Florida Cheap Car Insurance: Finding affordable car insurance in Florida can be a challenge, given the state’s unique factors that influence premiums. Florida’s no-fault insurance system, high population density, and susceptibility to hurricanes all contribute to higher insurance costs. However, with careful planning and research, drivers can find affordable coverage that meets their needs.

This guide explores the factors that affect car insurance costs in Florida, provides tips for lowering premiums, and Artikels the steps to find the best deals. We’ll delve into the state’s unique insurance landscape, compare different insurance companies, and equip you with the knowledge to make informed decisions about your car insurance.

Florida’s Car Insurance Market

Florida’s car insurance market is unique and complex, influenced by a variety of factors that contribute to higher premiums compared to other states. Understanding these factors is crucial for drivers seeking affordable car insurance in the Sunshine State.

Factors Influencing Car Insurance Costs in Florida

Florida’s car insurance costs are influenced by several factors, including:

- High Number of Accidents: Florida has a higher than average number of car accidents, contributing to higher insurance claims and, subsequently, higher premiums. This is attributed to factors like a large population, heavy traffic, and a significant number of tourists.

- No-Fault Insurance System: Florida’s no-fault insurance system requires drivers to file claims with their own insurance companies, regardless of who caused the accident. This can lead to higher premiums, as insurance companies have to cover more claims.

- High Cost of Medical Care: Florida’s healthcare costs are among the highest in the nation, leading to increased costs for insurance companies when covering medical expenses related to car accidents.

- High Number of Uninsured Drivers: Florida has a relatively high number of uninsured drivers, which can lead to higher premiums for insured drivers. When an uninsured driver causes an accident, insured drivers may have to pay for damages out of pocket.

- Fraudulent Claims: Florida has a significant problem with fraudulent insurance claims, which can lead to higher premiums for all drivers. Insurance companies have to factor in the cost of detecting and preventing fraud.

- High Property Values: Florida’s high property values, particularly in coastal areas, can also contribute to higher insurance premiums. If a car accident damages a vehicle in a high-value area, the cost of repairs or replacement can be higher.

Average Car Insurance Premiums in Florida

Florida’s average car insurance premiums are significantly higher than the national average. According to the National Association of Insurance Commissioners (NAIC), the average annual premium for car insurance in Florida in 2023 was $2,560, compared to the national average of $1,591. This means that Florida drivers pay an average of $969 more per year for car insurance than drivers in other states.

Impact of Florida’s No-Fault Insurance System

Florida’s no-fault insurance system has a significant impact on car insurance rates. This system requires drivers to file claims with their own insurance companies, regardless of who caused the accident. This can lead to higher premiums for several reasons:

- Increased Claims: With a no-fault system, more claims are filed, as drivers are encouraged to seek compensation for their injuries, even if they were partially at fault. This leads to increased costs for insurance companies.

- Higher Medical Expenses: No-fault systems often require drivers to carry Personal Injury Protection (PIP) coverage, which covers medical expenses for injuries sustained in an accident. This can lead to higher premiums, as insurance companies have to pay for more medical expenses.

- Limited Tort System: Florida’s no-fault system also limits the ability of drivers to sue for damages, except in cases of serious injury or death. This can make it more difficult for drivers to recover compensation for their losses, but it also helps to keep premiums lower.

Factors Affecting Florida Car Insurance Costs

Car insurance premiums in Florida are influenced by a variety of factors, each contributing to the overall cost. Understanding these factors empowers drivers to make informed decisions that can potentially lower their premiums.

Driving History

Your driving history is a major factor in determining your car insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, a history of accidents, traffic violations, or even DUI convictions will significantly increase your rates. Insurance companies consider this information because it reflects your risk of future accidents.

Age

Age plays a significant role in car insurance costs. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher premiums for young drivers. As drivers age, their risk of accidents tends to decrease, leading to lower premiums.

Vehicle Type

The type of vehicle you drive also influences your car insurance premiums. High-performance vehicles, luxury cars, and expensive SUVs tend to have higher insurance rates due to their higher repair costs and greater risk of theft. Conversely, older, less expensive vehicles typically have lower insurance premiums.

Location

Where you live in Florida can significantly impact your car insurance rates. Areas with higher crime rates or denser populations tend to have higher insurance premiums due to the increased risk of accidents and theft.

Insurance Discounts

Insurance discounts can significantly reduce your car insurance premiums. These discounts are offered for various reasons, such as good driving history, safety features in your vehicle, bundling multiple insurance policies, and completing defensive driving courses.

Example: A driver with a clean driving record, a vehicle equipped with anti-theft devices, and multiple insurance policies bundled together could potentially receive a significant discount on their premiums.

