Florida Car Rental Insurance Requirements: Navigating the world of car rentals in Florida can be a bit overwhelming, especially when it comes to understanding the complex web of insurance options. Whether you’re a seasoned traveler or a first-time renter, knowing what insurance you need and how it works is crucial to avoid unexpected financial burdens in case of an accident.

This guide will demystify Florida’s car rental insurance landscape, providing a comprehensive overview of the various insurance types, mandatory requirements, and additional coverage options. We’ll also delve into understanding your personal insurance coverage and how it interacts with rental car insurance, equipping you with the knowledge to make informed decisions and protect yourself on the road.

Florida Car Rental Insurance Basics

Renting a car in Florida can be a convenient way to explore the state, but it’s crucial to understand the insurance requirements and options available to protect yourself financially in case of an accident. This guide will break down the essential aspects of Florida car rental insurance, including the different types, coverage, costs, and factors that influence pricing.

Types of Car Rental Insurance

Understanding the different types of car rental insurance is essential to make an informed decision about your coverage needs. There are generally three main types of car rental insurance:

- Liability Insurance: This coverage protects you against financial losses if you are responsible for an accident that causes damage to another person’s property or injuries. It typically covers medical expenses, property damage, and legal fees up to a certain limit.

- Collision Damage Waiver (CDW): CDW covers damage to the rental car, including collisions and other incidents. It helps you avoid paying for repairs or replacement costs in case of an accident, but it may have a deductible that you’ll need to pay out of pocket.

- Personal Accident Insurance (PAI): PAI provides coverage for medical expenses and lost wages if you are injured in an accident while driving the rental car. It may also offer death benefits to your beneficiaries.

Coverage Offered by Each Type of Insurance

Each type of car rental insurance provides specific coverage to protect you in different situations.

- Liability Insurance: This coverage is typically required by law in Florida and protects you against claims made by third parties. It usually covers:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages to people injured in an accident that you caused.

- Property Damage Liability: Covers damage to another person’s property, such as their car or other belongings.

- Collision Damage Waiver (CDW): CDW is optional but highly recommended, especially if you don’t have comprehensive and collision coverage on your personal auto insurance. It typically covers:

- Collision Damage: Covers repairs or replacement costs for damage to the rental car caused by a collision.

- Other Damage: May cover damage to the rental car caused by events like theft, vandalism, or natural disasters.

- Personal Accident Insurance (PAI): PAI is an optional coverage that protects you personally in case of an accident. It typically covers:

- Medical Expenses: Covers medical bills for injuries sustained in an accident.

- Lost Wages: Provides compensation for lost income if you’re unable to work due to injuries.

- Death Benefits: May offer a payout to your beneficiaries if you die in an accident.

Average Cost of Car Rental Insurance

The cost of car rental insurance can vary significantly depending on factors like the rental company, the type of vehicle, the length of the rental period, and the specific coverage you choose. However, here’s a general estimate of average costs:

- Liability Insurance: Usually included in the base rental price, but may cost around $10-$20 per day if purchased separately.

- Collision Damage Waiver (CDW): Typically ranges from $10-$25 per day, but can be higher for luxury or specialty vehicles.

- Personal Accident Insurance (PAI): Often costs around $5-$10 per day.

Factors Influencing the Cost of Car Rental Insurance

Several factors can affect the cost of car rental insurance.

- Rental Company: Different rental companies have varying pricing structures and insurance policies.

- Vehicle Type: Luxury or specialty vehicles typically have higher insurance costs due to their value and potential repair expenses.

- Rental Duration: Longer rental periods generally have higher insurance costs.

- Location: Rental insurance costs may vary depending on the location, with urban areas often having higher premiums.

- Age and Driving Record: Younger drivers and those with poor driving records may face higher insurance premiums.

Mandatory Insurance Requirements

Renting a car in Florida comes with specific insurance requirements that drivers must adhere to. Failing to meet these requirements can lead to significant legal and financial consequences. Understanding the minimum insurance coverage mandated by the state is crucial for ensuring a safe and hassle-free rental experience.

