Florida average car insurance rates are a hot topic, particularly for those navigating the Sunshine State’s unique insurance landscape. This article delves into the factors that influence these rates, exploring the impact of driving history, age, vehicle type, location, and coverage levels. We’ll also examine how Florida’s no-fault insurance system plays a significant role in shaping car insurance costs.

From understanding the average rates in different cities and counties to exploring the pricing strategies of major insurance companies, this guide provides valuable insights for both current and prospective Florida residents.

Factors Influencing Florida Car Insurance Rates

Florida is known for its high car insurance rates, influenced by various factors. These rates are determined by a complex interplay of elements that insurance companies consider when assessing risk and setting premiums.

Driving History, Florida average car insurance rates

Your driving history is a crucial factor in determining your car insurance rates. Insurance companies view a clean driving record as a sign of responsible driving behavior, while accidents, traffic violations, and DUI convictions indicate a higher risk of future claims. A history of accidents, particularly those involving injuries or property damage, significantly increases your premiums. Similarly, traffic violations, such as speeding tickets, reckless driving, or running red lights, can result in higher rates.

Age

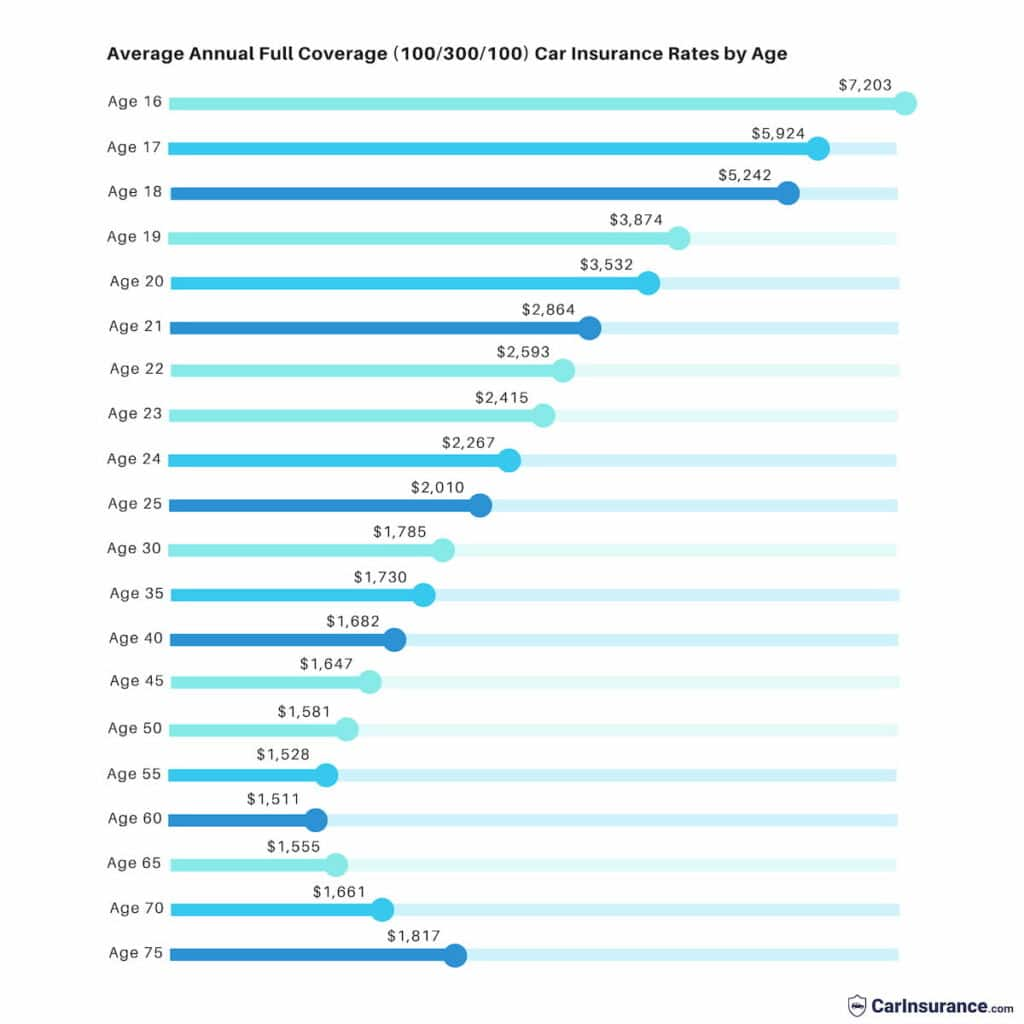

Age plays a significant role in car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher premiums for younger drivers. Conversely, older drivers, over 65, often enjoy lower rates due to their more cautious driving habits and lower accident frequency.