Finding Affordable Car Insurance in Florida

Navigating the Florida car insurance market can be challenging, especially when aiming for affordability. However, with a strategic approach and the right information, finding cheap car insurance in Florida is achievable. This section Artikels a step-by-step guide to help you secure the most competitive rates.

Steps to Find Cheap Car Insurance in Florida

Finding affordable car insurance in Florida requires a proactive approach. This involves comparing quotes from multiple insurers, exploring discounts, and adjusting your coverage needs.

- Get Multiple Quotes: The first step in securing cheap car insurance is obtaining quotes from various insurers. Use online comparison tools or contact insurance companies directly. Be sure to provide accurate information about your vehicle, driving history, and desired coverage.

- Explore Discounts: Many insurers offer discounts to reduce your premium. These discounts can include:

- Good Driver Discounts: A clean driving record with no accidents or violations can qualify you for significant discounts.

- Safe Driving Courses: Completing a defensive driving course can lower your premium by demonstrating your commitment to safe driving practices.

- Bundling Discounts: Combining your car insurance with other policies like homeowners or renters insurance can lead to substantial savings.

- Vehicle Safety Features Discounts: Cars equipped with safety features like anti-theft devices, airbags, and anti-lock brakes often qualify for discounts.

- Payment Discounts: Paying your premium in full or opting for automatic payments can result in lower rates.

- Adjust Coverage Levels: Review your current coverage levels to ensure they adequately meet your needs. Consider adjusting your coverage limits, deductibles, or removing unnecessary add-ons to potentially lower your premium.

- Shop Around Regularly: Car insurance rates can fluctuate over time. It’s essential to shop around for quotes at least annually to ensure you’re getting the best possible price.

- Consider a Higher Deductible: A higher deductible means you pay more out of pocket in the event of an accident, but it can also lead to lower premiums.

