Florida car insurance requirements set the stage for a comprehensive understanding of the state’s unique insurance landscape. Navigating the intricacies of Florida’s no-fault system, mandatory coverage, and optional add-ons can seem daunting, but this guide aims to provide clarity and empower you to make informed decisions about your car insurance needs.

Florida’s car insurance laws are designed to protect drivers and their passengers in the event of an accident. The state has a unique “no-fault” system, which means that drivers are typically responsible for their own medical expenses after an accident, regardless of who is at fault. Understanding these requirements is crucial for all drivers, as failure to comply can result in serious penalties, including fines, license suspension, and even jail time.

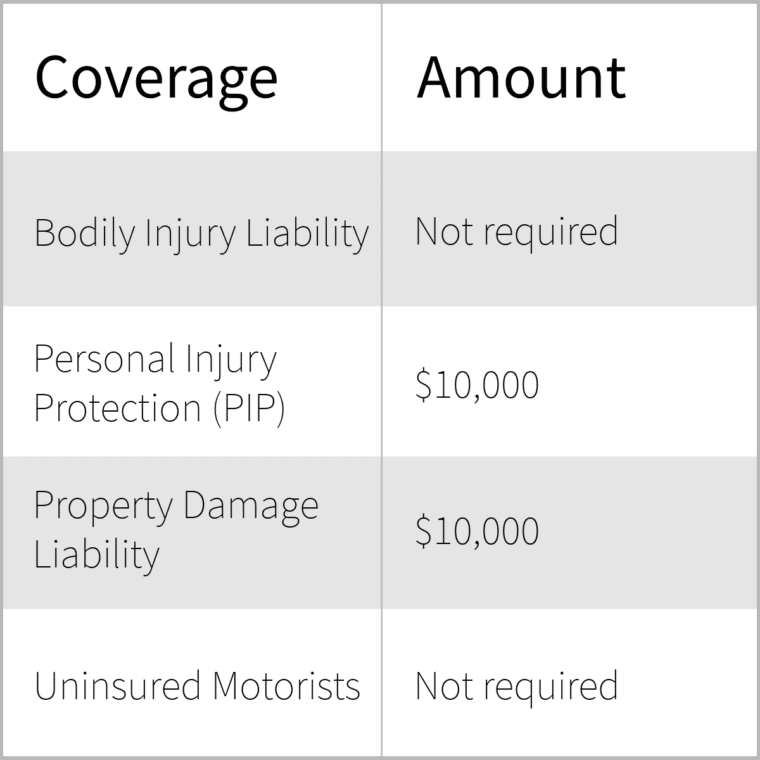

Florida’s Mandatory Car Insurance Requirements: Florida Car Insurance Requirements

In Florida, all drivers are required to carry a minimum amount of car insurance to protect themselves and others in the event of an accident. This mandatory insurance requirement is designed to ensure financial responsibility for damages caused by an insured driver.

Minimum Liability Coverage

Florida’s minimum liability coverage requirements are divided into three main categories: bodily injury liability, property damage liability, and personal injury protection (PIP).

- Bodily Injury Liability: This coverage protects you from financial liability if you injure someone else in an accident. The minimum required coverage is $10,000 per person and $20,000 per accident. This means that if you cause an accident that results in injuries to multiple people, your insurance will cover up to $10,000 per injured person, with a maximum of $20,000 for all injuries in the accident.

- Property Damage Liability: This coverage protects you from financial liability if you damage someone else’s property in an accident. The minimum required coverage in Florida is $10,000.

- Personal Injury Protection (PIP): This coverage is unique to Florida and is mandatory for all drivers. PIP covers your own medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident. The minimum required PIP coverage is $10,000.

It is crucial to understand that these minimum coverage requirements are just that – minimums. It is highly recommended to consider purchasing higher coverage limits to ensure adequate protection in case of a serious accident.

Understanding Florida’s No-Fault System

Florida’s car insurance system operates on a “no-fault” basis, meaning that after an accident, each driver involved files a claim with their own insurance company, regardless of who caused the accident. This system aims to streamline the claims process and reduce litigation.

How PIP Coverage Works

Personal Injury Protection (PIP) coverage is a mandatory component of Florida’s no-fault insurance system. PIP coverage provides benefits to the insured driver and passengers in their vehicle, regardless of fault, for medical expenses, lost wages, and other related costs incurred due to an accident.

- Medical Expenses: PIP covers reasonable and necessary medical expenses, including doctor visits, hospital stays, surgeries, and rehabilitation services.

- Lost Wages: PIP coverage provides benefits for lost wages due to an accident, up to a specific limit. The amount of lost wages covered depends on the individual’s income and the severity of their injuries.

- Other Expenses: PIP coverage may also cover other expenses related to the accident, such as funeral expenses, disability benefits, and replacement services.

Limitations and Benefits of the No-Fault System

The no-fault system in Florida has both advantages and disadvantages.

- Benefits:

- Faster Claims Processing: Since each driver files a claim with their own insurance company, the claims process is typically faster than in traditional fault-based systems, where drivers must prove fault before receiving benefits.

- Reduced Litigation: The no-fault system aims to reduce the number of lawsuits related to car accidents, as drivers are encouraged to seek compensation from their own insurance company rather than pursuing legal action against the other driver.

