- Factors Influencing Florida Car Insurance Rates

- Understanding Florida’s Insurance Market: Florida Car Insurance Rate

- Finding Affordable Car Insurance in Florida

- Insurance Coverage Options in Florida

- Florida’s No-Fault Insurance System

- Insurance Claims and Disputes in Florida

- Final Conclusion

- FAQ Compilation

Florida car insurance rates are a significant concern for residents of the Sunshine State, and for good reason. Florida’s unique insurance environment, characterized by high population density, a prevalence of uninsured drivers, and frequent natural disasters, contributes to some of the highest car insurance premiums in the nation. This comprehensive guide will delve into the intricacies of Florida car insurance rates, exploring the factors that influence them, the insurance market landscape, and strategies for finding affordable coverage.

From understanding the impact of your driving history and vehicle type to navigating the complexities of Florida’s no-fault insurance system, this guide will equip you with the knowledge necessary to make informed decisions about your car insurance. Whether you’re a new driver, a seasoned motorist, or simply seeking to optimize your coverage, this guide provides valuable insights and practical tips to help you navigate the Florida car insurance landscape with confidence.

Factors Influencing Florida Car Insurance Rates

Florida’s car insurance market is complex and influenced by a variety of factors. Understanding these factors can help drivers make informed decisions about their insurance coverage and potentially save money.

Driving History

A driver’s driving history plays a significant role in determining their car insurance rates. Insurance companies assess factors like accidents, traffic violations, and driving record to evaluate risk.

- Accidents: Drivers with a history of accidents, particularly at-fault accidents, are generally considered higher risk and face higher premiums. The severity of the accident, such as injuries or property damage, can also impact rates.

- Traffic Violations: Violations like speeding tickets, reckless driving, or DUI convictions can lead to increased insurance premiums. The severity of the violation and the frequency of offenses can significantly impact rates.

- Driving Record: A clean driving record with no accidents or violations is generally rewarded with lower premiums. Maintaining a safe driving record is crucial for keeping insurance costs down.

Age and Gender, Florida car insurance rate

Insurance companies often consider the age and gender of the driver when calculating premiums. Younger drivers, particularly those under 25, are often statistically more likely to be involved in accidents.

- Younger Drivers: Insurance companies may charge higher premiums for younger drivers due to their perceived higher risk.

- Older Drivers: Drivers over 65 may also see higher rates, as they may have age-related health conditions that could impact their driving ability.

- Gender: Historically, insurance companies have used gender as a factor in pricing, but this practice is increasingly regulated. In some states, including Florida, gender-based pricing is prohibited.

Vehicle Type, Make, and Model

The type, make, and model of a vehicle significantly impact insurance rates.

- Vehicle Type: Sports cars, luxury vehicles, and high-performance vehicles are often considered higher risk due to their potential for speed and accidents.

- Make and Model: Insurance companies use historical data to assess the safety features, repair costs, and theft risk of specific makes and models. Vehicles with a history of high repair costs or frequent thefts may have higher premiums.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and lane departure warnings can often qualify for discounts.

Coverage Levels

The amount and types of coverage chosen by a driver directly impact their insurance premiums.

- Liability Coverage: This coverage protects drivers against financial losses if they cause an accident that injures others or damages property. Higher liability limits generally result in higher premiums.

- Collision Coverage: This coverage pays for repairs to your vehicle if it is involved in an accident, regardless of fault.

- Comprehensive Coverage: This coverage pays for damage to your vehicle caused by non-collision events, such as theft, vandalism, or natural disasters.

Location

The location where a vehicle is insured can significantly impact rates.

- Zip Code: Insurance companies use data on accident rates, crime statistics, and traffic congestion within specific zip codes to determine premiums. Areas with high accident rates or crime levels may have higher insurance costs.

- County: Similar to zip codes, insurance companies consider county-level data to assess risk. Counties with high population density, a prevalence of uninsured drivers, or a history of natural disasters may have higher insurance premiums.

