GEICO car insurance Florida phone number is your direct line to the insurance provider, offering a convenient way to connect with their customer service team. Whether you need to get a quote, file a claim, or simply have a question about your policy, having this number readily available can save you time and hassle.

Understanding the different ways to contact GEICO in Florida, including their dedicated phone line, email address, and online chat options, ensures you can reach them through your preferred method.

Understanding GEICO Car Insurance in Florida: Geico Car Insurance Florida Phone Number

GEICO, a well-known insurance provider, offers a variety of car insurance options tailored to the specific needs of Florida residents. This guide will provide a comprehensive overview of GEICO car insurance in Florida, covering its features, benefits, and key factors that influence premium costs.

Types of Car Insurance Offered by GEICO in Florida

GEICO offers a range of car insurance coverages to cater to different requirements and budgets. These coverages include:

- Liability Coverage: This is the most basic type of car insurance and is required by law in Florida. It covers damages to other people’s property and injuries caused by an accident if you are at fault.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or falling objects.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault, in case of an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your losses.

- Rental Reimbursement Coverage: This coverage helps cover the cost of a rental car if your vehicle is damaged and unable to be driven.

- Roadside Assistance: This coverage provides assistance in case of a flat tire, dead battery, or other roadside emergencies.

Benefits of Choosing GEICO Car Insurance in Florida

Choosing GEICO car insurance in Florida can offer several advantages:

- Competitive Prices: GEICO is known for its competitive pricing, often offering lower premiums compared to other insurers. This is attributed to their efficient operations and direct-to-consumer business model.

- Excellent Customer Service: GEICO has a reputation for providing excellent customer service, with readily available agents and responsive online support channels. This ensures a smooth and hassle-free experience for policyholders.

- Wide Range of Coverage Options: GEICO offers a comprehensive suite of car insurance coverages, allowing you to customize your policy to meet your specific needs and budget. This flexibility ensures you have the right level of protection for your situation.

- Convenient Online and Mobile Access: GEICO provides easy online and mobile access to manage your policy, including making payments, filing claims, and accessing policy information. This convenience makes it easy to handle your insurance needs on the go.

- Discounts and Rewards: GEICO offers various discounts and rewards programs to help policyholders save money. These include discounts for good driving records, multiple policy bundling, and safe driving programs.

Factors Influencing Car Insurance Premiums in Florida

Several factors determine the cost of car insurance premiums in Florida, including:

- Driving History: Your driving record, including accidents, violations, and driving history, significantly impacts your premium. A clean driving record generally results in lower premiums.

- Vehicle Type and Age: The type and age of your vehicle influence the premium. Newer and more expensive vehicles generally have higher premiums due to their higher repair costs.

- Location: Your location in Florida impacts your premium, as certain areas have higher accident rates and claim frequencies. This leads to higher premiums for drivers in those regions.

- Coverage Levels: The level of coverage you choose directly affects your premium. Higher coverage levels, such as comprehensive and collision coverage, typically result in higher premiums.

- Credit Score: In Florida, insurance companies may consider your credit score when determining your premium. A good credit score generally translates to lower premiums.

- Age and Gender: Your age and gender can also play a role in your premium. Younger drivers and males often have higher premiums due to higher risk factors.

Coverage Options Available with GEICO Car Insurance in Florida

GEICO offers various coverage options that can be tailored to your specific needs and budget. These options include:

- Liability Coverage: This coverage is required by law in Florida and provides financial protection if you are at fault in an accident. It covers damages to other people’s property and injuries they sustain.

Florida law requires a minimum liability coverage of $10,000 for property damage and $10,000 per person/$20,000 per accident for bodily injury.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. It is typically optional, but it is often recommended for newer or more expensive vehicles.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or falling objects. It is optional but can be valuable for protecting your investment in your vehicle.

- Personal Injury Protection (PIP): This coverage is mandatory in Florida and pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault, in case of an accident.

Florida law requires a minimum PIP coverage of $10,000.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your losses. It is optional but can be crucial for protecting yourself financially in such situations.

- Rental Reimbursement Coverage: This coverage helps cover the cost of a rental car if your vehicle is damaged and unable to be driven. It can be particularly helpful if you rely on your vehicle for daily commutes or work.

- Roadside Assistance: This coverage provides assistance in case of a flat tire, dead battery, or other roadside emergencies. It can be a valuable addition to your policy, especially if you frequently drive long distances or in remote areas.

Contacting GEICO in Florida

Reaching out to GEICO in Florida is crucial for various reasons, from policy inquiries to claims reporting. This section provides detailed information on the various ways to contact GEICO in Florida, ensuring you can access the assistance you need efficiently.

GEICO Phone Number for Florida

GEICO’s official customer service phone number for Florida is 1-800-432-4224. This number can be used for a wide range of inquiries, including policy changes, billing issues, and claims reporting.

Contacting GEICO in Florida

| Method | Details |

|---|---|

| Phone | 1-800-432-4224 (General customer service) |

| customerservice@geico.com (For general inquiries) | |

| Online Chat | Available on the GEICO website (For quick questions and assistance) |

Situations for Direct Contact with GEICO

- Policy Changes: When making changes to your policy, such as adding a driver, vehicle, or coverage, direct contact with GEICO is recommended to ensure accuracy and proper documentation.

- Claims Reporting: If you need to report an accident or other insured event, contacting GEICO directly allows for immediate assistance and initiation of the claims process.

- Billing Inquiries: For questions about your premium, payment methods, or billing cycle, reaching out to GEICO directly provides personalized support and clarification.

- Technical Issues: If you experience difficulties with the GEICO website or mobile app, contacting customer service can help resolve technical problems and ensure smooth access to your policy information.

Getting a Quote and Policy Information

Obtaining a car insurance quote from GEICO in Florida is a straightforward process. You can request a quote online, over the phone, or through a GEICO agent. Whether you’re seeking coverage for a new car or want to compare rates for your existing vehicle, GEICO offers various options to suit your needs.

Requesting a Quote

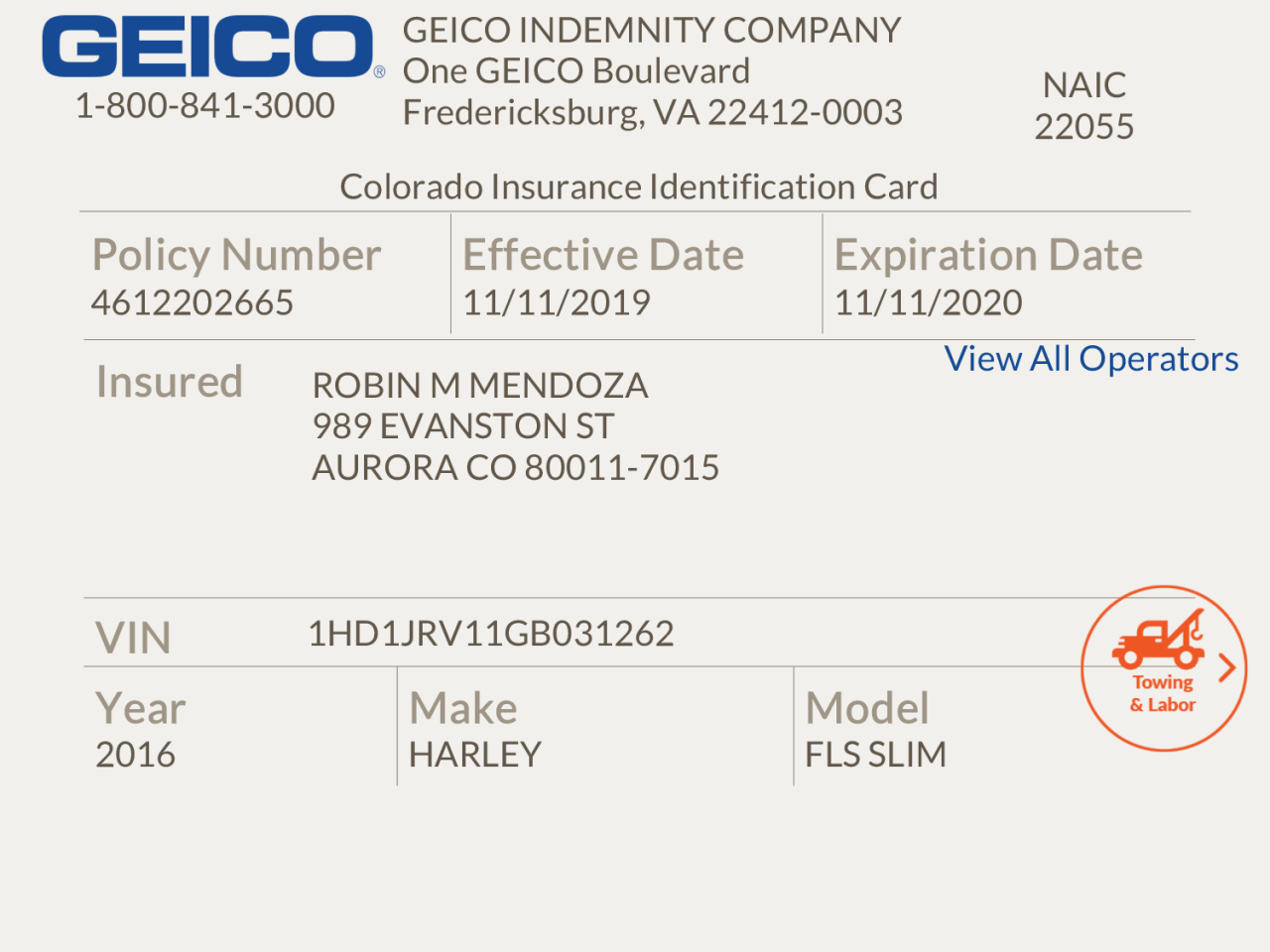

To get a quote, you’ll need to provide basic information about yourself and your vehicle. This includes your name, address, date of birth, driving history, and details about your car, such as its make, model, year, and mileage. You may also be asked about your driving habits, such as how many miles you drive annually and where you park your car overnight.

- Online Quote: GEICO’s website provides a convenient online quote tool. Simply enter your information, and the system will generate a personalized quote within minutes. This allows you to compare different coverage options and choose the one that best suits your needs.

- Phone Quote: You can also get a quote by calling GEICO’s customer service number. A representative will guide you through the process and answer any questions you may have.

- Agent Quote: If you prefer to speak with an agent in person, you can visit a local GEICO office or schedule an appointment with an agent who can provide you with a personalized quote.

Accessing and Managing Policy Information

GEICO provides convenient online access to your policy information through its website or mobile app.

- Online Account: You can create an online account to access your policy details, including coverage information, payment history, and claims information. You can also make changes to your policy, such as adding or removing drivers or vehicles, and update your contact information.

- Mobile App: GEICO’s mobile app allows you to manage your policy on the go. You can access your policy information, make payments, report claims, and contact customer support directly from your smartphone.

Payment Methods

GEICO accepts various payment methods for your car insurance premiums in Florida.

- Online Payment: You can make payments online through your GEICO account using a credit card, debit card, or bank account.

- Phone Payment: You can also make payments over the phone by calling GEICO’s customer service number.

- Mail Payment: You can send a check or money order to GEICO’s designated mailing address. However, ensure to include your policy number and contact information for proper processing.

- Automatic Payment: You can set up automatic payments to ensure your premiums are paid on time. This option allows you to schedule regular payments from your bank account or credit card.

Claims and Assistance

GEICO provides a comprehensive claims process to help Florida policyholders navigate the complexities of car insurance claims. The company aims to make the process as straightforward and efficient as possible, offering various resources and support to ensure a smooth experience.

Filing a Car Insurance Claim with GEICO in Florida

Filing a car insurance claim with GEICO in Florida is a relatively simple process. Here’s what you need to do:

- Report the accident to GEICO as soon as possible. You can report the accident online, over the phone, or through the GEICO mobile app. Be sure to provide all the necessary details, including the date, time, and location of the accident, as well as the names and contact information of any other parties involved.

- Gather evidence. Take photos or videos of the damage to your vehicle, the accident scene, and any injuries. If possible, get contact information from witnesses.

- File a claim with GEICO. You can file a claim online, over the phone, or through the GEICO mobile app. You will need to provide the claim number and other relevant information.

- Provide supporting documentation. This may include the police report, photos or videos of the damage, medical bills, and other relevant documents.

- Cooperate with GEICO’s investigation. GEICO will investigate the claim to determine the cause of the accident and the extent of the damage. You may be asked to provide additional information or documentation.

- Receive payment for your claim. Once GEICO has completed its investigation, you will receive payment for your claim. The payment may be made directly to you or to your repair shop.

Available Resources for Assistance with Car Insurance Claims

GEICO offers several resources to assist Florida policyholders with car insurance claims:

- 24/7 claims service. You can report an accident and file a claim at any time, day or night.

- Online claims portal. You can track the status of your claim, submit documents, and communicate with GEICO online.

- Mobile app. The GEICO mobile app allows you to report accidents, file claims, track the status of your claim, and access other helpful features.

- Claims specialists. GEICO has a team of claims specialists who are available to answer your questions and provide guidance throughout the claims process.

- Repair shop network. GEICO has a network of repair shops that are certified to repair vehicles to factory specifications.

Reporting an Accident to GEICO in Florida, Geico car insurance florida phone number

Reporting an accident to GEICO in Florida is essential for starting the claims process. You can report an accident using the following methods:

- Phone: Call GEICO’s 24/7 claims line at 1-800-432-4444.

- Online: Visit GEICO’s website and submit an accident report online.

- Mobile app: Use the GEICO mobile app to report an accident.

When reporting an accident, be prepared to provide the following information:

- Your policy number

- The date, time, and location of the accident

- The names and contact information of any other parties involved

- A description of the accident

- The extent of the damage to your vehicle

- Any injuries sustained

It is important to report the accident to GEICO as soon as possible to ensure that your claim is processed promptly and efficiently.

Ending Remarks

By familiarizing yourself with the GEICO car insurance Florida phone number and other contact methods, you can easily connect with their team whenever you need. Whether you’re seeking a quote, navigating a claim, or simply have a general inquiry, GEICO’s dedicated customer service ensures a smooth and efficient experience.

Clarifying Questions

What are the benefits of choosing GEICO car insurance in Florida?

GEICO offers competitive rates, a wide range of coverage options, and excellent customer service, making it a popular choice for Florida drivers. They also have a strong reputation for handling claims efficiently and fairly.

How can I file a claim with GEICO in Florida?

You can file a claim online, through their mobile app, or by calling their customer service line. Make sure to have your policy information readily available.

What payment methods does GEICO accept in Florida?

GEICO accepts various payment methods, including credit cards, debit cards, and electronic checks. You can also set up automatic payments to ensure your premiums are paid on time.