- Understanding Florida’s Car Insurance Market

- Factors Affecting Car Insurance Premiums

- Finding the Cheapest Car Insurance Options

- Strategies for Reducing Car Insurance Costs

- Essential Car Insurance Coverage in Florida

- Understanding Car Insurance Policies: Florida Cheapest Car Insurance

- Closure

- FAQ Guide

Florida cheapest car insurance is a hot topic, especially given the state’s unique insurance landscape. Florida’s no-fault insurance system and high rates of accidents can make finding affordable coverage a challenge. However, with a bit of research and strategic planning, you can find competitive car insurance rates in Florida.

This guide will delve into the factors that influence car insurance costs in Florida, providing insights into how to secure the most affordable options. We’ll explore strategies for reducing premiums, examine essential coverage requirements, and demystify the complexities of car insurance policies. Whether you’re a new driver or a seasoned Floridian, understanding these nuances can empower you to make informed decisions about your car insurance.

Understanding Florida’s Car Insurance Market

Florida’s car insurance market is unique and complex, driven by several factors that contribute to its high costs. Understanding these factors is crucial for drivers seeking affordable car insurance in the state.

Factors Influencing Car Insurance Costs in Florida

Several factors contribute to the high cost of car insurance in Florida. These factors include:

- High Number of Accidents and Claims: Florida has a higher-than-average rate of car accidents and insurance claims, driven by a large population, heavy traffic, and a high concentration of older drivers. This increased risk translates to higher premiums.

- No-Fault Insurance System: Florida’s no-fault insurance system requires drivers to cover their own medical expenses after an accident, regardless of fault. This can lead to more claims and higher premiums.

- High Litigation Rates: Florida has a high rate of lawsuits related to car accidents, which can increase insurance costs due to legal fees and settlements.

- High Cost of Living: Florida’s high cost of living, including medical expenses, contributes to higher car insurance premiums as insurers need to cover these costs in their payouts.

- Hurricane Risk: Florida is highly susceptible to hurricanes, which can cause widespread damage to vehicles. Insurers factor in this risk when calculating premiums.

- Fraudulent Claims: Florida has a problem with fraudulent car insurance claims, which drives up costs for all policyholders.

Florida’s No-Fault Insurance System

Florida’s no-fault insurance system, known as Personal Injury Protection (PIP), requires drivers to carry a minimum of $10,000 in coverage for their own medical expenses after an accident. This system aims to reduce lawsuits and expedite claims processing. However, it can also lead to higher premiums due to the increased number of claims.

Comparison of Car Insurance Costs in Florida

Florida consistently ranks among the states with the highest car insurance costs. According to the National Association of Insurance Commissioners (NAIC), the average annual premium for car insurance in Florida in 2023 was $2,300, significantly higher than the national average of $1,600. This difference highlights the unique factors that influence car insurance costs in Florida.

Factors Affecting Car Insurance Premiums

In Florida, car insurance premiums are influenced by a variety of factors, each contributing to the overall cost of coverage. Understanding these factors can empower drivers to make informed decisions and potentially reduce their insurance expenses.

Vehicle Type and Value

The type and value of your vehicle are significant factors that influence car insurance premiums. Higher-value vehicles, such as luxury cars or sports cars, are generally more expensive to insure due to their higher repair costs and potential for greater damage in an accident. Additionally, vehicles with a higher risk of theft or vandalism, such as convertibles or SUVs, may attract higher premiums.

Driver’s Age, Driving History, and Credit Score

Your age, driving history, and credit score play a crucial role in determining your car insurance premiums.

- Younger drivers, particularly those under 25, often face higher premiums due to their statistically higher risk of accidents.

- Drivers with a clean driving record, free of accidents or traffic violations, are generally rewarded with lower premiums.

- Credit score is increasingly used by insurance companies to assess risk. Drivers with good credit scores may qualify for lower premiums, while those with poor credit may face higher costs.

