- Florida’s Healthcare Landscape

- Types of Health Insurance in Florida

- Affordable Care Act (ACA) in Florida

- Medicare and Medicaid in Florida: Florida Health Care Insurance

- Health Insurance Costs in Florida

- Choosing the Right Health Insurance Plan

- Navigating the Florida Health Insurance Market

- Health Insurance Trends in Florida

- Final Summary

- Popular Questions

Florida health care insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. The Sunshine State’s healthcare landscape is a complex tapestry woven with unique challenges and opportunities, reflecting the state’s diverse population and booming economy. This guide delves into the intricacies of Florida’s health insurance market, providing insights into the various types of plans available, the impact of the Affordable Care Act, and the nuances of Medicare and Medicaid.

Understanding the intricacies of Florida’s health insurance market is crucial for residents seeking affordable and comprehensive coverage. This guide explores the diverse range of plans available, including individual, employer-sponsored, and government-funded options. It delves into the key features and benefits of each type of insurance, highlighting their suitability for different demographics and needs. Furthermore, the guide sheds light on the role of the Affordable Care Act in expanding access to affordable healthcare, analyzing its impact on Florida’s healthcare system and the state’s Health Choices marketplace. It also examines the coverage and benefits provided by Medicare and Medicaid, outlining eligibility criteria and key differences between these programs. Ultimately, this guide aims to empower Floridians with the knowledge and resources needed to navigate the complexities of the state’s health insurance market and make informed decisions about their healthcare coverage.

Florida’s Healthcare Landscape

Florida’s healthcare system is a complex and dynamic environment, facing unique challenges and opportunities. The state’s diverse population, aging demographics, and significant tourist influx contribute to a multifaceted healthcare landscape.

Challenges and Opportunities

Florida’s healthcare system faces various challenges, including a large uninsured population, high healthcare costs, and a shortage of healthcare professionals, particularly in rural areas. However, the state also presents numerous opportunities for innovation and growth, driven by its robust healthcare infrastructure, a growing focus on value-based care, and a burgeoning medical tourism industry.

Comparison with Other States, Florida health care insurance

Florida’s healthcare system differs from other states in several key aspects. Compared to states with universal healthcare coverage, Florida has a higher percentage of uninsured residents, resulting in limited access to preventative care and increased healthcare costs. Florida’s high population density and aging demographics also contribute to higher healthcare utilization rates compared to less populated states.

Impact of Demographics and Population Growth

Florida’s rapidly growing population, particularly its aging demographic, significantly impacts healthcare needs. The state experiences a higher demand for geriatric care, long-term care services, and chronic disease management. This demographic shift necessitates a focus on developing sustainable healthcare solutions that can cater to the unique needs of an aging population.

Types of Health Insurance in Florida

Florida offers a diverse range of health insurance options, catering to different needs and budgets. Understanding the various types available is crucial for making informed decisions about your health coverage.

Individual Health Insurance

Individual health insurance plans are purchased directly by individuals, independent of any employer or government program. These plans provide coverage for a wide range of medical expenses, including doctor visits, hospital stays, prescription drugs, and preventive care.

Key Features and Benefits

- Flexibility: Individuals have the freedom to choose a plan that best suits their specific needs and budget.

- Customization: Plans can be tailored to include various coverage options, such as deductibles, copayments, and out-of-pocket maximums.

- Portability: Coverage remains with the individual even if they change jobs or move to a different state.

Eligibility Criteria

- Individuals who are not eligible for employer-sponsored or government-funded health insurance can purchase individual plans.

- Eligibility may be subject to certain health conditions or pre-existing conditions.

Employer-Sponsored Health Insurance

Employer-sponsored health insurance plans are offered by employers to their employees, often as a benefit package. These plans typically provide comprehensive coverage for medical expenses, including hospitalization, surgery, and prescription drugs.

Key Features and Benefits

- Group Discounts: Employers negotiate lower premiums with insurance companies by pooling their employees together.

- Tax Advantages: Employer contributions to health insurance premiums are tax-deductible for both the employer and the employee.

- Wider Coverage: Employer-sponsored plans often offer a wider range of benefits compared to individual plans.

Eligibility Criteria

- Employees of participating companies are eligible for employer-sponsored health insurance.

- Eligibility may be subject to certain employment conditions, such as full-time employment or a minimum number of working hours.