Credit Score

In Florida, insurance companies are allowed to consider a driver’s credit score when calculating premiums.

- Credit Score Impact: Drivers with good credit scores are generally considered more financially responsible and may receive lower premiums. Conversely, those with poor credit scores may face higher rates.

- Florida’s Unique Environment: Florida’s unique insurance environment, characterized by high population density, a prevalence of uninsured drivers, and frequent natural disasters, contributes to higher insurance rates overall.

Understanding Florida’s Insurance Market: Florida Car Insurance Rate

Florida’s car insurance market is a complex and dynamic ecosystem influenced by a variety of factors, including the state’s unique demographics, climate, and legal environment. Understanding the key players, regulations, and competitive forces within this market is essential for consumers seeking to make informed decisions about their car insurance coverage.

Major Car Insurance Companies in Florida

The Florida car insurance market is dominated by a mix of national and regional insurance companies. These companies compete for market share by offering various coverage options, discounts, and pricing strategies. Some of the major players include:

- State Farm

- Geico

- Progressive

- Allstate

- USAA

- Florida Peninsula Insurance Company

- United Automobile Insurance Company

- Auto-Owners Insurance

- Nationwide

Types of Insurance Companies in Florida

Florida’s car insurance market features various types of insurance companies, each with its own structure and operating model. Understanding these differences can help consumers choose the best insurance provider for their needs.

- Private Insurance Companies: These companies are privately owned and operate for profit. They offer a wide range of insurance products, including car insurance, and are subject to state regulations. Examples include State Farm, Geico, and Progressive.

- Mutual Insurance Companies: These companies are owned by their policyholders, who share in the profits and losses. They often offer lower premiums and focus on customer service. Examples include USAA and Auto-Owners Insurance.

- State-Run Insurance Companies: Some states have their own insurance companies, but Florida does not.

Role of the Florida Office of Insurance Regulation (OIR)

The Florida Office of Insurance Regulation (OIR) plays a crucial role in overseeing the state’s insurance market, including car insurance. The OIR is responsible for:

- Licensing and Regulating Insurance Companies: The OIR ensures that insurance companies meet specific financial requirements and operate ethically.

- Setting Rates and Coverage Requirements: The OIR sets minimum coverage requirements for car insurance and reviews rate filings to ensure they are fair and reasonable.

- Protecting Consumers: The OIR investigates consumer complaints and provides resources to help consumers understand their insurance rights and options.

Impact of Competition on Car Insurance Rates

Competition among insurance companies can influence car insurance rates. When there is more competition, companies may offer lower premiums to attract customers. Conversely, limited competition can lead to higher rates. Factors that can impact competition in Florida’s car insurance market include:

- Number of Insurance Companies: A higher number of insurance companies operating in the state typically leads to greater competition.

- Regulation: The OIR’s regulatory framework can influence competition by setting minimum coverage requirements and reviewing rate filings.

- Economic Conditions: Economic factors, such as inflation and interest rates, can affect the profitability of insurance companies and influence their pricing strategies.

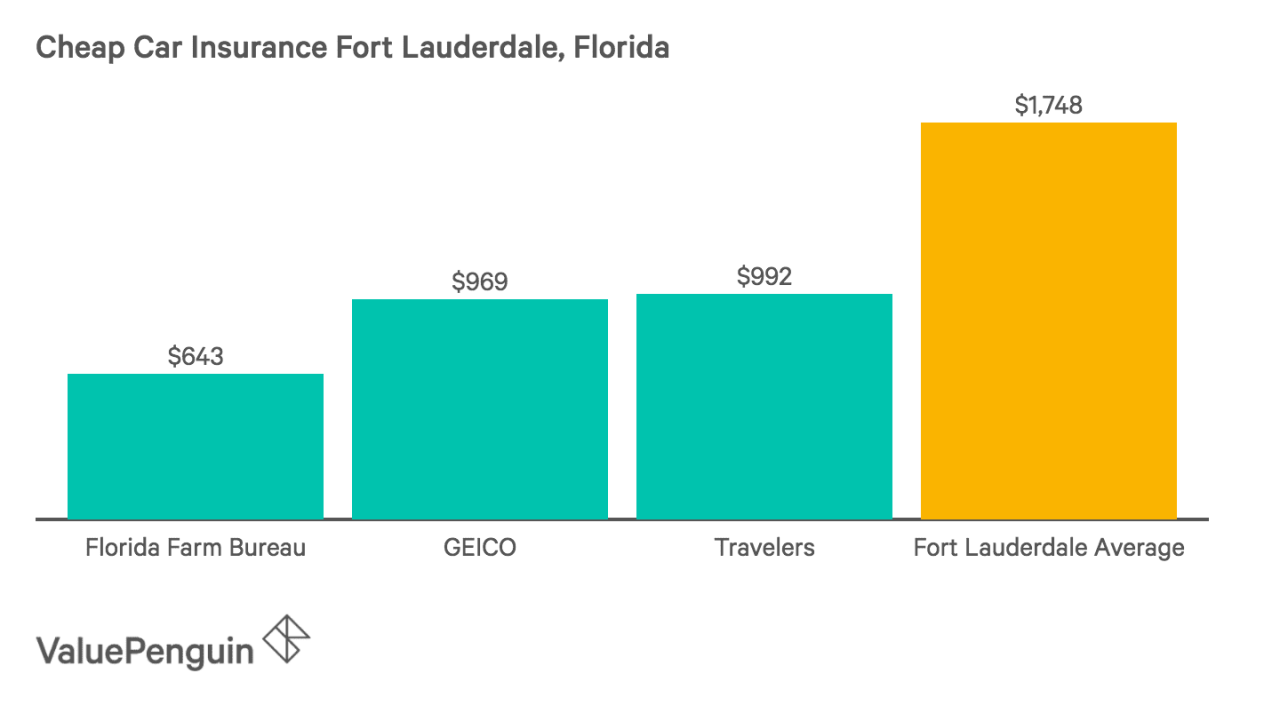

Finding Affordable Car Insurance in Florida

Florida is known for its high car insurance rates, but there are ways to find affordable coverage. By understanding the factors that influence rates and employing smart strategies, you can significantly reduce your premiums.

Strategies for Lowering Car Insurance Premiums in Florida

Several strategies can help you lower your car insurance premiums in Florida.

| Tip | Description | Potential Savings | Example |

|---|---|---|---|

| Improve Your Driving Record | Maintaining a clean driving record with no accidents or traffic violations is crucial. Insurance companies consider your driving history a significant factor in determining your rates. | Up to 25% | A driver with a clean record for five years might qualify for a good driver discount, saving them hundreds of dollars annually. |

| Shop Around and Compare Quotes | Getting quotes from multiple insurers is essential to find the best rates. Use online comparison tools or contact insurers directly. | Varies depending on the insurer and your profile | Comparing quotes from three different insurers could reveal a difference of $500 per year. |

| Consider Increasing Your Deductible | Raising your deductible, the amount you pay out-of-pocket before your insurance covers the rest, can lower your premiums. However, ensure you can afford the higher deductible in case of an accident. | Up to 15% | Increasing your deductible from $500 to $1000 could save you $100 annually. |

| Bundle Your Policies | Combining your car insurance with other policies like homeowners or renters insurance can often lead to significant discounts. | Up to 10% | Bundling your car and homeowners insurance could save you $150 per year. |

| Choose a Safe Vehicle | Cars with safety features like anti-theft systems, airbags, and stability control are generally considered safer and attract lower insurance rates. | Varies depending on the vehicle and insurer | A car with a 5-star safety rating might receive a 10% discount compared to a car with a 3-star rating. |

| Take a Defensive Driving Course | Completing a defensive driving course demonstrates your commitment to safe driving practices and can earn you a discount. | Up to 10% | A driver who completes a defensive driving course might receive a 5% discount on their premium. |

| Maintain Good Credit | In Florida, insurance companies can use your credit score to determine your rates. Having good credit can lead to lower premiums. | Varies depending on your credit score and insurer | A driver with excellent credit might pay $100 less per year compared to someone with poor credit. |

Benefits and Drawbacks of Insurance Discounts

Discounts can significantly lower your car insurance premiums, but understanding their benefits and drawbacks is essential.

Good Driver Discount: This discount is offered to drivers with clean driving records, rewarding safe driving habits. It can significantly reduce premiums. However, a single accident or traffic violation can disqualify you from this discount.

Safe Vehicle Discount: Cars with advanced safety features are generally considered safer and attract lower insurance rates. This discount rewards drivers who choose vehicles with features like airbags, anti-theft systems, and stability control. However, the discount amount can vary depending on the specific features and the insurer.

Multi-Policy Discount: Combining multiple insurance policies, such as car and homeowners insurance, with the same insurer can lead to significant savings. This discount rewards customer loyalty and simplifies policy management. However, it might not be beneficial if you already have multiple policies with different insurers offering competitive rates.

The Importance of Comparing Quotes from Multiple Insurers

Getting quotes from multiple insurers is crucial for finding the most affordable car insurance in Florida. Each insurer uses different factors to calculate premiums, so comparing quotes can reveal significant price differences.

Online comparison tools: These tools allow you to enter your information once and receive quotes from multiple insurers simultaneously, simplifying the comparison process.

Direct contact with insurers: Contacting insurers directly can provide more personalized quotes and allow you to ask specific questions about their policies and discounts.

Insurance Coverage Options in Florida

Florida car insurance policies offer a range of coverage options to protect drivers and their vehicles in the event of an accident or other covered incidents. Understanding these options is crucial for choosing the right coverage that meets your individual needs and budget.

Types of Car Insurance Coverage in Florida

Florida car insurance policies typically include several coverage options, each designed to address specific types of risks and losses. Here’s a breakdown of the most common coverage types:

| Coverage Type | Description | Benefits | Limitations |

|---|---|---|---|

| Liability Coverage | Covers damages to other people’s property or injuries caused by you in an accident. | Protects you financially against lawsuits or claims arising from accidents you cause. | Does not cover your own vehicle’s damage. |

| Collision Coverage | Covers repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. | Provides financial protection for your vehicle in case of an accident, regardless of fault. | May have a deductible you need to pay before insurance kicks in. |

| Comprehensive Coverage | Covers damages to your vehicle from non-accident events like theft, vandalism, fire, or natural disasters. | Provides financial protection for your vehicle against a wider range of risks. | May have a deductible you need to pay before insurance kicks in. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault. | Provides financial protection for medical expenses and other losses after an accident. | Has a limit on the amount of coverage, and you may need to pay a deductible. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | Covers your losses if you’re injured or your vehicle is damaged by an uninsured or underinsured driver. | Provides financial protection when the other driver doesn’t have enough insurance to cover your losses. | May have a limit on the amount of coverage, and you may need to pay a deductible. |

Minimum Insurance Requirements in Florida

Florida law mandates a minimum level of car insurance coverage for all drivers. These requirements are designed to ensure that drivers have adequate financial protection in case of an accident. The minimum coverage levels include:

- Personal Injury Protection (PIP): $10,000 per person

- Property Damage Liability: $10,000 per accident

While these minimums are legally required, they may not be sufficient to cover all potential losses in a serious accident. Many drivers choose to purchase additional coverage beyond the minimum requirements to ensure they have adequate financial protection.

Determining Appropriate Coverage Levels

Choosing the right level of car insurance coverage is a personal decision that depends on various factors, including your individual needs, financial situation, and risk tolerance. Here are some key considerations:

- Value of your vehicle: If you have a newer or more expensive vehicle, you may want to consider higher coverage limits for collision and comprehensive coverage to ensure you’re adequately protected in case of an accident or damage.