Location and Coverage Options

Your location and the coverage options you choose can significantly impact your car insurance premiums.

- Areas with higher rates of accidents, theft, or vandalism generally have higher insurance premiums.

- The level of coverage you select, such as liability, collision, or comprehensive, directly affects your premium. Higher coverage levels usually mean higher premiums.

Impact of Different Factors on Premium Costs

| Factor | Impact on Premium | Example |

|---|---|---|

| Vehicle Type and Value | Higher-value vehicles generally have higher premiums. | A luxury sedan may have a higher premium than a compact car. |

| Driver’s Age | Younger drivers often face higher premiums. | A 20-year-old driver may have a higher premium than a 40-year-old driver. |

| Driving History | Clean driving record leads to lower premiums. | A driver with no accidents or violations may have a lower premium than a driver with multiple accidents. |

| Credit Score | Good credit score may qualify for lower premiums. | A driver with a high credit score may have a lower premium than a driver with a low credit score. |

| Location | Areas with higher accident rates have higher premiums. | A driver living in a city with high traffic density may have a higher premium than a driver living in a rural area. |

| Coverage Options | Higher coverage levels generally mean higher premiums. | A driver with full coverage may have a higher premium than a driver with only liability coverage. |

Finding the Cheapest Car Insurance Options

Finding the most affordable car insurance in Florida requires a strategic approach. It involves understanding your specific needs, exploring different providers, and comparing their offerings. This section will guide you through the process of finding the cheapest car insurance options in Florida, providing practical tips and insights.

