Florida State Car Insurance Requirements are crucial for all drivers in the Sunshine State. These requirements ensure that drivers are financially responsible in the event of an accident, protecting both themselves and others on the road. Understanding these requirements is essential for all Florida drivers, regardless of their experience level.

Florida law mandates that all drivers carry a minimum amount of liability insurance to cover potential damages and injuries caused to others in an accident. These requirements are designed to protect victims of accidents and ensure that they receive compensation for their losses. Additionally, Florida’s Financial Responsibility Laws impose penalties for drivers who fail to meet these minimum insurance requirements, including license suspension and fines. This stringent system helps maintain road safety and financial accountability among Florida’s drivers.

Florida’s Mandatory Car Insurance Requirements: Florida State Car Insurance Requirements

Florida law mandates that all drivers carry a minimum amount of liability insurance to protect themselves and others in case of an accident. These requirements ensure financial responsibility for damages and injuries caused by drivers.

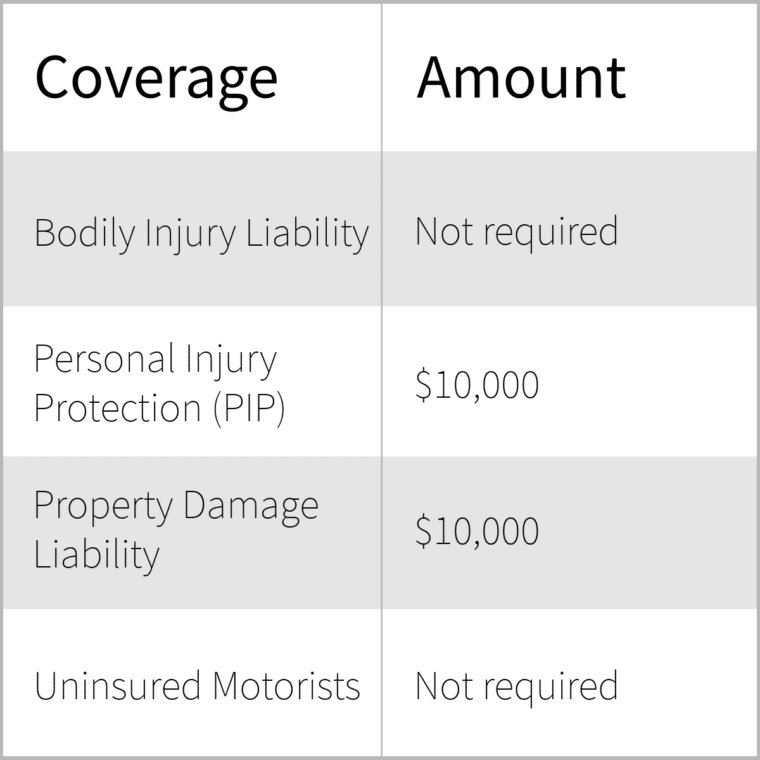

Minimum Liability Coverage Amounts

Florida requires drivers to carry the following minimum liability coverage amounts:

- Bodily Injury Liability: $10,000 per person / $20,000 per accident. This coverage pays for medical expenses, lost wages, and other damages to individuals injured in an accident caused by the insured driver.

- Property Damage Liability: $10,000 per accident. This coverage pays for damages to property, such as another vehicle or a building, caused by the insured driver.

It’s important to note that these minimum coverage amounts are just that – minimums. Drivers are strongly encouraged to purchase higher coverage limits to adequately protect themselves financially in the event of a serious accident.

Penalties for Driving Without Insurance, Florida state car insurance requirements

Driving without the minimum required car insurance in Florida can result in significant penalties, including:

- Fines: Drivers caught driving without insurance can face fines of up to $500 for the first offense and even higher fines for subsequent offenses.

- License Suspension: The Florida Department of Motor Vehicles (DMV) can suspend a driver’s license for up to three years for driving without insurance.

- Vehicle Impoundment: The vehicle involved in the violation may be impounded until proof of insurance is provided.

- Court Costs: Drivers may be required to pay court costs and other legal fees associated with the violation.

- Higher Insurance Premiums: Even after obtaining insurance, drivers with a history of driving without insurance may face higher premiums for several years.

Types of Car Insurance Available in Florida

Beyond the mandatory liability coverage, Florida drivers have access to various optional car insurance coverages that can provide additional protection and peace of mind. Here’s a breakdown of the common types:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are injured in an accident caused by a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): This coverage, often called “no-fault” insurance, covers medical expenses and lost wages for you and your passengers, regardless of fault, up to a certain limit.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of fault, even if you are not at fault in the accident.

- Rental Reimbursement Coverage: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance Coverage: This coverage provides assistance for situations such as flat tires, jump starts, and towing.

Ultimate Conclusion

Navigating the complex world of car insurance in Florida can be daunting, but understanding the state’s requirements and available options is essential for every driver. By familiarizing yourself with the minimum liability coverage, the impact of Financial Responsibility Laws, and the factors that influence insurance rates, you can make informed decisions about your car insurance policy. Remember to compare quotes from different insurance providers, carefully review your policy, and know how to file a claim should you need to. With the right knowledge and preparation, you can drive confidently and securely on Florida’s roads.

Answers to Common Questions

What are the minimum liability coverage amounts required by Florida law?

Florida law requires drivers to carry at least $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person and $20,000 per accident.

What are the penalties for driving without car insurance in Florida?

Driving without the minimum required car insurance in Florida can result in fines, license suspension, and even jail time. You may also be required to pay for damages and injuries caused in an accident, even if you were not at fault.

How do I obtain car insurance in Florida?

You can obtain car insurance in Florida by contacting insurance providers directly or using online comparison tools. Be sure to compare quotes from different companies and carefully review the coverage options before making a decision.