Vehicle Type

The type of vehicle you drive significantly influences your car insurance rates. High-performance cars, luxury vehicles, and expensive SUVs are generally more expensive to repair or replace in case of an accident. These vehicles are often associated with higher premiums. Conversely, less expensive and safer vehicles with good safety ratings often attract lower rates.

Location

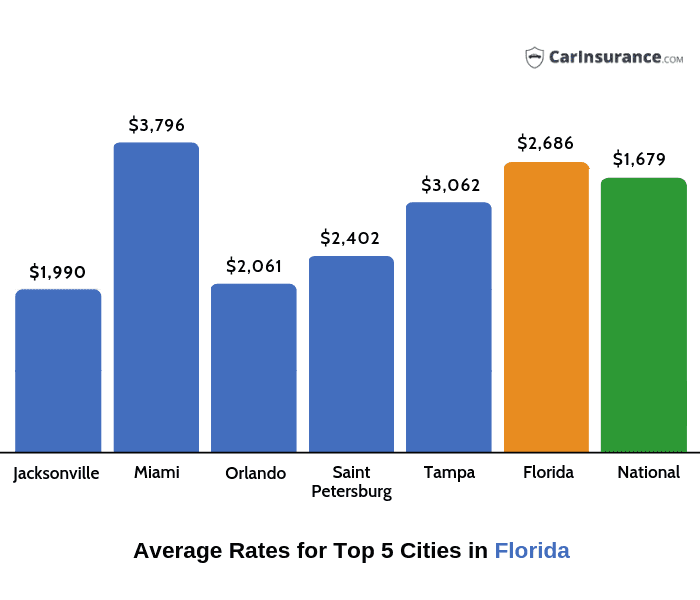

Your location in Florida is a significant factor in determining your car insurance rates. Urban areas with high traffic density and higher crime rates tend to have higher insurance premiums. Conversely, rural areas with lower traffic volume and fewer accidents typically have lower rates.

Coverage Levels

The level of coverage you choose directly impacts your car insurance premiums. Comprehensive coverage, which protects against damage from events like theft, vandalism, and natural disasters, is optional. Collision coverage, which covers damage to your vehicle in an accident, is also optional. However, if you have a car loan, your lender may require you to carry both comprehensive and collision coverage. Liability coverage, which protects you financially if you are responsible for an accident that injures someone or damages their property, is mandatory in Florida. Higher liability limits offer greater protection but also result in higher premiums.

Florida’s No-Fault Insurance System

Florida has a no-fault insurance system, where drivers are required to carry Personal Injury Protection (PIP) coverage. This coverage pays for medical expenses and lost wages regardless of who is at fault in an accident. Florida’s no-fault system aims to reduce the number of lawsuits related to car accidents. However, it can also contribute to higher insurance premiums, as PIP coverage is mandatory and can be expensive.

Average Car Insurance Rates by City and County

Car insurance rates in Florida vary significantly depending on the location. This variation is influenced by several factors, including population density, crime rates, and traffic congestion. Understanding these differences can help you find the best car insurance rates for your specific location.

Average Car Insurance Rates in Florida Cities and Counties

The table below displays the average car insurance rates for major cities and counties in Florida, based on data from [Insert Source]:

| City/County | Average Rate | Rate Range | Key Factors |

|---|---|---|---|

| Miami-Dade County | $2,500 | $1,800 – $3,500 | High population density, high crime rates, heavy traffic congestion |

| Tampa | $2,000 | $1,500 – $2,800 | Moderate population density, moderate crime rates, moderate traffic congestion |

| Orlando | $1,800 | $1,300 – $2,500 | High population density, moderate crime rates, moderate traffic congestion |

| Jacksonville | $1,600 | $1,200 – $2,200 | Moderate population density, moderate crime rates, moderate traffic congestion |

| Palm Beach County | $2,200 | $1,600 – $3,000 | High population density, moderate crime rates, moderate traffic congestion |

| Broward County | $2,300 | $1,700 – $3,200 | High population density, high crime rates, heavy traffic congestion |

Factors Contributing to Rate Variations

The average car insurance rates across different regions of Florida vary due to several key factors.