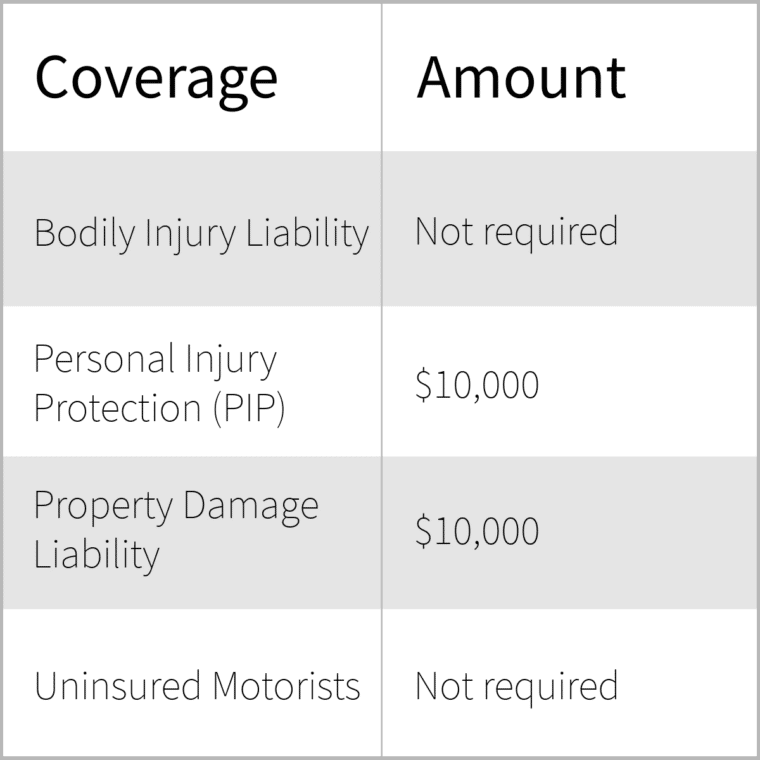

Minimum Insurance Requirements in Florida

The minimum insurance requirements for renting a car in Florida are dictated by the state’s Financial Responsibility Law. This law ensures that drivers have adequate financial protection in case of an accident.

- Personal Injury Protection (PIP): PIP covers medical expenses, lost wages, and other related costs for the driver and passengers of the rented vehicle, regardless of fault. The minimum PIP coverage required in Florida is $10,000 per person.

- Property Damage Liability (PDL): PDL covers damages to another person’s property, including their vehicle, in case of an accident. The minimum PDL coverage required in Florida is $10,000 per accident.

Consequences of Driving Without Required Insurance

Driving a rental car without the minimum required insurance in Florida can lead to serious consequences, including:

- Fines and Penalties: You could face substantial fines and penalties for driving without the required insurance. The exact amount of the fine may vary depending on the specific circumstances of the violation.

- License Suspension: Driving without insurance can result in the suspension of your driver’s license, making it illegal for you to operate a vehicle in Florida.

- Vehicle Impoundment: The authorities may impound your rental vehicle if you are caught driving without the required insurance.

Financial Implications of Inadequate Insurance

In the event of an accident, inadequate insurance coverage can result in significant financial repercussions.

- High Out-of-Pocket Expenses: Without sufficient insurance, you will be responsible for covering the costs of medical bills, property damage, and legal fees. These expenses can quickly add up, potentially leading to financial hardship.

- Legal Action: If you are at fault in an accident and do not have adequate insurance, the injured party may sue you for damages. This can result in significant financial losses, including legal fees and potential judgments against you.

- Loss of Rental Vehicle: The rental company may hold you liable for the full cost of repairs or replacement of the damaged vehicle if you do not have adequate insurance coverage.

Minimum Insurance Requirements by Vehicle Type

Here’s a table comparing the minimum insurance requirements for different types of vehicles in Florida:

| Vehicle Type | PIP Coverage | PDL Coverage |

|---|---|---|

| Passenger Cars | $10,000 | $10,000 |

| Trucks and SUVs | $10,000 | $10,000 |

| Motorcycles | $10,000 | $10,000 |

Understanding Your Personal Coverage

Before you head out on your Florida vacation, it’s essential to understand how your personal auto insurance policy might cover you while driving a rental car. You might be surprised to learn that your existing coverage could provide significant protection, potentially saving you money on additional rental insurance.