Government-Funded Health Insurance

Government-funded health insurance programs provide coverage to specific populations, such as low-income individuals, seniors, and people with disabilities. These programs are designed to ensure access to affordable healthcare for vulnerable groups.

Key Features and Benefits

- Affordable Premiums: Government-funded plans typically have lower premiums compared to individual or employer-sponsored plans.

- Subsidies: Individuals may be eligible for government subsidies to help offset the cost of premiums.

- Comprehensive Coverage: Government-funded plans often provide comprehensive coverage for a wide range of medical expenses.

Eligibility Criteria

- Eligibility for government-funded health insurance programs is based on income, age, and other factors.

- Specific eligibility criteria vary depending on the program.

Types of Health Insurance Plans

| Type of Plan | Key Features | Eligibility Criteria |

|---|---|---|

| Individual Health Insurance | Purchased directly by individuals, customizable coverage, portable. | Individuals not eligible for employer-sponsored or government-funded plans. |

| Employer-Sponsored Health Insurance | Offered by employers to employees, group discounts, tax advantages. | Employees of participating companies, subject to employment conditions. |

| Medicare | Government-funded health insurance for individuals aged 65 and older, people with disabilities, and individuals with end-stage renal disease. | Individuals meeting age, disability, or medical condition criteria. |

| Medicaid | Government-funded health insurance for low-income individuals and families. | Individuals and families meeting income and other eligibility requirements. |

| Children’s Health Insurance Program (CHIP) | Government-funded health insurance for children from low-income families. | Children meeting income and other eligibility requirements. |

Affordable Care Act (ACA) in Florida

The Affordable Care Act (ACA), also known as Obamacare, has had a significant impact on healthcare access and affordability in Florida. The ACA aimed to expand health insurance coverage, improve affordability, and increase consumer protections. This section delves into the implementation of the ACA in Florida, its successes, and challenges.

Florida Health Choices: The State’s ACA Marketplace

Florida Health Choices, the state’s ACA marketplace, serves as a platform for individuals and families to find and compare affordable health insurance plans. It offers a variety of plans from different insurance companies, allowing consumers to choose the best option based on their needs and budget.

The marketplace provides a user-friendly platform where individuals can:

- Compare plans: Users can compare plans based on price, coverage, and other factors.

- Get financial assistance: Individuals with low to moderate incomes may be eligible for subsidies to help them afford their premiums.

- Enroll in a plan: Users can enroll in a plan directly through the marketplace.

Florida Health Choices plays a crucial role in connecting individuals with affordable health insurance plans, especially for those who previously lacked coverage.

Effectiveness of the ACA in Florida

The ACA has had both successes and challenges in Florida.

Successes

- Increased insurance coverage: The ACA led to a significant increase in the number of Floridians with health insurance. According to the U.S. Census Bureau, the uninsured rate in Florida decreased from 23.4% in 2013 to 13.3% in 2016, following the implementation of the ACA.

- Expanded access to preventive care: The ACA requires most health insurance plans to cover preventive services without any out-of-pocket costs. This has improved access to preventive care services like screenings and vaccinations, leading to better health outcomes for Floridians.

- Increased affordability: The ACA’s subsidies have helped many Floridians afford health insurance. The average annual premium for a benchmark silver plan in Florida was $4,500 in 2022, but many individuals received subsidies that significantly reduced their out-of-pocket costs.

Challenges

- High healthcare costs: Despite the ACA’s efforts, healthcare costs in Florida remain high. This has made it challenging for some individuals to afford their premiums and out-of-pocket expenses, even with subsidies.

- Limited provider networks: Some individuals have limited access to healthcare providers within their insurance plan’s network. This can make it difficult to find a doctor or specialist in their area, particularly in rural parts of the state.

- Political challenges: The ACA has faced political challenges in Florida, with some lawmakers seeking to repeal or weaken the law. These challenges have created uncertainty and instability in the healthcare system.

Medicare and Medicaid in Florida: Florida Health Care Insurance

Florida, like other states, offers crucial healthcare programs for its residents through Medicare and Medicaid. These programs provide access to healthcare services for individuals who meet specific eligibility requirements. Understanding the coverage, benefits, and eligibility criteria for both Medicare and Medicaid in Florida is essential for Floridians seeking healthcare assistance.

Medicare in Florida

Medicare is a federal health insurance program primarily for individuals aged 65 and older, as well as younger individuals with certain disabilities. It is divided into four parts, each with its own coverage and benefits:

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health services.

