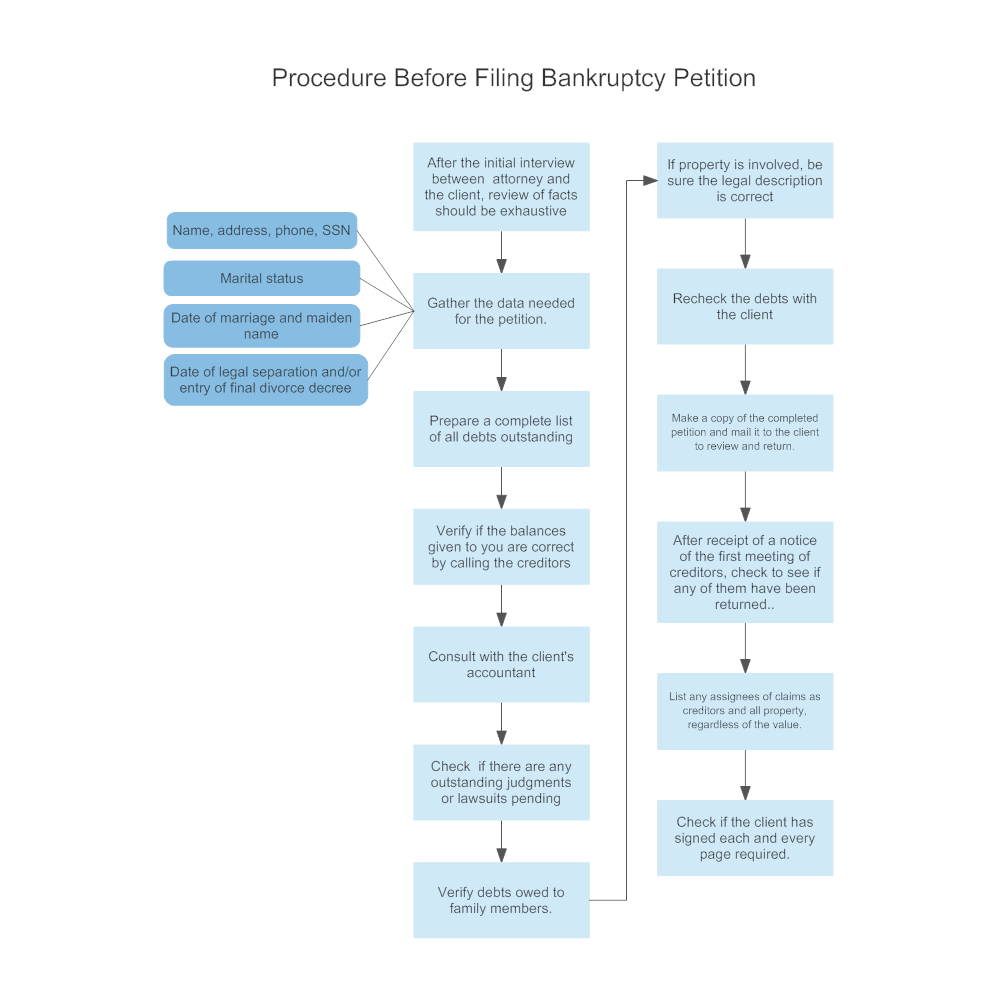

Steps Involved in Filing for Bankruptcy

Before you begin the process of filing for bankruptcy, it is crucial to gather all the necessary information and documents. These include:

- Your Social Security number

- Your driver’s license or other government-issued identification

- Your income and expense information for the past six months

- A list of your assets, including their value

- A list of your debts, including the amount owed, the creditor’s name, and the account number

- Your tax returns for the past two years

- Any other relevant documents, such as pay stubs, bank statements, and credit card statements

Once you have gathered all the necessary information, you can begin the process of filing for bankruptcy. The steps involved include:

- Choose the Chapter of Bankruptcy You Want to File: In Michigan, you can file for Chapter 7 or Chapter 13 bankruptcy. Chapter 7 bankruptcy is a liquidation bankruptcy, where your assets are sold to pay off your debts. Chapter 13 bankruptcy is a reorganization bankruptcy, where you create a payment plan to repay your debts over time.

- File the Bankruptcy Petition: The bankruptcy petition is the main document that you file with the court. It contains information about your finances, including your income, expenses, assets, and debts.

- File the Schedules: The bankruptcy schedules are a series of forms that provide detailed information about your finances. You will need to file schedules for your assets, liabilities, income, and expenses.

- File the Statement of Financial Affairs: This form provides additional information about your finances, including your employment history, your income sources, and your recent transactions.

- File the Credit Counseling Certificate: You are required to complete credit counseling before you can file for bankruptcy. You will need to obtain a certificate from a credit counseling agency.

- File the Debtor’s Examination: You will be required to appear at a meeting with the bankruptcy trustee. At this meeting, the trustee will ask you questions about your finances.

- Attend the 341 Meeting: This meeting is an opportunity for your creditors to ask you questions about your finances.

- File the Discharge: Once you have completed the bankruptcy process, you will receive a discharge order. This order releases you from your debts.