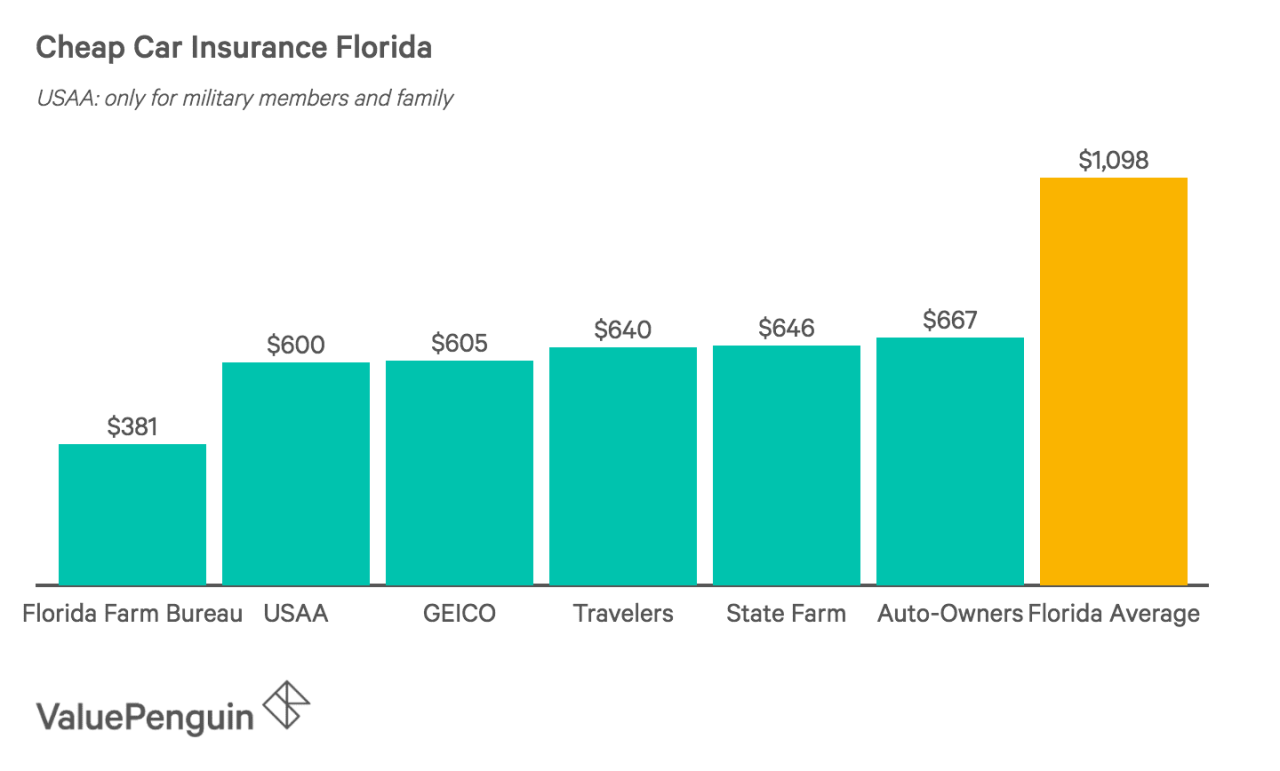

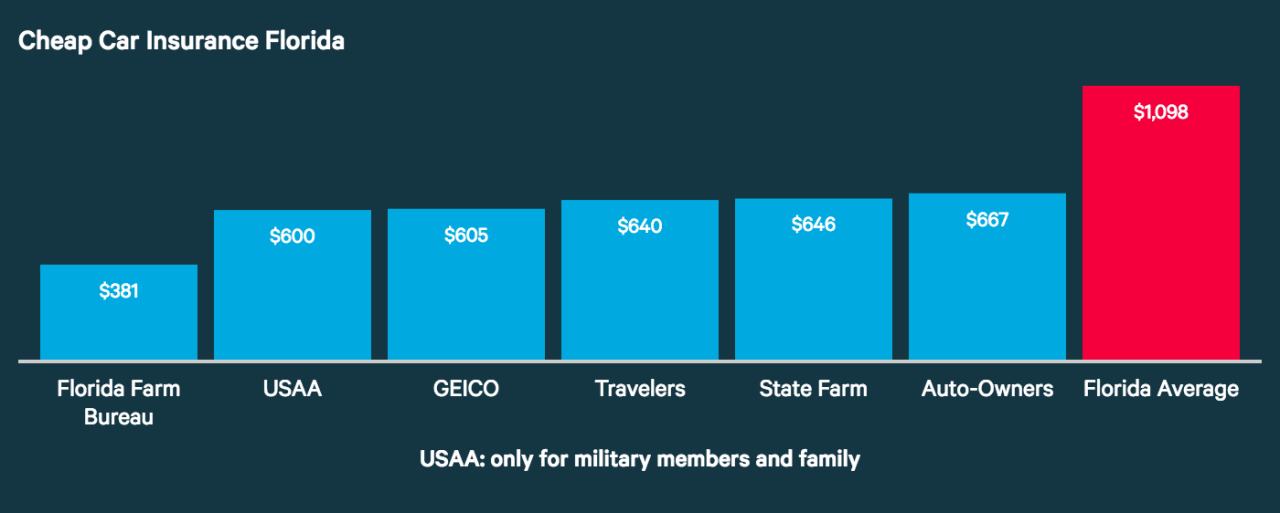

Reputable Car Insurance Companies in Florida

Several reputable car insurance companies operate in Florida, offering competitive rates and reliable coverage. Here’s a list of some of the most well-known options:

- State Farm: State Farm is one of the largest insurance companies in the United States and offers a wide range of coverage options and discounts in Florida.

- GEICO: GEICO is known for its competitive rates and online convenience, making it a popular choice for many Floridians.

- Progressive: Progressive offers customizable coverage options and a strong focus on customer service, making it a well-regarded insurer in Florida.

- Allstate: Allstate provides comprehensive coverage options and a strong reputation for claims handling, making it a reliable choice in Florida.

- USAA: USAA is a military-focused insurer known for its excellent customer service and competitive rates, particularly for active-duty military personnel and their families.

Comparison of Car Insurance Policies in Florida

The following table provides a comparison of features and pricing for different car insurance policies available in Florida. It’s important to note that specific rates will vary based on individual factors such as driving history, vehicle type, and location.

| Company | Coverage Options | Discounts | Average Annual Premium (Estimate) |

|---|---|---|---|

| State Farm | Liability, Collision, Comprehensive, Uninsured Motorist, Personal Injury Protection | Good Driver, Safe Driver, Bundling, Multi-Car, Vehicle Safety Features | $1,500 – $2,500 |

| GEICO | Liability, Collision, Comprehensive, Uninsured Motorist, Personal Injury Protection | Good Driver, Safe Driver, Bundling, Multi-Car, Vehicle Safety Features | $1,400 – $2,400 |

| Progressive | Liability, Collision, Comprehensive, Uninsured Motorist, Personal Injury Protection | Good Driver, Safe Driver, Bundling, Multi-Car, Vehicle Safety Features | $1,300 – $2,300 |

| Allstate | Liability, Collision, Comprehensive, Uninsured Motorist, Personal Injury Protection | Good Driver, Safe Driver, Bundling, Multi-Car, Vehicle Safety Features | $1,600 – $2,600 |

| USAA | Liability, Collision, Comprehensive, Uninsured Motorist, Personal Injury Protection | Good Driver, Safe Driver, Bundling, Multi-Car, Vehicle Safety Features | $1,200 – $2,200 |

Tips for Lowering Car Insurance Costs in Florida

Florida’s car insurance market is highly competitive, offering numerous options for drivers to find affordable coverage. However, premiums can vary significantly depending on several factors, including your driving history, the type of car you drive, and your location. By implementing effective strategies, you can significantly reduce your car insurance costs and secure the best possible rates.