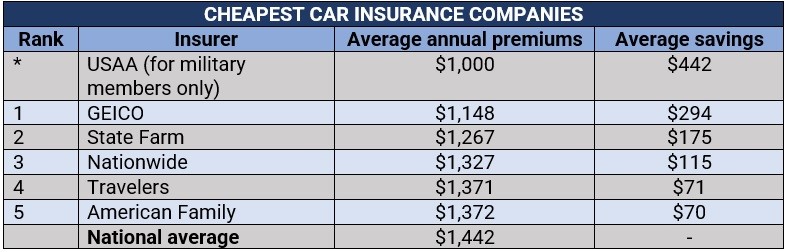

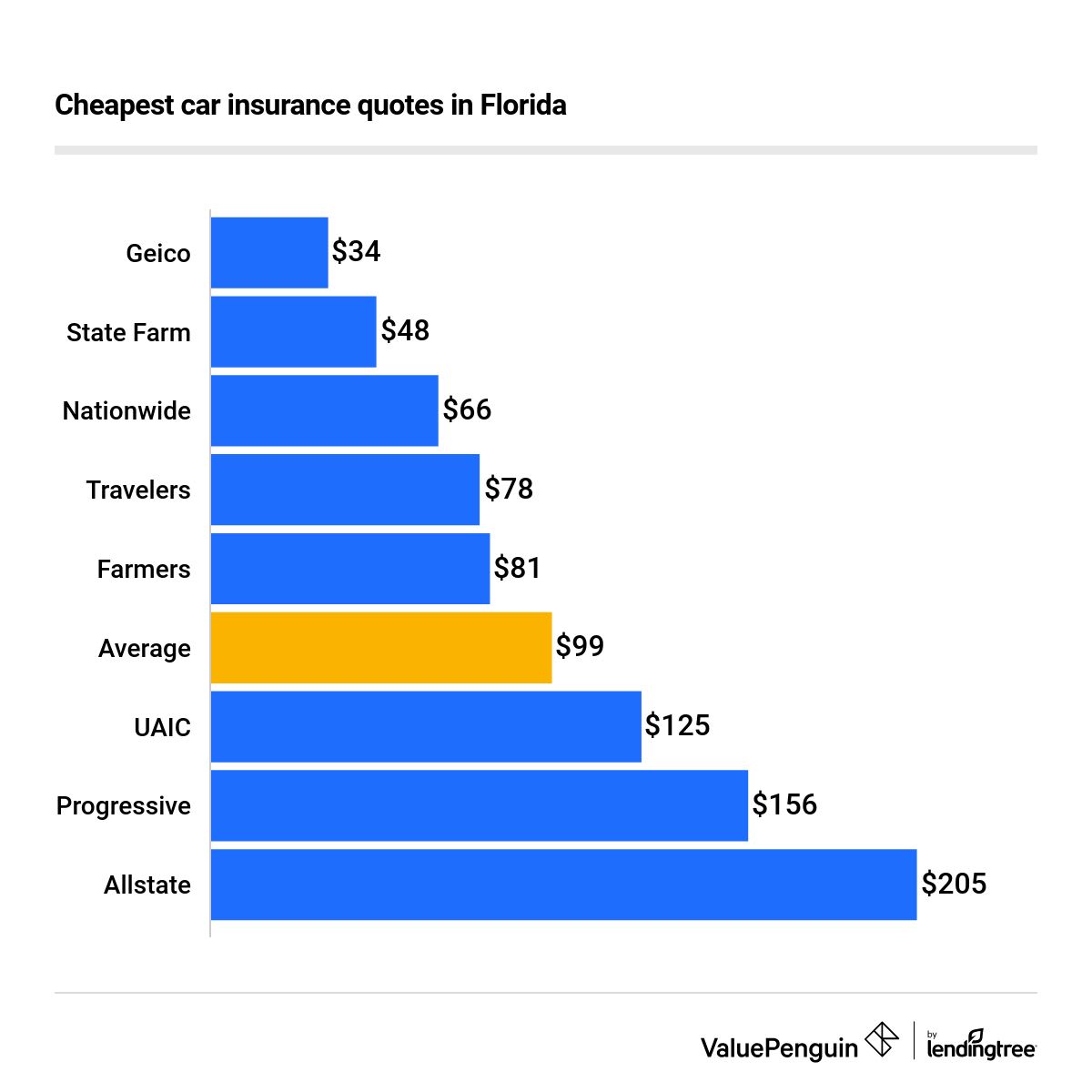

Comparing Car Insurance Providers in Florida

Different car insurance providers in Florida offer varying coverage options and pricing structures. Understanding the strengths and weaknesses of each provider can help you make an informed decision.

- State Farm: State Farm is one of the largest insurance providers in the US, offering comprehensive coverage and competitive pricing. They are known for their excellent customer service and a wide range of discounts.

- Geico: Geico is another popular choice, renowned for its competitive rates and convenient online services. They offer various discounts and have a user-friendly website for managing policies.

- Progressive: Progressive is known for its personalized insurance options and its “Name Your Price” tool, which allows customers to set a budget and find the best coverage within their range.

- Allstate: Allstate is a well-established provider offering a wide range of coverage options and discounts. They are known for their strong financial stability and customer support.

- Florida Peninsula Insurance Company: This provider specializes in offering insurance to Florida residents, focusing on affordable rates and tailored coverage options.

Using Online Car Insurance Comparison Tools

Online car insurance comparison tools are valuable resources for finding the cheapest options. They streamline the process by allowing you to compare quotes from multiple providers simultaneously.

- Benefits: Online tools save time and effort by eliminating the need to contact each provider individually. They provide a comprehensive overview of available options, allowing for easy comparison.

- Drawbacks: While convenient, online tools may not always provide the most accurate or up-to-date information. It’s essential to verify the details with the provider before making a final decision.

Online comparison tools can be a useful starting point, but it’s essential to confirm the details with the provider directly to ensure accuracy.

Strategies for Reducing Car Insurance Costs

In Florida, where car insurance premiums can be high, understanding strategies to reduce costs is essential. By implementing these strategies, you can significantly lower your insurance premiums and save money in the long run.

Improving Driving Habits and Safety Measures

Improving your driving habits and implementing safety measures can significantly reduce your car insurance premiums. Insurance companies often offer discounts for safe drivers.