Deadlines and Court Appearances

There are several deadlines and court appearances associated with the bankruptcy process. For example, you must file your bankruptcy petition within 180 days of receiving credit counseling. You will also need to attend the 341 meeting, which is typically scheduled within 30 to 45 days of filing your bankruptcy petition.

Advantages and Disadvantages of Self-Representation

Filing for bankruptcy without an attorney, also known as self-representation or pro se representation, can be a complex process. It’s crucial to understand the potential benefits and drawbacks before making a decision.

Cost Savings

Choosing to represent yourself in bankruptcy proceedings can lead to significant cost savings. Attorney fees can be substantial, especially for complex cases. However, the cost of hiring an attorney should be weighed against the potential risks and complications of self-representation.

Potential Benefits of Self-Representation

- Cost Savings: The most significant advantage of self-representation is the potential for significant cost savings. You won’t have to pay attorney fees, which can range from a few thousand dollars to tens of thousands of dollars depending on the complexity of the case.

- Control and Flexibility: Filing for bankruptcy without an attorney gives you complete control over your case. You can make all the decisions, file documents on your own timeline, and communicate directly with the court. This allows for greater flexibility and control over the process.

- Personal Knowledge: You are the one who understands your financial situation best. By representing yourself, you can ensure that the information presented to the court accurately reflects your circumstances.

Costs of Hiring an Attorney

- Hourly Fees: Most bankruptcy attorneys charge hourly fees, which can vary depending on the attorney’s experience, location, and the complexity of the case. The average hourly rate for a bankruptcy attorney in Michigan is between $200 and $400.

- Flat Fees: Some attorneys may offer flat fees for specific bankruptcy services, such as filing a Chapter 7 or Chapter 13 case. Flat fees can range from a few thousand dollars to tens of thousands of dollars.

- Contingency Fees: In rare cases, bankruptcy attorneys may accept contingency fees, where they only get paid if the case is successful. However, contingency fees are not common in bankruptcy cases.

Risks of Self-Representation

- Lack of Legal Expertise: Bankruptcy law is complex and constantly changing. Without legal training, you may not understand the intricacies of the law, the proper procedures, or the deadlines for filing documents. This could lead to mistakes that could jeopardize your case.

- Difficulty Navigating the Legal System: The bankruptcy process involves a significant amount of paperwork, court appearances, and communication with creditors. Navigating the legal system can be challenging for someone without legal experience.

- Increased Risk of Adverse Outcomes: Without an attorney’s guidance, you may not be able to negotiate the best possible outcome for your case. This could lead to a less favorable discharge of debt, a longer repayment plan, or even the denial of your bankruptcy petition.

Resources for Self-Representation

Filing for bankruptcy in Michigan without an attorney can be a challenging process, but it’s not impossible. There are a number of resources available to help you navigate the process, including government agencies, non-profit organizations, and legal aid programs.

Government Agencies

Government agencies offer valuable information and resources to individuals filing for bankruptcy. These agencies are committed to providing guidance and support to ensure a fair and transparent process.

- United States Bankruptcy Court for the Eastern District of Michigan: This court handles bankruptcy cases in Michigan. They offer a variety of resources, including forms, instructions, and information on the bankruptcy process.

- Website: https://www.mied.uscourts.gov/

- Phone: (313) 234-5100

- United States Trustee Program: The United States Trustee Program oversees bankruptcy cases and provides information on the bankruptcy process, including forms and instructions.

- Website: https://www.justice.gov/ust/

- Phone: (800) 859-1504

- Michigan Legal Help: Michigan Legal Help is a website that provides free legal information and resources to Michigan residents, including information on bankruptcy.

- Website: https://www.michiganlegalhelp.org/

- Phone: (800) 777-0000

Non-Profit Organizations

Non-profit organizations provide valuable support and resources to individuals filing for bankruptcy. These organizations offer guidance, education, and advocacy services to help individuals navigate the complex legal system.

- National Consumer Law Center: The National Consumer Law Center provides information and resources on a variety of consumer issues, including bankruptcy.

- Website: https://www.nclc.org/

- Phone: (617) 542-8010

- The National Association of Consumer Bankruptcy Attorneys: This organization provides information and resources for individuals filing for bankruptcy, including a directory of attorneys.

- Website: https://www.nacba.org/

- Phone: (202) 393-1200

Legal Aid Programs

Legal aid programs offer free or low-cost legal assistance to individuals who cannot afford to hire an attorney. These programs are vital resources for individuals facing financial hardship and navigating the complexities of the legal system.

- Legal Aid and Defender Association of Detroit: This organization provides free legal assistance to low-income individuals in Detroit, including assistance with bankruptcy cases.

- Website: https://www.ladad.org/

- Phone: (313) 962-0800

- Michigan Legal Services: This organization provides free legal assistance to low-income individuals throughout Michigan, including assistance with bankruptcy cases.

- Website: https://www.michiganlegalservices.org/

- Phone: (800) 777-0000

Common Mistakes to Avoid

Filing for bankruptcy without an attorney can be challenging, and making mistakes can have serious consequences. It’s crucial to understand common pitfalls and take steps to avoid them. This section Artikels some common mistakes and how to prevent them.

Incorrectly Completing Forms

Bankruptcy forms are complex and require careful completion. Even a small error can lead to delays or rejection of your case. For example, failing to disclose all assets or liabilities can have severe repercussions, including dismissal of your case.

“It’s important to be thorough and accurate when completing bankruptcy forms. Double-check your information and seek help if you need it.”

- Read Instructions Carefully: Thoroughly read all instructions accompanying the forms. Pay attention to specific requirements and deadlines.

- Seek Assistance: If you are unsure about any information, seek assistance from a qualified bankruptcy professional or a court-approved credit counseling agency.

- Double-Check Your Work: Carefully review all forms before submitting them. Ensure all information is accurate and complete.

Failing to Meet Deadlines

Bankruptcy deadlines are strict. Missing a deadline can lead to penalties or dismissal of your case. For instance, failing to file your bankruptcy petition within the statutory time frame could result in the case being dismissed.

“Meeting deadlines is critical in bankruptcy proceedings. Keep track of all deadlines and act promptly to avoid any potential issues.”

- Set Reminders: Use a calendar or reminder system to track all important deadlines.

- Seek Extensions: If you anticipate difficulty meeting a deadline, consider seeking an extension from the court. However, extensions are not always granted.

- File Early: If possible, file your bankruptcy petition well in advance of the deadline to avoid any last-minute complications.

Not Disclosing All Assets and Liabilities

Full disclosure of all assets and liabilities is crucial in bankruptcy proceedings. Failing to disclose all assets can lead to penalties, including dismissal of your case. For instance, hiding assets or understating liabilities can result in fraud charges.

“Be truthful and transparent when disclosing your assets and liabilities. Omitting information can have severe consequences.”

- Review Your Finances: Carefully review your financial records and create a comprehensive list of all your assets and liabilities.

- Consult with Professionals: If you are unsure about what assets or liabilities to disclose, seek guidance from a bankruptcy professional or a court-approved credit counseling agency.

- Avoid Hiding Assets: Don’t attempt to hide assets or understate your liabilities. This can lead to serious legal consequences.

When to Seek Legal Advice

While filing for bankruptcy in Michigan without an attorney is possible, it’s crucial to understand when professional legal guidance is necessary. Navigating the complexities of bankruptcy law can be challenging, and seeking legal advice can ensure your rights are protected and that you make informed decisions.

Situations Requiring Legal Representation

There are situations where legal representation is essential. A bankruptcy attorney can provide valuable insights, navigate legal complexities, and ensure your best interests are represented throughout the process.

- Complex Financial Situations: If you have a complex financial situation involving multiple creditors, secured debts, or significant assets, an attorney can help you understand your options and develop a strategy that aligns with your specific needs.

- Potential Challenges: If you anticipate facing objections from creditors or potential legal disputes, an attorney can advocate for you and protect your rights.

- Understanding Legal Requirements: Bankruptcy law is complex, and an attorney can help you understand the legal requirements, filing procedures, and potential consequences.

- Negotiating with Creditors: An attorney can negotiate with creditors on your behalf, potentially securing more favorable terms and reducing your overall debt burden.

- Protecting Your Assets: Bankruptcy law allows for exemptions that protect certain assets from being liquidated. An attorney can help you identify and claim these exemptions to safeguard your property.

Factors to Consider When Choosing a Bankruptcy Attorney

Choosing the right bankruptcy attorney is crucial for a successful outcome. Here are factors to consider:

- Experience: Look for an attorney with extensive experience in bankruptcy law and a proven track record of success.

- Reputation: Research the attorney’s reputation and client reviews to gauge their professionalism and expertise.

- Communication: Choose an attorney who communicates effectively, explains legal concepts clearly, and keeps you informed throughout the process.

- Fees: Discuss the attorney’s fees upfront and ensure you understand the payment structure and any additional costs.

- Compatibility: It’s essential to feel comfortable and confident with your attorney. Choose someone you can trust and who understands your financial situation.

End of Discussion: Filing Bankruptcy In Michigan Without An Attorney

While filing for bankruptcy without an attorney can save you money, it’s crucial to understand the complexities and potential pitfalls involved. If you’re unsure about any aspect of the process or if your situation is particularly complex, seeking legal advice from a qualified bankruptcy attorney is highly recommended.

Essential Questionnaire

What are the different types of bankruptcy in Michigan?

Michigan offers Chapter 7, Chapter 13, and Chapter 11 bankruptcy. Chapter 7 is liquidation, Chapter 13 is a repayment plan, and Chapter 11 is for businesses.

How do I find the necessary forms for filing bankruptcy?

You can download forms from the U.S. Courts website or obtain them from the bankruptcy court clerk’s office.

What happens after I file for bankruptcy?

The court will review your case and hold a meeting of creditors. If your case is approved, you’ll be discharged from your debts.

Can I still own a car after filing bankruptcy?

It depends on the type of bankruptcy you file and the terms of your loan. You may be able to keep your car, but it may be subject to certain conditions.

What are some common mistakes to avoid when filing for bankruptcy?

Avoid hiding assets, failing to disclose all your debts, and neglecting to file all necessary paperwork.