- Population Density: Areas with higher population density, such as Miami-Dade County and Broward County, tend to have higher car insurance rates. This is because there are more cars on the road, increasing the risk of accidents.

- Crime Rates: Cities and counties with higher crime rates, such as Miami-Dade County and Broward County, also tend to have higher car insurance rates. This is because insurance companies have to pay out more claims for stolen or damaged vehicles in these areas.

- Traffic Congestion: Areas with heavy traffic congestion, such as Miami-Dade County and Broward County, also tend to have higher car insurance rates. This is because accidents are more likely to occur in congested areas.

Impact of Factors on Insurance Premiums

The impact of these factors on insurance premiums can be significant. For example, a driver living in Miami-Dade County, with its high population density, high crime rates, and heavy traffic congestion, can expect to pay significantly higher car insurance premiums compared to a driver living in a rural area of Florida.

“The cost of car insurance is not just about the car you drive, but also where you drive it.”

Insurance Companies and Their Rates

Florida is home to numerous car insurance companies, each offering a range of coverage options and rates. Understanding the different providers and their pricing strategies is crucial for finding the best insurance policy that meets your needs and budget.

Major Car Insurance Companies in Florida

Several major insurance companies operate in Florida, catering to diverse customer needs. These companies are known for their wide coverage options, competitive rates, and established reputation.

- State Farm: State Farm is one of the largest insurance providers in the US, offering comprehensive car insurance coverage in Florida. They are known for their customer service and various discounts.

- GEICO: GEICO is another major player in the Florida insurance market, known for its competitive rates and convenient online services. They offer a wide range of coverage options and discounts.

- Progressive: Progressive is a popular choice for drivers seeking customized coverage options and innovative features. They offer a range of discounts and a user-friendly online platform.

- Allstate: Allstate is a well-established insurance company with a strong presence in Florida. They offer a wide range of coverage options, including specialized insurance for classic cars.

- USAA: USAA is a highly-rated insurance company that primarily serves military personnel and their families. They offer competitive rates and excellent customer service.

Average Car Insurance Rates by Company

The average car insurance rates in Florida vary significantly depending on the company, coverage options, and individual factors. Here is a table displaying the average rates offered by different insurance companies, along with their key features and benefits:

| Company Name | Average Rate | Coverage Options | Key Features |

|---|---|---|---|

| State Farm | $2,000 | Comprehensive, Collision, Liability, Personal Injury Protection (PIP), Uninsured/Underinsured Motorist (UM/UIM) | Discounts for good driving record, multiple policies, safety features |

| GEICO | $1,800 | Comprehensive, Collision, Liability, PIP, UM/UIM | Competitive rates, convenient online services, 24/7 customer support |

| Progressive | $1,900 | Comprehensive, Collision, Liability, PIP, UM/UIM, Customized coverage options | Name Your Price tool, discounts for good driving record, safety features |

| Allstate | $2,100 | Comprehensive, Collision, Liability, PIP, UM/UIM, Classic car insurance | Discounts for good driving record, multiple policies, safety features |

| USAA | $1,700 | Comprehensive, Collision, Liability, PIP, UM/UIM | Competitive rates, excellent customer service, discounts for military personnel |

It’s important to note that these are average rates and actual premiums may vary based on individual factors such as driving history, age, vehicle type, and location.

Comparison of Pricing Strategies and Customer Service

Insurance companies employ different pricing strategies and customer service approaches to attract and retain customers. Understanding these differences can help you make an informed decision when choosing an insurance provider.

- State Farm: State Farm focuses on building long-term relationships with customers by offering personalized service and competitive rates. They emphasize customer satisfaction and have a strong reputation for their customer service.

- GEICO: GEICO emphasizes affordability and convenience, offering competitive rates and easy online services. They are known for their efficient claims processing and 24/7 customer support.

- Progressive: Progressive adopts a more customized approach, offering flexible coverage options and innovative features like their Name Your Price tool. They prioritize customer choice and strive to provide a personalized experience.

- Allstate: Allstate focuses on providing comprehensive coverage and peace of mind. They offer a wide range of coverage options, including specialized insurance for classic cars. Allstate is known for its strong financial stability and reliable customer service.