- Defensive Driving Courses: Completing a defensive driving course can reduce your premium by demonstrating your commitment to safe driving practices. These courses teach valuable skills like risk management, accident avoidance, and defensive driving techniques.

- Maintaining a Clean Driving Record: Avoiding traffic violations, such as speeding tickets and accidents, is crucial for keeping your premiums low. A clean driving record indicates a lower risk to insurance companies, leading to reduced premiums.

- Installing Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are considered safer by insurance companies. Installing these features can qualify you for discounts, as they reduce the risk of accidents and injuries.

- Using Telematics Devices: Telematics devices, such as those offered by insurance companies, track your driving behavior, including speed, braking, and acceleration. By demonstrating safe driving habits through telematics, you can earn discounts and potentially lower your premiums.

Increasing Deductibles and Reducing Coverage

Increasing your deductibles and reducing unnecessary coverage can significantly reduce your car insurance premiums.

- Higher Deductibles: A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your premium, as you are taking on more financial responsibility in case of an accident. However, ensure the increased deductible is within your financial capacity.

- Reducing Unnecessary Coverage: Review your current coverage and eliminate any unnecessary components. For instance, if you have a fully paid-off car, you might not need collision or comprehensive coverage. Similarly, if you have multiple vehicles, you might be able to reduce the coverage on older vehicles.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Multi-Policy Discounts: Insurance companies reward customers who bundle multiple policies with them. By insuring your car, home, and other assets with the same provider, you can often receive substantial discounts on your premiums.

Negotiating Car Insurance Rates, Florida cheapest car insurance

Negotiating your car insurance rates with providers is a valuable strategy to secure the best possible price.

- Shop Around for Quotes: Before renewing your policy, obtain quotes from multiple insurance companies. This allows you to compare prices and coverage options to find the most favorable deal.

- Highlight Your Positive Factors: When speaking with insurance agents, emphasize your positive driving record, safety features, and any relevant discounts you qualify for. This can strengthen your negotiating position.

- Be Prepared to Switch Providers: If you are unable to negotiate a satisfactory rate with your current provider, be prepared to switch to another company offering a better deal. This competition can incentivize your current provider to offer a more competitive rate.

Essential Car Insurance Coverage in Florida

Driving in Florida requires you to have certain car insurance coverage to be legally allowed on the road. Understanding these requirements is crucial for all drivers, as failure to comply can result in fines and even license suspension. This section details the mandatory coverage and explores the importance of optional coverage options.

Mandatory Car Insurance Coverage in Florida

Florida law mandates that all drivers carry specific car insurance coverage to protect themselves and others in case of an accident. These coverages are designed to address financial liabilities arising from accidents, including injuries, property damage, and legal costs.

- Personal Injury Protection (PIP): PIP coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident. It is a no-fault coverage, meaning your own insurance company pays for your medical bills, even if you were responsible for the accident. Florida law requires a minimum PIP coverage of $10,000.

- Property Damage Liability (PDL): PDL coverage protects you against financial losses if you cause damage to another person’s property in an accident. This coverage pays for repairs or replacement of the damaged property. Florida law requires a minimum PDL coverage of $10,000.

Optional Car Insurance Coverage

While mandatory coverage is essential, optional coverage can provide additional financial protection in case of various events. These coverages are not required by law but are highly recommended to ensure comprehensive protection.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of fault. If you have a car loan or lease, your lender may require collision coverage. It is also a wise choice if you have a newer or more expensive vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, hail, or natural disasters. It is particularly beneficial if you live in an area prone to such events or if you have a newer or more expensive vehicle.

Uninsured/Underinsured Motorist Coverage

This coverage is crucial in Florida, where a significant number of drivers are uninsured or underinsured. Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers if you are injured in an accident caused by a driver without adequate insurance or no insurance at all.

- Uninsured Motorist (UM) Coverage: This coverage pays for your medical expenses, lost wages, and other related costs if you are injured by an uninsured driver.

