- Florida Car Lease Insurance Requirements Overview

- Types of Insurance Required for Leased Cars: Florida Car Lease Insurance Requirements

- Minimum Coverage Requirements

- Additional Insurance Options

- Insurance Coverage for Lease-Specific Risks

- Obtaining and Maintaining Insurance

- Insurance Claims and Disputes

- Insurance Requirements for Out-of-State Residents

- Legal Implications of Insufficient Coverage

- Resources and Information

- Closing Notes

- FAQ Resource

Florida car lease insurance requirements are crucial for both lessees and lessors, ensuring financial protection in case of accidents or other unforeseen events. Understanding these requirements is essential to avoid legal complications and financial burdens.

Navigating the complexities of car insurance can be overwhelming, especially when leasing a vehicle. Florida has specific regulations regarding insurance coverage for leased cars, and it’s vital to be aware of these rules to ensure you’re properly protected.

Florida Car Lease Insurance Requirements Overview

In Florida, driving a leased vehicle comes with specific insurance requirements that go beyond the minimum liability coverage mandated for all drivers. These regulations ensure that both the leaseholder and the leasing company are protected in case of accidents, damages, or other unforeseen events.

Purpose and Importance of Florida Car Lease Insurance Requirements

The purpose of these insurance requirements is to protect the financial interests of both the leasing company and the leaseholder. The leasing company has a vested interest in ensuring that the leased vehicle remains in good condition and is adequately insured against potential risks. The leaseholder, on the other hand, needs insurance to cover their own financial liability in case of an accident or damage to the leased vehicle.

Consequences of Driving a Leased Car Without Proper Insurance Coverage

Driving a leased vehicle in Florida without the required insurance coverage can lead to severe consequences. Here are some of the potential repercussions:

- Financial Liability: In the event of an accident, you could be held personally liable for all damages, including the cost of repairs, medical expenses, and any other related costs. This can lead to significant financial hardship.

- Lease Termination: The leasing company has the right to terminate your lease agreement if you fail to maintain the required insurance coverage. This means you would have to return the vehicle and potentially face additional penalties.

- Legal Action: The leasing company can take legal action against you to recover any losses incurred due to your lack of insurance coverage.

- Driving Suspension: If you are involved in an accident without proper insurance coverage, your driver’s license could be suspended.

Types of Insurance Required for Leased Cars: Florida Car Lease Insurance Requirements

In Florida, leasing a car comes with specific insurance requirements designed to protect both the lessee (the person leasing the car) and the lessor (the company that owns the car). These requirements ensure that financial responsibility for potential damages or accidents falls on the right shoulders.

Liability Insurance

Liability insurance is a fundamental requirement for all vehicles, including leased cars, in Florida. This type of insurance protects you financially if you are found at fault in an accident that causes injury or property damage to others. It covers medical expenses, lost wages, and property damage up to the policy limits.

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for individuals injured in an accident caused by the insured driver.

- Property Damage Liability: Covers damages to another person’s property, such as their vehicle, in an accident caused by the insured driver.

For example, if you accidentally rear-end another vehicle, causing injury to the driver and damage to their car, your liability insurance would cover their medical bills, lost wages, and the cost of repairing their vehicle.

Collision Coverage

Collision coverage protects your leased vehicle from damage caused by a collision with another vehicle or object, regardless of who is at fault. This coverage helps pay for repairs or replacement of your leased car after an accident.

- Collision coverage is typically optional, but leasing companies often require it as part of the lease agreement.

For instance, if you collide with a tree while driving your leased car, collision coverage will help pay for the repairs or replacement of your car, even if you are solely responsible for the accident.

Comprehensive Coverage

Comprehensive coverage protects your leased car from damage caused by events other than collisions, such as theft, vandalism, fire, natural disasters, and falling objects. This coverage helps pay for repairs or replacement of your leased car after such events.

- Comprehensive coverage is typically optional, but leasing companies often require it as part of the lease agreement.

For instance, if your leased car is stolen or damaged by a hailstorm, comprehensive coverage will help pay for the repairs or replacement of your car.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, is required in Florida for all vehicles. This coverage pays for your medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident.

- PIP coverage is mandatory in Florida and is a separate policy from liability insurance.

For example, if you are injured in an accident while driving your leased car, PIP coverage will pay for your medical bills, lost wages, and other related costs, even if you are at fault for the accident.

Uninsured/Underinsured Motorist (UM/UIM) Coverage

UM/UIM coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. This coverage helps pay for your medical expenses, lost wages, and other related costs if the other driver’s insurance is insufficient to cover your losses.

- UM/UIM coverage is optional but highly recommended, especially in Florida where there is a significant number of uninsured drivers.

For example, if you are injured in an accident with an uninsured driver, your UM/UIM coverage will pay for your medical bills, lost wages, and other related costs, even if the other driver has no insurance.

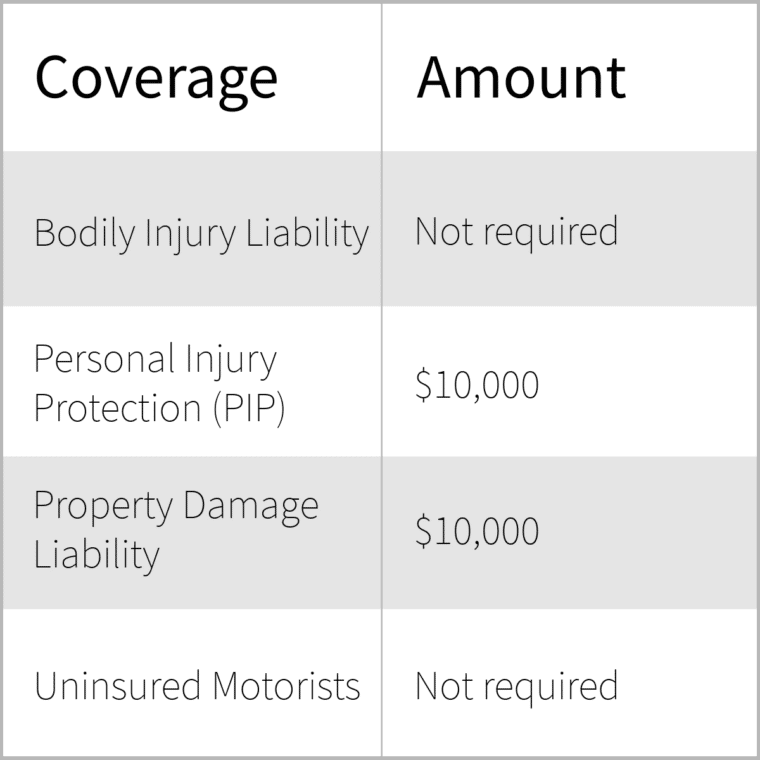

Minimum Coverage Requirements

In Florida, leased cars are subject to specific minimum insurance coverage requirements mandated by state law. These requirements are designed to protect both the lessee and the lessor in case of an accident or other covered event.

Minimum Coverage Limits

The minimum coverage limits for leased cars in Florida are generally the same as those required for owned vehicles. However, there are some key differences that lessees should be aware of.

- Personal Injury Protection (PIP): Florida requires all drivers to carry PIP coverage, which pays for medical expenses, lost wages, and other related costs incurred by the insured in an accident, regardless of fault. The minimum PIP coverage limit is $10,000.

- Property Damage Liability (PDL): This coverage protects the insured against claims for damage to another person’s property. The minimum PDL coverage limit in Florida is $10,000.

- Bodily Injury Liability (BIL): BIL coverage protects the insured against claims for bodily injury caused to another person. The minimum BIL coverage limits in Florida are $10,000 per person and $20,000 per accident.

Comparison with Other States

Florida’s minimum insurance coverage requirements for leased cars are relatively similar to those of other states. However, some states have higher minimum coverage limits or require additional types of coverage, such as uninsured motorist coverage.

- New York, for instance, requires a minimum of $25,000 per person and $50,000 per accident for bodily injury liability coverage, while Florida requires $10,000 per person and $20,000 per accident.

- California requires drivers to carry $15,000 in property damage liability coverage, compared to Florida’s $10,000 minimum.

Additional Insurance Options

While Florida law requires specific minimum coverage for leased vehicles, lessees may consider additional insurance options to enhance protection and mitigate potential financial risks. These optional coverages offer greater peace of mind and can help safeguard against unexpected expenses.

Gap Insurance

Gap insurance bridges the gap between the actual cash value (ACV) of a leased vehicle and the remaining balance owed on the lease. If a leased vehicle is totaled or stolen, the insurance payout from collision or comprehensive coverage may not be enough to cover the outstanding lease balance. Gap insurance steps in to cover this difference, protecting lessees from significant out-of-pocket expenses.

Gap insurance is particularly beneficial for leased vehicles, as their value depreciates rapidly, especially during the early years of the lease.

Rental Car Reimbursement

Rental car reimbursement coverage helps pay for a rental car while your leased vehicle is being repaired after an accident or other covered event. This coverage can be particularly helpful for individuals who rely on their vehicles for daily commutes, work, or other essential activities.

Rental car reimbursement coverage is typically offered as an add-on to collision or comprehensive insurance policies.

Additional Liability Coverage

While Florida requires minimum liability coverage, lessees may choose to increase their liability limits to provide greater financial protection in case of an accident. Higher liability limits can help cover the costs of medical expenses, property damage, and legal fees for the other party involved in an accident.

It’s crucial to consider the potential costs associated with a significant accident and choose liability limits that provide adequate protection.

Waiver of Deductible

This coverage eliminates the deductible that you would normally have to pay for collision or comprehensive claims. By paying a small additional premium, you can avoid having to pay a significant amount out of pocket for repairs or replacement.

A waiver of deductible can be particularly helpful for individuals who frequently encounter minor accidents or have a high deductible.

Insurance Coverage for Lease-Specific Risks

Leasing a car in Florida comes with unique financial risks that go beyond the standard car insurance requirements. Understanding these risks and securing the right insurance coverage is crucial for protecting your financial well-being.

Lease Gap Insurance

Lease gap insurance is a specialized coverage designed to bridge the gap between the actual cash value (ACV) of your leased car and the remaining balance on your lease agreement in case of a total loss. This coverage is particularly important in Florida due to the high prevalence of severe weather events, which can lead to vehicle damage or theft.

- Scenario: You lease a car for $30,000 and after two years, the car is totaled in a hurricane. The ACV of the car is $15,000, leaving a $15,000 gap between the ACV and your lease balance. Lease gap insurance would cover this gap, preventing you from being financially responsible for the remaining lease payments.

Obtaining and Maintaining Insurance

Securing the right insurance for your leased car in Florida is crucial to protecting yourself financially and fulfilling your lease agreement. This process involves choosing the right insurance policy, ensuring continuous coverage, and understanding your responsibilities as a lessee.

Obtaining Insurance for a Leased Car

When you lease a car in Florida, you’ll need to provide your leasing company with proof of insurance. This typically involves obtaining a certificate of insurance from your insurance provider. The process of obtaining insurance for a leased car is similar to obtaining insurance for a car you own. However, there are some key differences to consider:

- Contacting Insurance Providers: Start by contacting multiple insurance providers to compare quotes and coverage options. You can get quotes online, over the phone, or in person. Be sure to provide all necessary information, including your driving history, vehicle details, and desired coverage levels.

- Understanding Lease Requirements: Carefully review your lease agreement to understand the specific insurance requirements set by your leasing company. They may require certain coverage levels, such as collision and comprehensive coverage, or even require you to name them as an additional insured on your policy.

- Negotiating Coverage: Don’t hesitate to negotiate with insurance providers to find the best possible rates. You can leverage factors like good driving history, bundling multiple insurance policies, or even seeking discounts for safety features on your leased vehicle.

- Providing Proof of Insurance: Once you’ve secured insurance, provide your leasing company with a copy of your certificate of insurance. This typically needs to be done before you take possession of the leased vehicle.

Maintaining Insurance Coverage

Maintaining continuous insurance coverage throughout your lease term is critical. Failure to do so can lead to financial penalties, including fines, legal issues, and even lease termination. Here are some tips to ensure you stay insured:

- Regularly Review Your Policy: Review your insurance policy periodically to ensure that it still meets your needs and that the coverage levels are adequate. If your driving habits or financial situation changes, you may need to adjust your policy accordingly.

- Promptly Pay Premiums: Pay your insurance premiums on time to avoid any lapse in coverage. Late payments can lead to cancellation of your policy, which can result in serious consequences.

- Notify Your Insurer of Changes: Notify your insurer immediately of any changes that could affect your insurance coverage, such as a change of address, a new driver added to your policy, or a change in the vehicle you’re driving.

- Maintain a Good Driving Record: A good driving record can help you secure lower insurance premiums and maintain your coverage. Avoid traffic violations and accidents, as these can lead to higher premiums or even policy cancellation.

Finding Affordable Insurance Options

Finding affordable and suitable insurance for your leased car requires careful research and comparison. Here are some tips to help you find the best options:

- Shop Around: Don’t settle for the first quote you receive. Contact multiple insurance providers to compare rates and coverage options.

- Explore Discounts: Inquire about available discounts, such as good driver discounts, multi-car discounts, or discounts for safety features.

- Consider Bundling: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant savings.

- Adjust Coverage Levels: Consider adjusting your coverage levels to find a balance between affordability and protection. If you have a newer leased car, you may want to consider higher coverage levels, while older leased cars may require less comprehensive coverage.

- Seek Professional Advice: If you’re struggling to find the right insurance coverage, consider seeking advice from an independent insurance agent. They can help you compare options and find a policy that meets your needs and budget.

Insurance Claims and Disputes

Filing an insurance claim for a leased vehicle is a process that requires careful attention to detail and adherence to specific procedures. Disputes can arise with the insurer or the leasing company, and understanding how to navigate these situations effectively is crucial.

Filing an Insurance Claim

When filing an insurance claim for a leased vehicle, it is essential to understand the specific steps involved and the documentation required. The following steps Artikel the typical process for filing an insurance claim:

- Contact your insurance company immediately: Report the incident to your insurer as soon as possible, providing all relevant details, including the date, time, location, and nature of the incident.

- Gather all necessary documentation: This includes the police report (if applicable), photographs of the damage, and any witness statements. You may also need to provide the lease agreement and the vehicle’s registration information.

- Complete the claim form: Your insurance company will provide you with a claim form that you need to complete accurately and thoroughly. Be sure to include all relevant details about the incident and your insurance policy.

- Submit the claim: Once you have completed the claim form and gathered all necessary documentation, submit it to your insurance company according to their instructions.

- Follow up: After submitting your claim, follow up with your insurance company to ensure they have received it and to inquire about the status of your claim.

Resolving Insurance Disputes, Florida car lease insurance requirements

Disputes can arise with the insurer or the leasing company during the claims process. These disputes can involve issues such as the amount of coverage, the cause of the damage, or the repair process. Here are some strategies for resolving insurance disputes effectively:

- Communicate effectively: Maintain clear and professional communication with your insurer and the leasing company. Keep a detailed record of all correspondence, including dates, times, and the content of each communication.

- Understand your policy: Review your insurance policy carefully to understand your coverage limits, exclusions, and the process for filing a claim.

- Negotiate: If you disagree with the insurer’s assessment of the damage or the amount of coverage, attempt to negotiate a fair settlement. Be prepared to provide supporting documentation and evidence to support your position.

- Seek mediation: If negotiations fail, consider seeking mediation from an independent third party. A mediator can help facilitate communication and reach a mutually agreeable solution.

- File a complaint: If all other efforts fail, you may need to file a complaint with the Florida Department of Financial Services (DFS). The DFS can investigate your complaint and take appropriate action against the insurer.

Resources for Resolving Insurance Claims and Disputes

Several resources are available to help you resolve insurance claims and disputes effectively. These resources can provide information, guidance, and support throughout the process:

- Florida Department of Financial Services (DFS): The DFS regulates insurance companies in Florida and offers resources for consumers, including information on filing complaints and resolving disputes.

- Florida Office of Insurance Regulation (OIR): The OIR is a division of the DFS that provides consumer protection services, including information on insurance policies and claims processes.

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that represents state insurance regulators and offers resources for consumers, including information on insurance claims and disputes.

- Consumer Reports: Consumer Reports provides independent reviews and ratings of insurance companies and offers guidance on filing claims and resolving disputes.

Insurance Requirements for Out-of-State Residents

If you’re an out-of-state resident leasing a car in Florida, you’ll need to comply with the state’s insurance requirements. While the general principles are similar to those for Florida residents, there are some key differences you need to understand.

Insurance Requirements for Out-of-State Lessees

Out-of-state residents leasing cars in Florida are generally required to maintain insurance coverage that meets or exceeds the minimum requirements set by the state. This means that your insurance policy must provide the following minimum coverages:

* Personal Injury Protection (PIP): $10,000 per person

* Property Damage Liability (PDL): $10,000 per accident

These minimum requirements apply regardless of where you reside. However, your lease agreement may specify higher insurance limits, which you must adhere to.

Meeting the Insurance Requirements

Here are some ways you can meet the insurance requirements as an out-of-state lessee:

* Maintain an Existing Policy: If your current insurance policy provides the required coverage, you can simply inform your insurer that you’re leasing a car in Florida. They may need to make adjustments to your policy to ensure compliance with Florida’s requirements.

* Purchase a New Policy: If your existing policy doesn’t meet Florida’s minimum requirements, you’ll need to purchase a new policy from a Florida-licensed insurer.

* Obtain a Non-Resident Insurance Certificate: Some insurers offer non-resident insurance certificates that provide the necessary coverage for out-of-state residents driving in Florida. This option is often preferred by those who only need coverage for a short period.

It’s crucial to ensure that your insurance policy clearly states the coverages you have in Florida. You should also keep a copy of your insurance card in your car at all times.

Legal Implications of Insufficient Coverage

Driving a leased car without the proper insurance coverage in Florida can have serious legal and financial consequences. It’s crucial to understand the potential penalties and liabilities you may face if you fail to meet the minimum insurance requirements.

Fines and Penalties

Driving a leased car without the required insurance coverage in Florida can result in fines and penalties. The Florida Department of Motor Vehicles (DMV) will impose fines for driving without insurance, and the leasing company may also impose penalties for violating the terms of your lease agreement.

- Fines: The minimum fine for driving without insurance in Florida is $150. However, the fine can be much higher depending on the severity of the offense. For example, if you are involved in an accident without insurance, you may face a fine of up to $500.

- License Suspension: The DMV may suspend your driver’s license if you are caught driving without insurance. The length of the suspension will depend on the severity of the offense and your driving history.

- Lease Agreement Violations: Your lease agreement likely requires you to maintain a minimum level of insurance coverage. Failing to do so can result in penalties, including:

- Increased lease payments

- Early termination of the lease

- Legal action by the leasing company

Legal Liabilities

Driving a leased car without proper insurance can expose you to significant legal liabilities. In the event of an accident, you may be held personally liable for the damages, even if you were not at fault.

- Personal Injury Claims: If you cause an accident that results in injuries to others, you could be sued for damages. Without insurance, you would be responsible for paying medical bills, lost wages, and other expenses.

- Property Damage Claims: If you damage another person’s property in an accident, you could be sued for repairs or replacement costs. Without insurance, you would be responsible for paying these expenses out of pocket.

- Legal Fees: If you are sued, you will have to pay for legal representation to defend yourself. These fees can be substantial, especially if the case goes to trial.

Real-Life Cases

Several real-life cases demonstrate the consequences of driving a leased car without proper insurance in Florida.

- In one case, a driver was involved in an accident while driving a leased car without insurance. The driver was found liable for the damages and was ordered to pay over $100,000 in compensation to the other party.

- Another case involved a driver who was pulled over for a traffic violation. The driver was found to be driving without insurance and was fined $150. The driver’s license was also suspended for six months.

- In a third case, a driver was involved in an accident while driving a leased car with insufficient insurance coverage. The leasing company sued the driver for breach of contract and recovered damages for the vehicle’s repairs.

Resources and Information

Understanding Florida car lease insurance requirements can be challenging. Fortunately, several resources provide comprehensive information and guidance.

Reputable Sources for Information

To ensure you meet all insurance requirements and protect yourself financially, consult these reputable sources:

| Resource Name | Website Address | Description |

|---|---|---|

| Florida Department of Highway Safety and Motor Vehicles (FLHSMV) | https://www.flhsmv.gov/ | The official website of the Florida Department of Highway Safety and Motor Vehicles, providing information on all aspects of vehicle registration, licensing, and insurance. |

| Florida Office of Insurance Regulation (OIR) | https://www.floir.com/ | The state agency responsible for regulating insurance companies and ensuring consumer protection. Provides information on insurance requirements, complaints, and consumer rights. |

| National Association of Insurance Commissioners (NAIC) | https://www.naic.org/ | A non-profit organization that works to promote uniformity and consistency in insurance regulation across the United States. Provides resources on insurance requirements and consumer protection. |

| Insurance Information Institute (III) | https://www.iii.org/ | A non-profit organization dedicated to providing information and resources on insurance topics. Provides educational materials on car insurance, including coverage options and consumer rights. |

| Your Car Lease Company | [Contact your lease company directly] | Your lease agreement should Artikel specific insurance requirements. Contact your lease company for clarification on coverage levels and any additional requirements. |

| Your Insurance Agent or Broker | [Contact your insurance agent or broker] | Your insurance agent or broker can provide personalized advice on the best insurance coverage options for your leased vehicle. |

Closing Notes

In conclusion, understanding Florida car lease insurance requirements is paramount for safeguarding your financial well-being and avoiding potential legal issues. By adhering to the mandated coverage and exploring optional insurance options, you can drive with peace of mind, knowing you’re protected in the event of an accident or other unforeseen circumstance.

FAQ Resource

What happens if I don’t have the required insurance coverage for my leased car in Florida?

Driving a leased car without proper insurance coverage in Florida can result in significant penalties, including fines, suspension of your driver’s license, and even legal action by the leasing company.

Can I use my existing car insurance policy for my leased car in Florida?

While you can use your existing policy, it’s essential to ensure it meets the minimum coverage requirements for leased vehicles in Florida. It’s always best to consult with your insurance agent to confirm coverage adequacy.

How do I file an insurance claim for a leased car in Florida?

The process for filing a claim for a leased car is similar to filing a claim for an owned vehicle. Contact your insurance company, provide details of the accident, and follow their instructions. Remember to notify your leasing company as well.