- Understanding Florida Car Insurance Rates: Florida Car Insurance Rates By Zip Code

- Exploring Car Insurance Rates by Zip Code

- Analyzing Factors Influencing Rates

- Strategies for Saving on Car Insurance

- Understanding Insurance Coverage

- Addressing Common Concerns

- Final Summary

- Frequently Asked Questions

Florida Car Insurance Rates by Zip Code: Navigating the complex world of car insurance in Florida can be daunting, especially when considering how rates can vary drastically depending on your location. Understanding the factors that influence these rates, particularly the impact of zip code, is crucial for securing the best possible coverage at an affordable price.

This comprehensive guide delves into the intricacies of Florida car insurance rates, exploring how zip code plays a significant role in determining your premiums. We’ll examine the key factors driving these variations, empowering you to make informed decisions about your insurance needs.

Understanding Florida Car Insurance Rates: Florida Car Insurance Rates By Zip Code

Florida has the highest average car insurance rates in the United States. This can be attributed to a variety of factors, including the state’s high population density, a large number of uninsured drivers, and a high frequency of car accidents.

Factors Influencing Florida Car Insurance Rates

The cost of car insurance in Florida is determined by several factors, including:

- Driving History: Your driving record is a major factor in determining your insurance rates. If you have a history of accidents, tickets, or other violations, you can expect to pay higher premiums.