- Underinsured Motorist (UIM) Coverage: This coverage provides protection if you are injured by a driver who has insurance, but their coverage limits are insufficient to cover your losses.

Understanding Car Insurance Policies: Florida Cheapest Car Insurance

Navigating the world of car insurance can feel overwhelming, especially with the various terms and conditions that come with each policy. Understanding the intricacies of your policy is crucial to ensure you’re adequately covered in case of an accident or other unforeseen events. This section will delve into the common terms and conditions found in car insurance policies, providing clarity on what they mean and how they affect your coverage.

Common Car Insurance Policy Terms and Conditions

Understanding the language used in your car insurance policy is essential for making informed decisions about your coverage. Here are some common terms and conditions you should familiarize yourself with:

- Premium: The amount you pay for your car insurance policy, typically on a monthly or annual basis.

- Deductible: The amount you agree to pay out-of-pocket before your insurance coverage kicks in. A higher deductible generally means lower premiums, while a lower deductible means higher premiums.

- Coverage Limits: The maximum amount your insurance company will pay for covered losses, such as bodily injury liability or property damage liability.

- Exclusions: Specific situations or events that are not covered by your insurance policy. For example, most policies exclude coverage for damage caused by wear and tear or acts of God.

- Policy Period: The duration of your car insurance policy, typically for a year.

- Renewal: The process of extending your car insurance policy for another term after it expires.

Types of Car Insurance Claims and Their Processing Procedures

Car insurance claims can range from minor fender benders to catastrophic accidents. Understanding the different types of claims and the procedures involved in processing them can help you navigate the process smoothly. Here’s a breakdown of common claim types:

- Liability Claims: These claims arise when you’re at fault for an accident and are responsible for covering the other party’s damages, including medical expenses and property damage.

- Collision Claims: These claims apply when your vehicle is involved in an accident with another vehicle or object, regardless of fault. Your collision coverage pays for repairs to your vehicle, minus your deductible.

- Comprehensive Claims: These claims cover damage to your vehicle caused by non-collision events, such as theft, vandalism, or natural disasters. Like collision coverage, you’ll need to pay your deductible before your insurance company covers the rest.

- Uninsured/Underinsured Motorist Claims: These claims protect you when you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. Your own insurance policy will cover your damages in these situations.

Importance of Reviewing and Understanding Your Car Insurance Policy

It’s crucial to review your car insurance policy regularly to ensure you’re adequately covered and understand the terms and conditions. Here are some reasons why:

- Ensure Adequate Coverage: As your life circumstances change, your insurance needs may change as well. Reviewing your policy ensures you have the right coverage for your current situation.

- Identify Potential Gaps in Coverage: Reviewing your policy can help you identify any gaps in coverage that might leave you financially vulnerable in the event of an accident or other unforeseen event.

- Negotiate Better Rates: Understanding your policy’s terms and conditions can help you negotiate better rates with your insurance company.

- Avoid Unexpected Costs: By understanding your policy’s exclusions and limitations, you can avoid unexpected costs associated with events that are not covered.

Closure

Navigating Florida’s car insurance market can be complex, but armed with knowledge, you can find the best deals and protect yourself on the road. By understanding the factors that influence premiums, employing cost-saving strategies, and carefully selecting coverage options, you can secure affordable car insurance in Florida that meets your individual needs.

FAQ Guide

How can I compare car insurance quotes in Florida?

You can compare car insurance quotes online through comparison websites or directly with insurance providers. Be sure to provide accurate information and compare quotes from multiple companies to find the best deal.

What are the penalties for driving without car insurance in Florida?

Driving without car insurance in Florida is illegal and can result in fines, license suspension, and even jail time. It’s crucial to maintain valid car insurance to avoid these consequences.

What are some common car insurance discounts available in Florida?

Many discounts are available, including good driver discounts, safe driving courses, multi-car discounts, and bundling insurance policies.