- Guaranteed Benefits: Regardless of fault, PIP coverage guarantees benefits to the insured driver and passengers for medical expenses, lost wages, and other related costs.

- Limitations:

- Limited Coverage: PIP coverage has specific limits on the amount of benefits it provides. In some cases, the limits may not be sufficient to cover all of the insured’s expenses, especially for serious injuries.

- Threshold for Suing: While the no-fault system aims to reduce litigation, there are certain circumstances where drivers can sue the other driver for additional damages. To sue, a driver must meet a “threshold” requirement, which typically involves a serious injury, such as permanent disfigurement or significant impairment.

- Higher Insurance Premiums: The no-fault system can lead to higher insurance premiums, as insurance companies need to cover the costs of providing PIP coverage to all drivers.

Additional Coverage Options in Florida

In addition to the mandatory coverage required by Florida law, you have the option to purchase additional coverage to protect yourself financially in case of an accident. These optional coverages can provide significant financial protection, but it’s important to understand their benefits and drawbacks to make informed decisions about your insurance needs.

Collision Coverage, Florida car insurance requirements

Collision coverage protects you against financial loss if your vehicle is damaged in an accident, regardless of who is at fault. This coverage will pay for repairs or replacement of your vehicle, minus your deductible.

Benefits:

* Financial protection: Collision coverage provides financial protection against the cost of repairs or replacement of your vehicle in an accident.

* Peace of mind: Having collision coverage gives you peace of mind knowing that you are financially protected in case of an accident, regardless of who is at fault.

Drawbacks:

* Cost: Collision coverage can be expensive, especially for newer or more expensive vehicles.

* Deductible: You will have to pay a deductible before your insurance company covers the rest of the costs.

Comprehensive Coverage

Comprehensive coverage protects you against financial loss if your vehicle is damaged by something other than a collision, such as theft, vandalism, fire, or natural disasters. This coverage will pay for repairs or replacement of your vehicle, minus your deductible.

Benefits:

* Protection against a wide range of risks: Comprehensive coverage protects you against a wide range of risks that are not covered by collision coverage.

* Peace of mind: Knowing that your vehicle is protected against these risks can give you peace of mind.

Drawbacks:

* Cost: Comprehensive coverage can be expensive, especially for newer or more expensive vehicles.

* Deductible: You will have to pay a deductible before your insurance company covers the rest of the costs.

Uninsured/Underinsured Motorist (UM/UIM) Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured. This coverage will pay for your medical expenses, lost wages, and other damages, up to the limits of your policy.

Benefits:

* Financial protection: UM/UIM coverage provides financial protection in case you are injured in an accident caused by an uninsured or underinsured driver.

* Peace of mind: Knowing that you have this coverage can give you peace of mind in case of an accident.

Drawbacks:

* Cost: UM/UIM coverage can be expensive, especially if you choose high limits.

* Limits: Your UM/UIM coverage has limits, so it may not cover all of your losses if they exceed those limits.

Medical Payments Coverage (Med Pay)

Medical payments coverage (Med Pay) pays for your medical expenses, regardless of who is at fault in an accident. This coverage is typically limited to a certain amount, such as $1,000 or $5,000.

Benefits:

* Quick payment: Med Pay coverage typically pays for your medical expenses quickly, without waiting for a determination of fault.

* Coverage for all passengers: Med Pay coverage applies to you and all passengers in your vehicle, regardless of whether they are covered by other insurance.

Drawbacks:

* Limited coverage: Med Pay coverage is typically limited to a certain amount, so it may not cover all of your medical expenses.

* Not required by law: Med Pay coverage is not required by law in Florida, so you may have to pay extra for it.

Key Features and Costs of Optional Coverages

| Coverage | Key Features | Cost |

|---|---|---|

| Collision Coverage | Protects against damage to your vehicle in an accident, regardless of fault. | Varies depending on factors such as vehicle age, value, and driving record. |

| Comprehensive Coverage | Protects against damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. | Varies depending on factors such as vehicle age, value, and location. |

| Uninsured/Underinsured Motorist (UM/UIM) Coverage | Protects you if you are injured in an accident caused by an uninsured or underinsured driver. | Varies depending on the limits of coverage chosen. |

| Medical Payments Coverage (Med Pay) | Pays for your medical expenses, regardless of fault, up to a certain limit. | Varies depending on the amount of coverage chosen. |

Outcome Summary

By understanding Florida’s car insurance requirements, you can navigate the complexities of the state’s insurance landscape with confidence. Remember, having the right coverage is essential for protecting yourself financially and legally in the event of an accident. Don’t hesitate to consult with a licensed insurance agent to ensure you have the right coverage to meet your individual needs.

Detailed FAQs

What happens if I get into an accident and don’t have the minimum required car insurance?

You could face serious consequences, including fines, license suspension, and even jail time. Additionally, you may be held personally liable for the damages and injuries caused to others.

Can I choose to have less coverage than the minimum requirements?

No, Florida law requires all drivers to carry at least the minimum liability coverage. You cannot opt out of these requirements.

How do I know if I have enough insurance coverage?

Review your insurance policy carefully and ensure that you have at least the minimum liability coverage required by Florida law. If you have any doubts, contact your insurance agent for clarification.

How often should I review my car insurance policy?

It’s a good idea to review your policy at least annually, or whenever you experience a major life change, such as a new car, a change in driving habits, or a change in your financial situation.