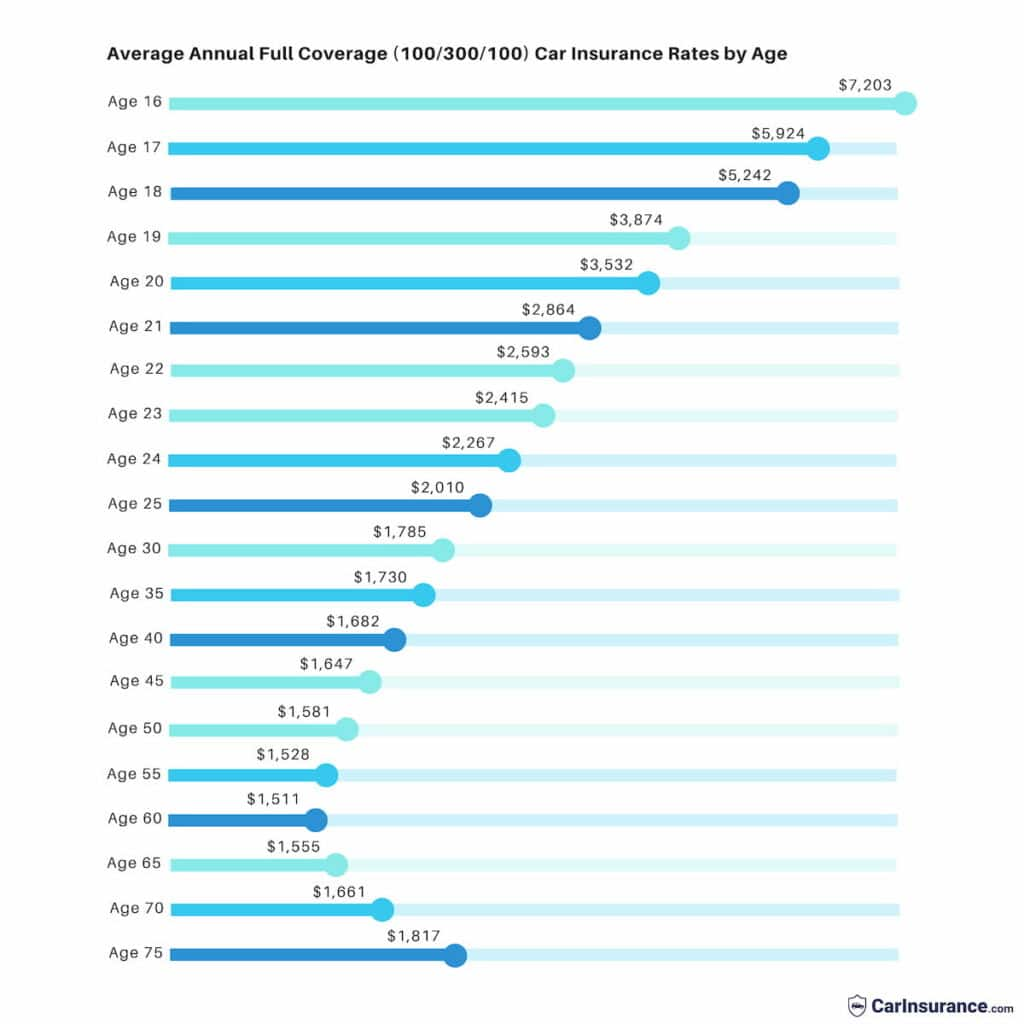

- Age and Gender: Younger drivers, especially males, are statistically more likely to be involved in accidents, leading to higher premiums.

- Vehicle Type: The type of vehicle you drive also affects your insurance rates. Sports cars and luxury vehicles are generally more expensive to insure due to their higher repair costs and greater risk of theft.

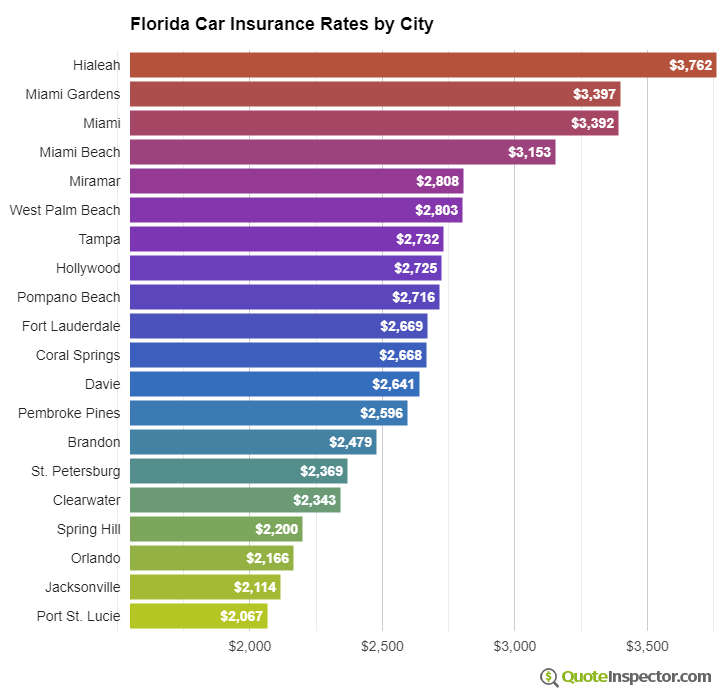

- Location: Where you live in Florida can also impact your car insurance rates. Areas with higher crime rates or more frequent accidents tend to have higher insurance premiums.

- Credit Score: In Florida, insurers can use your credit score to determine your insurance rates. This is because studies have shown a correlation between credit score and driving behavior.

- Coverage Levels: The amount of coverage you choose will also impact your premium. Higher coverage limits, such as comprehensive and collision coverage, will generally result in higher premiums.

Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a crucial role in regulating the state’s insurance industry, including car insurance. The DFS:

- Licenses and Regulates Insurers: The DFS licenses and regulates insurance companies operating in Florida, ensuring they meet certain standards and comply with state laws.

- Protects Consumers: The DFS investigates consumer complaints against insurance companies and provides resources and information to help consumers understand their insurance policies.

- Monitors Market Conditions: The DFS monitors the insurance market to identify potential problems and ensure fair competition among insurers.