Comparing Your Personal Coverage and Rental Company Coverage, Florida car rental insurance requirements

Your personal auto insurance policy often provides coverage for rental vehicles, but the extent of this coverage can vary depending on your policy and the specific circumstances. It’s crucial to review your policy carefully and compare its provisions with the coverage offered by the rental company.

- Liability Coverage: Your personal insurance policy likely includes liability coverage, which protects you financially if you’re responsible for an accident involving a rental car. This coverage typically covers bodily injury and property damage to others. The rental company also offers liability insurance, but it’s often limited to the minimum required by the state.

- Collision and Comprehensive Coverage: These coverages protect you from damage to the rental car itself. Collision coverage covers damage resulting from an accident, while comprehensive coverage protects against damage caused by events like theft, vandalism, or natural disasters. Your personal insurance might extend these coverages to rental vehicles, but there might be limitations or deductibles. The rental company also offers these coverages, but they can be expensive.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses related to injuries sustained in an accident. Your personal insurance might provide PIP coverage for rental car accidents, but the coverage limits might be different from those for your own vehicle.

Primary and Secondary Coverage

Understanding the concepts of primary and secondary insurance coverage is crucial when dealing with rental car accidents.

Primary insurance is the coverage that pays for losses first, while secondary insurance only pays after the primary insurance has been exhausted.

In most cases, your personal auto insurance will be the primary coverage for a rental car, while the rental company’s insurance will be secondary. This means that your insurance company will handle claims first, and the rental company’s insurance will only step in if your coverage is insufficient.

Scenarios Where Your Personal Insurance Might Cover a Rental Car Accident

Here are some examples of scenarios where your personal insurance might cover a rental car accident:

- You are at fault for an accident: Your personal liability coverage will likely pay for damages to the other vehicle and any injuries sustained by the other driver or passengers. This applies even if the rental company’s insurance is also available.

- You are involved in a hit-and-run accident: Your comprehensive coverage might pay for damage to the rental car if you are a victim of a hit-and-run accident. This coverage would apply even if you are not at fault.

- Your rental car is stolen or vandalized: Your comprehensive coverage would likely cover the cost of repairing or replacing the stolen or vandalized rental car.

Verifying Your Existing Insurance Coverage

To ensure that your personal insurance covers rental car accidents, it’s essential to verify your coverage with your insurance agent or company.

- Review your policy documents: Carefully examine your insurance policy documents to understand the coverage you have for rental cars. Pay attention to any limitations, deductibles, or exclusions.

- Contact your insurance agent: Discuss your rental car coverage with your insurance agent to clarify any questions or concerns you might have. They can provide detailed information about your policy and its applicability to rental cars.

- Request a Certificate of Insurance: Obtain a Certificate of Insurance from your insurance company to verify your coverage for rental cars. This document will provide proof of your insurance coverage and can be presented to the rental company.

Additional Insurance Options

When renting a car in Florida, you have the option of purchasing additional insurance from the rental company. These add-on policies can offer extra protection beyond your existing car insurance or credit card coverage. However, it’s essential to carefully consider the benefits and drawbacks before deciding if additional insurance is necessary.

Benefits and Drawbacks of Purchasing Additional Insurance

Purchasing additional insurance from a rental company can offer peace of mind, knowing that you have comprehensive coverage for potential incidents. However, these policies often come with a hefty price tag, and the coverage might overlap with your existing insurance or credit card benefits.

- Benefits:

- Peace of mind: Knowing that you have additional coverage for potential incidents can reduce stress and anxiety during your trip.

- Convenience: You can purchase the insurance directly from the rental company, simplifying the process.

- Potential for lower deductibles: Some add-on insurance policies may offer lower deductibles than your existing insurance.

