Health care insurance Florida is a critical aspect of life in the Sunshine State, offering residents a wide range of options to navigate the complex healthcare system. From understanding the different types of plans available to choosing the right coverage for your individual needs, this guide provides a comprehensive overview of the Florida health insurance landscape.

Florida’s unique demographics and healthcare needs influence the insurance market, with high healthcare costs and limited provider networks posing challenges for many residents. The Affordable Care Act (ACA) has significantly impacted healthcare access and affordability in Florida, providing subsidies and marketplaces to help individuals and families find affordable coverage.

Understanding Florida’s Healthcare Insurance Landscape

Navigating the complex world of health insurance in Florida can be daunting, but understanding the different types of plans, the regulatory landscape, and key statistics about coverage can empower you to make informed decisions.

Types of Health Insurance Plans in Florida

Florida offers a diverse range of health insurance plans to cater to different needs and budgets. These plans are primarily categorized into two main groups:

- Individual Health Insurance: Purchased directly by individuals or families, these plans offer a wide range of coverage options and premiums. They are often more flexible than employer-sponsored plans but may have higher premiums.

- Employer-Sponsored Health Insurance: Provided by employers as a benefit to their employees, these plans are often more affordable than individual plans due to group purchasing power. They may offer a limited selection of plans but provide access to a broader network of providers.

Within these two categories, Florida offers various types of plans, including:

- Health Maintenance Organizations (HMOs): HMOs typically have a lower premium but require you to choose a primary care physician (PCP) within their network. You must obtain referrals from your PCP for specialist care.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing you to see any doctor within their network without needing a referral. However, they may have higher premiums and out-of-pocket costs.

- Point-of-Service (POS) Plans: POS plans combine features of both HMOs and PPOs. They require you to choose a PCP but allow you to see specialists outside the network for a higher copay.

- High Deductible Health Plans (HDHPs): HDHPs have lower premiums but require you to pay a higher deductible before coverage kicks in. They are often paired with a Health Savings Account (HSA), which allows you to save pre-tax money for medical expenses.

- Catastrophic Plans: These plans are available to individuals under 30 or those with hardship exemptions. They have very low premiums but cover only essential health benefits and have high deductibles and out-of-pocket costs.

Role of the Florida Department of Insurance

The Florida Department of Insurance (DOI) plays a crucial role in regulating the state’s health insurance market. Its primary responsibilities include:

- Licensing and Oversight: The DOI licenses and regulates health insurance companies operating in Florida, ensuring they meet financial stability requirements and comply with state regulations.

- Consumer Protection: The DOI investigates consumer complaints against insurance companies, mediates disputes, and provides information and resources to help consumers understand their rights and responsibilities.

- Market Monitoring: The DOI monitors the health insurance market to identify trends and potential problems, such as rate increases or access issues, and takes steps to address them.

Key Statistics about Health Insurance Coverage in Florida

- Uninsured Rate: In 2021, Florida’s uninsured rate was 11.9%, according to the U.S. Census Bureau. This is higher than the national average of 8.6% but has been declining steadily since the implementation of the Affordable Care Act (ACA) in 2014.

- ACA Marketplace Enrollment: Florida has a robust ACA marketplace, with over 2 million residents enrolled in plans as of 2022. The marketplace offers subsidies to help individuals and families afford coverage, making it a valuable resource for many Floridians.

- Medicaid Coverage: Florida’s Medicaid program, known as “Florida Healthy Kids,” provides health insurance to low-income children, pregnant women, and individuals with disabilities. It is a significant source of coverage for many Floridians.

Navigating Health Insurance Options in Florida

Florida’s healthcare insurance landscape offers a wide range of plans, each with unique coverage, costs, and benefits. Understanding these options is crucial for making an informed decision that aligns with your individual needs and budget. This section will guide you through the intricacies of Florida’s health insurance plans, empowering you to make the right choice.

Comparing and Contrasting Health Insurance Plans

Choosing the right health insurance plan in Florida involves carefully evaluating different options based on coverage, costs, and benefits. The most common types of health insurance plans in Florida are:

- Health Maintenance Organizations (HMOs): HMOs provide comprehensive health coverage through a network of doctors and hospitals. They typically have lower monthly premiums but require you to choose a primary care physician (PCP) within the network. You’ll need a referral from your PCP to see specialists or receive other services.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing you to see doctors and hospitals both inside and outside the network. While PPOs generally have higher premiums, they provide greater choice and may offer lower out-of-pocket costs for in-network services.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs in that they require you to choose a PCP and use providers within the network. However, unlike HMOs, EPOs do not require referrals for specialist visits. EPOs typically offer lower premiums than PPOs but less flexibility.