- Driving history: If you have a history of accidents or traffic violations, you may want to consider higher liability coverage limits to protect yourself from potential lawsuits or claims.

- Financial situation: Your financial resources play a significant role in determining your coverage needs. If you have limited savings or assets, you may want to prioritize higher liability coverage to protect yourself from potential financial hardship.

- Risk tolerance: Your personal risk tolerance also influences your coverage choices. If you’re risk-averse, you may opt for higher coverage limits to ensure maximum protection. Conversely, if you’re comfortable with a higher level of risk, you may choose lower coverage limits to save on premiums.

Florida’s No-Fault Insurance System

Florida operates under a unique no-fault insurance system, which differs significantly from the traditional fault-based systems prevalent in most other states. This system primarily aims to expedite the claims process and reduce litigation after accidents.

Understanding Florida’s No-Fault System

Under Florida’s no-fault system, drivers are required to carry Personal Injury Protection (PIP) coverage, which covers their own medical expenses and lost wages regardless of who caused the accident. This means that, in most cases, drivers can seek compensation for their injuries from their own insurance company, regardless of fault. However, this system also has limitations and specific scenarios where fault can be assigned, leading to potential claims against the at-fault driver’s insurance company.

The Role of Personal Injury Protection (PIP) Coverage

PIP coverage in Florida is mandatory for all drivers. It provides coverage for:

- Medical Expenses: PIP covers 80% of reasonable and necessary medical expenses incurred due to a car accident, up to a maximum of $10,000. This includes expenses such as hospital stays, doctor visits, and rehabilitation.

- Lost Wages: PIP also covers 60% of lost wages up to a maximum of $2,500. This helps compensate for income lost due to the inability to work following an accident.

- Death Benefits: In the unfortunate event of a fatal accident, PIP coverage can provide death benefits to the deceased’s beneficiaries, up to a maximum of $5,000.

Limitations of No-Fault Coverage

While Florida’s no-fault system aims to streamline claims, it has limitations:

- Limited Coverage for Non-Economic Damages: PIP coverage only covers medical expenses and lost wages. It does not cover pain and suffering, emotional distress, or other non-economic damages.

- Threshold for Filing a Fault-Based Claim: To pursue a fault-based claim against the at-fault driver’s insurance company, the injured party must meet a certain threshold. This threshold typically requires a significant injury, such as a permanent injury, a significant disfigurement, or a disability.

- Limited Coverage for Passengers: PIP coverage only applies to the policyholder and their family members. Passengers in the policyholder’s vehicle may have to rely on their own PIP coverage or pursue a claim against the at-fault driver’s insurance company.

Scenarios Where Fault May Be Assigned

While Florida’s no-fault system prioritizes PIP coverage, there are specific scenarios where fault can be assigned:

- Serious Injuries: If the injured party sustains a serious injury, such as a permanent injury, a significant disfigurement, or a disability, they may be able to file a claim against the at-fault driver’s insurance company.

- Death: In the event of a fatal accident, the deceased’s beneficiaries may be able to file a wrongful death claim against the at-fault driver’s insurance company.

- Property Damage: While PIP coverage does not cover property damage, the injured party can still file a claim against the at-fault driver’s insurance company for damages to their vehicle or other property.

Filing a Claim Under Florida’s No-Fault System

To file a claim under Florida’s no-fault system, the injured party should follow these steps:

- Report the Accident: Contact your insurance company immediately after the accident and report the details. Provide them with all relevant information, including the date, time, location, and other parties involved.

- Seek Medical Attention: It is crucial to seek medical attention promptly after the accident, even if you feel minor injuries. This will help document your injuries and establish a claim for PIP coverage.

- File a PIP Claim: Submit a claim for PIP coverage to your insurance company, providing all necessary documentation, such as medical bills and lost wage statements.

