Florida Car Insurance Requirements: What You Need to Know Navigating the world of car insurance can be confusing, especially in a state like Florida with its unique laws and regulations. Understanding Florida’s car insurance requirements is crucial for every driver, ensuring you’re protected on the road and avoiding potential legal consequences.

This guide will delve into the essentials of Florida car insurance, covering everything from the minimum coverage levels required by law to the factors that influence your insurance rates. We’ll also explore the state’s no-fault system, provide tips for finding affordable insurance, and offer insights into understanding your policy and filing a claim.

Florida Car Insurance Basics

Driving without car insurance in Florida is illegal and can lead to serious consequences. Florida law mandates that all drivers carry a minimum amount of car insurance coverage to protect themselves and others on the road. This ensures that drivers are financially responsible for any damages or injuries they may cause in an accident.

Minimum Coverage Requirements

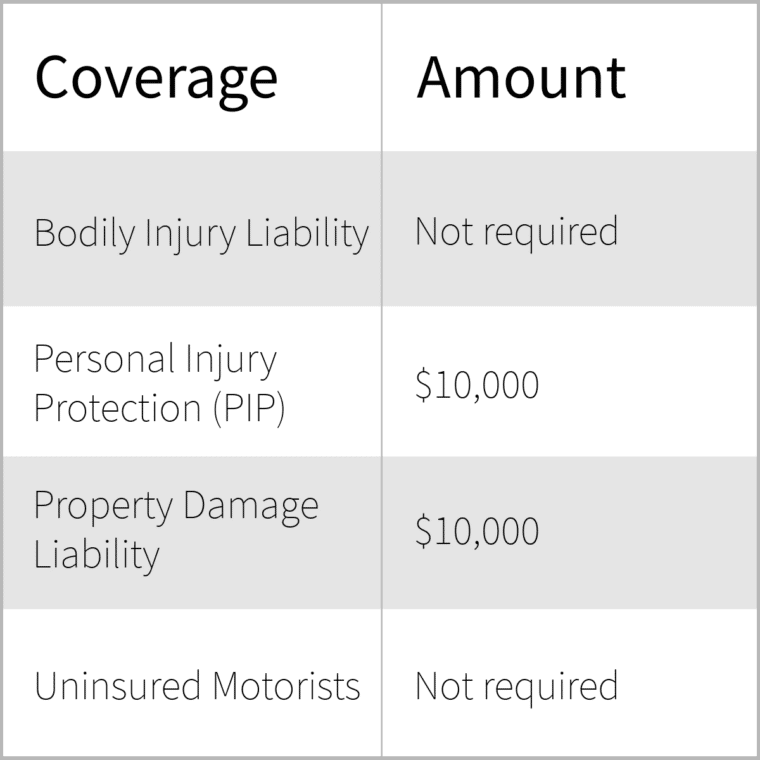

Florida law requires drivers to carry the following minimum liability insurance coverage:

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident. Florida requires a minimum of $10,000 in PIP coverage.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s vehicle or property if you are at fault in an accident. Florida requires a minimum of $10,000 in PDL coverage.

It is important to note that these minimum coverage requirements may not be enough to fully cover your financial obligations in the event of a serious accident.

Types of Car Insurance Coverage

While the minimum coverage is legally required, there are other types of car insurance coverage available in Florida that can provide additional protection:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged due to events other than an accident, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. It is often used to supplement PIP coverage.

- Rental Reimbursement Coverage: This coverage provides you with a rental car while your vehicle is being repaired after an accident.

Financial Responsibility Laws

Florida’s financial responsibility laws are designed to ensure that drivers have the financial means to cover damages they may cause to others in an accident. These laws require drivers to carry a minimum amount of car insurance or prove their ability to pay for damages out of pocket.

Penalties for Driving Without Insurance

Driving without the required minimum car insurance in Florida is a serious offense. The penalties for this violation can be significant, including:

- Fines: Drivers caught driving without insurance can face fines ranging from $150 to $500, depending on the circumstances.

- License Suspension: The Florida Department of Motor Vehicles (DMV) can suspend the driver’s license for up to three years.

- Vehicle Impoundment: The vehicle involved in the violation may be impounded until the driver provides proof of insurance.

- Court Costs: Drivers may also face additional court costs, including fines, attorney fees, and other expenses.

- Increased Insurance Premiums: If a driver is found guilty of driving without insurance, they may face significantly higher insurance premiums in the future.

- Jail Time: In some cases, driving without insurance can result in jail time, especially if the driver is involved in an accident that causes injury or death.

Examples of How Financial Responsibility Laws Affect Drivers

Here are some real-life examples of how Florida’s financial responsibility laws can impact drivers:

- Accident with Uninsured Driver: If you are involved in an accident with a driver who does not have insurance, you may be responsible for covering your own damages, including medical bills and vehicle repairs. This can be a significant financial burden, especially if you are injured in the accident.

- Hit-and-Run Accident: If you are involved in a hit-and-run accident and the other driver is not identified, you may still be required to provide proof of insurance to avoid penalties. This can be a challenging situation, as you may not have the opportunity to exchange insurance information with the other driver.

