Florida Car Insurance Minimum Requirements: Navigating the legal landscape of driving in the Sunshine State can be a complex endeavor, particularly when it comes to understanding the mandatory car insurance coverage. This guide delves into the essential requirements for drivers, providing a comprehensive overview of the legal obligations and consequences associated with non-compliance. From the basic coverage types to the exemptions and exceptions, we’ll explore the intricacies of Florida’s car insurance laws to ensure you’re fully informed and protected on the road.

The Florida Department of Motor Vehicles (FLHSMV) mandates that all drivers carry a minimum amount of car insurance to ensure financial responsibility in the event of an accident. These requirements are designed to protect both the driver and other parties involved in a collision, covering potential damages and medical expenses. Understanding these minimum requirements is crucial for any driver in Florida, as failing to meet them can result in severe penalties, including fines, license suspension, and even legal action.

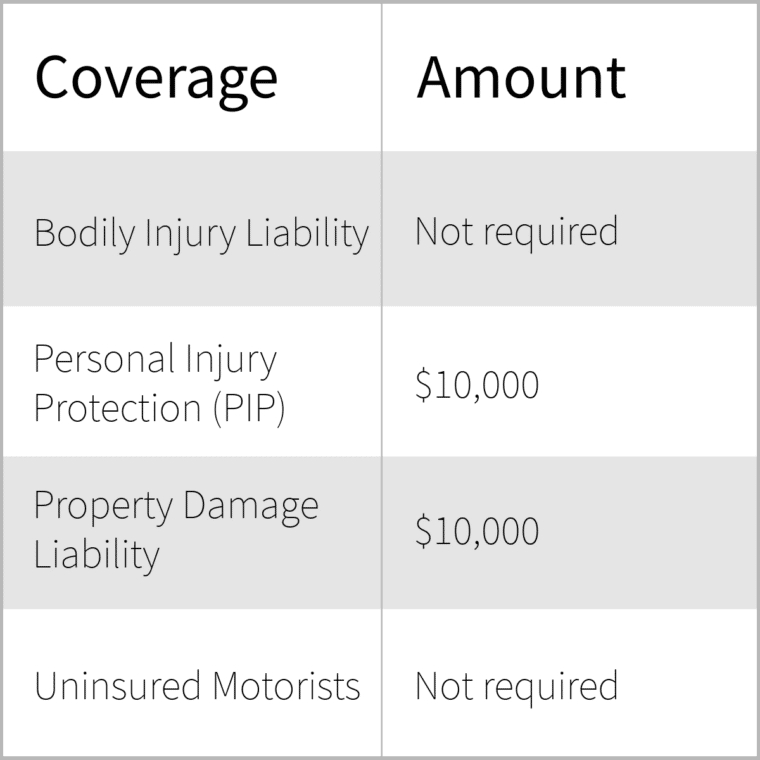

Florida Car Insurance Minimum Requirements Overview

Florida is a state that mandates every driver to carry a minimum amount of car insurance to protect themselves and others from financial hardship in the event of an accident. These minimum requirements are set by the state to ensure that drivers have adequate financial coverage to handle the costs associated with accidents.

Purpose of Florida’s Minimum Car Insurance Requirements

Florida’s minimum car insurance requirements are in place to protect drivers and their passengers from the financial burden of accidents. These requirements help ensure that drivers have sufficient coverage to cover the costs of medical bills, property damage, and other expenses that may arise from an accident. They also serve as a deterrent to uninsured drivers, reducing the number of accidents involving drivers who cannot afford to pay for damages.

Consequences of Driving Without Minimum Insurance Coverage

Driving without the required minimum car insurance in Florida can result in serious consequences, including:

- Suspension of driver’s license: Driving without insurance is a serious offense, and your license can be suspended until you provide proof of insurance.

- High fines: You may be subject to significant fines, which can vary depending on the severity of the offense.

- Imprisonment: In some cases, driving without insurance can even lead to jail time.

- Financial responsibility: Even if you are not at fault in an accident, you could be held financially responsible for damages if you are uninsured.

Required Coverage Types: Florida Car Insurance Minimum Requirements

Florida law mandates that all drivers carry specific types of car insurance to protect themselves and others in the event of an accident. These coverage types are designed to ensure financial responsibility and provide compensation for damages and injuries.

Personal Injury Protection (PIP)

PIP coverage is a no-fault insurance benefit that covers medical expenses and lost wages for the insured and their passengers, regardless of who caused the accident. It is mandatory in Florida and provides a safety net for accident victims.

Florida requires a minimum PIP coverage of $10,000.

This coverage helps pay for medical bills, lost wages, and other expenses related to injuries sustained in a car accident. PIP coverage is crucial for drivers because it provides financial support during a difficult time.

Property Damage Liability (PDL)

PDL coverage protects drivers against financial losses arising from damages caused to another person’s property in an accident. It covers repairs or replacement costs for the other driver’s vehicle or any other property damaged in the accident.

Florida requires a minimum PDL coverage of $10,000.

This coverage is essential because it can prevent significant financial burdens in the event of an accident where the driver is at fault.

Bodily Injury Liability (BIL), Florida car insurance minimum requirements

BIL coverage protects drivers against financial losses arising from injuries caused to another person in an accident. It covers medical expenses, lost wages, and other costs associated with the other driver’s injuries.

Florida requires a minimum BIL coverage of $10,000 per person and $20,000 per accident.

This coverage is essential because it can provide significant financial protection in the event of an accident where the driver is at fault and another person is injured.

Uninsured Motorist (UM) Coverage

UM coverage protects drivers against financial losses arising from injuries or damages caused by an uninsured or hit-and-run driver. It covers medical expenses, lost wages, and other costs associated with injuries or damages caused by an uninsured driver.

Florida requires a minimum UM coverage of $10,000 per person and $20,000 per accident.

This coverage is important because it provides financial protection in situations where the other driver does not have adequate insurance or is uninsured.

Underinsured Motorist (UIM) Coverage

UIM coverage protects drivers against financial losses arising from injuries or damages caused by an underinsured driver. It covers the difference between the other driver’s liability coverage and the insured driver’s actual losses.

Florida requires a minimum UIM coverage of $10,000 per person and $20,000 per accident.

This coverage is essential because it provides financial protection in situations where the other driver’s liability coverage is insufficient to cover the insured driver’s losses.

Financial Responsibility Laws

Florida’s financial responsibility laws are designed to ensure that drivers have the financial means to cover the costs of accidents they may cause. These laws are closely tied to car insurance requirements, as they often mandate minimum coverage levels to comply with the law.

Financial Responsibility Laws and Car Insurance

Financial responsibility laws establish the minimum financial resources a driver must have to cover potential damages resulting from an accident. In Florida, drivers must prove they can cover these costs through a combination of:

- Car insurance: This is the most common way to meet financial responsibility requirements. Florida requires all drivers to have at least the minimum liability insurance coverage, which includes bodily injury liability, property damage liability, and personal injury protection (PIP).

- Surety bond: A surety bond is a financial guarantee provided by an insurance company to ensure that a driver can pay for damages caused by an accident.

- Cash deposit: Drivers can also meet financial responsibility requirements by depositing a certain amount of cash with the state.

Consequences of Not Meeting Financial Responsibility Requirements

Failing to meet Florida’s financial responsibility laws can have serious consequences, including:

- License suspension: The state may suspend a driver’s license if they are involved in an accident and cannot prove they have the necessary financial resources to cover damages.

- Vehicle registration suspension: Similar to license suspension, the state can suspend a driver’s vehicle registration if they fail to meet financial responsibility requirements.

- Fines and penalties: Drivers who are found to be in violation of financial responsibility laws may face fines and other penalties.

Examples of Financial Responsibility Laws in Action

Here are some real-world examples of how financial responsibility laws impact drivers in Florida:

- Accident with injuries: If a driver is involved in an accident that results in injuries to another person, they must have sufficient insurance coverage to pay for medical bills and other damages.

- Damage to property: If a driver causes damage to another person’s property, they must have adequate insurance coverage to cover the repair costs.

- Uninsured motorist coverage: Florida requires drivers to have uninsured motorist coverage, which protects them in the event of an accident with a driver who does not have insurance.

Epilogue

Driving in Florida comes with a set of responsibilities, and adhering to the minimum car insurance requirements is paramount. Being aware of the coverage types, exemptions, and potential consequences ensures that you are both legally compliant and financially protected on the road. Remember, responsible driving practices and understanding your insurance obligations go hand-in-hand with enjoying the freedom of driving in the Sunshine State.

Question & Answer Hub

What happens if I get into an accident without the minimum required insurance?

You could face significant financial consequences, including being responsible for all damages and medical expenses, even if you weren’t at fault. You could also face fines, license suspension, and even legal action.

Can I get a discount on my car insurance if I have a clean driving record?

Yes, most insurance companies offer discounts for drivers with a good driving history. These discounts can vary depending on the insurer and your specific driving record.

How often do I need to renew my car insurance policy?

Car insurance policies typically have a term of six months or a year. You’ll need to renew your policy before it expires to maintain continuous coverage.

Is there a grace period if I miss my car insurance payment?

Most insurance companies have a grace period, typically 10-15 days, before your policy lapses. However, it’s important to contact your insurer immediately if you’re unable to make a payment to avoid any potential lapse in coverage.