Florida health care insurance companies play a crucial role in providing access to essential medical services for residents of the Sunshine State. With a diverse population and a complex healthcare landscape, navigating the world of health insurance in Florida can be a daunting task. This comprehensive guide will delve into the intricacies of the Florida health insurance market, providing valuable insights into the key factors that influence costs, the different types of plans available, and strategies for finding affordable coverage.

From understanding the major insurance providers and their coverage offerings to navigating the enrollment process and exploring resources for low-income individuals, this guide aims to empower Floridians with the knowledge they need to make informed decisions about their health insurance.

Florida Health Insurance Landscape

Florida’s health insurance market is dynamic and complex, influenced by factors such as population demographics, healthcare utilization patterns, and regulatory changes. This landscape is characterized by a diverse range of insurance providers, plan options, and coverage levels, catering to the needs of a large and diverse population.

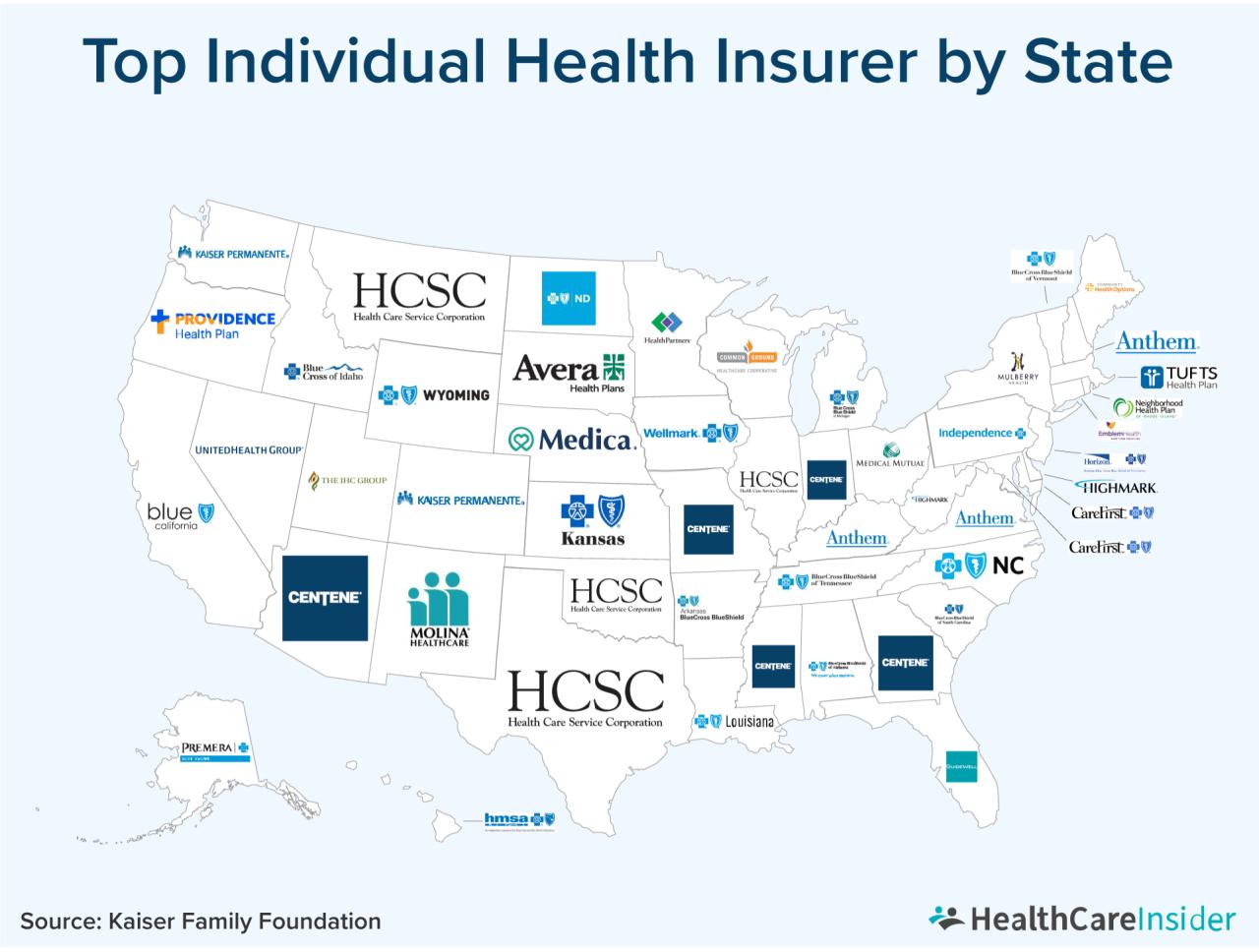

Major Health Insurance Companies in Florida

Florida’s health insurance market is dominated by several major players, each with its own market share and coverage offerings. These companies compete to attract individuals, families, and employers seeking comprehensive and affordable health insurance plans.

- Florida Blue: As the state’s largest health insurer, Florida Blue holds a significant market share and offers a wide range of health insurance plans, including HMO, PPO, and POS options. The company has a strong presence across the state, with a vast network of providers and extensive coverage options.

- UnitedHealthcare: UnitedHealthcare is another major player in the Florida health insurance market, providing a diverse portfolio of plans, including individual, family, and employer-sponsored coverage. The company’s extensive provider network and focus on value-based care make it a popular choice for many Floridians.

