- Florida Blue Overview

- Health Insurance Plans Offered

- Provider Network and Coverage

- Customer Service and Support

- Cost and Affordability

- Health and Wellness Programs

- Consumer Reviews and Ratings

- Comparison to Other Health Insurance Providers

- Outcome Summary: Florida Blue Health Care Insurance

- User Queries

Florida Blue health care insurance stands as a prominent player in the Sunshine State’s healthcare landscape, offering a wide array of plans designed to cater to diverse needs. From individual coverage to family plans and employer-sponsored options, Florida Blue provides comprehensive health insurance solutions backed by a robust provider network and a commitment to customer service. This guide delves into the intricacies of Florida Blue, exploring its history, plan offerings, provider network, customer support, cost considerations, and health and wellness programs.

Florida Blue’s history dates back to 1947, with its roots firmly planted in the Blue Cross and Blue Shield Association. Over the years, the company has evolved into a leading health insurer in Florida, serving millions of residents across the state. Driven by a mission to improve the health and well-being of its members, Florida Blue has become synonymous with quality healthcare and financial stability. This guide will shed light on the company’s mission, vision, and core values, providing insights into its commitment to its customers and the broader community.

Florida Blue Overview

Florida Blue, a leading health insurance provider in Florida, has a rich history spanning over 75 years. Established in 1947 as Blue Cross and Blue Shield of Florida, the company has consistently adapted to the evolving healthcare landscape, expanding its services and offerings to meet the diverse needs of its customers.

History and Evolution

Florida Blue’s journey began in the aftermath of World War II, when the demand for affordable and accessible healthcare grew significantly. Recognizing this need, the company was founded with the mission of providing quality healthcare coverage to Floridians. Over the decades, Florida Blue has undergone several transformations, expanding its reach and diversifying its product portfolio. In 1999, the company adopted the name Florida Blue to reflect its commitment to the state and its focus on delivering innovative healthcare solutions.

Mission, Vision, and Core Values

Florida Blue’s mission is to improve the health and well-being of the people and communities it serves. This mission is driven by the company’s vision of creating a healthier Florida, where everyone has access to quality, affordable healthcare. Florida Blue’s core values guide its actions and decisions, ensuring that its commitment to its mission and vision remains unwavering. These values include:

- Customer Focus: Florida Blue prioritizes its customers’ needs and strives to deliver exceptional service and support.

- Integrity: The company operates with honesty, transparency, and ethical behavior in all its dealings.

- Innovation: Florida Blue continuously seeks new ways to improve its products, services, and processes to meet the evolving needs of its customers.

- Community Involvement: Florida Blue is deeply committed to supporting the communities it serves through various philanthropic initiatives and programs.

Key Statistics

Florida Blue’s success is reflected in its impressive statistics:

- Market Share: Florida Blue holds a significant market share in the Florida health insurance market, providing coverage to millions of Floridians.

- Customer Base: The company boasts a vast customer base, encompassing individuals, families, and businesses of all sizes.

- Financial Performance: Florida Blue has consistently demonstrated strong financial performance, reflecting its commitment to responsible financial management and its ability to navigate the complexities of the healthcare industry.

Health Insurance Plans Offered

Florida Blue offers a wide range of health insurance plans designed to meet the diverse needs of individuals, families, and employers in Florida. These plans are categorized by coverage type, each offering different levels of benefits and cost-sharing arrangements.

Health Insurance Plan Options

Florida Blue provides a comprehensive selection of health insurance plans, encompassing individual, family, and employer-sponsored coverage. The table below Artikels the key characteristics of each plan type, including coverage type, key features, and target audience:

| Plan Name | Coverage Type | Key Features | Target Audience |

|---|---|---|---|

| Florida Blue HMO | Health Maintenance Organization (HMO) |

|

Individuals and families seeking affordable coverage with a focus on preventive care and routine medical services. |

| Florida Blue PPO | Preferred Provider Organization (PPO) |

|

Individuals and families who value flexibility in choosing providers and prefer a wider network of options. |

| Florida Blue POS | Point-of-Service (POS) |

|

Individuals and families seeking a balance between cost-effectiveness and flexibility, with the option for out-of-network care. |

| Florida Blue EPO | Exclusive Provider Organization (EPO) |

|

Individuals and families seeking affordable coverage with a restricted provider network and limited out-of-network options. |

Key Features of Florida Blue Plans

Florida Blue plans are known for their comprehensive benefits and customizable options. Key features include:

- Coverage for essential health benefits: Florida Blue plans cover essential health benefits mandated by the Affordable Care Act, including preventive care, hospitalization, prescription drugs, and mental health services.

- Prescription drug coverage: Florida Blue offers various prescription drug formularies, with varying co-pays and coverage levels depending on the plan.

- Dental and vision coverage: Optional dental and vision coverage is available, allowing individuals to tailor their plans to their specific needs.

- Telehealth services: Florida Blue offers telehealth services, providing convenient access to medical professionals via video conferencing or phone consultations.

- Wellness programs: Florida Blue encourages healthy lifestyles with wellness programs that offer incentives for preventive care and healthy habits.

- Customer support: Florida Blue provides comprehensive customer support through phone, email, and online resources.

Florida Blue Employer-Sponsored Plans

Florida Blue offers a range of employer-sponsored health insurance plans, tailored to the specific needs of businesses. These plans typically include:

- Group health insurance: Provides coverage to employees and their dependents through a single policy.

- Self-funded plans: Employers assume the financial risk for health care costs, often with administrative support from Florida Blue.

- Health savings accounts (HSAs): Allow employees to contribute pre-tax dollars to a dedicated account for health care expenses.

- Flexible spending accounts (FSAs): Allow employees to set aside pre-tax dollars for eligible health care and dependent care expenses.

Provider Network and Coverage

Florida Blue boasts a vast and comprehensive provider network across the state of Florida, ensuring members have access to quality healthcare services wherever they are. The network encompasses a wide range of healthcare professionals, hospitals, and facilities, offering extensive coverage and convenient access to care.

Provider Network Size and Scope

Florida Blue’s provider network is extensive, spanning across the entire state of Florida. It includes a vast number of doctors, hospitals, and other healthcare providers, ensuring members have a wide range of choices for their healthcare needs.

- Doctors: Florida Blue’s network comprises thousands of physicians across various specialties, including primary care, specialists, and surgeons. This extensive network ensures members have access to qualified healthcare professionals in their local communities.

- Hospitals: The network includes hundreds of hospitals across Florida, ranging from major academic medical centers to smaller community hospitals. This comprehensive coverage ensures members have access to high-quality hospital care when needed.

- Other Healthcare Providers: Florida Blue’s network extends beyond doctors and hospitals, including a wide range of other healthcare providers, such as pharmacists, therapists, and home health agencies. This broad network ensures members have access to a comprehensive range of healthcare services.

Geographical Coverage

Florida Blue’s provider network is geographically diverse, covering all regions of the state, from the bustling urban centers to the more rural areas. This extensive coverage ensures that members have access to quality healthcare services regardless of their location in Florida.

- Urban Areas: Florida Blue’s network is particularly strong in major urban areas like Miami, Orlando, Tampa, and Jacksonville, where members have access to a wide range of specialists and hospitals.

- Rural Areas: Florida Blue’s network also extends to rural areas, ensuring that members living in less populated regions have access to quality healthcare services. The network includes hospitals and clinics in smaller towns and communities across the state.

Out-of-Network Coverage

While Florida Blue encourages members to use providers within its network for optimal cost savings, it also provides out-of-network coverage for situations where a member may need to see a provider outside the network.

Out-of-network coverage typically involves higher out-of-pocket costs than in-network coverage.

- Out-of-Network Costs: When a member uses an out-of-network provider, they may be responsible for a higher co-pay, coinsurance, and deductible. Additionally, the insurer may not cover all the costs associated with the service.

- Prior Authorization: In some cases, members may need to obtain prior authorization from Florida Blue before receiving out-of-network care. This process helps ensure that the care is medically necessary and helps control costs.

- Exceptions: Florida Blue may make exceptions to its out-of-network coverage policies in certain situations, such as emergencies or when a member needs to see a specialist who is not in the network.

Customer Service and Support

Florida Blue prioritizes customer satisfaction and provides a comprehensive range of support channels to address inquiries, resolve issues, and ensure a seamless experience for its members.

Customer Service Channels, Florida blue health care insurance

Florida Blue offers various convenient channels for members to connect with customer service representatives. These channels include:

- Phone: Members can reach customer service by calling the toll-free number available on their insurance card or Florida Blue’s website. This option provides immediate assistance for urgent inquiries or complex issues requiring real-time guidance.

- Email: For non-urgent inquiries or to submit documentation, members can send an email to the designated customer service address provided on the Florida Blue website. This allows for a more detailed and organized communication, particularly for complex inquiries or requests requiring attachments.

- Online Resources: Florida Blue offers a user-friendly website with a comprehensive knowledge base, FAQs, and online tools for managing accounts, viewing claims, and accessing essential information. This self-service option provides quick and convenient access to information 24/7.

- Live Chat: Florida Blue provides a live chat feature on its website for real-time assistance with specific questions or inquiries. This option offers immediate support for quick and straightforward questions, offering a convenient alternative to phone calls or emails.

Customer Support Availability and Accessibility

Florida Blue strives to ensure readily available customer support for its members.

- Phone Hours: The phone lines are typically open during standard business hours, Monday through Friday, with extended hours on certain days to accommodate member needs.

- Email Response Time: Florida Blue aims to respond to emails within 24-48 hours, ensuring prompt attention to inquiries.

- Live Chat Availability: Live chat support is typically available during standard business hours, providing real-time assistance for immediate inquiries.

Claim Filing, Dispute Resolution, and Medical Records Access

Florida Blue offers a streamlined process for claim filing, dispute resolution, and medical records access.

- Claim Filing: Members can file claims online, by phone, or through their provider. Florida Blue provides clear instructions and forms for submitting claims, ensuring a smooth and efficient process.

- Dispute Resolution: In case of disputes regarding claims or coverage, Florida Blue offers a transparent and fair dispute resolution process. Members can appeal decisions through a defined process, with opportunities for review and mediation.

- Medical Records Access: Members can request copies of their medical records through Florida Blue’s website, by phone, or through their provider. Florida Blue complies with privacy regulations and ensures secure access to medical records.

Cost and Affordability

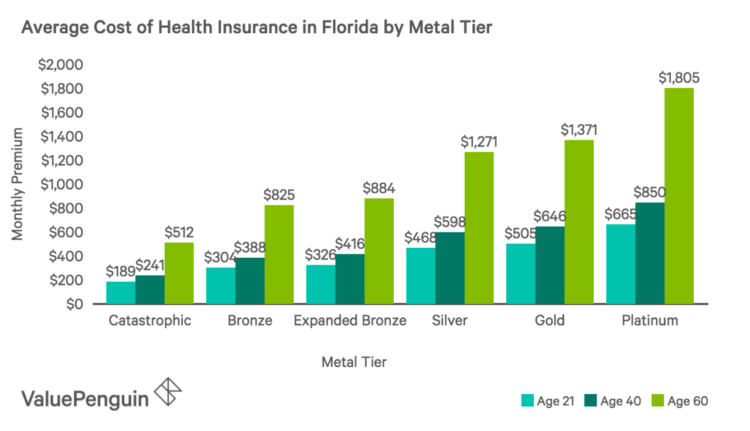

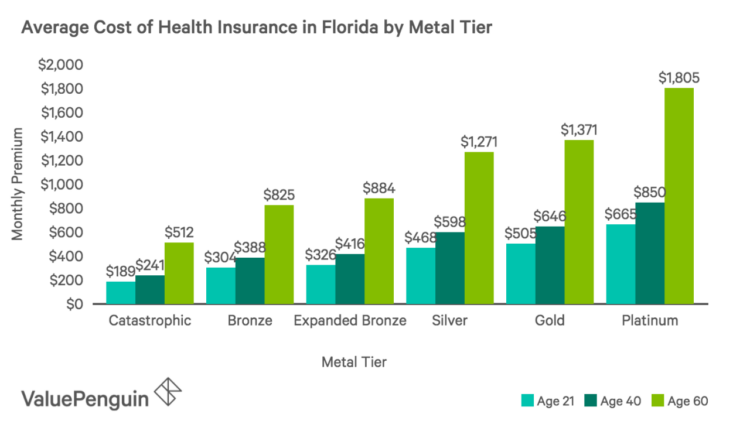

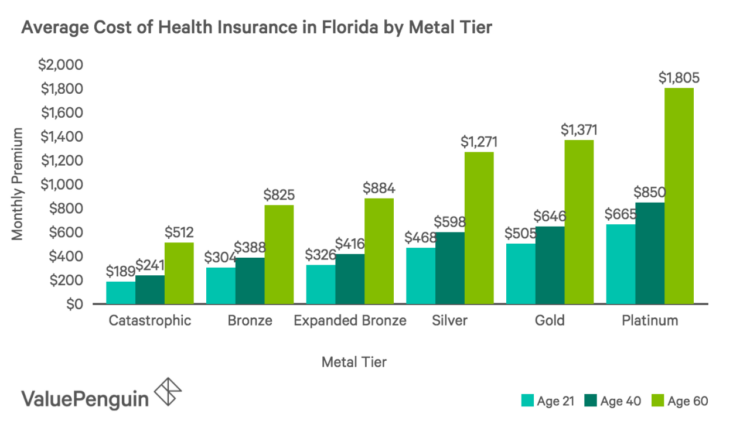

Understanding the cost of health insurance is crucial when making a decision. Florida Blue offers various plans, each with its own price tag, which can vary depending on several factors. This section explores the cost of Florida Blue plans, considering factors like age, location, and coverage level, and delves into the availability of subsidies and financial assistance programs for eligible individuals and families. Additionally, we compare the cost of Florida Blue plans to other health insurance providers in the state.

Factors Influencing Cost

The cost of Florida Blue health insurance plans can vary based on several factors, including:

- Age: Generally, older individuals tend to have higher healthcare costs due to a greater likelihood of needing medical services. Therefore, their premiums are often higher.

- Location: The cost of living and healthcare expenses can vary significantly across different regions of Florida. For instance, premiums in urban areas might be higher compared to rural areas.

- Coverage Level: The level of coverage you choose directly impacts the cost of your plan. Plans with higher coverage, such as comprehensive plans, typically have higher premiums compared to plans with lower coverage, such as basic plans.

- Tobacco Use: Florida Blue may charge higher premiums to individuals who use tobacco products.

Financial Assistance and Subsidies

Florida Blue participates in the Affordable Care Act (ACA) marketplace, which offers subsidies and financial assistance to eligible individuals and families to make health insurance more affordable. These subsidies are based on income and family size.

- Premium Tax Credits: These credits are available to individuals and families with incomes below certain thresholds. The amount of the credit depends on your income and the cost of the plan you choose.

- Cost-Sharing Reductions: These reductions help lower out-of-pocket costs, such as deductibles, copayments, and coinsurance, for individuals with lower incomes.

To determine your eligibility for financial assistance, you can use the ACA marketplace website or contact Florida Blue directly.

Comparison with Other Providers

Florida Blue is not the only health insurance provider in Florida. Comparing plans from different providers can help you find the most affordable option that meets your needs. Consider factors like:

- Network Size: A larger provider network offers access to a wider range of doctors and hospitals, which can be crucial for finding in-network providers.

- Plan Benefits: Compare the benefits offered by different plans, such as coverage for prescription drugs, mental health services, and preventive care.

- Customer Service: Research customer reviews and ratings to gauge the quality of customer service provided by different insurers.

Remember that comparing plans from different providers can be a time-consuming process, but it can be worthwhile to find the most cost-effective and suitable option for your individual circumstances.

Health and Wellness Programs

Florida Blue understands that proactive health management is crucial for overall well-being and cost savings. They offer a comprehensive suite of health and wellness programs designed to empower members to take control of their health and live healthier lives.

Preventive Screenings

Preventive screenings play a vital role in early detection and intervention, helping to identify potential health issues before they become serious. Florida Blue encourages members to take advantage of covered preventive screenings, such as:

- Annual physical exams

- Cancer screenings (e.g., mammograms, colonoscopies)

- Blood pressure and cholesterol checks

- Diabetes screenings

- Immunizations

These screenings can help identify risk factors and allow for timely interventions, leading to better health outcomes and potentially reducing the need for more expensive treatments in the future.

Disease Management Programs

Florida Blue offers specialized disease management programs for individuals with chronic conditions, such as diabetes, heart disease, and asthma. These programs provide personalized support and education to help members manage their conditions effectively and improve their quality of life.

- Personalized care plans: These plans are tailored to individual needs and goals, providing guidance on medication management, lifestyle modifications, and self-monitoring techniques.

- Regular communication and support: Members receive ongoing support from dedicated healthcare professionals, including nurses, pharmacists, and dietitians, who can answer questions, provide guidance, and address concerns.

- Educational resources: Members have access to a wealth of information and resources on managing their conditions, including online tools, educational materials, and support groups.

Fitness Incentives

Florida Blue recognizes the importance of physical activity for overall health and well-being. They offer various fitness incentives to encourage members to stay active.

- Fitness trackers: Members can earn rewards for tracking their activity levels using fitness trackers, promoting a more active lifestyle.

- Gym memberships: Florida Blue may offer discounts or subsidies for gym memberships, making it more affordable for members to access fitness facilities.

- Wellness challenges: Participating in wellness challenges can encourage members to engage in healthy activities and compete with others, fostering a sense of community and motivation.

These incentives can help members adopt healthier habits, reduce their risk of chronic diseases, and improve their overall well-being.

Consumer Reviews and Ratings

Understanding what other consumers think about Florida Blue is crucial when deciding whether this insurance provider is right for you. By examining customer reviews and ratings from reputable sources, you can gain valuable insights into the company’s strengths and weaknesses, particularly regarding customer service, plan coverage, and overall satisfaction.

Review Summary

Florida Blue has received a mixed bag of reviews from consumers. While some praise the company for its affordable plans and helpful customer service, others express dissatisfaction with coverage limitations and billing issues. To provide a comprehensive picture, we’ve compiled reviews from various sources, highlighting key insights and presenting a balanced perspective.

| Review Source | Rating | Key Insights |

|---|---|---|

| Better Business Bureau (BBB) | A+ | Florida Blue holds an A+ rating from the BBB, indicating a strong commitment to customer satisfaction. Reviews on the BBB website highlight positive experiences with customer service, including responsive agents and efficient claim processing. However, some customers report difficulties with billing and coverage disputes. |

| Trustpilot | 3.5 stars | Trustpilot displays a more mixed picture of Florida Blue’s customer experience. While some reviewers appreciate the company’s coverage options and accessibility, others criticize the lack of transparency and responsiveness from customer service representatives. |

| Consumer Reports | Not Rated | Consumer Reports currently does not rate Florida Blue. However, their website provides valuable information on health insurance plans, allowing consumers to compare coverage options and pricing from different providers, including Florida Blue. |

Comparison to Other Health Insurance Providers

Choosing the right health insurance provider in Florida can be a complex decision, as various companies offer diverse plans and services. Comparing Florida Blue to other major health insurance providers in the state can help consumers make an informed choice. This comparison will focus on key factors such as plan options, provider networks, and customer satisfaction, highlighting the strengths and weaknesses of each provider.