- Part B (Medical Insurance): Covers doctor’s visits, outpatient care, preventive services, and some durable medical equipment.

- Part C (Medicare Advantage): Offered by private insurance companies and provides all the benefits of Part A and Part B, sometimes with additional coverage like vision, dental, and prescription drugs.

- Part D (Prescription Drug Coverage): Covers prescription drugs through private insurance companies.

To be eligible for Medicare in Florida, individuals must meet the following criteria:

- Age: Be at least 65 years old.

- Citizenship: Be a U.S. citizen or lawful permanent resident.

- Disability: Have a qualifying disability and have received Social Security Disability Insurance (SSDI) for at least 24 months.

- End-Stage Renal Disease (ESRD): Have ESRD and have received Social Security Disability Insurance (SSDI) for at least 24 months.

Florida offers various resources and assistance programs for Medicare beneficiaries, including:

- Florida SHIP (State Health Insurance Assistance Program): Provides free, unbiased counseling and information about Medicare and other health insurance options.

- Florida Medicaid: Individuals eligible for both Medicare and Medicaid may be able to receive additional coverage through Medicaid, which can help with out-of-pocket costs for Medicare services.

Medicaid in Florida

Medicaid is a federal-state partnership program that provides health insurance coverage to low-income individuals and families, children, pregnant women, people with disabilities, and seniors. Florida’s Medicaid program is called “Medicaid.”

The eligibility criteria for Medicaid in Florida are based on income and other factors, including:

- Income: Must meet specific income guidelines based on family size.

- Citizenship: Must be a U.S. citizen or lawful permanent resident.

- Residency: Must live in Florida.

- Other factors: May also consider factors like pregnancy, disability, and age.

Florida’s Medicaid program offers a wide range of benefits, including:

- Hospitalization: Covers inpatient and outpatient hospital services.

- Physician services: Covers doctor’s visits and other medical services.

- Prescription drugs: Covers prescription medications.

- Dental care: Covers dental services for children and adults.

- Mental health services: Covers mental health and substance abuse treatment.

- Vision care: Covers eye exams and eyeglasses for children.

- Transportation: Provides transportation to medical appointments for individuals who cannot afford it.

Key Differences Between Medicare and Medicaid in Florida

Medicare and Medicaid are distinct programs with different eligibility requirements, coverage, and benefits. Here’s a comparison of their key differences:

| Feature | Medicare | Medicaid |

|---|---|---|

| Eligibility | Primarily for individuals aged 65 and older, younger individuals with disabilities, and individuals with End-Stage Renal Disease (ESRD) | For low-income individuals and families, children, pregnant women, people with disabilities, and seniors |

| Funding | Federally funded | Jointly funded by the federal and state governments |

| Coverage | Covers hospital, medical, prescription drug, and other healthcare services | Covers a wide range of healthcare services, including hospital, physician, prescription drug, dental, mental health, and vision care |

| Cost | Individuals pay premiums, deductibles, and coinsurance | Generally free or low-cost, depending on income and other factors |

| Administration | Administered by the federal government | Administered by each state |

Both Medicare and Medicaid play crucial roles in providing healthcare access to Floridians. While Medicare focuses on older adults and individuals with disabilities, Medicaid provides essential coverage for low-income individuals and families. Understanding the eligibility criteria, coverage, and benefits of each program is essential for individuals seeking healthcare assistance in Florida.