- Driving Without Insurance: If you are caught driving without insurance, you could face significant fines, license suspension, and other penalties. This can make it difficult to get around and could also impact your ability to find a job or rent an apartment.

Florida’s No-Fault System

Florida operates under a “no-fault” insurance system, a unique approach to handling car accidents. This system aims to streamline the claims process and reduce litigation, but it also has specific implications for drivers.

Understanding Florida’s No-Fault System

Florida’s no-fault system mandates that drivers carry Personal Injury Protection (PIP) coverage. This coverage provides benefits to the insured driver and passengers, regardless of fault, for medical expenses, lost wages, and other related costs resulting from an accident.

Benefits of Florida’s No-Fault System

- Faster Claims Processing: The no-fault system allows for quicker claim settlements, as fault determination is less crucial in the initial stages.

- Reduced Litigation: By focusing on providing benefits to the injured party, regardless of fault, the no-fault system aims to reduce the number of lawsuits arising from accidents.

- Lower Premiums: The potential for fewer lawsuits and streamlined claims processing can contribute to lower insurance premiums for drivers.

Limitations of Florida’s No-Fault System

- Limited Coverage: PIP coverage has limitations, including caps on medical expenses and lost wages. For more significant injuries or losses, drivers may need to pursue additional compensation through a lawsuit.

- Potential for Disputes: Despite the focus on streamlining claims, disputes can still arise regarding the extent of injuries or the amount of benefits owed.

- Increased Premiums for Higher Coverage: Drivers who opt for higher PIP coverage limits may face higher insurance premiums.

Comparison with Other States

- Pure No-Fault States: In these states, drivers can only sue for pain and suffering if their injuries meet specific criteria, such as “serious injury” or “permanent disability.”

- Tort States: In tort states, drivers have the right to sue for all damages, including pain and suffering, regardless of fault.

- Modified No-Fault States: These states combine elements of no-fault and tort systems, allowing drivers to sue for certain types of damages but restricting lawsuits for others.

Factors Affecting Insurance Rates

Your car insurance rates in Florida are determined by various factors, including your driving history, age, vehicle type, location, and credit score. Insurance companies analyze these factors to assess your risk profile and determine the premium you will pay. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is a significant factor influencing your car insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or driving under the influence (DUI) convictions can lead to higher rates.

- Accidents: Insurance companies consider the number and severity of accidents you’ve been involved in. A recent accident, especially one that was your fault, will likely increase your premiums.

- Traffic Violations: Speeding tickets, running red lights, and other traffic violations can also increase your insurance rates. The severity of the violation will influence the impact on your premiums.

- DUI Convictions: Driving under the influence convictions are considered very serious offenses, resulting in significant increases in insurance rates. These convictions may also lead to a suspension of your driver’s license.

Age

Age is another key factor influencing car insurance rates. Younger drivers, particularly those under the age of 25, are statistically more likely to be involved in accidents. Insurance companies typically charge higher premiums for younger drivers, reflecting this increased risk. However, as you age and gain more driving experience, your rates will generally decrease.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance premiums. Insurance companies assess the risk associated with different vehicle types.

- High-Performance Vehicles: Sports cars, luxury vehicles, and other high-performance cars are often considered more expensive to repair and more likely to be involved in accidents. These vehicles typically have higher insurance rates.

- Safety Features: Vehicles equipped with safety features such as anti-lock brakes, airbags, and electronic stability control can lower your insurance rates. These features can help prevent accidents or mitigate their severity, reducing the risk for insurance companies.

- Vehicle Value: The value of your vehicle also influences your insurance premiums. More expensive vehicles are more costly to replace or repair, leading to higher insurance rates.

Location, Florida car insurance requirement

Your location in Florida can significantly impact your car insurance rates. Insurance companies consider factors such as the density of traffic, crime rates, and the frequency of accidents in your area.

- Urban Areas: Urban areas with high traffic density and congestion often have higher insurance rates due to the increased risk of accidents.

- Rural Areas: Rural areas with lower population density and fewer traffic hazards generally have lower insurance rates.

Credit Score

While it may seem counterintuitive, your credit score can also influence your car insurance rates in Florida. Insurance companies use your credit score as a proxy for your overall financial responsibility. Individuals with good credit scores are often considered less risky policyholders, leading to lower insurance premiums.

Finding Affordable Insurance

Finding affordable car insurance in Florida can be a challenge, especially considering the state’s unique insurance landscape. However, with some research and effort, you can find a policy that fits your budget.

Benefits of Shopping Around

Comparing quotes from multiple insurance companies is crucial for finding the best rates. By shopping around, you can potentially save hundreds of dollars on your annual premiums. This process involves obtaining quotes from several insurers and comparing their rates, coverage options, and other factors.

Understanding Your Policy: Florida Car Insurance Requirement

Your Florida car insurance policy is a contract between you and your insurance company. It Artikels the terms and conditions of your coverage, including what is covered, what is not covered, and how much you will pay for your insurance. Understanding the key components of your policy is crucial for making informed decisions about your coverage and ensuring you are adequately protected in case of an accident.

