Florida Car Insurance Cheapest: Navigating the Sunshine State’s complex insurance landscape can feel overwhelming, especially when trying to find the most affordable rates. With its unique No-Fault system and high-risk driver pool, Florida presents distinct challenges for drivers seeking budget-friendly car insurance. But fear not, finding the cheapest Florida car insurance is achievable with the right strategies and knowledge.

This comprehensive guide will unravel the intricacies of Florida car insurance, equipping you with the tools and insights to make informed decisions and secure the best possible rates. We’ll delve into the factors influencing insurance costs, explore key coverage options, and provide actionable steps to find the cheapest car insurance in Florida. Get ready to unlock savings and drive with confidence!

Understanding Florida Car Insurance

Florida’s car insurance landscape is unique, influenced by several factors that shape its cost and coverage. Understanding these intricacies is crucial for Florida residents seeking the best car insurance deal.

Florida’s No-Fault Insurance System

Florida operates under a no-fault insurance system, meaning that drivers involved in an accident must first file a claim with their own insurance company, regardless of who was at fault. This system aims to expedite the claims process and reduce litigation.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for injuries sustained in an accident, regardless of fault. Florida law requires a minimum PIP coverage of $10,000.

- Property Damage Liability (PDL): This coverage pays for damages to the other driver’s vehicle or property if you are at fault in an accident. Florida law requires a minimum PDL coverage of $10,000.

Florida’s High-Risk Driver Pool, Florida car insurance cheapest

Florida has a higher-than-average concentration of high-risk drivers, which contributes to higher insurance premiums. This is attributed to factors such as:

- High population density: Florida’s densely populated areas lead to increased traffic congestion and the likelihood of accidents.

- Large number of tourists: Tourists often drive unfamiliar roads and may be less familiar with local driving laws, increasing the risk of accidents.

- Prevalence of fraud: Florida has a history of insurance fraud, which inflates insurance costs for all drivers.

Common Car Insurance Coverage Options in Florida

Here are some common car insurance coverage options available in Florida:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage pays for damages to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance.

- Medical Payments Coverage (Med Pay): This coverage supplements PIP and pays for medical expenses, regardless of fault, up to the policy limit.

Key Factors Affecting Car Insurance Prices

Understanding the factors that influence car insurance prices is crucial for finding the best coverage at the most affordable rate. Several key elements play a significant role in determining your premium, and understanding their impact can help you make informed decisions about your insurance policy.

Demographics

Demographics, such as age, driving history, and credit score, can significantly impact your car insurance premiums. Insurance companies use these factors to assess your risk profile and determine how likely you are to file a claim.

| Factor | Influence on Premiums |

|---|---|

| Age | Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. As drivers gain experience and age, their premiums typically decrease. |

| Driving History | A clean driving record with no accidents or traffic violations generally leads to lower premiums. However, any incidents, such as speeding tickets or accidents, can significantly increase your rates. |

| Credit Score | In many states, insurance companies use credit scores as a proxy for risk assessment. Individuals with higher credit scores often receive lower premiums, as they are perceived as more financially responsible. |

Vehicle Type, Model, and Safety Features

The type, model, and safety features of your car also influence insurance costs. Insurance companies consider factors like the vehicle’s value, repair costs, and safety ratings when determining premiums.

- Vehicle Value: More expensive vehicles generally have higher premiums, as they cost more to repair or replace in case of an accident.

- Model: Certain car models are known for their safety features or propensity for accidents. For example, sports cars often have higher premiums due to their higher performance and potential for higher speeds.

- Safety Features: Cars equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, may qualify for discounts as they are considered safer and less likely to be involved in accidents.

Location and Driving Habits

Your location and driving habits are also important factors in determining your car insurance rates. These factors influence the likelihood of accidents and the potential costs associated with them.

- City and County: Insurance rates vary by city and county due to differences in accident rates, traffic density, and crime rates. For example, urban areas with heavy traffic and higher crime rates may have higher insurance premiums.

- Driving Habits: Drivers who commute long distances or drive frequently in high-risk areas, such as busy highways, may face higher premiums. Conversely, drivers who have shorter commutes and drive less often may qualify for lower rates.