Average Car Insurance Rates in Florida

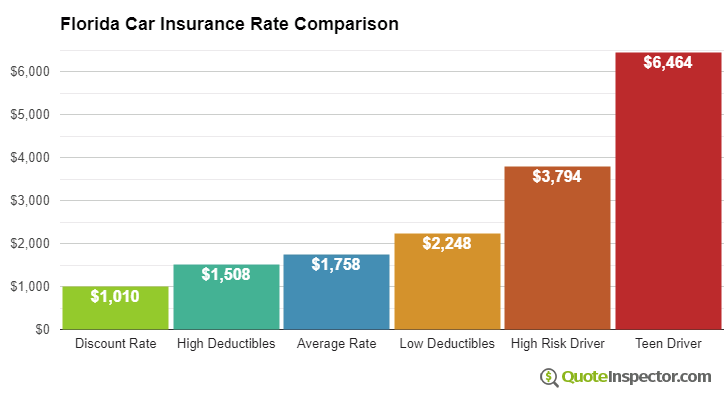

According to the National Association of Insurance Commissioners (NAIC), the average annual car insurance premium in Florida in 2023 was $2,500. This is significantly higher than the national average of $1,500.

The high average car insurance rates in Florida can be attributed to a combination of factors, including the state’s high population density, a large number of uninsured drivers, and a high frequency of car accidents.

Exploring Car Insurance Rates by Zip Code

Car insurance rates in Florida vary significantly based on zip code. This variation is not arbitrary but reflects a complex interplay of factors that insurers use to assess risk. Understanding these factors is crucial for drivers in Florida seeking the most competitive car insurance rates.

Factors Influencing Car Insurance Rates by Zip Code, Florida car insurance rates by zip code

The variation in car insurance rates across different zip codes in Florida is influenced by a number of factors. These factors can be broadly categorized as:

- Demographics: The age, gender, and driving history of residents in a particular zip code can significantly impact insurance rates. For instance, areas with a higher concentration of young drivers or drivers with a history of accidents may experience higher insurance premiums.

- Crime Rates: Areas with high crime rates, particularly those prone to car theft or vandalism, tend to have higher car insurance rates. This is because insurers are more likely to face claims for stolen or damaged vehicles in such areas.

- Traffic Density: Zip codes with heavy traffic congestion are associated with a higher risk of accidents. This increased risk of accidents can lead to higher insurance premiums for drivers in these areas.

- Weather Conditions: Florida’s susceptibility to hurricanes and other severe weather events can influence car insurance rates. Areas prone to hurricanes may see higher premiums due to the increased risk of damage to vehicles during storms.

- Road Conditions: The quality and condition of roads in a particular zip code can influence the frequency of accidents. Areas with poorly maintained roads or a high density of potholes may experience higher insurance rates.

Top 10 Most Expensive and Least Expensive Zip Codes

The following table showcases the top 10 most expensive and least expensive zip codes for car insurance in Florida, based on data from a leading insurance comparison website:

| Rank | Zip Code | Average Annual Premium |

|---|---|---|

| 1 | 33133 (Miami) | $2,800 |

| 2 | 33169 (Miami) | $2,750 |

| 3 | 33180 (Miami) | $2,700 |

| 4 | 33144 (Miami) | $2,650 |

| 5 | 33126 (Miami) | $2,600 |

| 6 | 33139 (Miami) | $2,550 |

| 7 | 33173 (Miami) | $2,500 |

| 8 | 33156 (Miami) | $2,450 |

| 9 | 33165 (Miami) | $2,400 |

| 10 | 33185 (Miami) | $2,350 |

| Rank | Zip Code | Average Annual Premium |

|---|---|---|

| 1 | 32548 (Lake City) | $1,200 |

| 2 | 32601 (Gainesville) | $1,250 |

| 3 | 32669 (Ocala) | $1,300 |

| 4 | 32691 (Ocala) | $1,350 |

| 5 | 32614 (Gainesville) | $1,400 |

| 6 | 32578 (Starke) | $1,450 |

| 7 | 32641 (Ocala) | $1,500 |

| 8 | 32696 (Ocala) | $1,550 |

| 9 | 32653 (Ocala) | $1,600 |

| 10 | 32670 (Ocala) | $1,650 |

It is important to note that these are just average premiums and actual rates may vary depending on individual factors such as driving history, vehicle type, and coverage options.

Analyzing Factors Influencing Rates

Car insurance rates in Florida, like elsewhere, are influenced by a multitude of factors, encompassing individual characteristics, vehicle details, and the surrounding environment. These factors work in conjunction to determine the level of risk associated with each policyholder, ultimately impacting the premium they pay.