- Negotiate with Your Insurance Company: If you have questions or disagreements about your PIP coverage, contact your insurance company and attempt to negotiate a settlement. If you are unable to reach an agreement, you may need to seek legal advice.

Insurance Claims and Disputes in Florida

Filing a car insurance claim in Florida can be a complex process, but understanding the steps involved can help you navigate it more smoothly.

Filing a Car Insurance Claim

The process of filing a car insurance claim in Florida generally involves these steps:

- Report the accident: Immediately after an accident, contact your insurance company to report the incident. Provide them with all the necessary details, including the date, time, location, and any injuries sustained.

- File a claim: Your insurance company will guide you through the claim filing process. You will need to provide them with supporting documentation, such as a police report, medical records, and repair estimates.

- Investigation: Your insurance company will investigate the claim to determine the extent of the damages and the cause of the accident. They may also contact the other parties involved in the accident.

- Negotiation: Once the investigation is complete, your insurance company will negotiate a settlement with you. If you disagree with their offer, you can appeal the decision or seek independent legal advice.

- Payment: If a settlement is reached, your insurance company will issue payment for the damages. The payment can be made directly to you or to the repair shop or medical provider.

Common Disputes During the Claims Process

Disputes can arise during the claims process for various reasons. Some common disputes include:

- Liability: Disagreements about who is responsible for the accident can lead to disputes. This can occur when there are multiple parties involved or when the parties disagree on the cause of the accident.

- Damages: Disputes can arise regarding the amount of damages covered by the insurance policy. This can involve the cost of repairs, medical expenses, lost wages, and other related expenses.

- Policy coverage: Disputes can occur if the insurance company claims that the damage is not covered under the policy. This can be due to policy exclusions, limits, or other provisions.

- Bad faith: Disputes can arise if the insurance company is accused of acting in bad faith. This can involve unreasonable delays in processing claims, denials without proper justification, or attempts to settle for an unfairly low amount.

Tips for Navigating Insurance Claims and Resolving Disputes

Navigating insurance claims can be challenging, but these tips can help you protect your rights:

- Document everything: Keep detailed records of all communication with your insurance company, including dates, times, and summaries of conversations. Take photographs or videos of the damage to your vehicle and the accident scene.

- Understand your policy: Review your insurance policy carefully to understand your coverage limits, exclusions, and other provisions. This will help you avoid disputes later on.

- Be polite but assertive: Communicate with your insurance company in a respectful manner, but be clear about your expectations and rights. Do not hesitate to ask for clarification or dispute decisions that you believe are unfair.

- Consider legal advice: If you are unable to resolve a dispute with your insurance company, consider seeking legal advice from an experienced attorney specializing in insurance law. They can help you understand your rights and options and represent you in negotiations or litigation.

The Role of the Florida Department of Financial Services (DFS)

The Florida Department of Financial Services (DFS) plays a crucial role in handling consumer complaints related to insurance. They have the authority to investigate insurance companies and take enforcement actions against those found to be engaging in unfair or deceptive practices. If you have a complaint about your insurance company, you can file it with the DFS online or by phone. They will investigate your complaint and attempt to resolve it through mediation or other means. If they find that the insurance company has violated state laws, they can impose fines or other penalties.

Final Conclusion

Understanding Florida car insurance rates is essential for every driver in the state. By taking the time to learn about the factors that influence your premiums, comparing quotes from multiple insurers, and exploring available discounts, you can secure the best possible coverage at a price that fits your budget. Remember, navigating the Florida car insurance market effectively requires a proactive approach, and this guide provides the tools and knowledge you need to make informed decisions and protect yourself on the road.

FAQ Compilation

What is the average car insurance rate in Florida?

The average car insurance rate in Florida varies depending on factors like your driving history, vehicle type, and location. It’s best to get personalized quotes from multiple insurers to determine your specific rate.

How can I lower my car insurance premium in Florida?

There are several ways to lower your premium, including maintaining a good driving record, choosing a safe vehicle, bundling policies, and exploring discounts.

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage.