- Florida Car Insurance Minimums Overview

- Understanding Florida’s No-Fault System

- Bodily Injury Liability Coverage

- Property Damage Liability Coverage

- Uninsured Motorist Coverage

- Factors Affecting Florida Car Insurance Costs: Florida Car Insurance Minimums

- Choosing the Right Coverage

- Closing Notes

- Frequently Asked Questions

Florida car insurance minimums set the stage for understanding the legal requirements for driving in the Sunshine State. Florida, known for its warm weather and vibrant culture, also has a unique approach to car insurance, employing a no-fault system that differs from many other states. This means that if you’re involved in an accident, your own insurance company will cover your injuries, regardless of who was at fault. But what exactly are the minimums you need to comply with the law, and how do they affect your coverage and costs? This guide delves into the intricacies of Florida car insurance minimums, providing a clear understanding of your legal obligations and options.

This article will cover the essential aspects of Florida car insurance minimums, including the types of coverage mandated by law, the minimum amounts required for each type, and the factors that influence insurance costs. It will also explain the intricacies of Florida’s no-fault system, highlighting the role of Personal Injury Protection (PIP) and its implications for accident claims. By understanding these key elements, you can make informed decisions about your car insurance coverage and ensure you’re adequately protected on the road.

Florida Car Insurance Minimums Overview

Florida law requires all drivers to have a minimum level of car insurance coverage. This ensures that drivers can pay for damages caused to others in an accident. It also provides some financial protection for drivers involved in accidents.

Florida’s Required Car Insurance Coverages

Florida law mandates several types of car insurance coverage, each with a minimum required amount. Understanding these coverages is crucial for ensuring compliance with Florida’s insurance requirements.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs incurred by the insured person, regardless of who is at fault in an accident. Florida requires a minimum PIP coverage of $10,000.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s property, such as their vehicle, in the event of an accident. Florida requires a minimum PDL coverage of $10,000.

- Bodily Injury Liability (BIL): This coverage pays for medical expenses, lost wages, and other related costs incurred by the other party in an accident, if the insured driver is at fault. Florida requires a minimum BIL coverage of $10,000 per person and $20,000 per accident.

Minimum Coverage Amounts

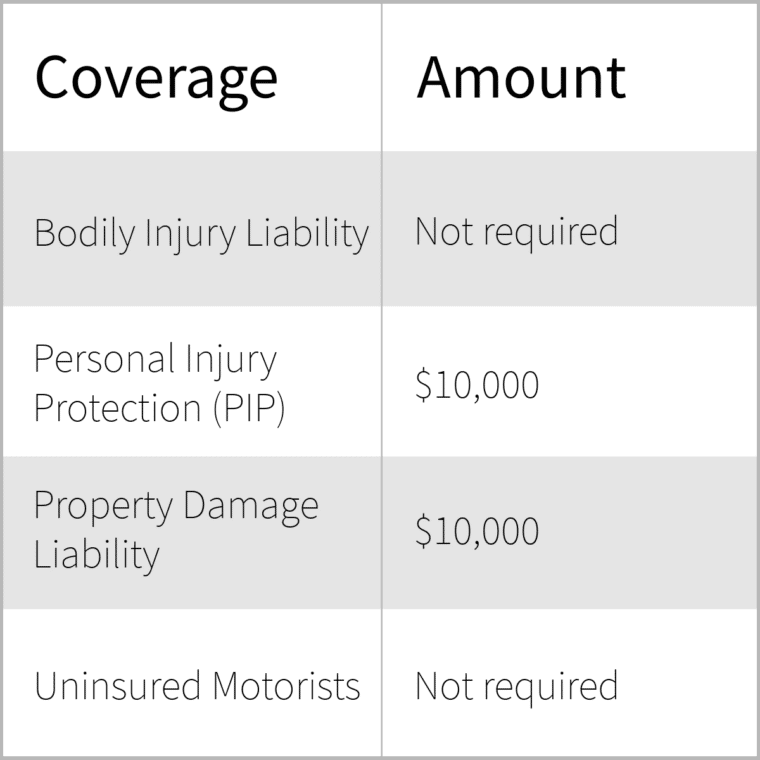

The following table summarizes the minimum required coverage amounts for each type of car insurance in Florida:

| Coverage Type | Minimum Coverage Amount |

|---|---|

| Personal Injury Protection (PIP) | $10,000 |

| Property Damage Liability (PDL) | $10,000 |

| Bodily Injury Liability (BIL) | $10,000 per person / $20,000 per accident |

Understanding Florida’s No-Fault System

Florida operates under a no-fault insurance system, meaning that drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of who caused it. This system aims to streamline the claims process and reduce litigation. However, it also introduces a unique type of coverage called Personal Injury Protection (PIP), which plays a crucial role in Florida’s insurance landscape.

Personal Injury Protection (PIP) Coverage

PIP coverage is mandatory for all drivers in Florida and is designed to provide immediate financial assistance for medical expenses and lost wages following an accident. This coverage helps alleviate the burden of medical bills and lost income while the driver focuses on recovery.

- Coverage for Medical Expenses: PIP covers 80% of reasonable and necessary medical expenses incurred within the first three years of an accident, up to a maximum of $10,000. This coverage includes expenses like doctor visits, hospital stays, ambulance services, and prescription medications.

- Coverage for Lost Wages: PIP also provides benefits for lost wages, covering 60% of the insured’s average weekly wage, up to a maximum of $2,000 per month. This coverage helps compensate for income lost due to the inability to work following an accident.

- Limitations: It’s important to note that PIP coverage has limitations. It doesn’t cover all types of expenses, such as pain and suffering, and it has a limit on the amount of coverage available. For example, if the driver chooses a lower PIP coverage limit, they may receive less financial assistance for medical expenses and lost wages.

Comparing PIP Coverage with Other Types of Insurance

PIP coverage differs from other types of insurance in several ways.

- Health Insurance: While health insurance covers medical expenses, it typically has a higher deductible and co-pay, and may not cover all the same services as PIP. PIP can act as a supplement to health insurance, covering expenses that health insurance might not fully cover.

- Liability Insurance: Liability insurance covers damages caused to others, such as property damage or injuries. PIP, on the other hand, focuses on the insured’s own medical expenses and lost wages.

Bodily Injury Liability Coverage

Bodily injury liability coverage is a crucial component of car insurance in Florida. It protects you financially if you are at fault in an accident that causes injuries to another person. This coverage pays for the medical expenses, lost wages, and pain and suffering of the injured party up to the policy limits.

How Bodily Injury Liability Coverage Works

When you are at fault in an accident, your bodily injury liability coverage kicks in to cover the costs associated with the other driver’s injuries. This coverage helps to protect you from financial ruin by paying for the other driver’s medical bills, lost wages, and pain and suffering, up to the policy limits. It also helps to avoid lawsuits and potential judgments against you.

Examples of Bodily Injury Liability Coverage Application

Here are some scenarios where bodily injury liability coverage would be applied:

- You rear-end another car, causing injuries to the driver.

- You run a red light and collide with another vehicle, resulting in injuries to the other driver and passengers.

- You are driving and make a sudden lane change, hitting another vehicle, causing injuries to the other driver.

In each of these scenarios, your bodily injury liability coverage would pay for the other driver’s medical expenses, lost wages, and pain and suffering, up to your policy limits.

Property Damage Liability Coverage

Property damage liability coverage is a crucial component of your Florida car insurance policy. It protects you financially if you are at fault in an accident that causes damage to another person’s property. This coverage helps cover the costs of repairs or replacement of the damaged property, ensuring you are not personally liable for these expenses.

Examples of Property Damage Liability Coverage Use

Property damage liability coverage comes into play in various scenarios where you are responsible for causing damage to another person’s property. Here are some common examples:

- Rear-ending a vehicle: If you rear-end another car, causing damage to their bumper, headlights, or other parts, your property damage liability coverage will help pay for the repairs.

- Hitting a parked car: If you accidentally hit a parked car while driving, your property damage liability coverage will cover the costs of repairing the damaged vehicle.

- Damaging a fence or mailbox: If you accidentally hit a fence or mailbox while driving, your property damage liability coverage will help pay for the repairs or replacement of the damaged property.

- Causing damage to a building: If you accidentally drive your car into a building, causing damage to the structure, your property damage liability coverage will help cover the costs of repairs.

Uninsured Motorist Coverage

In Florida, uninsured motorist coverage (UM) is an essential component of car insurance. It protects you financially if you are involved in an accident with a driver who lacks sufficient liability insurance or is uninsured entirely.

This coverage is crucial because it safeguards you against potential financial losses arising from accidents caused by uninsured or underinsured motorists.

Types of Uninsured Motorist Coverage

Uninsured motorist coverage in Florida comes in two primary forms:

- Uninsured Motorist Bodily Injury Coverage (UMBI): This coverage protects you and your passengers for medical expenses, lost wages, and pain and suffering if you are injured in an accident caused by an uninsured or underinsured driver.

- Uninsured Motorist Property Damage Coverage (UMPD): This coverage pays for damages to your vehicle if the at-fault driver is uninsured or underinsured.

Situations Where Uninsured Motorist Coverage is Crucial

Uninsured motorist coverage can be a lifeline in several scenarios:

- Hit-and-Run Accidents: In hit-and-run accidents, the at-fault driver flees the scene, leaving you with no way to pursue compensation through their insurance. UM coverage steps in to cover your losses.

- Accidents with Drivers Lacking Sufficient Coverage: Even if the other driver has insurance, their coverage might not be enough to cover your damages, especially in cases of serious injuries or significant property damage. UM coverage can bridge the gap.

- Accidents with Drivers Whose Insurance is Invalid: Sometimes, a driver’s insurance policy might be canceled or invalid for various reasons. UM coverage provides protection in such cases.

Benefits of Uninsured Motorist Coverage

Having uninsured motorist coverage offers several advantages:

- Financial Security: UM coverage ensures you have financial resources to cover medical expenses, lost wages, and property damage, even if the other driver is uninsured or underinsured.

- Peace of Mind: Knowing you have this coverage can provide peace of mind, knowing you are protected in the event of an accident with an uninsured driver.

- Legal Representation: Many UM policies include legal representation to help you navigate the claims process and protect your rights.

Choosing the Right Coverage Limits

When choosing uninsured motorist coverage, it is crucial to select limits that adequately protect you and your family. It is recommended to choose limits that are at least equal to your bodily injury liability coverage.

“In Florida, it is against the law to waive uninsured motorist coverage. You must have this coverage, but you can choose the amount of coverage you want.”

Factors Affecting Florida Car Insurance Costs: Florida Car Insurance Minimums

Car insurance premiums in Florida are influenced by various factors, leading to a wide range of costs for drivers. Understanding these factors can help you make informed decisions about your coverage and potentially reduce your premiums.

Driving History

Your driving history plays a significant role in determining your insurance costs. A clean driving record with no accidents, violations, or DUI convictions will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or DUI convictions will likely lead to higher premiums. Insurance companies consider your driving history as an indicator of your risk profile.

Vehicle Type

The type of vehicle you drive is another crucial factor affecting insurance costs. Luxury vehicles, high-performance cars, and sports cars are typically more expensive to insure due to their higher repair costs and greater risk of theft. On the other hand, smaller, less expensive vehicles generally have lower insurance premiums.

Age

Your age is a factor that insurance companies consider when determining your premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher insurance rates. As you age, your driving experience increases, and your risk profile tends to improve, resulting in lower premiums.

Location

The location where you live can also impact your insurance costs. Areas with high traffic density, crime rates, and accident rates tend to have higher insurance premiums. Insurance companies assess the risk associated with different locations and adjust premiums accordingly.

Other Factors

- Credit Score: Your credit score can be a factor in determining your insurance rates in some states, including Florida. Insurance companies may view a good credit score as an indicator of financial responsibility and stability.

- Coverage Levels: The amount of coverage you choose will also impact your premiums. Higher coverage limits, such as for bodily injury liability or property damage liability, will generally result in higher premiums.

- Discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, multiple policy discounts, and defensive driving courses.

Choosing the Right Coverage

While Florida’s minimum car insurance requirements are in place to protect you from financial ruin in case of an accident, they may not be enough to fully cover your potential losses. This section explores the benefits and drawbacks of exceeding the minimum requirements and provides tips for finding affordable insurance options without compromising on coverage.

Benefits of Exceeding Minimum Requirements, Florida car insurance minimums

Choosing coverage beyond the minimums offers significant financial protection in the event of an accident.

- Greater Financial Security: Higher limits on bodily injury liability coverage protect you from substantial financial burdens if you are found at fault for an accident resulting in severe injuries to others. Similarly, increased property damage liability coverage provides peace of mind if you cause significant damage to another person’s vehicle or property.

- Protection from Underinsured Motorists: Uninsured/underinsured motorist coverage (UM/UIM) is crucial in Florida, as many drivers operate without sufficient insurance. Exceeding the minimum requirements for UM/UIM coverage can significantly reduce your financial liability if you are involved in an accident with an uninsured or underinsured driver.

- Comprehensive and Collision Coverage: While not mandatory in Florida, comprehensive and collision coverage can provide valuable protection for your vehicle. Comprehensive coverage covers damages caused by events like theft, vandalism, and natural disasters, while collision coverage covers damages resulting from accidents, regardless of fault.

Drawbacks of Exceeding Minimum Requirements

While exceeding minimum coverage offers significant benefits, it also comes with increased premiums. However, the potential financial protection it provides can outweigh the added cost.

- Higher Premiums: Higher coverage limits generally result in higher premiums. However, the cost increase may be offset by potential savings on deductibles or reduced out-of-pocket expenses in case of an accident.

- Potential for Over-Insurance: While exceeding minimum requirements is generally beneficial, it’s essential to avoid over-insuring your vehicle. If the value of your vehicle is significantly lower than the coverage limits, you may be paying for unnecessary coverage.

Finding Affordable Coverage Options

Finding affordable insurance options without compromising on coverage requires careful consideration and comparison shopping.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare coverage options and prices. Utilize online comparison tools or work with an independent insurance agent to streamline the process.

- Shop Around Regularly: Insurance rates can fluctuate, so it’s essential to shop around for new quotes periodically to ensure you’re getting the best possible price. Consider switching providers if you find a more competitive offer.

- Bundle Policies: Many insurance providers offer discounts for bundling multiple policies, such as car, home, and renters insurance. Combining your policies with the same provider can lead to significant cost savings.

- Consider Deductibles: Higher deductibles generally lead to lower premiums. However, it’s crucial to choose a deductible you can comfortably afford in case of an accident.

- Maintain a Good Driving Record: A clean driving record is a significant factor in determining your insurance premiums. Avoid traffic violations and accidents to maintain lower rates.

Closing Notes

Navigating the world of Florida car insurance can be complex, but understanding the minimum requirements and available options is crucial for every driver. By ensuring you meet the legal minimums and exploring additional coverage options that suit your needs, you can drive with peace of mind knowing you’re protected in case of an accident. Remember, driving without proper insurance can lead to serious consequences, including fines, license suspension, and even jail time. So, take the time to understand your obligations, compare insurance options, and choose the coverage that provides the best balance of protection and affordability for you.

Frequently Asked Questions

What happens if I get into an accident and don’t have the minimum required car insurance?

You could face serious consequences, including fines, license suspension, and even jail time. You may also be held personally liable for any damages or injuries caused to others.

Can I choose to have more coverage than the minimum required?

Yes, you can choose to purchase higher coverage limits than the minimum requirements. This can provide you with greater financial protection in case of a serious accident.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least annually to ensure it still meets your needs and that you’re getting the best rates.

How can I lower my car insurance premiums?

There are several ways to potentially lower your premiums, including maintaining a good driving record, choosing a safe vehicle, and bundling your insurance policies.