- GEICO Car Insurance in Florida

- Getting a Car Insurance Quote from GEICO in Florida

- Benefits and Features of GEICO Car Insurance in Florida: Geico Car Insurance Quote Florida

- Florida-Specific Considerations for Car Insurance

- GEICO’s Digital Presence in Florida

- Ending Remarks

- Frequently Asked Questions

GEICO car insurance quote Florida – discover how this well-known insurance company can help you find affordable coverage for your vehicle in the Sunshine State. With a reputation for competitive rates and reliable service, GEICO has become a popular choice for Floridian drivers seeking auto insurance. Understanding your options and exploring the factors that influence your premium can help you make an informed decision about your car insurance.

Whether you’re a new driver or a seasoned veteran on the road, finding the right car insurance policy can feel like a daunting task. But, it doesn’t have to be. GEICO offers a variety of coverage options to fit your needs and budget, from basic liability coverage to comprehensive and collision protection. This guide will help you navigate the process of obtaining a quote, explore the factors that influence your rate, and discover the benefits of choosing GEICO in Florida.

GEICO Car Insurance in Florida

GEICO, a leading car insurance provider in the United States, has a strong presence in Florida. The company has been operating in the state for decades and has established itself as a reliable and affordable insurance option for Florida drivers.

History of GEICO in Florida

GEICO’s history in Florida dates back to the 1950s, when the company began offering insurance to military personnel stationed in the state. GEICO’s focus on offering competitive rates and excellent customer service helped it gain traction in the Florida market. Over the years, GEICO has continued to expand its presence in Florida, opening numerous offices and establishing a network of agents throughout the state.

Types of Car Insurance Coverage

GEICO offers a comprehensive range of car insurance coverage options in Florida, designed to meet the diverse needs of drivers. These options include:

- Liability Coverage: This coverage is mandatory in Florida and protects drivers against financial losses if they are found liable for an accident. It covers damages to other vehicles and injuries to other people involved in the accident.

- Personal Injury Protection (PIP): This coverage, also mandatory in Florida, provides medical benefits to the insured driver and passengers, regardless of who is at fault in an accident.

- Collision Coverage: This coverage helps pay for repairs or replacement of the insured vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects the insured vehicle from damage caused by events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if the insured driver is involved in an accident with a driver who is uninsured or underinsured.

- Rental Reimbursement: This coverage provides financial assistance to cover the cost of a rental car while the insured vehicle is being repaired.

- Roadside Assistance: This coverage provides assistance in case of a breakdown, flat tire, or other roadside emergencies.

Customer Service Policies and Procedures

GEICO is committed to providing exceptional customer service to its policyholders in Florida. The company offers various ways for customers to contact them, including:

- Phone: Customers can call GEICO’s toll-free number 24/7 to get assistance with their policies, file claims, or ask general questions.

- Website: GEICO’s website provides a wealth of information about its products and services, including policy details, claim filing instructions, and FAQs. Customers can also manage their policies online, make payments, and access their account information.

- Mobile App: GEICO’s mobile app allows customers to access their policies, file claims, get roadside assistance, and more, all from their smartphones.

- Local Agents: GEICO has a network of local agents throughout Florida who can provide personalized assistance and answer any questions customers may have.

Getting a Car Insurance Quote from GEICO in Florida

Getting a car insurance quote from GEICO in Florida is a straightforward process. You can obtain a quote online, over the phone, or by visiting a local GEICO office.

Obtaining a Car Insurance Quote

To get a car insurance quote from GEICO in Florida, you’ll need to provide some basic information about yourself and your vehicle. This information includes:

- Your name, address, and date of birth

- Your driving history, including any accidents or violations

- Your vehicle’s make, model, year, and VIN

- Your desired coverage levels

Once you’ve provided this information, GEICO will generate a personalized car insurance quote for you.