Demographic Factors

Demographic factors play a significant role in shaping car insurance rates. These factors primarily reflect the risk profile of the insured individual based on their personal circumstances.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents due to their lack of experience and higher risk-taking behavior. As drivers gain experience and age, their rates generally decrease.

- Driving History: A clean driving record with no accidents or traffic violations is a key indicator of safe driving practices. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase insurance premiums.

- Credit Score: While controversial, some insurance companies utilize credit scores as a proxy for risk assessment. A good credit score can reflect responsible financial behavior, which may be correlated with responsible driving habits. However, this practice has been criticized for its potential to unfairly penalize individuals with lower credit scores, regardless of their driving history.

Vehicle Factors

The type of vehicle you drive also contributes significantly to your car insurance rates. Insurance companies assess the inherent risk associated with different vehicles based on their safety features, repair costs, and likelihood of theft.

- Vehicle Make and Model: Some car models are known for their safety features and lower repair costs, leading to lower insurance premiums. Conversely, vehicles with a history of high repair costs or a propensity for theft may attract higher rates.

- Vehicle Value: The value of your vehicle directly impacts your insurance premium. More expensive vehicles generally have higher premiums because they are more costly to replace in case of an accident or theft.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, are often considered safer and attract lower insurance premiums.

Coverage Options

The type and amount of coverage you choose also impact your insurance rates. Higher coverage limits, such as comprehensive and collision coverage, provide greater protection but come with a higher premium.

- Liability Coverage: This coverage protects you financially in case you are responsible for an accident that causes injuries or property damage to others. Higher liability limits offer greater protection but also result in higher premiums.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects you against damage to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters.

Driving Habits

Your driving habits, even outside of your official driving record, can influence your car insurance rates. Insurance companies may consider factors like your annual mileage and driving history.

- Annual Mileage: Drivers who travel long distances or commute regularly are statistically more likely to be involved in accidents. Higher annual mileage may result in higher insurance premiums.

- Driving History: While your official driving record is a primary factor, insurance companies may also use telematics devices or data from your smartphone to assess your driving behavior. This can include factors like speeding, hard braking, and driving at night.

Environmental Factors

The environment in which you drive can also play a role in determining your insurance rates.

- Crime Rates: Areas with higher crime rates, particularly those with a high incidence of vehicle theft, tend to have higher car insurance premiums.

- Population Density: Densely populated areas with heavy traffic congestion often have higher accident rates, which can lead to higher insurance premiums.

- Traffic Congestion: Traffic congestion increases the likelihood of accidents, making areas with significant traffic congestion more risky for insurance companies.

Strategies for Saving on Car Insurance

Finding affordable car insurance in Florida is crucial, given the state’s high average premiums. Fortunately, several strategies can help you lower your costs and secure the best possible coverage.

Comparing Quotes from Multiple Providers

Obtaining quotes from multiple insurance companies is the most effective way to find the best rates. Each insurer uses its own algorithms to determine premiums, factoring in various elements like your driving history, vehicle type, and location. Comparing quotes ensures you’re not overpaying and helps you identify the insurer offering the most competitive rates for your specific circumstances.

- Utilize online comparison websites: These platforms allow you to enter your information once and receive quotes from multiple insurers simultaneously, streamlining the comparison process.

- Contact insurance agents directly: Speaking with agents can provide personalized guidance and help you understand the nuances of different policies. They can also assist with finding discounts or exploring options tailored to your needs.

Negotiating Discounts

Insurance companies offer various discounts to lower premiums. Knowing what discounts are available and actively pursuing them can significantly reduce your costs.

- Good driver discounts: Maintaining a clean driving record, free of accidents or violations, qualifies you for significant discounts. Insurance companies view safe drivers as lower risk and reward them with lower premiums.

- Bundling discounts: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to substantial savings. Insurers often offer discounts for bundling multiple policies, incentivizing customers to consolidate their coverage.

- Safety features discounts: Vehicles equipped with advanced safety features, like anti-theft devices, airbags, or anti-lock brakes, are considered safer and may qualify for discounts. Insurance companies recognize these features as reducing the risk of accidents and offer lower premiums accordingly.

- Student discounts: Good students often qualify for discounts, demonstrating their responsible behavior and lower risk profile. Insurers may offer discounts to students maintaining a certain GPA or participating in specific extracurricular activities.

- Military discounts: Active military personnel and veterans often qualify for discounts, acknowledging their service and commitment. Insurers may offer special rates or discounts to military members, recognizing their responsible driving habits and disciplined nature.

Exploring Different Coverage Options

The level of coverage you choose significantly impacts your premiums. Evaluating your specific needs and understanding the different coverage options can help you find the right balance between affordability and protection.

- Deductibles: A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible generally lowers your premium, as you agree to shoulder a greater financial burden in case of an accident. However, ensure you can comfortably afford the deductible if you need to file a claim.

- Liability coverage: This coverage protects you financially if you’re found liable for an accident causing injury or damage to another person or property. Florida requires a minimum liability coverage of $10,000 per person and $20,000 per accident. Increasing your liability limits provides additional protection but also increases your premium. Evaluate your risk tolerance and potential financial exposure to determine the appropriate level of liability coverage.

- Collision and comprehensive coverage: These coverages protect your vehicle from damage caused by collisions, theft, vandalism, or natural disasters. While these coverages offer peace of mind, they also increase your premium. Consider the age and value of your vehicle when deciding on these coverages. For older vehicles with lower market value, it may be more cost-effective to forgo these coverages, as the cost of repairs may exceed the value of the vehicle.

Understanding Insurance Coverage

Navigating the world of car insurance in Florida can be overwhelming, especially with the variety of coverage options available. Understanding the different types of coverage and their benefits is crucial to making informed decisions and ensuring you have adequate protection in case of an accident.

Types of Car Insurance Coverage

Florida law requires drivers to have a minimum amount of liability insurance to protect others in case of an accident. However, it’s highly recommended to consider additional coverages to protect yourself and your vehicle. Here’s a breakdown of common car insurance coverages:

Liability Coverage

- Bodily Injury Liability: This coverage protects you financially if you cause injury to another person in an accident. It covers medical expenses, lost wages, and pain and suffering.

- Property Damage Liability: This coverage protects you if you damage someone else’s property in an accident. It covers repairs or replacement costs for the damaged property.

Collision Coverage

This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s optional but highly recommended, especially if you have a newer or financed vehicle.

Comprehensive Coverage

This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It’s also optional but can be beneficial, especially if you have a newer or valuable vehicle.

Personal Injury Protection (PIP)

Florida requires drivers to have PIP coverage, which covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

Uninsured/Underinsured Motorist Coverage (UM/UIM)

This coverage protects you if you’re injured in an accident caused by an uninsured or underinsured driver. It covers medical expenses, lost wages, and other related costs.

Medical Payments Coverage (Med Pay)

This coverage pays for medical expenses for you and your passengers, regardless of fault, up to a certain limit. It’s optional but can provide additional coverage beyond PIP.

Rental Reimbursement Coverage

This coverage pays for a rental car while your vehicle is being repaired after an accident. It’s optional and can be helpful if you rely on your vehicle for daily transportation.

Towing and Labor Coverage

This coverage pays for towing and labor costs if your vehicle breaks down or needs to be towed. It’s optional and can be helpful in emergency situations.

Importance of Adequate Insurance Coverage

Having adequate insurance coverage is essential for protecting yourself and your finances in case of an accident. It can help you avoid significant financial losses, including:

- Medical Expenses: Accidents can result in substantial medical bills, and insurance coverage can help cover these costs.

- Lost Wages: If you’re unable to work due to injuries, insurance coverage can help replace lost income.

- Vehicle Repair or Replacement Costs: Accidents can cause significant damage to your vehicle, and insurance coverage can help pay for repairs or replacement.

- Legal Fees: If you’re involved in an accident, you may need legal representation, and insurance coverage can help cover these costs.