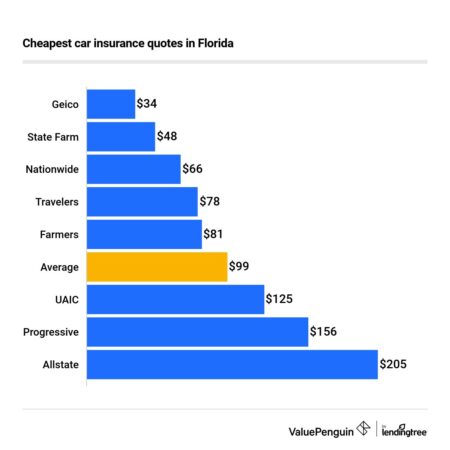

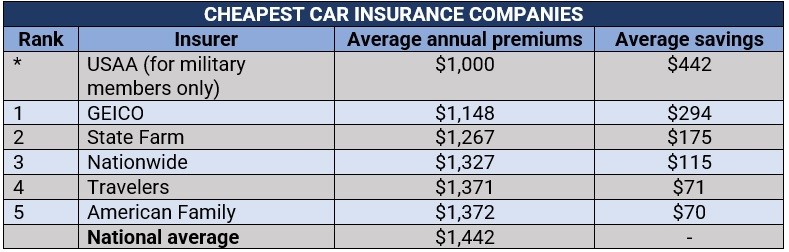

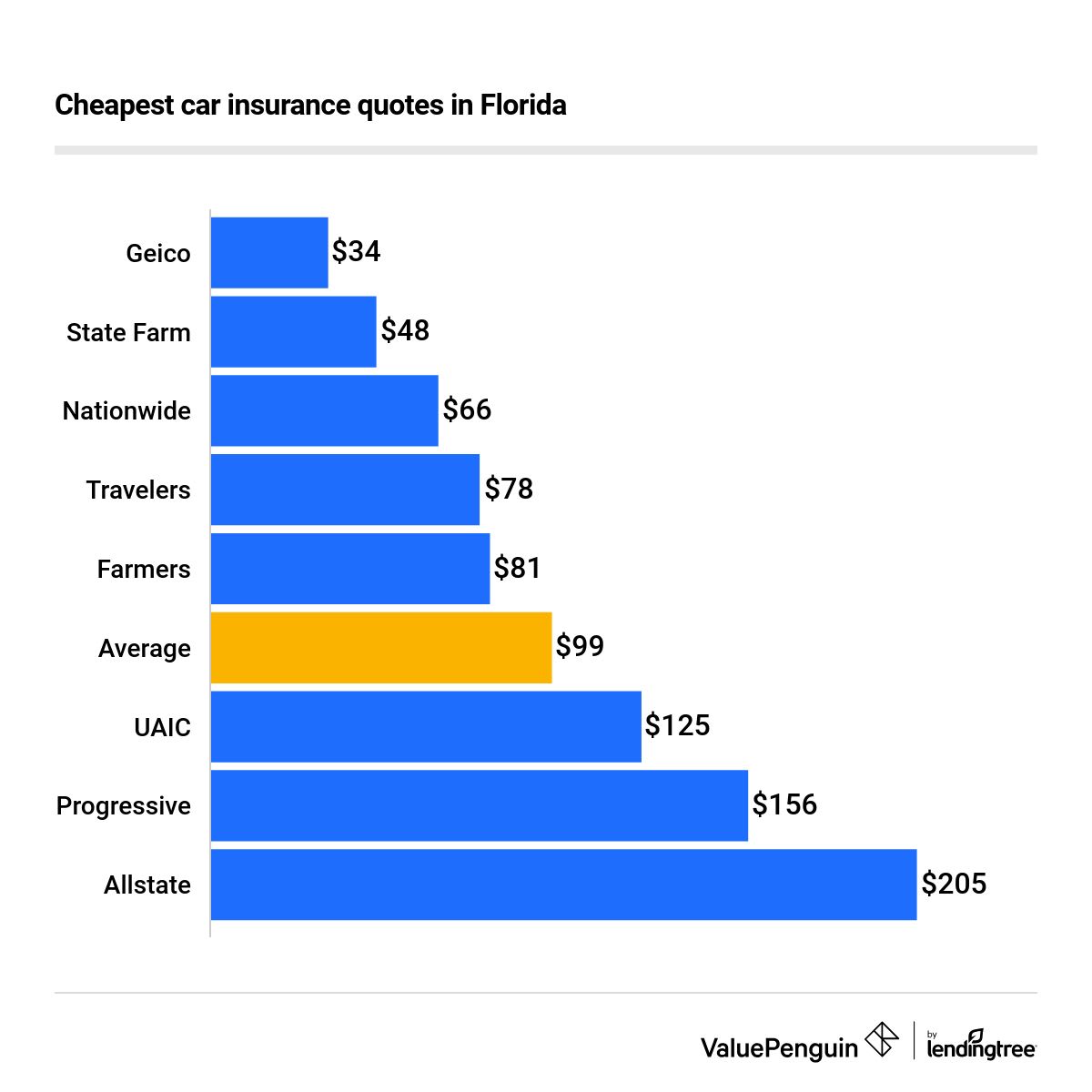

Finding the Cheapest Florida Car Insurance

Finding the cheapest Florida car insurance involves a strategic approach that goes beyond simply comparing quotes. It’s about understanding your individual needs, exploring available discounts, and effectively negotiating with insurers. This guide will provide you with the tools and knowledge to secure the most affordable car insurance policy in Florida.

Comparing Car Insurance Quotes

Comparing car insurance quotes from different providers is essential to find the best deal. Here’s a step-by-step guide:

- Gather Your Information: Before you begin, gather all necessary information, including your driving history, vehicle details, and desired coverage levels. This will streamline the quote process and ensure accurate results.

- Use Online Comparison Tools: Many websites offer free online comparison tools that allow you to input your information and receive quotes from multiple insurers simultaneously. These tools save time and effort, making the comparison process efficient.

- Contact Insurers Directly: While online comparison tools are useful, it’s also advisable to contact insurers directly to discuss specific needs and obtain personalized quotes. This allows you to ask questions, clarify details, and explore potential discounts.

- Compare Quotes Thoroughly: Once you have received quotes from multiple providers, compare them carefully, considering factors such as coverage, deductibles, premiums, and any additional features or benefits offered.

- Read Policy Documents: Before making a decision, carefully read the policy documents from each insurer to fully understand the coverage details, exclusions, and terms and conditions.

Common Discounts Offered by Florida Car Insurance Companies

Florida car insurance companies offer various discounts to reduce premiums. Understanding these discounts and qualifying for them can significantly lower your insurance costs. Here are some common discounts:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, typically with no accidents or traffic violations. The discount amount can vary based on the insurer and the driver’s history.

- Safe Driver Discount: Similar to the good driver discount, this discount is offered to drivers who demonstrate safe driving habits, often through the use of telematics devices or driving courses.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you may qualify for a multi-car discount, which typically reduces the premium for each vehicle.

- Multi-Policy Discount: This discount is available when you bundle multiple insurance policies, such as car insurance, homeowners insurance, or renters insurance, with the same provider.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for a discount on your car insurance.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle, such as alarms or GPS tracking systems, can deter theft and qualify you for a discount.

- Loyalty Discount: Some insurers offer discounts to long-term customers who have maintained their policies for a certain period.

- Student Discount: Students with good academic records may qualify for a discount, as they are generally considered to be safer drivers.

- Good Credit Discount: In some states, including Florida, insurers may use credit scores as a factor in determining insurance rates. If you have good credit, you may qualify for a discount.

Negotiating Car Insurance Rates

While comparing quotes and exploring discounts are crucial, negotiating with insurers can further lower your premiums. Here are some tips:

- Be Prepared: Before contacting an insurer, gather all relevant information, including your driving history, vehicle details, and quotes from other providers. This will give you leverage during negotiations.

- Highlight Your Positive Attributes: Emphasize your good driving record, safe driving habits, and any other factors that make you a low-risk driver. This can help you secure a better rate.

- Be Willing to Compromise: While it’s essential to advocate for the best possible rate, be open to compromises. Consider factors such as deductibles, coverage levels, and optional features to find a balance that works for you.

- Explore Bundling Options: Bundling multiple insurance policies with the same provider can often result in significant discounts. Ask about available bundling options and their potential cost savings.

- Don’t Be Afraid to Shop Around: Even after negotiating with an insurer, don’t hesitate to compare their final offer with quotes from other providers. This ensures you are getting the best possible deal.

Understanding Car Insurance Coverage Options

Choosing the right car insurance coverage is crucial in Florida. Understanding the different types of coverage available and their benefits can help you make an informed decision that protects you and your finances.