- USAA: USAA prioritizes serving military personnel and their families, offering competitive rates and exceptional customer service. They are known for their commitment to their members and their strong reputation for financial stability.

Tips for Saving on Car Insurance in Florida

Navigating the world of car insurance in Florida can be a challenge, but with some strategic planning, you can significantly reduce your premiums and keep more money in your pocket. By understanding the factors that influence your rates and implementing a few smart strategies, you can achieve substantial savings without compromising your coverage.

Maintaining a Good Driving Record

Your driving history is a major factor in determining your car insurance rates. Maintaining a clean driving record is crucial for securing lower premiums. Avoiding accidents, traffic violations, and DUI convictions can significantly reduce your insurance costs.

- Avoid Accidents: Accidents are a major factor in determining your insurance rates. Even minor accidents can lead to increased premiums. Drive defensively, be aware of your surroundings, and follow traffic laws to minimize your risk of accidents.

- Obey Traffic Laws: Traffic violations, such as speeding tickets, running red lights, and parking violations, can also increase your insurance rates. Always obey traffic laws and drive safely to avoid receiving any citations.

- Maintain a Clean Driving Record: By driving responsibly and avoiding accidents and violations, you can maintain a clean driving record, which will help you secure lower insurance premiums.

Taking Defensive Driving Courses

Taking a defensive driving course can demonstrate to insurers that you are committed to safe driving practices. These courses teach you valuable techniques for avoiding accidents and improving your driving skills, which can lead to lower insurance premiums.

- Reduced Premiums: Many insurance companies offer discounts to drivers who complete approved defensive driving courses. The discount can vary depending on the insurer and the course you take.

- Improved Driving Skills: Defensive driving courses provide valuable training on safe driving techniques, such as how to avoid distractions, manage speed, and handle challenging driving situations. This can lead to safer driving habits and potentially reduce your risk of accidents.

- Potential for Accident Forgiveness: Some insurers may offer accident forgiveness programs to drivers who complete defensive driving courses, which can help you avoid a premium increase after your first accident.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can result in lower premiums, as you are essentially taking on more financial responsibility in the event of an accident.

- Significant Savings: Increasing your deductible can lead to substantial savings on your car insurance premiums. However, it’s important to choose a deductible that you can comfortably afford in the event of an accident.

- Higher Deductible, Lower Premium: The higher your deductible, the lower your premium will generally be. Consider your financial situation and risk tolerance when deciding on your deductible amount.

- Financial Preparedness: Ensure you have enough funds set aside to cover your deductible in the event of an accident. This will help you avoid financial strain if you need to file a claim.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant discounts. Insurance companies often offer bundled packages at a lower rate than purchasing each policy separately.

- Cost Savings: Bundling your policies can result in substantial savings on your overall insurance premiums. Insurance companies often offer discounts for bundling multiple policies together.

- Convenience: Bundling your policies with one insurer simplifies your insurance management. You have a single point of contact for all your insurance needs, which can be convenient and efficient.

- Potential for Additional Discounts: Some insurers may offer additional discounts for bundling multiple policies, such as multi-car discounts or loyalty discounts.

Exploring Discounts for Safe Driving Practices

Insurance companies often offer discounts to drivers who demonstrate safe driving practices. These discounts can help you reduce your premiums and reward you for your responsible driving habits.

- Good Student Discount: If you are a student with good grades, you may qualify for a good student discount. This discount recognizes your commitment to academic excellence and responsible behavior.

- Safe Driver Discount: Many insurance companies offer discounts to drivers who have a clean driving record and have not been involved in any accidents or traffic violations. This discount rewards safe driving habits.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can reduce your insurance premiums. These devices deter theft and can help lower your risk of car theft.

Choosing the Right Coverage Levels

Choosing the right coverage levels for your car insurance policy is crucial for ensuring you have adequate protection without paying for unnecessary coverage. Understanding your policy terms and coverage options can help you save money on your premiums.

- Liability Coverage: Liability coverage protects you financially if you are responsible for an accident that causes injury or damage to others. It’s essential to have sufficient liability coverage to protect yourself from significant financial losses.

- Collision Coverage: Collision coverage protects you from damage to your own vehicle in an accident, regardless of who is at fault. This coverage is optional, and you may choose to waive it if your vehicle is older or has a low value.