Factors Affecting Car Insurance Rates in Florida

Several factors influence car insurance rates in Florida. These include:

- Vehicle type: The make, model, and year of your vehicle can affect your insurance rate. Luxury or high-performance vehicles are generally more expensive to insure than basic models.

- Driving history: Your driving record, including accidents, violations, and driving history, plays a significant role in determining your car insurance rate. A clean driving record will generally result in lower premiums.

- Age: Younger drivers are statistically more likely to be involved in accidents, which can lead to higher insurance rates. Older drivers often enjoy lower rates as they tend to have more experience and a better driving record.

- Location: Car insurance rates can vary based on your location. Areas with higher crime rates or more traffic congestion may have higher insurance rates.

- Credit score: In some states, including Florida, insurance companies may use your credit score to determine your car insurance rate. A higher credit score generally leads to lower premiums.

- Coverage levels: The amount of coverage you choose will affect your insurance rate. Higher coverage levels generally result in higher premiums.

Tips for Getting the Best Car Insurance Quote

Here are some tips for getting the best possible car insurance quote from GEICO in Florida:

- Compare quotes from multiple insurers: Don’t settle for the first quote you get. Compare quotes from several different insurance companies to ensure you’re getting the best rate.

- Negotiate your rate: Once you’ve received a quote from GEICO, don’t be afraid to negotiate. Ask about discounts and see if there’s any room for flexibility.

- Improve your driving record: A clean driving record can significantly reduce your insurance premiums. Avoid speeding tickets, accidents, and other violations.

- Consider increasing your deductible: Increasing your deductible can lower your premium. However, be sure you can afford to pay the deductible if you have to file a claim.

- Bundle your insurance: If you have other insurance policies, such as homeowners or renters insurance, consider bundling them with your car insurance. You may be eligible for a discount.

Benefits and Features of GEICO Car Insurance in Florida: Geico Car Insurance Quote Florida

GEICO, a leading national insurance provider, offers a range of car insurance products and services tailored to the specific needs of Florida drivers. This includes various discounts, coverage options, and customer service features designed to enhance the insurance experience.

Discounts

GEICO offers a variety of discounts to help Florida drivers save money on their car insurance premiums. These discounts can be applied to different aspects of the policy, including:

- Good Driver Discount: This discount is available to drivers with a clean driving record, demonstrating responsible driving habits.

- Multi-Car Discount: Drivers insuring multiple vehicles with GEICO can benefit from this discount, reflecting the reduced risk associated with insuring multiple cars.

- Multi-Policy Discount: Combining car insurance with other insurance products like homeowners or renters insurance can result in a multi-policy discount.

- Defensive Driving Course Discount: Completing a defensive driving course can qualify drivers for a discount, highlighting their commitment to safe driving practices.

- Military Discount: Active duty military personnel and veterans may be eligible for a military discount, recognizing their service and contributions.

Coverage Options

GEICO offers a comprehensive selection of coverage options to meet the diverse needs of Florida drivers. These coverage options provide financial protection against various risks associated with car ownership:

- Liability Coverage: This coverage protects drivers from financial responsibility for damages or injuries caused to others in an accident. It covers bodily injury liability and property damage liability.

- Collision Coverage: Collision coverage pays for repairs or replacement of the insured vehicle if it is involved in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects against damages to the insured vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP): PIP coverage covers medical expenses, lost wages, and other related expenses for the insured driver and passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects drivers from financial losses caused by accidents involving uninsured or underinsured drivers.

Customer Service

GEICO prioritizes customer service and provides multiple channels for customers to access support and information:

- 24/7 Customer Service: GEICO offers round-the-clock customer service through phone, email, and online chat, ensuring immediate assistance whenever needed.

- Online Account Management: Customers can manage their policies, make payments, and access other services conveniently through GEICO’s user-friendly online portal.

- Mobile App: The GEICO mobile app provides a convenient platform for managing policies, filing claims, and accessing other services on the go.

