- Understanding Full Coverage Car Insurance in Florida

- Factors Affecting Full Coverage Car Insurance Costs in Florida

- Choosing the Right Full Coverage Policy in Florida

- Common Exclusions and Limitations of Full Coverage in Florida

- Understanding Florida’s No-Fault Insurance System: Full Coverage Car Insurance Florida

- Tips for Saving Money on Full Coverage Car Insurance in Florida

- Final Thoughts

- Top FAQs

Full coverage car insurance Florida is a comprehensive policy designed to protect you financially in the event of an accident. It offers a range of coverage options, including liability, collision, and comprehensive coverage, providing peace of mind knowing you’re covered for various situations. This guide will delve into the intricacies of full coverage car insurance in Florida, exploring the factors that influence its cost, how to choose the right policy, and tips for saving money.

Understanding full coverage car insurance is crucial for Florida drivers, as the state has a unique no-fault insurance system. This system requires all drivers to have Personal Injury Protection (PIP) coverage, which covers medical expenses regardless of fault. However, full coverage extends beyond PIP, providing broader protection against financial losses resulting from accidents.

Understanding Full Coverage Car Insurance in Florida

Full coverage car insurance in Florida is a comprehensive policy that offers protection against a wide range of risks, providing peace of mind to drivers. This type of policy typically includes several essential coverages that can help safeguard your financial well-being in the event of an accident or other unforeseen circumstances.

Coverage Included in Full Coverage Car Insurance

A full coverage car insurance policy in Florida usually includes the following types of coverage:

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries to others. It is typically divided into two parts: bodily injury liability and property damage liability.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or an object, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, covers your medical expenses, lost wages, and other related costs, regardless of who caused the accident. It is mandatory in Florida.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It helps cover your medical expenses and property damage.

Benefits of Full Coverage Car Insurance in Florida

Having full coverage car insurance in Florida offers several benefits, particularly in situations where you may be liable for significant costs:

- Financial Protection: Full coverage insurance provides financial protection in case of an accident, ensuring you are not burdened with the cost of repairs, medical bills, or legal expenses.

- Peace of Mind: Knowing you have full coverage can provide peace of mind, allowing you to drive with less stress and worry about potential financial risks.

- Protection Against Natural Disasters: Florida is prone to hurricanes and other natural disasters. Comprehensive coverage can help protect your vehicle from damages caused by these events.

- Meeting Loan Requirements: If you have a car loan or lease, your lender may require you to have full coverage insurance to protect their investment.

Factors Affecting Full Coverage Car Insurance Costs in Florida

Understanding the factors that influence the cost of full coverage car insurance in Florida is crucial for drivers seeking to make informed decisions about their insurance coverage. Several key aspects, including demographics, vehicle characteristics, and location, play a significant role in determining insurance premiums.

Demographics

Demographic factors, such as age, driving history, and credit score, significantly influence car insurance premiums. These factors provide insurance companies with insights into a driver’s risk profile.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for young drivers due to their limited driving experience and higher risk of accidents.

- Driving History: A clean driving record with no accidents, traffic violations, or DUI convictions generally leads to lower insurance premiums. Drivers with a history of accidents or violations are considered higher risk and may face higher premiums.

- Credit Score: While the correlation between credit score and driving behavior is not fully understood, insurance companies often use credit scores as a proxy for risk assessment. Drivers with lower credit scores may face higher premiums, as they may be considered less financially responsible.

Vehicle Factors

The type of vehicle you drive also plays a significant role in determining your insurance premiums. Factors such as the make, model, year, and safety features of your car can influence the cost of insurance.

- Make and Model: Certain car makes and models are statistically more likely to be involved in accidents or have higher repair costs. Insurance companies often charge higher premiums for vehicles with a history of accidents or expensive repairs.

- Year: Newer cars often have advanced safety features and are less prone to breakdowns. Insurance companies may offer lower premiums for newer vehicles due to their improved safety and reliability.

- Safety Features: Vehicles equipped with safety features such as anti-lock brakes, airbags, and electronic stability control are generally considered safer and may result in lower insurance premiums.

Location

The location where you live can significantly impact your car insurance premiums. Insurance companies consider factors such as zip code, county, and population density to assess the risk of accidents and theft.