Policy Sections

Each Florida car insurance policy is typically divided into several sections, each addressing a specific aspect of your coverage. Here’s a breakdown of some common sections and their significance:

- Declarations Page: This page summarizes the essential information about your policy, including your name, address, policy number, coverage limits, premium amount, and effective dates. It serves as a quick reference for key policy details.

- Coverages: This section details the specific types of coverage you have purchased, such as liability, collision, comprehensive, and personal injury protection (PIP). It Artikels the limits of coverage for each type and the situations under which they apply.

- Exclusions and Limitations: This section specifies situations and events that are not covered by your policy. For example, it may exclude coverage for damages caused by wear and tear, acts of war, or driving under the influence.

- Conditions: This section Artikels the responsibilities of both you and your insurance company under the policy. It may include provisions about reporting accidents, cooperating with investigations, and handling claims.

- Definitions: This section provides clear definitions of key terms used throughout the policy, ensuring a consistent understanding of the language used.

Common Policy Exclusions and Limitations

While your Florida car insurance policy provides essential protection, it’s important to be aware of its limitations. Here are some common examples of exclusions and limitations:

- Driving without a valid license: Most policies exclude coverage if you are driving without a valid driver’s license, as this is a violation of Florida law.

- Driving under the influence: Coverage may be denied or limited if you are involved in an accident while driving under the influence of alcohol or drugs.

- Intentional acts: Your policy generally won’t cover damages caused by intentional acts, such as intentionally damaging your own vehicle or causing an accident on purpose.

- Uninsured or underinsured motorists: While Florida requires all drivers to have PIP coverage, it’s crucial to understand that PIP only covers medical expenses and lost wages. If you are involved in an accident with an uninsured or underinsured motorist, your own policy may provide additional coverage for damages beyond PIP limits, but this coverage often has limitations.

Filing a Claim

Filing a car insurance claim in Florida is a process that can seem daunting, but with the right information and preparation, it can be manageable. Understanding the steps involved, the necessary documentation, and effective communication strategies can help ensure a smooth and successful claim process.

Steps Involved in Filing a Claim

The initial steps involve reporting the accident to your insurance company and gathering the necessary documentation. This includes contacting your insurance company within the required timeframe, typically within 24 hours of the accident.

- Report the accident to your insurance company as soon as possible, ideally within 24 hours.

- Provide accurate details about the accident, including the date, time, location, and involved parties.

- File a police report if the accident involved injuries, property damage, or a hit-and-run.

- Gather all relevant documentation, such as photos of the damage, witness statements, and medical records.

- Cooperate with your insurance company’s investigation and provide any requested information promptly.

- Be patient and persistent throughout the process, as insurance claims can take time to process.

Documentation Required for a Successful Claim

Providing complete and accurate documentation is crucial for a successful claim.

- Police Report: A police report is required in cases involving injuries, property damage exceeding a certain threshold, or hit-and-run accidents. It provides an official record of the accident and can be crucial for supporting your claim.

- Photos and Videos: Take detailed photos and videos of the accident scene, the damage to your vehicle, and any injuries sustained. These visuals serve as evidence to support your claim.

- Witness Statements: Obtain contact information from any witnesses to the accident and request written statements describing what they observed. Their accounts can provide valuable corroboration.

- Medical Records: If you sustained injuries, gather all relevant medical records, including doctor’s notes, treatment records, and bills. These documents will support your claim for medical expenses.

- Vehicle Registration and Insurance Information: Keep copies of your vehicle registration and insurance information readily available for your insurance company.

Tips for Effective Communication with Your Insurance Company

Open and clear communication with your insurance company is essential for a smooth claim process.

- Be Prompt and Responsive: Respond to your insurance company’s requests for information promptly and provide complete and accurate details.

- Document All Interactions: Keep a record of all communications with your insurance company, including dates, times, and content of conversations.

- Be Polite and Professional: Maintain a professional and respectful tone in all communications, even if you are frustrated.

- Ask for Clarification: If you are unsure about any aspect of the claim process, ask for clarification from your insurance company.

- Understand Your Rights: Familiarize yourself with your rights as a policyholder in Florida and do not hesitate to seek legal advice if necessary.

Summary

Driving in Florida without the proper insurance can lead to hefty fines, license suspension, and even jail time. By understanding Florida’s car insurance requirements and taking the necessary steps to secure adequate coverage, you can protect yourself financially and legally while enjoying the freedom of the open road. Remember to review your policy regularly, compare quotes from different insurers, and stay informed about any changes in state laws to ensure you have the right coverage for your needs.

Expert Answers

What are the minimum car insurance coverage requirements in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident.

What happens if I get into an accident without car insurance in Florida?

Driving without insurance in Florida is a serious offense. You could face fines, license suspension, and even jail time. Additionally, you may be held personally liable for any damages caused to other vehicles or individuals.

How do I file a car insurance claim in Florida?

To file a claim, contact your insurance company as soon as possible after an accident. Provide them with the necessary details, including the date, time, and location of the accident, as well as information about the other parties involved. Follow your insurance company’s instructions for submitting the required documentation.