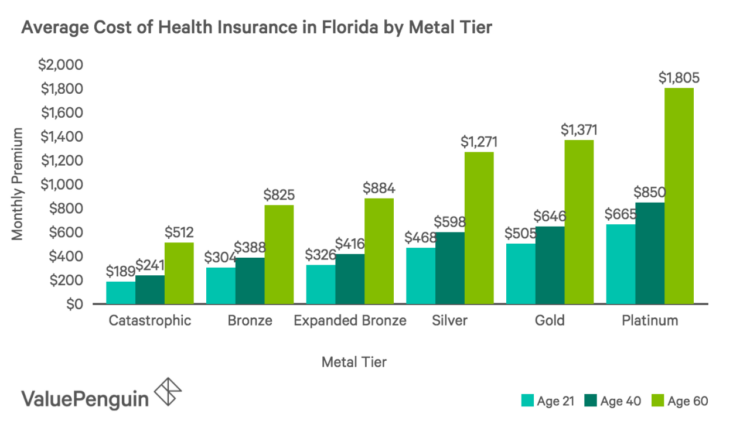

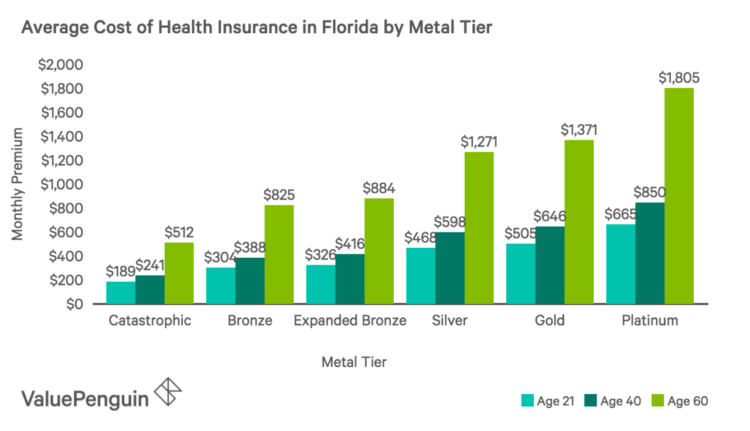

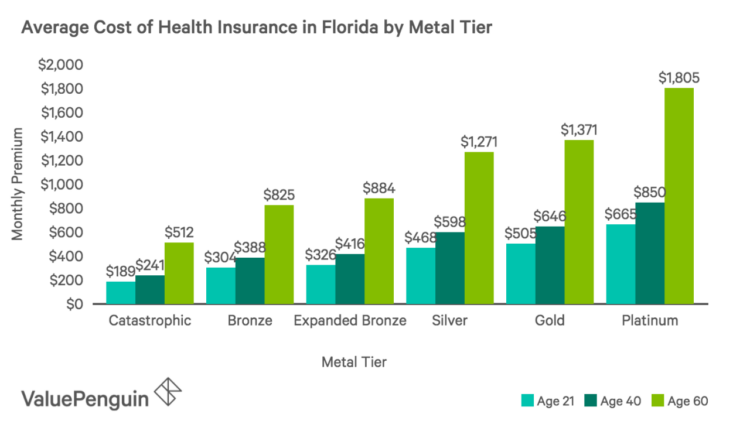

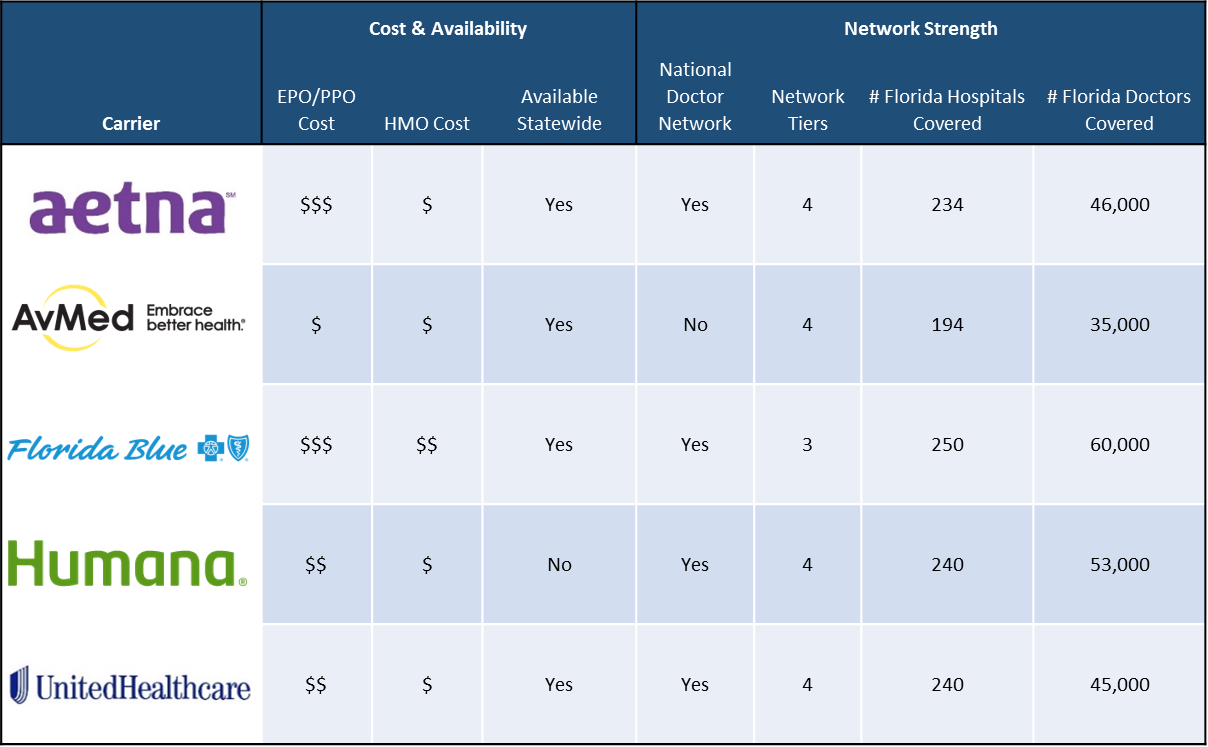

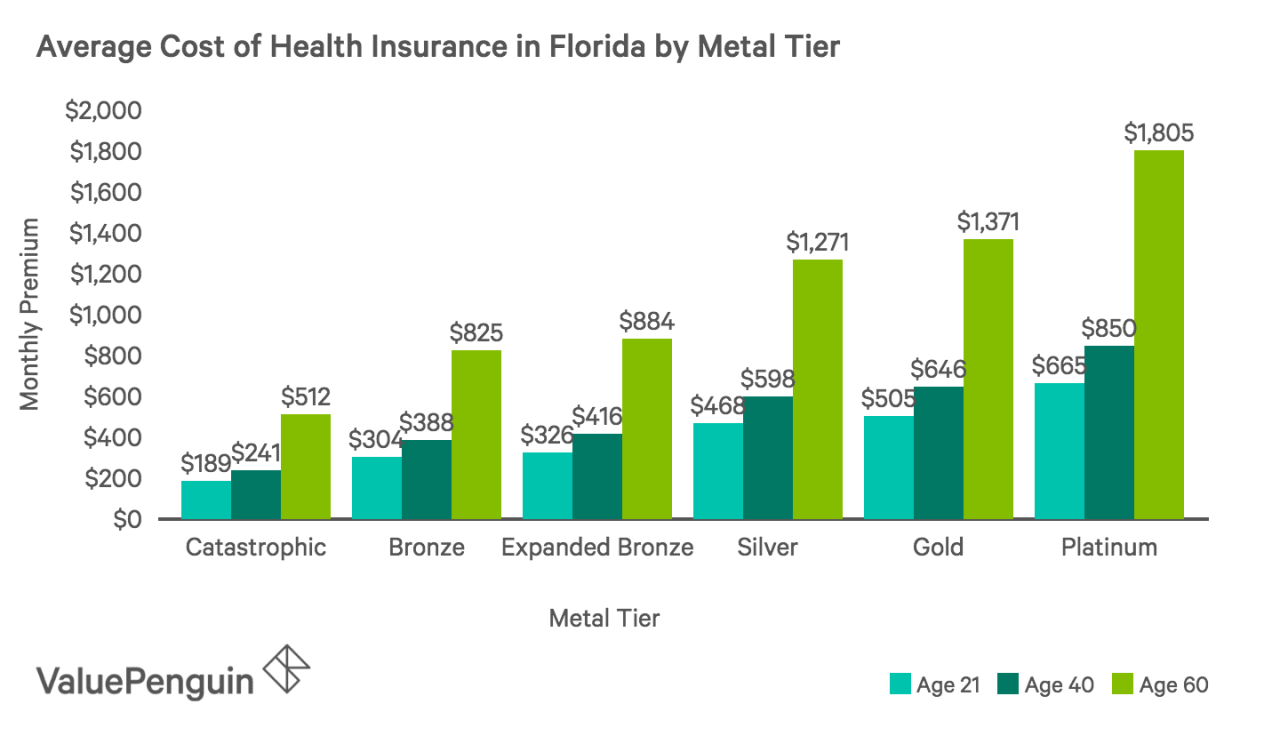

Health Insurance Costs in Florida

Florida’s healthcare landscape is dynamic, with various factors impacting health insurance costs. Understanding these factors is crucial for individuals and families seeking affordable coverage. This section delves into the key determinants of health insurance premiums in Florida, comparing them to national averages and providing insights into cost variations across different plan types.