Determining the Right Coverage

The amount of insurance coverage you need depends on several factors, including your financial situation, the value of your vehicle, and your driving habits. It’s essential to work with an insurance agent to determine the right coverage for your needs.

Addressing Common Concerns

Living in Florida means being prepared for the unexpected, especially when it comes to weather. Hurricanes and other natural disasters can significantly impact car insurance rates. Understanding how these events influence your premiums and knowing your rights as a policyholder is crucial.

Impact of Natural Disasters on Car Insurance Rates

Florida’s vulnerability to hurricanes and other natural disasters directly impacts car insurance rates. Insurance companies consider the risk of damage and claims in specific areas when setting premiums. Areas with a higher frequency of hurricanes or other natural disasters tend to have higher insurance rates.

- Hurricane Risk: Florida is highly susceptible to hurricanes, and the Florida Hurricane Catastrophe Fund (FHCF) plays a vital role in managing hurricane risk. The FHCF is a state-run reinsurance program that helps insurance companies cover losses from hurricanes. The FHCF assesses hurricane risk and sets reinsurance rates based on factors like historical hurricane activity and projected future risks. These rates ultimately influence the premiums you pay for car insurance.

- Other Natural Disasters: Besides hurricanes, Florida experiences other natural disasters like tornadoes, floods, and sinkholes. These events also contribute to higher insurance rates in affected areas. Insurance companies assess the risk of these events and factor them into their premium calculations.

- Increased Claims: Following a natural disaster, the number of insurance claims increases, which can lead to higher insurance premiums for everyone in the affected area. Insurance companies need to cover these claims, and they pass on the costs to policyholders through higher premiums.

Handling Claims and Disputes

Navigating insurance claims and disputes can be stressful. It’s essential to understand your rights and responsibilities as a policyholder.

- Report Claims Promptly: If your car is damaged in a natural disaster, report the claim to your insurance company as soon as possible. Document the damage with photos and videos, and keep detailed records of all communication with your insurance company.

- Understand Your Coverage: Review your insurance policy carefully to understand the extent of your coverage. Be aware of deductibles, coverage limits, and any exclusions.

- Negotiate Settlements: If you disagree with the insurance company’s assessment of the damage or the offered settlement, don’t hesitate to negotiate. Be prepared to present evidence supporting your claim, such as repair estimates from reputable mechanics.

- Seek Mediation or Arbitration: If you can’t reach an agreement with your insurance company, consider seeking mediation or arbitration. These processes can help resolve disputes fairly and efficiently.

Consumer Resources for Understanding Insurance Rights

Several resources are available to help you understand your insurance rights and options.

- Florida Department of Financial Services (DFS): The DFS regulates the insurance industry in Florida and provides information on consumer rights, insurance fraud, and filing complaints against insurance companies.

- Florida Office of Insurance Regulation (OIR): The OIR oversees the insurance market in Florida and provides information on insurance rates, coverage, and consumer protection.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that provides information and resources on insurance issues for consumers and regulators.

Final Summary

By understanding the factors that influence car insurance rates in Florida, particularly the role of zip code, you can take control of your insurance costs. Armed with this knowledge, you can effectively compare quotes, negotiate discounts, and choose coverage options that best suit your individual needs. Remember, a little research and planning can go a long way in securing the most favorable car insurance rates for your specific situation.

Frequently Asked Questions

What are the most expensive zip codes for car insurance in Florida?

The most expensive zip codes for car insurance in Florida tend to be located in densely populated urban areas with higher crime rates and traffic congestion.

How can I lower my car insurance premiums in Florida?

You can lower your car insurance premiums by maintaining a good driving record, choosing a safe vehicle, bundling your insurance policies, and taking advantage of available discounts.

What types of car insurance coverage are required in Florida?

Florida requires drivers to carry personal injury protection (PIP) and property damage liability (PDL) insurance.

What is the role of the Florida Department of Financial Services in regulating car insurance?

The Florida Department of Financial Services oversees the insurance industry in Florida, ensuring fair and competitive practices.