Liability Coverage

Liability coverage is the most basic type of car insurance and is required in Florida. It protects you financially if you cause an accident that injures someone or damages their property. This coverage covers:

- Bodily Injury Liability: Pays for medical expenses, lost wages, and other damages to the other driver and passengers in the event of an accident caused by you.

- Property Damage Liability: Covers the cost of repairing or replacing the other driver’s vehicle and any other property damaged in an accident you caused.

Florida law requires a minimum liability coverage of $10,000 per person for bodily injury, $20,000 per accident for bodily injury, and $10,000 for property damage.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional, but it’s often recommended, especially if you have a newer or financed vehicle.

When you file a collision claim, your deductible is the amount you pay out-of-pocket before your insurance company covers the rest.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as:

- Theft

- Vandalism

- Fire

- Natural disasters (e.g., hurricanes, floods)

- Falling objects

Like collision coverage, comprehensive coverage is optional. It’s generally recommended for newer vehicles or those with a high value.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. This coverage can help pay for your medical expenses, lost wages, and vehicle repairs.

UM/UIM coverage is optional in Florida, but it’s highly recommended.

Deductibles and Coverage Limits

Deductibles and coverage limits are crucial factors to consider when choosing car insurance.

A deductible is the amount you pay out-of-pocket before your insurance company starts covering your claim. Higher deductibles usually result in lower premiums, while lower deductibles mean higher premiums.

Coverage limits determine the maximum amount your insurance company will pay for a claim. You should choose coverage limits that adequately protect your financial interests. For example, if you have a high-value vehicle, you may want to consider higher coverage limits for collision and comprehensive coverage.

Avoiding Common Car Insurance Mistakes: Florida Car Insurance Cheapest

Choosing the right car insurance policy can save you a lot of money in the long run. However, many drivers make mistakes that can lead to higher premiums or inadequate coverage. By understanding common errors and taking steps to avoid them, you can ensure you have the right insurance at the best possible price.

Not Shopping Around for Quotes

It’s essential to compare quotes from multiple insurance companies before choosing a policy. Insurance rates can vary significantly between providers, so getting quotes from several companies can help you find the best deal.

- Many online comparison websites make it easy to get quotes from multiple insurers simultaneously.

- Consider contacting insurance agents directly to discuss your needs and get personalized quotes.

Failing to Review Your Policy Regularly

Your insurance needs can change over time. For example, if you get a new car, move to a different location, or add a driver to your policy, you’ll need to update your coverage. Regularly reviewing your policy ensures that you have the right coverage and that you’re not paying for unnecessary extras.

- Review your policy at least once a year, or whenever you experience a significant life change.

- Consider contacting your insurance agent to discuss any changes to your coverage needs.

Choosing the Wrong Deductible

Your deductible is the amount you pay out of pocket before your insurance kicks in. A higher deductible typically leads to lower premiums, while a lower deductible results in higher premiums. Choosing the right deductible depends on your financial situation and risk tolerance.

- A higher deductible might be suitable if you’re comfortable paying more out of pocket in case of an accident.

- A lower deductible is a better choice if you want lower out-of-pocket expenses in case of an accident.

Ignoring Discounts

Many insurance companies offer discounts for various factors, such as good driving records, safety features in your car, and bundling multiple insurance policies.

- Ask your insurance agent about all available discounts you may qualify for.

- Ensure your insurance company has all the necessary information to apply discounts to your policy.

Overlooking Necessary Coverage

Not all car insurance policies are created equal. Some policies may lack essential coverage, leaving you vulnerable in case of an accident.

- Ensure your policy includes liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

- Consider adding additional coverage, such as rental car reimbursement or roadside assistance, depending on your needs.

Ultimate Conclusion

In conclusion, securing the cheapest Florida car insurance requires a proactive approach. By understanding the factors influencing your rates, comparing quotes diligently, and taking advantage of available discounts, you can significantly reduce your insurance premiums. Remember, knowledge is power, and with this guide, you’re empowered to navigate the Florida car insurance market with confidence and find the best rates for your individual needs.

Helpful Answers

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to carry a minimum of Personal Injury Protection (PIP) coverage of $10,000 and Property Damage Liability (PDL) coverage of $10,000.

What are some common car insurance discounts available in Florida?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for anti-theft devices.

How often should I shop around for car insurance quotes?

It’s recommended to shop around for car insurance quotes at least once a year, or whenever your current policy is up for renewal.