- Drawbacks:

- Cost: Rental company insurance can be expensive, and the cost can vary significantly depending on the type of coverage and the rental duration.

- Overlapping coverage: Your existing car insurance or credit card may already provide sufficient coverage for your rental car, making the additional insurance unnecessary.

- Limited coverage: Some rental company insurance policies may have limitations on coverage, such as specific types of accidents or specific rental car models.

Types of Coverage Offered by Common Add-on Insurance Products

Rental companies typically offer various add-on insurance products, each with its own coverage features and limitations. Some common options include:

- Collision Damage Waiver (CDW): This coverage protects you from financial responsibility for damage to the rental car, excluding certain situations like driving under the influence or exceeding the rental agreement’s mileage limits.

- Loss Damage Waiver (LDW): Similar to CDW, LDW covers damage to the rental car, but it may also extend coverage to theft or vandalism.

- Personal Accident Insurance (PAI): This insurance provides coverage for medical expenses and death benefits in case of an accident while driving the rental car.

- Personal Effects Coverage (PEC): This coverage protects your personal belongings in the rental car against theft or damage.

- Roadside Assistance: This add-on provides assistance for situations like flat tires, jump starts, and towing.

Comparing Cost and Coverage of Various Add-on Insurance Options

The cost and coverage of rental company insurance products vary depending on the rental company, the rental car model, and the duration of the rental.

| Insurance Type | Cost | Coverage |

|—|—|—|

| Collision Damage Waiver (CDW) | $10-$30 per day | Protects against damage to the rental car, excluding certain situations. |

| Loss Damage Waiver (LDW) | $15-$40 per day | Covers damage, theft, and vandalism of the rental car. |

| Personal Accident Insurance (PAI) | $5-$10 per day | Provides coverage for medical expenses and death benefits in case of an accident. |

| Personal Effects Coverage (PEC) | $5-$10 per day | Protects personal belongings in the rental car against theft or damage. |

| Roadside Assistance | $5-$10 per day | Provides assistance for situations like flat tires, jump starts, and towing. |

Situations Where Purchasing Additional Insurance Might Be Beneficial

While it’s generally advisable to rely on your existing insurance or credit card coverage, there are situations where purchasing additional insurance from the rental company might be beneficial:

- High-value rental cars: If you’re renting a luxury or high-performance car, the deductible on your existing insurance might be insufficient to cover potential damage.

- Limited coverage on your existing insurance: If your existing insurance policy has limitations on rental car coverage, purchasing additional insurance might be necessary.

- Traveling to a high-risk area: If you’re traveling to an area known for high crime rates or accidents, purchasing additional insurance might offer extra peace of mind.

Avoiding Unnecessary Insurance

Rental car companies often try to sell you additional insurance, but you might already be covered. Understanding your existing insurance policies can save you money and unnecessary hassle.

Understanding Collision Damage Waiver (CDW) and Liability Insurance

CDW, or Collision Damage Waiver, is an optional insurance that protects you from financial responsibility for damage to the rental car. Liability insurance covers you in case you cause an accident that injures someone or damages their property.

When You Might Not Need CDW

Your personal auto insurance policy might already include coverage for rental cars.

- Collision Coverage: Check your policy for collision coverage, which typically extends to rental vehicles.

- Comprehensive Coverage: This coverage protects against damage from non-collision events like theft or vandalism.

- Liability Coverage: Your policy might include liability coverage for rental vehicles, providing protection against legal and financial responsibility for accidents you cause.

Contact your insurance company to confirm the extent of your coverage and to understand any limitations or deductibles that apply to rental vehicles.

Strategies for Reducing Rental Insurance Costs

- Decline Unnecessary Coverage: If your existing insurance provides sufficient coverage, decline optional insurance offered by the rental company.

- Use a Credit Card: Some credit cards offer rental car insurance as a perk. Check your card’s benefits for details about coverage and limitations.

- Consider a Third-Party Insurance Provider: If you frequently rent cars, consider a third-party insurance provider specializing in rental car coverage. They might offer more affordable options than rental companies.