- Zip Code: Areas with higher crime rates, traffic congestion, or a history of accidents may have higher insurance premiums. Insurance companies use zip codes to identify areas with higher risk profiles.

- County: Similar to zip codes, counties with higher accident rates or crime statistics may have higher insurance premiums.

- Population Density: Areas with higher population density often experience more traffic and congestion, increasing the risk of accidents. Insurance companies may charge higher premiums in densely populated areas.

Choosing the Right Full Coverage Policy in Florida

Choosing the right full coverage car insurance policy in Florida can be a daunting task, given the numerous options available and the varying factors influencing costs. However, by understanding your specific needs and comparing different providers, you can find a policy that offers comprehensive protection at a reasonable price.

Comparing Car Insurance Providers in Florida, Full coverage car insurance florida

To make an informed decision, it’s crucial to compare various car insurance providers in Florida. This comparison should encompass factors like full coverage options, premiums, and customer service. The following table provides a snapshot of some prominent car insurance companies in Florida:

| Insurance Provider | Full Coverage Options | Average Premium (Annual) | Customer Service Rating |

|---|---|---|---|

| State Farm | Comprehensive, Collision, Liability, Uninsured Motorist | $1,500 – $2,000 | 4.5/5 |

| Geico | Comprehensive, Collision, Liability, Uninsured Motorist | $1,400 – $1,900 | 4.0/5 |

| Progressive | Comprehensive, Collision, Liability, Uninsured Motorist | $1,300 – $1,800 | 3.5/5 |

| Allstate | Comprehensive, Collision, Liability, Uninsured Motorist | $1,600 – $2,100 | 4.2/5 |

| USAA | Comprehensive, Collision, Liability, Uninsured Motorist | $1,200 – $1,700 | 4.8/5 |

This table provides a general overview of some major insurance providers in Florida. However, it’s essential to note that premiums can vary significantly based on individual factors like driving history, vehicle type, and location.

Obtaining Quotes from Multiple Insurance Companies

Obtaining quotes from multiple insurance companies is crucial to finding the best possible rate. Here’s a step-by-step guide to obtaining quotes:

- Gather your information: Before contacting insurance companies, have your driver’s license, vehicle information (make, model, year), and any relevant details about your driving history readily available.

- Use online comparison tools: Several online platforms like Policygenius, Insurance.com, and NerdWallet allow you to compare quotes from multiple insurance companies simultaneously.

- Contact insurance companies directly: Reach out to insurance companies directly through their websites, phone, or email.

- Provide accurate information: Ensure that the information you provide to each insurance company is accurate and complete to receive a personalized quote.

- Compare quotes carefully: Once you receive quotes from multiple companies, compare them carefully, considering factors like coverage, deductibles, and premium amounts.

Factors to Consider When Choosing a Full Coverage Policy

When selecting a full coverage car insurance policy in Florida, several factors should be considered:

- Your individual needs: Evaluate your driving habits, the value of your vehicle, and your financial situation to determine the level of coverage you require.

- Coverage options: Ensure the policy includes comprehensive and collision coverage, along with liability, uninsured/underinsured motorist coverage, and any other essential benefits.

- Deductibles: Higher deductibles generally result in lower premiums, but you’ll have to pay more out of pocket in case of an accident.

- Premium costs: Compare premiums from different insurance companies and consider factors like discounts and promotions.

- Customer service: Look for an insurance company with a strong reputation for customer service, prompt claim processing, and accessibility.

Common Exclusions and Limitations of Full Coverage in Florida

While full coverage car insurance in Florida offers extensive protection, it’s essential to understand that it doesn’t cover every conceivable eventuality. There are specific exclusions and limitations that can significantly affect the extent of your coverage. Understanding these terms and conditions before purchasing a policy is crucial to ensure you have the appropriate protection for your needs.

Exclusions from Full Coverage

It’s crucial to be aware of situations where full coverage might not provide the protection you expect. Here are some common exclusions:

- Wear and Tear: Full coverage typically doesn’t cover damage caused by normal wear and tear, such as a worn-out tire or a cracked windshield due to age.

- Mechanical Failures: Mechanical breakdowns, such as engine failure or transmission issues, are generally not covered by full coverage. You may need a separate warranty or mechanical breakdown insurance for such events.

- Acts of God: While full coverage may cover damage from natural disasters like hurricanes, it often has limitations or exclusions for specific events. For example, flooding damage may be excluded unless you have additional flood insurance.

- Certain Types of Accidents: Full coverage may not cover accidents caused by intentional acts, such as driving under the influence or racing. Additionally, damage caused by driving without a valid license may be excluded.

- Modifications: Modifications to your vehicle, such as aftermarket parts or custom paint jobs, may not be fully covered. If you’ve made significant modifications, you may need to inform your insurer and obtain additional coverage.

- Uninsured or Underinsured Motorists: Full coverage doesn’t cover damage caused by an uninsured or underinsured motorist. You’ll need to purchase separate uninsured/underinsured motorist (UM/UIM) coverage for protection in such situations.

Limitations of Full Coverage

Full coverage also has limitations that can affect your coverage:

- Deductibles: You’ll need to pay a deductible for each claim you file under full coverage. This amount varies depending on your policy.

- Coverage Limits: Full coverage has limits on the amount of compensation you can receive for a covered event. These limits are specified in your policy and can affect the amount of reimbursement you receive if your vehicle is totaled or requires extensive repairs.

- Rental Car Coverage: Full coverage may include rental car coverage, but this often has limitations. For example, there may be a daily limit on the rental car reimbursement, or it might only apply for a specific period.

Understanding Florida’s No-Fault Insurance System: Full Coverage Car Insurance Florida

Florida operates under a unique no-fault insurance system, which significantly impacts how car insurance claims are handled. Unlike traditional fault-based systems, Florida’s no-fault system focuses on covering the insured’s own losses, regardless of who caused the accident. This system has implications for both accident claims and coverage.

Personal Injury Protection (PIP)

Florida’s no-fault system revolves around Personal Injury Protection (PIP), a mandatory coverage that pays for medical expenses and lost wages following an accident, regardless of fault. PIP coverage is a crucial component of Florida’s insurance system, providing immediate financial assistance to accident victims.

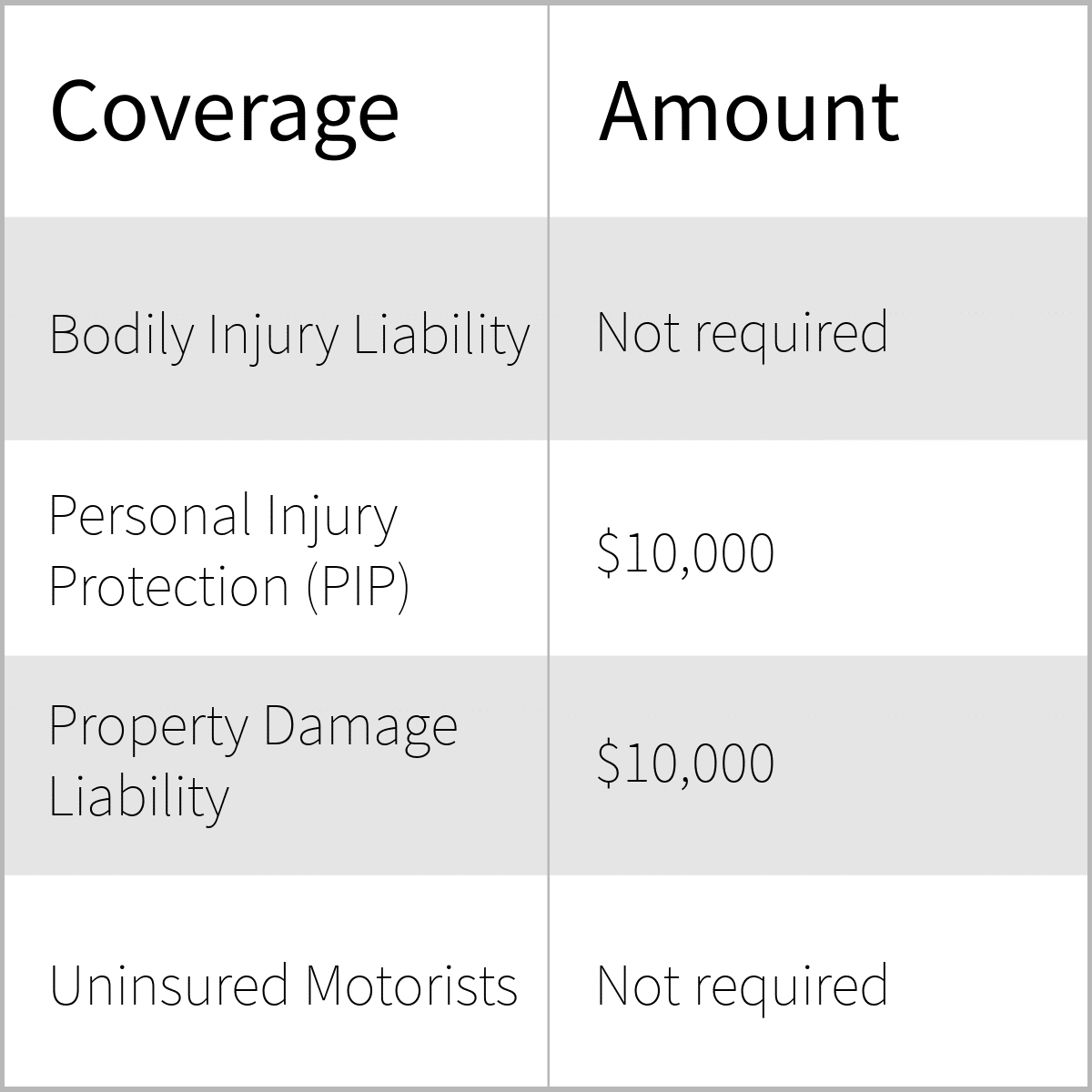

PIP coverage provides benefits for medical expenses, lost wages, and other related expenses incurred due to an accident. The coverage is capped at $10,000, and the insured has the option to choose a lower limit.

Florida’s no-fault system requires all drivers to have PIP coverage.

Implications of the No-Fault System on Accident Claims

Florida’s no-fault system simplifies the claims process by eliminating the need to determine fault immediately after an accident. This allows for quicker payment of medical expenses and lost wages, as the focus is on the insured’s own recovery.

However, this system also has some limitations. While PIP covers the insured’s own losses, it does not cover damages to the vehicle, unless the driver is at fault. In case of a serious injury or significant property damage, the insured may need to pursue a separate claim against the at-fault driver.

The no-fault system streamlines the claims process for the insured, but it does not necessarily eliminate the need for fault determination in certain cases.

Tips for Saving Money on Full Coverage Car Insurance in Florida

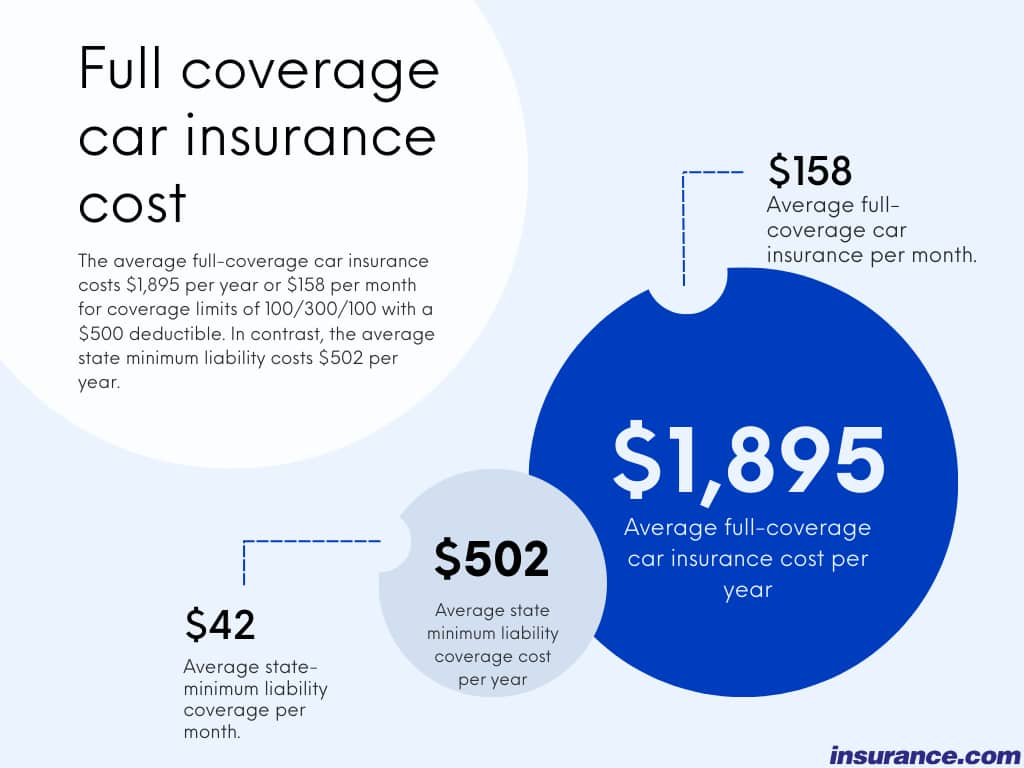

Full coverage car insurance in Florida can be expensive, but there are several strategies you can employ to lower your premiums. By understanding these strategies and implementing them, you can significantly reduce your insurance costs without compromising the essential coverage you need.

Increasing Deductibles

Raising your deductible is one of the most direct ways to reduce your premium. Your deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible means you’ll pay more in the event of an accident, but it also means you’ll pay less in premiums.

For example, if you have a $500 deductible and you’re in an accident that costs $5,000 to repair, you’ll pay $500 and your insurance company will pay the remaining $4,500. If you increase your deductible to $1,000, you’ll pay $1,000, but your premium will be lower.

Exploring Discounts

Insurance companies offer a variety of discounts to help policyholders save money. Some common discounts include:

- Good driver discount: This discount is awarded to drivers with a clean driving record.

- Safe driver discount: This discount is given to drivers who have completed a defensive driving course.

- Multi-car discount: If you insure multiple vehicles with the same company, you may qualify for a discount.

- Multi-policy discount: You may be eligible for a discount if you bundle your car insurance with other types of insurance, such as homeowners or renters insurance.

- Good student discount: This discount is often available to students with good grades.

- Anti-theft device discount: If your car has anti-theft devices, you may be eligible for a discount.

- Loyalty discount: Some companies offer discounts to customers who have been with them for a certain amount of time.

Maintaining a Good Driving Record

Your driving record is a major factor in determining your car insurance premium. Maintaining a clean driving record can help you save money on your insurance. This means avoiding traffic violations, accidents, and other driving infractions.

- Drive safely: This includes following traffic laws, being aware of your surroundings, and avoiding distractions.

- Take defensive driving courses: These courses can help you learn how to avoid accidents and improve your driving skills.

- Avoid speeding tickets: Speeding tickets can significantly increase your insurance premium.

- Be mindful of your driving habits: Avoid aggressive driving, such as tailgating or weaving in and out of traffic.

Improving Credit Score

In Florida, insurance companies can use your credit score to determine your car insurance premium. This practice is legal in many states, and insurance companies argue that credit score is a good predictor of risk. Improving your credit score can help you get a lower premium.

- Pay your bills on time: This is the most important factor in building a good credit score.

- Keep your credit utilization low: This means using only a small portion of your available credit.

- Don’t apply for too much credit: Too many inquiries on your credit report can lower your score.

- Check your credit report for errors: Errors on your credit report can lower your score.

Final Thoughts

Securing full coverage car insurance in Florida is an essential step in protecting yourself and your finances. By understanding the different types of coverage, factors affecting costs, and tips for saving money, you can make an informed decision and find a policy that meets your specific needs. Remember to carefully review the terms and conditions of any policy before purchasing, ensuring you are fully aware of the exclusions and limitations.

Top FAQs

What is the difference between full coverage and liability-only car insurance in Florida?

Full coverage car insurance in Florida includes liability, collision, and comprehensive coverage, providing broader protection against financial losses resulting from accidents. Liability-only insurance covers damages to other vehicles or property but does not cover damage to your own vehicle.

Is full coverage car insurance mandatory in Florida?

While full coverage car insurance is not mandatory in Florida, most lenders require it as a condition for financing a vehicle. It is generally advisable to have full coverage, especially if you have a newer car or a loan outstanding.

How can I get a discount on my full coverage car insurance in Florida?

There are various ways to get discounts on your full coverage car insurance in Florida, such as maintaining a good driving record, bundling insurance policies, taking a defensive driving course, and installing safety features in your vehicle.