Factors Influencing Health Insurance Premiums in Florida

Several factors contribute to the overall cost of health insurance in Florida. These factors are interconnected and can vary depending on individual circumstances and geographic location.

- Demographics: Age, gender, and health status are significant determinants of insurance premiums. Older individuals generally pay higher premiums due to increased healthcare utilization. Similarly, individuals with pre-existing conditions may face higher premiums.

- Healthcare Utilization: The frequency and type of healthcare services used by individuals significantly impact premiums. Individuals with chronic conditions or requiring frequent medical attention tend to have higher premiums.

- Provider Networks: The availability and cost of healthcare providers within a particular network influence premiums. Networks with a limited number of providers or those with high provider fees generally lead to higher premiums.

- Geographic Location: Health insurance costs can vary significantly across different regions in Florida. Urban areas with a higher concentration of healthcare providers and higher living costs often have higher premiums.

- Plan Type: Different types of health insurance plans have varying premium structures. For instance, plans with lower deductibles and copayments typically have higher premiums.

Comparison of Health Insurance Costs in Florida with Other States

Florida’s average health insurance costs are comparable to the national average. However, specific cost variations can be observed when comparing Florida to other states. For instance, some states may have lower premiums due to lower healthcare utilization rates or a more competitive insurance market.

It’s essential to note that these comparisons are based on averages and can vary significantly depending on individual factors and plan types.

Average Monthly Premiums for Different Health Insurance Plans in Florida

The following table illustrates the average monthly premiums for different types of health insurance plans in Florida, based on data from the U.S. Department of Health and Human Services:

| Plan Type | Average Monthly Premium |

|---|---|

| Bronze | $450 |

| Silver | $600 |

| Gold | $750 |

| Platinum | $900 |

These premiums are estimates and can vary based on factors such as age, location, and health status. It’s crucial to compare quotes from multiple insurance providers to find the most affordable plan that meets individual needs.

Choosing the Right Health Insurance Plan

Navigating the world of health insurance in Florida can feel overwhelming, especially with the wide array of plans available. Finding the right plan is crucial, as it directly impacts your healthcare access, costs, and overall well-being. This section will guide you through the process of selecting a health insurance plan that aligns with your individual needs and budget.

Understanding Your Healthcare Needs

The first step in choosing a health insurance plan is to understand your specific healthcare needs. This involves considering your current health status, anticipated healthcare needs in the future, and your personal preferences. For instance, if you have a chronic condition that requires regular medical attention, you might prioritize a plan with comprehensive coverage and a wide provider network. Conversely, if you are generally healthy and only seek occasional preventive care, a plan with lower premiums and higher deductibles might be more suitable.

Factors to Consider When Choosing a Plan

Once you have a clear understanding of your healthcare needs, you can start evaluating different health insurance plans. Here are some key factors to consider:

Coverage

- Essential Health Benefits: The Affordable Care Act (ACA) mandates that all health insurance plans offer essential health benefits, including preventive care, hospitalization, prescription drugs, and mental health services. However, the specific coverage levels and copayments may vary between plans.

- Deductibles: This is the amount you pay out-of-pocket before your insurance starts covering your medical expenses. Higher deductibles typically result in lower premiums, while lower deductibles come with higher premiums.

- Copayments: These are fixed amounts you pay for specific services, such as doctor’s visits or prescriptions.

- Coinsurance: This is a percentage of your medical expenses that you pay after meeting your deductible.

- Out-of-Pocket Maximum: This is the maximum amount you will have to pay out-of-pocket for covered services in a given year.

Provider Network

- In-Network Providers: These are doctors, hospitals, and other healthcare providers who have contracted with your insurance company to provide services at discounted rates. Choosing a plan with a provider network that includes your preferred doctors and hospitals is crucial.

- Out-of-Network Providers: These are providers who are not part of your insurance company’s network. You will generally pay higher costs for services received from out-of-network providers.

Out-of-Pocket Expenses

- Premiums: These are the monthly payments you make for your health insurance plan. Premiums can vary significantly based on factors such as age, location, and coverage level.

- Deductibles, Copayments, and Coinsurance: These are the out-of-pocket expenses you pay for covered services.

- Prescription Drug Costs: Some plans have formularies that list the drugs they cover. You may have to pay higher copayments for drugs not on the formulary.