Filing a Claim

GEICO streamlines the claims process for Florida drivers, making it efficient and convenient. To file a claim, drivers need to provide the following information:

- Policy Information: Policy number, insured’s name, and contact information.

- Accident Details: Date, time, location, and description of the accident.

- Vehicle Information: Year, make, model, and VIN of the involved vehicles.

- Driver Information: Names, contact information, and driver’s license numbers of all involved drivers.

- Witness Information: Names and contact information of any witnesses to the accident.

- Police Report: If a police report was filed, the report number and a copy of the report.

- Photos and Videos: Photos or videos of the accident scene and damaged vehicles.

Once the claim is filed, GEICO will investigate the accident and assess the damages. The claims process typically involves:

- Initial Claim Assessment: GEICO reviews the submitted information and determines the validity of the claim.

- Damage Inspection: GEICO may arrange for an independent inspection of the damaged vehicles to assess the extent of repairs.

- Claim Settlement: Based on the investigation and assessment, GEICO will determine the amount of coverage payable for the claim.

Advantages and Disadvantages

GEICO car insurance in Florida offers several advantages over other insurance providers, including:

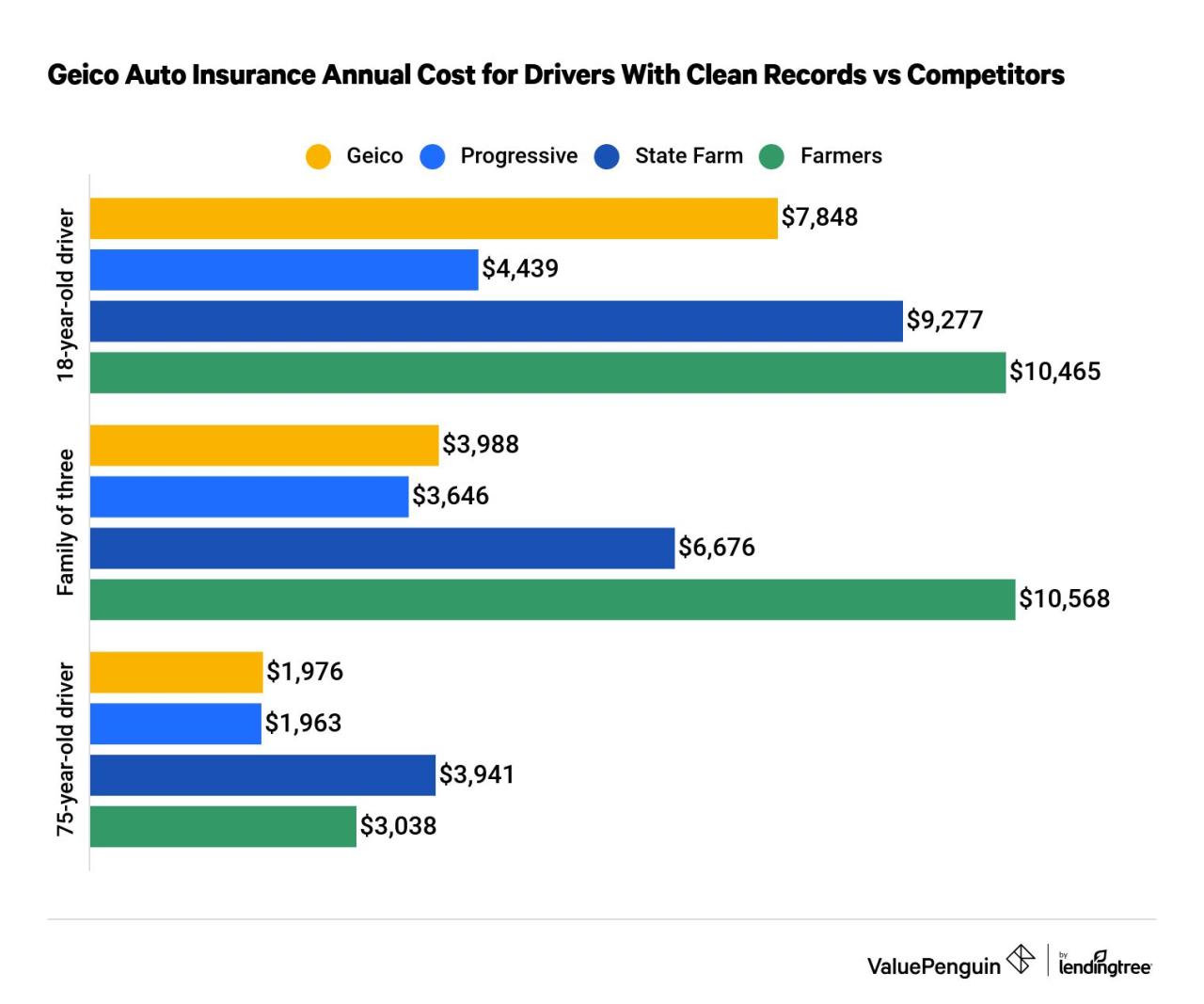

- Competitive Pricing: GEICO is known for its competitive rates, making it a cost-effective option for Florida drivers.

- Wide Coverage Options: GEICO offers a comprehensive range of coverage options to meet the diverse needs of Florida drivers.

- Excellent Customer Service: GEICO prioritizes customer service and provides multiple channels for accessing support and information.

- User-Friendly Online Platform: GEICO’s online portal and mobile app provide convenient tools for managing policies and filing claims.

However, GEICO also has some disadvantages:

- Limited Availability: GEICO may not be available in all areas of Florida, limiting its accessibility to some drivers.

- Higher Deductibles: GEICO may offer higher deductibles compared to some other insurance providers, which can increase out-of-pocket expenses in case of an accident.

- Potential for Higher Premiums: While GEICO is generally known for competitive rates, premiums can vary based on individual factors, and some drivers may find their rates higher than other providers.

Florida-Specific Considerations for Car Insurance

Florida has a unique set of regulations and challenges that impact car insurance costs and coverage. Understanding these specific considerations is crucial for Florida residents to find the right insurance policy.

Florida’s No-Fault Insurance Law

Florida operates under a no-fault insurance system, meaning drivers are primarily responsible for covering their own medical expenses after an accident, regardless of who is at fault. This system is designed to reduce litigation and expedite claims processing.

Common Risks and Challenges for Drivers in Florida

Florida’s climate and geography pose specific risks to drivers, influencing insurance premiums and coverage needs.

- Hurricanes and Tropical Storms: Florida is highly susceptible to hurricanes and tropical storms, which can cause significant damage to vehicles. Comprehensive coverage is essential to protect against damage caused by these natural disasters.

- Flooding: Flooding is another common risk in Florida, especially during hurricane season and heavy rainfall. Flood insurance is a separate policy from standard car insurance and is highly recommended for drivers in flood-prone areas.

- Traffic Congestion: Florida’s population density and tourism contribute to heavy traffic congestion, increasing the risk of accidents. This, in turn, can lead to higher insurance premiums due to increased claims frequency.

Florida Department of Motor Vehicles (DMV) and Car Insurance Regulations

The Florida Department of Motor Vehicles (DMV) plays a significant role in regulating car insurance in the state.

- Minimum Insurance Requirements: The DMV sets minimum insurance requirements for all drivers in Florida. These requirements include bodily injury liability, property damage liability, and personal injury protection (PIP).

- Financial Responsibility Law: Florida’s financial responsibility law mandates that drivers must provide proof of financial responsibility, typically through car insurance, to legally operate a vehicle.

- Enforcement and Oversight: The DMV enforces insurance regulations and oversees insurance companies operating within the state, ensuring compliance with state laws and consumer protection standards.

GEICO’s Digital Presence in Florida

GEICO, a leading car insurance provider in Florida, has a strong digital presence that caters to the needs of its customers. The company leverages its website, mobile app, and social media platforms to provide a seamless and convenient insurance experience.

GEICO’s Website and Mobile App, Geico car insurance quote florida

GEICO’s website and mobile app are designed to provide users with a comprehensive and user-friendly experience. The website, accessible at geico.com, allows users to obtain quotes, manage their policies, file claims, and access other essential services. The mobile app, available for both Android and iOS devices, offers similar features and functionalities, providing users with the convenience of managing their insurance needs on the go.

The GEICO website and mobile app are designed to be user-friendly and intuitive. They offer a variety of features, including:

- Online quoting: Users can obtain quotes for car insurance in minutes, providing them with an instant understanding of their potential coverage options and costs.

- Policy management: Users can manage their existing policies, make payments, view their policy details, and access their insurance cards online.

- Claim filing: Users can file claims online or through the mobile app, streamlining the claims process and reducing the hassle of traditional methods.

- 24/7 customer support: Users can access customer support through the website or mobile app, providing them with immediate assistance for any queries or concerns.

- Personalized recommendations: The website and mobile app utilize user data to provide personalized recommendations for coverage options and discounts, ensuring users receive the most relevant and valuable information.

GEICO’s Social Media Presence

GEICO actively engages with its customers on social media platforms like Facebook and Twitter. The company utilizes these platforms to share updates, promotions, and important information about its services. It also uses social media to respond to customer queries and address concerns, fostering a sense of community and transparency.

GEICO’s social media presence in Florida allows the company to:

- Connect with customers: GEICO uses social media to engage with its customers, respond to their queries, and address their concerns, building a stronger relationship with them.

- Promote its services: GEICO utilizes social media to promote its car insurance products and services, reaching a wider audience and generating interest in its offerings.

- Share updates and information: GEICO keeps its customers informed about important updates, new features, and industry trends through social media posts and updates.

- Build brand awareness: GEICO’s social media presence helps to build brand awareness and establish a positive image among potential customers in Florida.

GEICO’s Online Reviews and Customer Feedback

GEICO receives a significant amount of online reviews and customer feedback across various platforms, including Google, Yelp, and Trustpilot. These reviews provide valuable insights into customer satisfaction with GEICO’s services and products.

GEICO’s online reviews and customer feedback reveal several common themes and trends, including:

- Positive customer experiences: Many customers express positive experiences with GEICO, highlighting its competitive pricing, excellent customer service, and efficient claims handling process.

- Digital convenience: Customers appreciate the ease of use and convenience offered by GEICO’s website and mobile app, particularly for obtaining quotes, managing policies, and filing claims.

- Prompt and responsive customer support: Customers often praise GEICO’s customer support team for their prompt responses and helpful assistance in resolving any issues or concerns.

- Areas for improvement: Some customers suggest areas for improvement, such as simplifying the policy language or enhancing the mobile app’s functionality.

Ending Remarks

GEICO car insurance quote Florida can provide you with a comprehensive understanding of your coverage options and help you make an informed decision about your auto insurance. By considering the factors that influence your rate, taking advantage of discounts, and comparing quotes from multiple insurers, you can secure the best possible coverage at a price that fits your budget. Remember, protecting yourself and your vehicle on the road is crucial, and GEICO is here to help you navigate the process with confidence and ease.

Frequently Asked Questions

What are the minimum car insurance requirements in Florida?

Florida requires drivers to have at least $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL) coverage, and $10,000 in Bodily Injury Liability (BIL) coverage per person and $20,000 per accident.

Does GEICO offer discounts in Florida?

Yes, GEICO offers a variety of discounts in Florida, including discounts for good drivers, safe drivers, multiple car policies, and more.

How do I file a claim with GEICO in Florida?

You can file a claim with GEICO online, over the phone, or by visiting a local GEICO office. You will need to provide information about the accident, including the date, time, and location, as well as the names and contact information of all parties involved.