Plan Options and Coverage

Florida Blue offers a wide range of health insurance plans, including HMO, PPO, and Medicare Advantage plans. However, the availability and specific features of these plans can vary depending on the location and individual needs. Other major health insurance providers in Florida, such as Humana, Cigna, and UnitedHealthcare, also offer a variety of plan options. Comparing the coverage offered by each provider, including deductibles, copayments, and out-of-pocket maximums, is crucial for determining the best plan for your specific circumstances.

Provider Networks

The provider network, or the list of doctors and hospitals that are in-network with a particular insurance plan, is a critical factor to consider. Florida Blue has a large and extensive provider network throughout Florida, but it’s important to verify that your preferred doctors and hospitals are included in the network before enrolling in a plan. Other providers, such as Humana and Cigna, also have extensive networks, but their coverage may vary depending on the plan and location. It’s essential to compare the provider networks of different insurers to ensure that your healthcare needs are met.

Customer Satisfaction

Customer satisfaction is a key indicator of a health insurance provider’s reliability and responsiveness. Florida Blue consistently receives high ratings for customer satisfaction, but it’s important to research customer reviews and ratings from independent sources to get a comprehensive understanding of the provider’s reputation. Other providers, such as Humana and UnitedHealthcare, also have varying levels of customer satisfaction, so it’s crucial to consider these factors when making a decision.

Factors to Consider When Choosing a Provider

- Plan Options and Coverage: Compare the coverage offered by different plans, including deductibles, copayments, and out-of-pocket maximums, to find the best fit for your budget and health needs.

- Provider Network: Ensure that your preferred doctors and hospitals are included in the provider network of the chosen plan.

- Customer Satisfaction: Research customer reviews and ratings to assess the provider’s reputation for responsiveness and reliability.

- Cost and Affordability: Compare the premiums and out-of-pocket costs of different plans to find the most affordable option.

- Health and Wellness Programs: Explore the health and wellness programs offered by different providers to see if they align with your health goals.

Outcome Summary: Florida Blue Health Care Insurance

In the realm of health insurance, Florida Blue stands out as a reputable and reliable provider, offering a comprehensive range of plans, a vast provider network, and a commitment to customer satisfaction. By understanding the intricacies of Florida Blue’s offerings, individuals and families can make informed decisions about their healthcare coverage, ensuring they have access to the quality care they need while navigating the complexities of the healthcare system. This guide has provided a detailed overview of Florida Blue’s services, empowering readers with the knowledge to make informed choices and prioritize their health and well-being.

User Queries

What are the different types of health insurance plans offered by Florida Blue?

Florida Blue offers a variety of plans, including HMOs, PPOs, POS plans, and high-deductible health plans (HDHPs). The best plan for you will depend on your individual needs and preferences.

How can I find a doctor in the Florida Blue network?

You can use Florida Blue’s online directory to find doctors and other healthcare providers in your area. You can also contact customer service for assistance.

What are the benefits of participating in Florida Blue’s health and wellness programs?

Participating in Florida Blue’s health and wellness programs can help you improve your overall health, manage chronic conditions, and potentially save money on your healthcare costs.

How can I file a claim with Florida Blue?

You can file a claim online, by phone, or by mail. Florida Blue provides detailed instructions on how to file a claim on its website.

What are the contact details for Florida Blue customer service?

You can contact Florida Blue customer service by phone, email, or through their website. Their contact information is readily available on their website.