Comparing Health Insurance Plans

Once you have identified the key factors to consider, you can start comparing different health insurance plans. Here are some tips for comparing plans:

- Use Online Comparison Tools: Several websites and insurance marketplaces offer online comparison tools that allow you to compare plans based on your needs and budget.

- Review Plan Documents: Carefully review the plan documents, including the Summary of Benefits and Coverage (SBC), to understand the details of each plan.

- Contact Insurance Companies: If you have any questions, contact the insurance companies directly to clarify details or get personalized advice.

Navigating the Florida Health Insurance Market

The Florida health insurance market can be complex, with various plans and options available. To ensure you find the right plan that meets your individual needs and budget, it’s essential to understand the resources and tools available to you.

The Role of Health Insurance Brokers and Agents

Navigating the Florida health insurance market can be challenging, especially with the vast array of plans and options available. This is where health insurance brokers and agents play a crucial role. They act as intermediaries, connecting individuals with insurance companies and helping them choose the right plan based on their specific requirements.

- Expertise and Knowledge: Brokers and agents are well-versed in the complexities of the health insurance market. They possess in-depth knowledge of different plans, their benefits, and coverage details, enabling them to guide individuals toward plans that align with their health needs and financial capabilities.

- Personalized Guidance: Unlike navigating the insurance market alone, brokers and agents provide personalized guidance. They take the time to understand individual circumstances, including health conditions, medical history, and budget constraints, ensuring the chosen plan effectively addresses their unique needs.

- Comparative Analysis: Brokers and agents can compare plans from multiple insurance companies, allowing individuals to evaluate different options side-by-side. This comprehensive comparison empowers individuals to make informed decisions, selecting the plan that offers the best value for their money.

- Streamlined Enrollment Process: Brokers and agents can simplify the enrollment process. They assist individuals in completing necessary paperwork, verifying eligibility, and ensuring a smooth transition to their chosen plan.

- Ongoing Support: The support provided by brokers and agents extends beyond the initial enrollment. They are available to answer questions, address concerns, and assist with any changes or adjustments to the plan throughout the year.

Open Enrollment Periods and Deadlines

In Florida, there are specific open enrollment periods for individuals to enroll in or change their health insurance plans. These periods are typically annual and provide a window of opportunity for individuals to review their existing coverage and make necessary adjustments.

- Annual Open Enrollment Period: The annual open enrollment period for health insurance plans offered through the Affordable Care Act (ACA) marketplace typically runs from November 1st to January 15th of the following year. This period allows individuals to choose a new plan, change their existing plan, or enroll in coverage for the first time.

- Special Enrollment Periods: In addition to the annual open enrollment period, individuals may qualify for special enrollment periods due to certain life events, such as marriage, birth of a child, or job loss. These special enrollment periods allow individuals to enroll in or change their health insurance plans outside the regular open enrollment period.

- Deadlines: It’s crucial to be aware of the deadlines associated with open enrollment periods and special enrollment periods. Missing deadlines can result in a delay in coverage or the inability to enroll in a plan.

Resources for Navigating the Health Insurance Market

The Florida Department of Health and the Centers for Medicare and Medicaid Services (CMS) provide various resources to help individuals understand and navigate the health insurance market.

- Florida Department of Health: The Florida Department of Health offers information on health insurance plans, open enrollment periods, and resources for finding affordable coverage. They also provide assistance with understanding the ACA and its benefits.

- Centers for Medicare and Medicaid Services (CMS): CMS is the federal agency responsible for administering Medicare and Medicaid. They provide comprehensive information on these programs, including eligibility requirements, benefits, and enrollment procedures. Their website offers a wealth of resources, including tools for comparing plans and finding coverage options.

- Healthcare.gov: The official website for the Affordable Care Act (ACA) marketplace, healthcare.gov, provides a platform for individuals to compare plans, enroll in coverage, and access information about financial assistance programs.

- Local Community Health Centers: Many local community health centers offer assistance with navigating the health insurance market. They can provide guidance on eligibility for various programs, help with enrollment procedures, and connect individuals with resources for affordable healthcare.

Health Insurance Trends in Florida

Florida’s health insurance landscape is constantly evolving, driven by a confluence of factors including demographic shifts, technological advancements, and policy changes. Understanding these trends is crucial for individuals and businesses seeking to navigate the complex healthcare system effectively.