Negotiating with Rental Companies

- Be Informed: Before arriving at the rental counter, understand your existing insurance coverage and the rental company’s insurance options.

- Ask for a Breakdown: Request a detailed explanation of the coverage offered and the costs involved.

- Be Polite but Firm: If you decline additional insurance, be polite but firm in your decision. Explain that you have sufficient coverage through your personal insurance or credit card.

- Document Everything: Keep records of your conversations with rental company representatives and any documents you sign.

Understanding Your Responsibilities

Renting a car in Florida comes with responsibilities that extend beyond the rental itself. Understanding the terms and conditions of your rental agreement is crucial to ensuring you have the proper insurance coverage and avoiding potential legal and financial consequences.

Rental Agreement Clauses Impacting Insurance

The rental agreement is a legally binding document that Artikels the terms of your rental, including important clauses that can significantly impact your insurance coverage.

- Additional Driver Clauses: These clauses specify who is authorized to drive the rental car. If you allow an unauthorized driver to operate the vehicle, your insurance coverage may be voided, leaving you personally liable for any damages or accidents.

- Geographic Restrictions: Rental agreements often restrict where you can drive the rental car. Driving outside the designated areas can void your insurance coverage and potentially result in penalties.

- Usage Restrictions: Some rental agreements prohibit using the car for specific purposes, such as commercial use or towing. Violating these restrictions can invalidate your insurance and lead to legal consequences.

- Fuel Policies: Rental agreements specify how the car should be returned, including fuel requirements. Failure to comply with these policies can result in additional charges and potential insurance issues.

Consequences of Violating Rental Agreement Terms

Violating the terms of your rental agreement can have serious consequences, including:

- Loss of Insurance Coverage: One of the most significant consequences is the loss of insurance coverage. If you violate the agreement, the rental company may deny your insurance claim, leaving you responsible for all damages, injuries, or legal fees.

- Additional Fees and Penalties: You may face additional fees and penalties for violating the agreement, such as late fees, cleaning charges, or even fines for traffic violations.

- Legal Action: In severe cases, the rental company may pursue legal action against you for damages, lost revenue, or other expenses incurred due to your violation.

Documenting Your Rental Experience

Documenting your rental experience can help protect your rights and ensure proper insurance coverage in case of an accident or dispute.

- Inspect the Car Thoroughly: Before signing the rental agreement, carefully inspect the car for any pre-existing damage. Take pictures or videos of any scratches, dents, or other issues, and document them in the rental agreement.

- Keep Copies of All Documents: Retain copies of your rental agreement, insurance documents, and any other relevant paperwork. This will provide you with a record of the terms of your rental and the insurance coverage you have.

- Report Any Accidents or Incidents: Immediately report any accidents or incidents involving the rental car to the rental company and your insurance provider. Provide detailed descriptions of the events, including dates, times, locations, and witness information.

Closing Notes

Ultimately, navigating Florida car rental insurance is about finding the right balance between cost and coverage. By understanding the basics, your personal insurance coverage, and the additional options available, you can confidently choose the insurance plan that best suits your needs and budget. Remember, a little research can go a long way in ensuring a smooth and worry-free rental experience.

Query Resolution: Florida Car Rental Insurance Requirements

Do I need to purchase insurance from the rental company if I have my own car insurance?

It depends on your personal insurance coverage. Check with your insurance provider to see if your policy covers rental cars. If it does, you may not need to purchase additional insurance from the rental company. However, it’s always wise to review the rental agreement and understand the specific terms and conditions related to insurance.

What happens if I’m in an accident and don’t have the required insurance?

Driving without the required insurance in Florida can result in fines, license suspension, and even jail time. Additionally, you could be held personally liable for any damages or injuries caused in an accident. It’s crucial to ensure you have the minimum required insurance coverage to avoid legal and financial consequences.

Can I decline the collision damage waiver (CDW)?

Yes, you can decline the CDW if your personal insurance policy covers rental cars. However, carefully review the terms of your policy and ensure it provides sufficient coverage for the rental car. It’s also advisable to check with your insurance provider to confirm your coverage details.