Improving Your Driving Record, Florida cheap car insurance

A clean driving record is crucial for obtaining lower car insurance premiums. Insurance companies consider your driving history as a significant indicator of your risk profile. By maintaining a safe driving record, you can significantly reduce your insurance costs.

- Avoid Traffic Violations: Traffic violations, such as speeding tickets, reckless driving, and DUI convictions, can dramatically increase your insurance premiums. These violations signal to insurance companies that you pose a higher risk of accidents. Therefore, it’s essential to drive responsibly and avoid any traffic offenses.

- Complete Defensive Driving Courses: Many insurance companies offer discounts for completing defensive driving courses. These courses teach safe driving techniques and help you understand the rules of the road, potentially reducing your risk of accidents. Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount on your insurance premiums.

- Maintain a Clean Accident History: Accidents, even those not your fault, can affect your insurance premiums. By driving cautiously and avoiding accidents, you can maintain a clean accident history, which will benefit your insurance rates. Insurance companies consider drivers with a clean accident history to be less risky, leading to lower premiums.

Comparing Quotes from Multiple Insurance Companies

Shopping around for car insurance quotes from multiple companies is crucial for securing the best possible rates. Insurance companies have different pricing models and risk assessments, leading to varying premiums. Comparing quotes from several providers allows you to find the most competitive rates and potentially save money on your car insurance.

- Utilize Online Comparison Tools: Several online comparison tools and websites allow you to enter your information once and receive quotes from multiple insurance companies simultaneously. These tools simplify the quote comparison process, saving you time and effort. Online comparison tools provide a convenient way to compare rates and identify the best deals.

- Contact Insurance Companies Directly: In addition to online comparison tools, you can also contact insurance companies directly to obtain quotes. This allows you to discuss your specific needs and circumstances with an insurance agent and potentially negotiate better rates. Direct contact with insurance companies provides a personalized approach and allows you to ask questions and clarify details.

- Consider Bundling Policies: Many insurance companies offer discounts for bundling multiple insurance policies, such as car insurance, homeowners insurance, and renters insurance. Bundling your policies can lead to significant savings on your overall insurance costs. Combining your policies with one insurer can result in lower premiums and greater convenience.

Other Tips for Lowering Car Insurance Costs in Florida

- Choose a Safe Car: The type of car you drive significantly impacts your insurance premiums. Vehicles with high safety ratings and lower theft rates generally have lower insurance costs. Researching car safety ratings and theft statistics can help you choose a vehicle that minimizes your insurance expenses.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can also lead to lower premiums. Consider increasing your deductible if you’re comfortable with a higher out-of-pocket expense in exchange for lower insurance costs.

- Maintain Good Credit: In some states, including Florida, insurance companies use credit scores as a factor in determining insurance rates. Maintaining good credit can potentially lower your insurance premiums. Pay your bills on time, keep your credit utilization low, and avoid opening too many new credit accounts to improve your credit score and potentially save on car insurance.

Understanding Florida’s Insurance Laws

Navigating the complexities of Florida’s car insurance laws can be challenging, but understanding the key provisions is crucial for drivers. These laws directly impact your coverage options, financial responsibilities, and overall driving experience.

Minimum Liability Coverage Requirements

Florida requires all drivers to carry a minimum amount of liability insurance to protect themselves and others in case of an accident. This mandatory coverage is designed to cover the financial costs associated with injuries or property damage caused by an insured driver.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for the insured driver and passengers, regardless of fault. Florida requires a minimum PIP coverage of $10,000.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s property, such as their vehicle, if you are at fault in an accident. The minimum required PDL coverage in Florida is $10,000.

- Bodily Injury Liability (BIL): This coverage pays for medical expenses, lost wages, and other related costs for injuries sustained by other drivers or passengers in an accident if you are at fault. The minimum required BIL coverage in Florida is $10,000 per person and $20,000 per accident.

End of Discussion: Florida Cheap Car Insurance

Navigating the world of Florida car insurance can be complex, but with the right information and strategies, you can find affordable coverage that protects you on the road. By understanding the factors that influence premiums, comparing quotes from multiple insurers, and taking advantage of available discounts, drivers in Florida can secure the best possible rates. Remember, your insurance is an investment in your safety and financial security, so don’t settle for anything less than the best value for your money.

FAQ Guide

What is Florida’s no-fault insurance system?

Florida’s no-fault insurance system requires drivers to file claims with their own insurance company, regardless of who caused the accident. This system aims to streamline claims processing and reduce litigation.

What are the minimum liability coverage requirements in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage.

How can I find out if an insurance company is reputable?

You can check an insurance company’s reputation with the Florida Office of Insurance Regulation (OIR) or consumer review websites like the Better Business Bureau.