Impact of Demographic Shifts

Florida’s aging population, coupled with a growing influx of retirees, has significantly influenced the demand for health insurance. This demographic shift has led to a rise in Medicare enrollment and a greater emphasis on coverage for chronic conditions.

- According to the U.S. Census Bureau, Florida has the highest percentage of residents aged 65 and older in the nation, at 21.2%. This demographic trend has resulted in a substantial increase in Medicare enrollment, putting pressure on the system to provide adequate coverage for an aging population.

- The growing number of retirees in Florida has also led to an increased demand for health insurance plans that offer comprehensive coverage for chronic conditions, such as diabetes, heart disease, and arthritis.

Impact of Technological Advancements

Emerging technologies are transforming the Florida healthcare market, impacting everything from patient engagement to cost containment.

- Telemedicine, for instance, has gained significant traction in Florida, allowing patients to access healthcare services remotely via video conferencing and other digital platforms. This trend has the potential to reduce healthcare costs and improve access to care, especially for those living in rural areas.

- Artificial intelligence (AI) is also playing a growing role in healthcare, enabling more accurate diagnoses, personalized treatment plans, and more efficient drug discovery. These advancements are expected to further enhance healthcare outcomes and potentially lower costs in the long run.

Impact of Policy Changes

Policy changes at both the state and federal levels are also influencing the Florida health insurance landscape.

- The Affordable Care Act (ACA) has expanded access to health insurance for millions of Floridians, particularly low-income individuals and families. The ACA’s marketplaces have provided a platform for individuals to compare and purchase plans, fostering greater competition and potentially lowering premiums.

- State-level policies, such as Florida’s decision to not expand Medicaid under the ACA, have also impacted health insurance coverage and costs. The lack of Medicaid expansion has left a significant number of Floridians uninsured, particularly those in low-income households.

Future Trends in Florida’s Health Insurance Landscape

Predicting the future of health insurance in Florida is challenging but essential for informed decision-making. Based on current trends, several key factors are likely to shape the landscape in the coming years.

- Continued growth in telehealth services: Telemedicine is expected to continue its upward trajectory, offering greater convenience and accessibility for patients. As technology advances and regulations evolve, telehealth is likely to become an increasingly integrated part of the healthcare system.

- Increased focus on value-based care: The healthcare industry is shifting toward value-based care models, where providers are rewarded for delivering quality care at lower costs. This trend is expected to incentivize healthcare providers to focus on preventive care, disease management, and patient engagement, potentially leading to better health outcomes and lower overall costs.

- Greater emphasis on data analytics: The use of data analytics in healthcare is expected to grow, enabling providers to identify trends, predict patient needs, and optimize care delivery. This data-driven approach can help improve patient outcomes, reduce costs, and enhance the overall efficiency of the healthcare system.

Final Summary

Navigating Florida’s health insurance market can feel like a daunting task, but with the right information and resources, it can be a manageable process. This guide has provided a comprehensive overview of the key factors to consider, from understanding the different types of health insurance plans to navigating the state’s marketplace and choosing the right coverage for your individual needs and budget. By leveraging the resources available, seeking guidance from qualified professionals, and staying informed about the latest trends, Floridians can ensure they have access to the healthcare coverage they need to thrive in the Sunshine State.

Popular Questions

What is the open enrollment period for health insurance in Florida?

The open enrollment period for individual health insurance plans in Florida typically runs from November 1st to January 15th. However, there may be special enrollment periods available for certain life events, such as losing your job or getting married.

What are the main factors to consider when choosing a health insurance plan in Florida?

When selecting a health insurance plan in Florida, it’s crucial to consider factors such as coverage, provider network, out-of-pocket expenses, and premium costs. You should also evaluate the plan’s coverage for essential health benefits, such as preventive care, hospitalization, and prescription drugs.

What are the resources available to help Floridians navigate the health insurance market?

Florida residents can access resources such as the Florida Health Choices marketplace, the Florida Department of Health, and health insurance brokers and agents to assist them in navigating the health insurance market. These resources provide information on plan options, eligibility criteria, and enrollment processes.

What are the latest trends in health insurance coverage and costs in Florida?

Recent trends in Florida’s health insurance market include rising premiums, increased use of telehealth services, and growing emphasis on value-based care. These trends are driven by factors such as rising healthcare costs, technological advancements, and changing consumer preferences.