- Cigna: Cigna is a well-established national health insurer with a strong presence in Florida. The company offers a variety of health insurance plans, including HMO, PPO, and POS options, with a focus on preventive care and wellness programs.

- Humana: Humana is a leading provider of Medicare and Medicaid plans in Florida, offering a range of coverage options for seniors and individuals with specific health needs. The company is known for its strong customer service and focus on personalized care.

- Aetna: Aetna is a national health insurer with a significant presence in Florida, providing a range of health insurance plans, including HMO, PPO, and POS options. The company is known for its extensive provider network and focus on quality care.

Types of Health Insurance Plans in Florida

Florida residents have access to various types of health insurance plans, each with its own unique features and benefits. Understanding the differences between these plans is crucial for choosing the best option based on individual needs and preferences.

- Health Maintenance Organization (HMO): HMO plans typically have lower premiums than other types of plans, but they require members to choose a primary care physician (PCP) within the network. Members must obtain referrals from their PCP to see specialists or receive other healthcare services. HMOs generally offer lower out-of-pocket costs for in-network care.

- Preferred Provider Organization (PPO): PPO plans provide more flexibility than HMOs, allowing members to see providers both in and out of network. However, out-of-network care is generally more expensive. PPOs typically have higher premiums than HMOs but offer greater choice and flexibility.

- Point-of-Service (POS): POS plans combine elements of both HMO and PPO plans. Members can choose to see providers in or out of network, but they may face higher out-of-pocket costs for out-of-network care. POS plans offer a balance between cost and flexibility.

Key Factors Influencing Health Insurance Costs

Florida’s health insurance market is dynamic and influenced by various factors that shape the cost of premiums. Understanding these factors is crucial for both individuals and businesses seeking health insurance coverage.

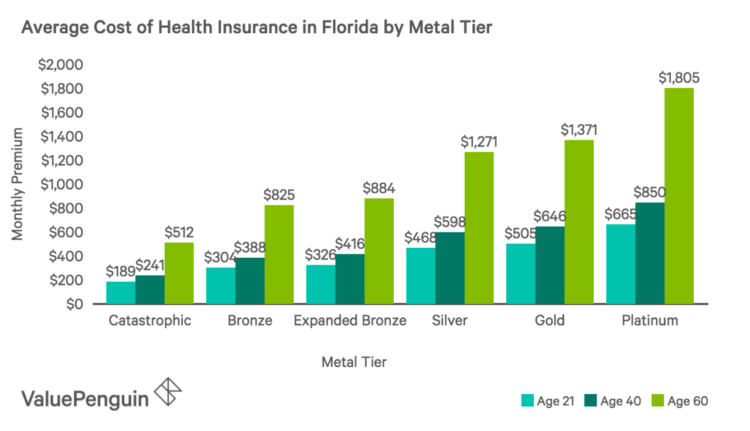

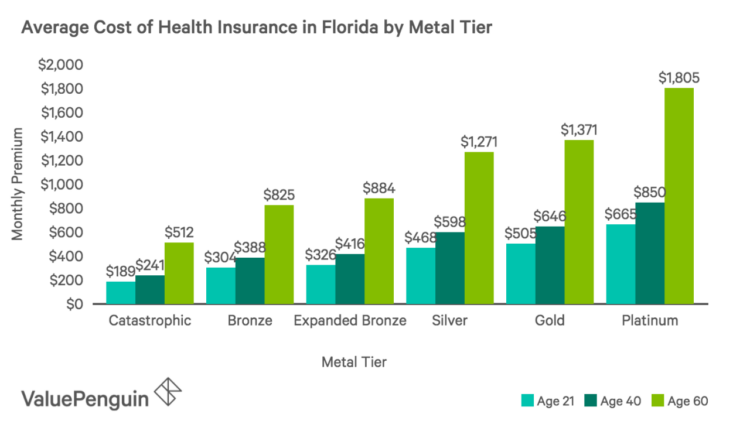

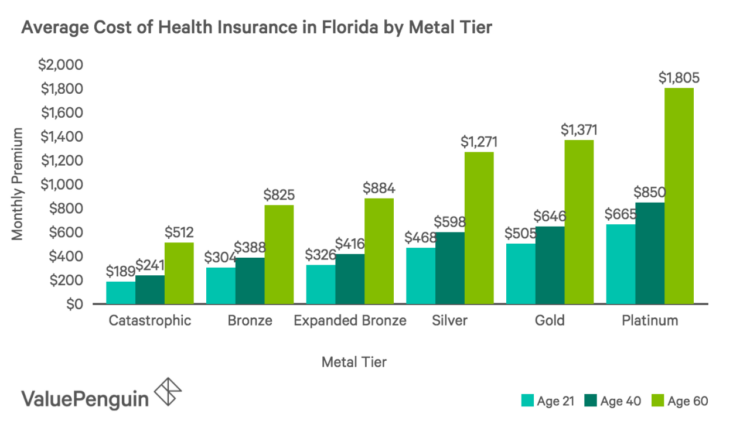

Age

Age is a significant factor in determining health insurance premiums. As individuals age, their risk of developing health conditions increases, leading to higher healthcare utilization. This increased risk is reflected in higher premiums for older individuals.

Health Status

An individual’s health status plays a crucial role in determining insurance costs. Individuals with pre-existing conditions or a history of significant health issues are likely to face higher premiums. Insurance companies consider the likelihood of future healthcare expenses when setting premiums.

Location

Geographic location can influence health insurance costs. Areas with higher concentrations of healthcare providers, specialized facilities, or higher costs of living often have higher insurance premiums. This is because insurance companies must account for the costs of providing coverage in those regions.

Plan Type

The type of health insurance plan chosen significantly affects premiums. Different plans offer varying levels of coverage and benefits, which influence the cost. For example, plans with lower deductibles or broader coverage typically have higher premiums.

Florida’s Healthcare Policies and Regulations

Florida’s healthcare policies and regulations have a direct impact on insurance costs. The state’s regulations regarding essential health benefits, coverage mandates, and rate review processes can influence premiums. For instance, the state’s mandate for coverage of certain services can increase costs for insurers.

Competition and Consumer Demand

Competition among health insurance companies in Florida plays a role in shaping insurance pricing. When competition is high, insurers may offer lower premiums to attract customers. Consumer demand also influences pricing, as insurers adjust premiums based on the demand for specific plans or coverage options.

Navigating Health Insurance Options in Florida

Finding the right health insurance plan in Florida can feel overwhelming, but with the right approach, you can navigate the process successfully. Understanding the available options, enrollment methods, and key factors to consider will empower you to make informed decisions.

Understanding Health Insurance Options in Florida

Florida offers a variety of health insurance plans through different avenues, each with its own features and costs. Here’s a breakdown of the most common options:

- Individual Health Insurance: This is purchased directly from an insurance company, offering flexibility in plan selection but potentially higher costs.

- Employer-Sponsored Health Insurance: Many Florida employers offer group health insurance plans, typically with lower premiums than individual plans.

- Medicare: For individuals aged 65 and older or those with certain disabilities, Medicare provides federal health insurance coverage.

- Medicaid: Florida’s Medicaid program provides health insurance for low-income individuals and families, including children, pregnant women, and people with disabilities.

- Affordable Care Act (ACA) Marketplace: The ACA Marketplace, also known as HealthCare.gov, offers subsidized health insurance plans for individuals and families who meet certain income requirements.

Enrolling in a Health Insurance Plan

Once you’ve determined the best type of plan for your needs, you can enroll through the following methods:

- Through the ACA Marketplace: The ACA Marketplace offers a streamlined enrollment process, allowing you to compare plans, estimate costs, and apply for subsidies. You can enroll during the annual open enrollment period or during a special enrollment period if you experience a qualifying life event.

- Directly with an Insurance Company: You can contact insurance companies directly to explore individual health insurance plans. This option provides greater flexibility in choosing a plan but may require more research and comparison.

Comparing Health Insurance Plans

To ensure you select the most suitable plan, carefully compare different options based on these key factors:

- Premiums: The monthly cost of your health insurance plan. Consider your budget and compare premiums across different plans.

- Deductibles: The amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums.

- Co-pays and Co-insurance: These are the amounts you pay for specific services, like doctor visits or prescriptions, after your deductible is met. Co-pays are fixed amounts, while co-insurance is a percentage of the cost.

- Network: The list of doctors, hospitals, and other healthcare providers covered by your plan. Ensure your preferred providers are included in the network.

- Coverage: The specific services and benefits included in your plan. Consider your health needs and prioritize coverage for essential services.

Tips for Choosing the Best Health Insurance Plan

Here are some tips to help you navigate the decision-making process:

- Assess Your Needs: Consider your current health status, anticipated healthcare needs, and budget.

- Research Plans: Explore different insurance companies and compare their plans using online tools or by contacting insurance brokers.

- Utilize Resources: Take advantage of resources like the ACA Marketplace, state insurance departments, and consumer advocacy groups for guidance and support.

- Seek Professional Advice: If you’re unsure about your options, consult with a licensed insurance agent or broker for personalized recommendations.

Accessing Affordable Health Care in Florida

Florida’s diverse population presents a complex landscape for healthcare access, with various factors impacting affordability and availability. While the state boasts a robust network of healthcare providers, challenges remain for low-income and uninsured individuals, highlighting the need for comprehensive solutions to ensure equitable access to quality care.

Government Programs

Government programs play a crucial role in providing financial assistance and healthcare coverage to eligible Floridians.

- Medicaid: This program provides health insurance to low-income individuals and families, including children, pregnant women, and people with disabilities. Medicaid coverage in Florida is administered by the Agency for Health Care Administration (AHCA) and is available to individuals meeting specific income and asset requirements.

- Medicare: This federal program offers health insurance to individuals aged 65 and older, as well as people with certain disabilities. Medicare is divided into four parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug coverage).

These programs significantly contribute to improving access to healthcare for vulnerable populations.

Community Health Centers

Community health centers (CHCs) are non-profit organizations that provide comprehensive primary and preventive care services to underserved communities. They offer a range of services, including medical, dental, mental health, and substance abuse treatment.

- Sliding Fee Scale: CHCs operate on a sliding fee scale, meaning that the cost of services is based on the patient’s ability to pay. This ensures that everyone, regardless of their financial status, can access essential healthcare services.

- Federally Qualified Health Centers (FQHCs): FQHCs receive federal funding and are required to provide services to all individuals, regardless of their ability to pay. They are often located in areas with limited access to healthcare and serve as a vital resource for low-income and uninsured individuals.

Challenges Faced by Low-Income and Uninsured Individuals

Despite the availability of government programs and community resources, accessing affordable healthcare remains a challenge for many Floridians, particularly those with low incomes and lacking health insurance.

- High Out-of-Pocket Costs: Even with insurance, high deductibles, copayments, and coinsurance can make healthcare unaffordable for low-income individuals.

- Limited Access to Specialists: Finding specialists who accept Medicaid or other government programs can be challenging, especially in rural areas.

- Navigating the Healthcare System: The complex healthcare system can be overwhelming for individuals unfamiliar with insurance plans, eligibility requirements, and billing procedures.

These challenges highlight the need for ongoing efforts to improve affordability and accessibility of healthcare services for all Floridians.

Health Insurance Trends and Future Outlook

The Florida health insurance market is constantly evolving, driven by technological advancements, shifting demographics, and changing consumer preferences. Understanding these trends is crucial for individuals and businesses alike, as they navigate the complexities of health insurance in the state.

Growth of Telehealth and Personalized Medicine

Telehealth, the delivery of healthcare services remotely using technology, has gained significant traction in Florida, particularly during the COVID-19 pandemic. This trend is expected to continue, driven by factors such as convenience, affordability, and improved access to specialized care. The increasing adoption of telehealth is likely to influence health insurance plans, with insurers incorporating telehealth services into their coverage and developing new plans specifically tailored to virtual care.

Personalized medicine, which tailors treatment plans to an individual’s genetic makeup, lifestyle, and other factors, is another emerging trend with the potential to reshape health insurance. As personalized medicine gains momentum, insurers may offer plans that cover genetic testing and personalized treatment options, leading to more targeted and effective healthcare.

Impact of Future Policy Changes and Technological Advancements, Florida health care insurance companies

The future of health insurance in Florida is likely to be shaped by policy changes and technological advancements. For instance, the ongoing debate over universal healthcare could significantly impact the health insurance landscape, potentially leading to a single-payer system or expanding coverage under existing programs.

Technological advancements, such as artificial intelligence (AI) and blockchain, are expected to revolutionize healthcare administration and insurance operations. AI-powered tools can help insurers automate tasks, detect fraud, and personalize services. Blockchain technology can enhance data security and transparency, improving the efficiency and integrity of insurance claims processing.

Future Outlook for Health Insurance Costs and Coverage

Predicting future health insurance costs and coverage in Florida is a complex task, influenced by a multitude of factors. However, some trends suggest that costs may continue to rise, driven by factors such as an aging population, rising healthcare costs, and the adoption of new technologies.

Insurers may respond to these pressures by adjusting premiums, introducing new cost-sharing mechanisms, and offering more limited coverage options. On the other hand, the growing adoption of value-based care models, which emphasize quality over quantity, could potentially lead to cost containment and improved outcomes.

Final Conclusion: Florida Health Care Insurance Companies

Ultimately, understanding the Florida health care insurance landscape is essential for individuals and families seeking quality healthcare. By staying informed about the latest trends, regulations, and available resources, Floridians can confidently navigate the complexities of the health insurance market and secure the coverage they need to protect their well-being.

Common Queries

What are the main types of health insurance plans available in Florida?

Florida offers a variety of health insurance plans, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Point-of-Service (POS) plans. Each plan type has its own network of providers, coverage options, and cost structure.

How can I find the best health insurance plan for my needs?

To find the best plan, consider your budget, health status, preferred providers, and coverage needs. You can compare plans using online tools, consult with an insurance broker, or contact the Florida Department of Insurance for guidance.

What are the eligibility requirements for Medicaid in Florida?

Eligibility for Medicaid in Florida is based on income, family size, and other factors. You can apply for Medicaid online or through your local Department of Children and Families office.