- Comprehensive Coverage: Comprehensive coverage protects you from damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters. This coverage is also optional, and you may choose to waive it if your vehicle has a low value.

Understanding Policy Terms

Thoroughly understanding the terms and conditions of your car insurance policy is essential for making informed decisions about your coverage. Familiarizing yourself with key definitions, exclusions, and limitations can help you avoid unexpected costs and ensure you have the right coverage for your needs.

- Deductibles: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lead to lower premiums, but it’s important to ensure you can afford to pay it in the event of an accident.

- Exclusions: Understand the exclusions in your policy, which are specific situations or events that are not covered by your insurance. This will help you avoid surprises and ensure you have the right coverage for your needs.

- Limitations: Be aware of any limitations on your coverage, such as maximum payout amounts or time limits for filing claims. This will help you make informed decisions about your coverage and avoid unexpected costs.

The Impact of Florida’s Insurance Market: Florida Average Car Insurance Rates

Florida’s car insurance market is a complex and dynamic ecosystem, influenced by a multitude of factors, including the state’s unique demographics, climate, and legal landscape. This complex interplay of factors shapes the competitive landscape, impacting average insurance rates and the overall affordability of car insurance for Florida residents.

The Competitive Landscape and Its Impact on Rates

The Florida car insurance market is highly competitive, with numerous insurance companies vying for customers. This competition can lead to lower rates, as insurers try to attract policyholders with competitive pricing. However, the market is also characterized by a high concentration of insurance companies, with a few dominant players holding significant market share. This can limit competition and potentially result in higher rates.

- The presence of numerous smaller, regional insurance companies, alongside larger national insurers, adds to the market’s diversity and complexity.

- Florida’s unique regulatory environment, including the state’s no-fault insurance system and its high frequency of claims, also influences the competitive landscape and insurance rates.

The Role of Regulatory Changes and Legislative Actions

Regulatory changes and legislative actions have a significant impact on Florida’s car insurance market. These changes can affect insurance company profitability, consumer costs, and the overall availability of insurance.

- For instance, the Florida Legislature’s 2021 passage of Senate Bill 76, which included measures aimed at reducing insurance fraud and limiting attorney fees in certain cases, was intended to lower insurance costs for consumers. However, the impact of these measures on rates is still being evaluated.

- Another example is the state’s ongoing debate regarding the use of “Assignment of Benefits” (AOB) in property insurance claims. AOB allows policyholders to assign their benefits to third-party contractors, potentially leading to inflated repair costs and higher insurance premiums. Efforts to reform AOB have been a focus of recent legislative sessions, with the aim of controlling costs and preventing abuse.

Challenges Faced by Florida Residents in Finding Affordable Car Insurance

Florida residents face a number of challenges in finding affordable car insurance. These challenges are often amplified by the state’s unique insurance market dynamics.

- High insurance rates are a significant concern for many Floridians, particularly those in areas prone to natural disasters such as hurricanes and floods.

- The state’s no-fault insurance system, which requires drivers to carry Personal Injury Protection (PIP) coverage, can also contribute to higher premiums.

- Florida’s high population density and the prevalence of traffic accidents also contribute to the high cost of car insurance.

Potential Implications for the State’s Economy

The affordability of car insurance has significant implications for Florida’s economy. High insurance costs can burden individuals and businesses, potentially impacting their financial well-being and economic activity.

- For instance, high insurance premiums can make it more difficult for businesses to operate, potentially leading to job losses and slower economic growth.

- The high cost of car insurance can also discourage people from moving to or staying in Florida, potentially impacting the state’s population growth and economic development.

Epilogue

Navigating the Florida car insurance market can be complex, but by understanding the factors that influence rates and utilizing available resources, you can find the best coverage at a price that suits your needs. By taking advantage of discounts, comparing quotes, and making informed decisions about coverage levels, you can secure the protection you need while minimizing your insurance costs.

Key Questions Answered

What are the main factors that influence Florida car insurance rates?

Several factors influence car insurance rates in Florida, including your driving history, age, vehicle type, location, and coverage levels. A clean driving record, being a safe driver, and choosing a safe vehicle can all contribute to lower premiums.

Is car insurance mandatory in Florida?

Yes, Florida requires all drivers to carry at least the minimum liability insurance coverage.

What are the common types of car insurance coverage in Florida?

Common types of coverage include liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage.