Florida State Minimum Car Insurance is a critical requirement for all drivers in the Sunshine State. It ensures that drivers have financial protection in case of an accident, safeguarding themselves and others on the road. Understanding the specific coverage types and financial responsibility limits is essential to comply with Florida law and avoid potential penalties.

This guide delves into the intricacies of Florida’s car insurance regulations, exploring the mandatory coverage types, the no-fault system, and the factors influencing insurance costs. We’ll also discuss additional coverage options and provide tips for finding affordable car insurance in Florida.

Florida’s Minimum Car Insurance Requirements

Driving in Florida requires you to have a minimum level of car insurance, as mandated by the state. This is to ensure that you can cover potential financial liabilities arising from accidents you may be involved in. This article will delve into the specifics of Florida’s minimum car insurance requirements, providing a comprehensive understanding of the coverage types, financial responsibility limits, and the consequences of driving without the necessary insurance.

Mandatory Coverage Types

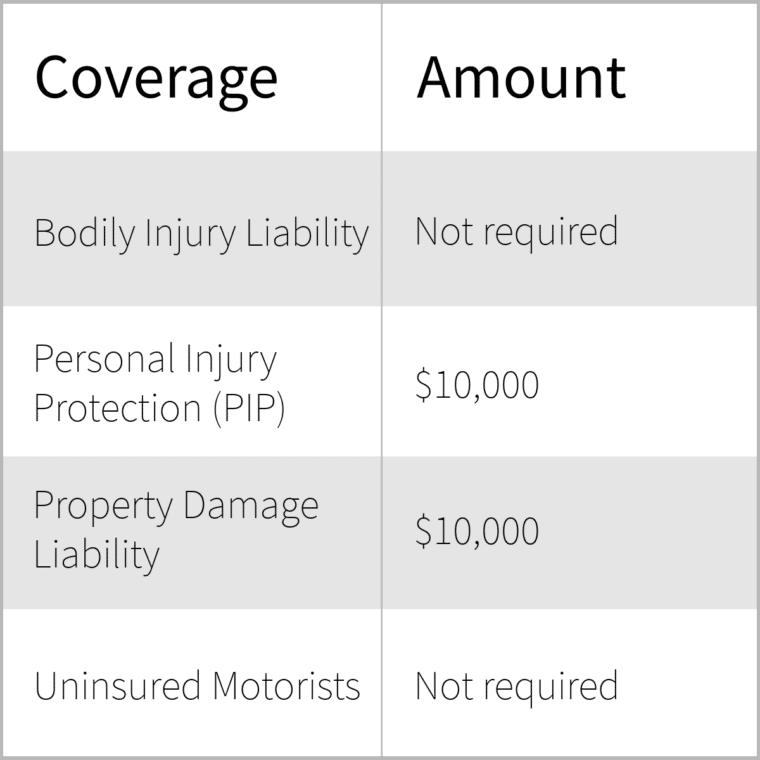

Florida’s minimum car insurance requirements include two main types of coverage: Personal Injury Protection (PIP) and Property Damage Liability (PDL).

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident. It also covers funeral expenses.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s vehicle or property if you are at fault in an accident.

Minimum Financial Responsibility Limits

The minimum financial responsibility limits for each coverage type in Florida are as follows:

| Coverage Type | Minimum Limit |

|---|---|

| Personal Injury Protection (PIP) | $10,000 |

| Property Damage Liability (PDL) | $10,000 |

Consequences of Driving Without Minimum Insurance

Driving without the minimum required insurance in Florida can result in serious consequences. These include:

- Fines and Penalties: You could face hefty fines, license suspension, and even jail time.

- Financial Responsibility: You are fully responsible for all damages and injuries caused in an accident, even if you are not at fault.

- Increased Insurance Premiums: If you eventually get insurance, your premiums will likely be higher than they would have been if you had maintained continuous coverage.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

Understanding Florida’s No-Fault System

Florida operates under a no-fault insurance system, meaning that after an accident, each driver involved is primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system aims to simplify the claims process and reduce the number of lawsuits.

Personal Injury Protection (PIP) Coverage, Florida state minimum car insurance

PIP coverage is a mandatory component of Florida’s no-fault system. It provides coverage for medical expenses and lost wages incurred by the policyholder and their passengers, regardless of who caused the accident. PIP coverage has a limit of $10,000 per person, and it pays 80% of reasonable medical expenses and 60% of lost wages.

- Limitations: PIP coverage has certain limitations. It does not cover all medical expenses, such as those for pain and suffering or lost wages beyond the 60% limit. It also has a deductible, which is typically $250 or $500.

- Choosing PIP Coverage: Florida law allows you to choose a lower PIP coverage limit of $5,000, but this is generally not recommended. Having a higher PIP limit provides better protection in case of serious injuries.

- PIP Coverage and Fault: Even if you are not at fault for an accident, your PIP coverage will still pay for your medical expenses and lost wages. However, if the other driver is at fault, you can file a claim against their liability insurance to recover damages beyond your PIP coverage limits.

Bodily Injury Liability (BI) Coverage

BI coverage is optional in Florida, but it is highly recommended. It protects you financially if you are found liable for causing an accident and injuring another person. BI coverage pays for the other driver’s medical expenses, lost wages, and pain and suffering.

- Minimum Requirements: Florida law requires drivers to carry a minimum of $10,000 per person and $20,000 per accident in BI coverage.

- Underinsured/Uninsured Motorist Coverage (UM/UIM): This coverage is optional in Florida but is essential. It protects you if the other driver is underinsured or uninsured. It pays for your medical expenses, lost wages, and pain and suffering if the other driver’s liability coverage is insufficient or unavailable.

Factors Influencing Florida Car Insurance Costs

Several factors influence the cost of car insurance in Florida, making it crucial to understand how these elements can affect your premiums. By considering these factors, you can make informed decisions to potentially reduce your insurance costs.

Age and Driving Experience

Your age and driving experience are significant factors in determining your car insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher premiums for young drivers. As you gain more driving experience and reach older age brackets, your premiums tend to decrease. Insurance companies often consider you a more experienced and responsible driver with a lower risk profile.

Driving History

Your driving history plays a crucial role in calculating your car insurance rates. A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, if you have a history of accidents, speeding tickets, or DUI convictions, your insurance premiums will likely be higher. Insurance companies view these incidents as indicators of risk and may consider you a higher-risk driver.

Vehicle Type

The type of vehicle you drive significantly influences your car insurance premiums. Some vehicles are considered more expensive to repair or replace, making them more costly to insure. For instance, luxury cars, high-performance vehicles, and sports cars often have higher insurance rates due to their higher repair costs and potential for higher accident severity.

Location

Your location in Florida also impacts your car insurance rates. Areas with higher crime rates, traffic congestion, and a higher frequency of accidents generally have higher insurance premiums. Insurance companies assess the risk associated with different geographic locations and adjust their rates accordingly.

Average Car Insurance Rates in Different Regions of Florida

Florida is a large state with diverse geographic regions, and insurance rates can vary significantly depending on your location. For example, car insurance rates in Miami, a densely populated metropolitan area with high traffic volume, tend to be higher compared to more rural areas like Pensacola or Tallahassee.

Impact of Florida’s High-Risk Insurance Pool

Florida’s high-risk insurance pool, known as the Florida Automobile Joint Underwriting Association (FAJUA), is a safety net for drivers who have been denied coverage by private insurers due to their high-risk profiles. This pool provides insurance to drivers who have a history of accidents, traffic violations, or other factors that make them difficult to insure in the private market. While FAJUA helps ensure access to insurance for high-risk drivers, premiums are generally higher than those offered by private insurers.

Exploring Additional Car Insurance Coverage Options: Florida State Minimum Car Insurance

Florida’s minimum car insurance requirements provide basic protection, but many drivers opt for additional coverage to enhance their financial security in the event of an accident. These optional coverages can help protect you from significant out-of-pocket expenses and ensure you have the necessary resources to repair or replace your vehicle and manage medical bills.

Collision Coverage

Collision coverage reimburses you for damage to your vehicle caused by an accident, regardless of fault. This coverage is essential for drivers who want to ensure they can repair or replace their vehicle if they are involved in a collision, even if they are not at fault.

- Benefits: Collision coverage provides financial protection for repairs or replacement of your vehicle after an accident, even if you are not at fault. It can help you avoid substantial out-of-pocket expenses.

- Drawbacks: Collision coverage can be expensive, especially for newer or high-value vehicles. You will have to pay a deductible before the insurance company covers the remaining costs.

Collision coverage is typically recommended for drivers who have financed or leased their vehicle, as the lender or leasing company may require it.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

- Benefits: Comprehensive coverage provides financial protection for repairs or replacement of your vehicle if it is damaged by events other than collisions. It can help you avoid substantial out-of-pocket expenses.

- Drawbacks: Comprehensive coverage can be expensive, especially for newer or high-value vehicles. You will have to pay a deductible before the insurance company covers the remaining costs.

Comprehensive coverage is typically recommended for drivers who have financed or leased their vehicle, as the lender or leasing company may require it. It can also be beneficial for drivers who live in areas prone to natural disasters or have a high-value vehicle.

Uninsured/Underinsured Motorist (UM/UIM) Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers if you are involved in an accident with a driver who is uninsured or has insufficient insurance to cover your damages.

- Benefits: UM/UIM coverage can help you recover compensation for your injuries and property damage if the other driver is uninsured or underinsured. It can also help you pay for medical bills and lost wages.

- Drawbacks: UM/UIM coverage is not mandatory in Florida, but it is highly recommended. It can be expensive, but it can provide essential financial protection in the event of an accident with an uninsured or underinsured driver.

UM/UIM coverage is especially important in Florida, as the state has a high percentage of uninsured drivers.

Medical Payments Coverage

Medical payments coverage (MedPay) pays for medical expenses for you and your passengers, regardless of fault, in the event of an accident.

- Benefits: MedPay can help you cover medical expenses for injuries sustained in an accident, even if you are not at fault. It can help you avoid out-of-pocket expenses for medical bills.

- Drawbacks: MedPay is not mandatory in Florida, but it can be helpful. It can be expensive, and it may not cover all medical expenses. It is important to note that MedPay is secondary coverage, meaning it only pays for medical expenses after your health insurance has paid its share.

MedPay can be especially helpful for drivers who have a high deductible on their health insurance or have limited health insurance coverage.

Finding Affordable Car Insurance in Florida

Finding affordable car insurance in Florida can be a challenge, but with the right strategies, you can significantly reduce your premiums. This section provides a step-by-step guide to comparing quotes, negotiating lower premiums, and accessing resources for finding affordable car insurance.

Comparing Car Insurance Quotes

Comparing quotes from multiple insurance providers is essential for finding the best rates. This process involves gathering information from various insurers, analyzing their offerings, and choosing the most suitable option. Here’s a step-by-step guide:

- Gather your information: Before you start comparing quotes, gather all the necessary information, including your driver’s license number, vehicle identification number (VIN), and details about your driving history and any accidents or violations. This information will be required by insurance providers to generate accurate quotes.

- Use online comparison tools: Many websites and apps allow you to compare quotes from multiple insurance providers simultaneously. These tools save time and effort by streamlining the comparison process. Popular comparison websites include, but are not limited to, Bankrate, NerdWallet, and Insurify. These platforms provide a comprehensive overview of available options, allowing you to quickly identify the most competitive rates.

- Contact insurance providers directly: While online comparison tools are convenient, contacting insurance providers directly can provide more personalized quotes and allow you to discuss specific needs and preferences. This approach allows you to get a deeper understanding of the coverage options and negotiate better rates.

- Compare quotes carefully: Once you have received quotes from multiple providers, compare them carefully, paying attention to coverage details, deductibles, and premium amounts. Consider factors like your budget, driving history, and the level of coverage you require when making your decision.

Negotiating Lower Premiums

Once you’ve compared quotes, you can negotiate lower premiums by leveraging various strategies. Here are some tips for reducing your car insurance costs:

- Bundle your policies: Many insurance providers offer discounts for bundling multiple policies, such as car and home insurance. By combining your policies, you can often achieve significant savings on your premiums.

- Ask for discounts: Inquire about available discounts, such as good driver discounts, safe driver discounts, and discounts for having safety features in your vehicle. Some insurers may also offer discounts for paying your premiums annually or in full.

- Shop around regularly: Car insurance rates can fluctuate over time, so it’s essential to shop around regularly to ensure you’re getting the best rates. Compare quotes every six months or annually to identify potential savings.

- Consider increasing your deductible: Increasing your deductible can lower your premium, but it means you’ll pay more out of pocket in the event of an accident. Carefully weigh the benefits and drawbacks of increasing your deductible before making a decision.

- Improve your credit score: In some states, including Florida, insurance companies use credit scores as a factor in determining insurance rates. Improving your credit score can potentially lower your premiums.

Resources for Finding Affordable Car Insurance

Several resources can assist you in finding affordable car insurance in Florida. Here are some valuable options:

- Florida Office of Insurance Regulation (OIR): The OIR is the state agency responsible for regulating the insurance industry in Florida. Their website provides information on consumer rights, insurance rates, and complaint resolution processes. You can access valuable resources and guidance on finding affordable car insurance through the OIR website.

- Florida Department of Financial Services (DFS): The DFS offers consumer protection resources and information on insurance-related matters. Their website provides guidance on choosing the right insurance, understanding your policy, and resolving disputes with insurance companies.

- Consumer Reports: Consumer Reports is a non-profit organization that provides independent reviews and ratings of products and services, including car insurance. Their website offers valuable information on insurance companies, coverage options, and tips for finding affordable insurance.

Ending Remarks

Navigating Florida’s car insurance landscape can be complex, but understanding the requirements and available options empowers you to make informed decisions. By adhering to the state’s minimum insurance requirements and considering additional coverage based on your individual needs, you can ensure financial protection while driving in Florida. Remember, staying informed and taking proactive steps to secure affordable car insurance is crucial for peace of mind on the road.

Expert Answers

What happens if I get into an accident without the minimum required car insurance?

Driving without the minimum required car insurance in Florida can result in serious consequences, including fines, license suspension, and even jail time. You may also be held personally liable for any damages or injuries caused in the accident.

Is it possible to get a discount on my car insurance in Florida?

Yes, there are several ways to potentially lower your car insurance premiums in Florida. These include maintaining a clean driving record, taking a defensive driving course, bundling your car insurance with other policies, and choosing a higher deductible.

What are the different types of car insurance coverage available in Florida?

In addition to the minimum required coverage, Florida offers a range of optional coverage types, including collision, comprehensive, uninsured/underinsured motorist (UM/UIM), and medical payments coverage. These additional options can provide enhanced financial protection in various situations.