- Point of Service (POS) Plans: POS plans combine features of HMOs and PPOs. They allow you to choose a PCP and receive care within the network at lower costs. However, you can also see out-of-network providers for an additional fee.

- High Deductible Health Plans (HDHPs): HDHPs offer lower premiums than traditional plans but have higher deductibles, meaning you pay more out-of-pocket for healthcare services until you reach the deductible limit. These plans are often paired with Health Savings Accounts (HSAs), which allow you to save pre-tax dollars for healthcare expenses.

Factors to Consider When Choosing a Health Insurance Plan, Health care insurance florida

Several factors influence your choice of health insurance plan in Florida, including:

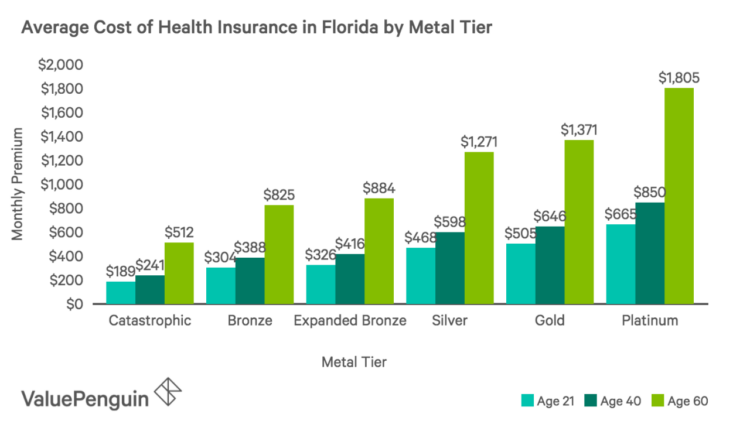

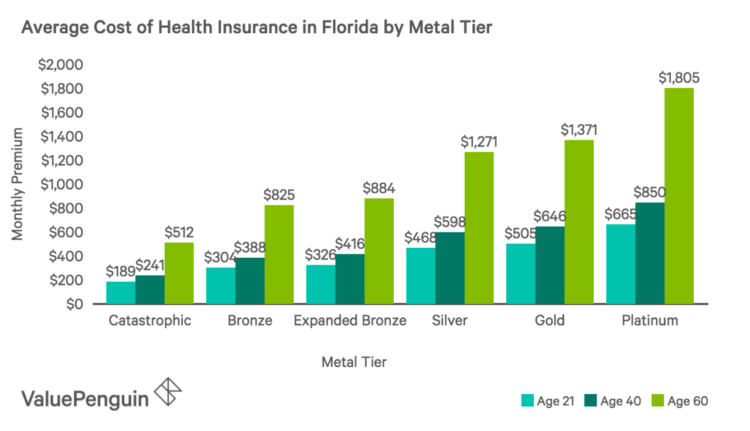

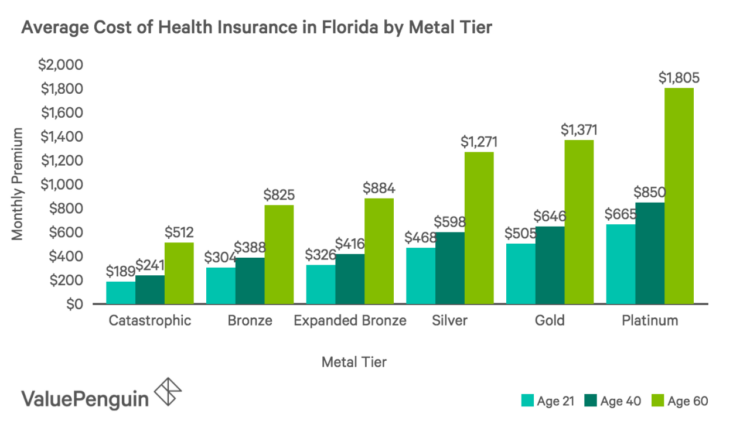

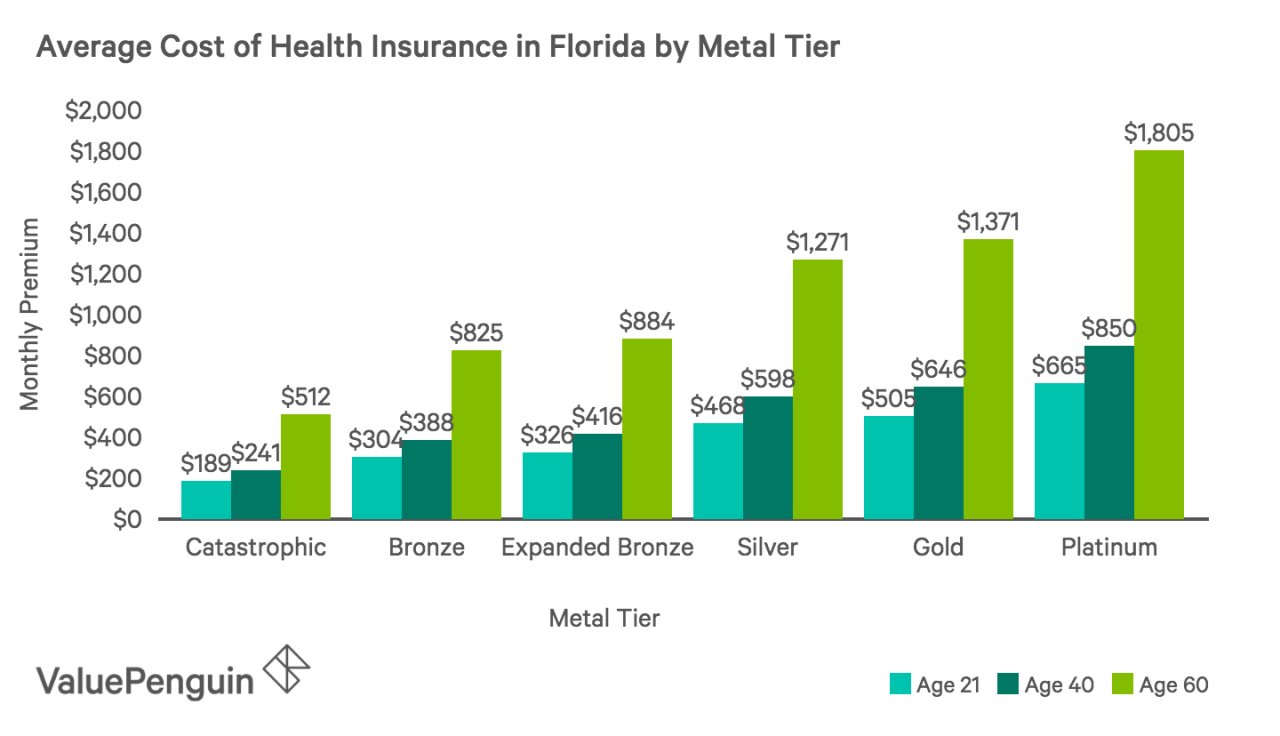

- Age: Younger individuals may opt for plans with lower premiums and higher deductibles, while older individuals might prefer plans with more comprehensive coverage and lower out-of-pocket costs.

- Health Status: If you have pre-existing conditions, you’ll need a plan that covers your specific needs. For example, individuals with diabetes might choose a plan with comprehensive coverage for diabetes management.

- Budget: Consider your monthly budget and how much you can afford to pay for premiums and out-of-pocket expenses. Compare plans with different premium levels and deductibles to find one that fits your financial situation.

- Lifestyle: Your lifestyle also plays a role in choosing a plan. If you frequently travel, you might prefer a plan with extensive coverage outside your state.

Finding and Enrolling in a Health Insurance Plan

Here’s a step-by-step guide to finding and enrolling in a health insurance plan in Florida:

- Determine your eligibility: First, determine if you qualify for any government-sponsored programs like Medicaid or Medicare. These programs offer subsidized healthcare coverage for eligible individuals.

- Compare plans: Once you’ve determined your eligibility, use online marketplaces like Healthcare.gov or Florida Health Choices to compare different plans based on your needs and budget. You can filter plans by coverage, premiums, deductibles, and other factors.

- Contact insurance providers: After comparing plans, contact the insurance providers you’re interested in to ask questions about their coverage, costs, and benefits. You can also ask about the network of doctors and hospitals they cover.

- Enroll in a plan: Once you’ve chosen a plan, you can enroll online, by phone, or through an insurance broker. The enrollment period for health insurance plans in Florida typically runs from November 1st to January 15th.

Affordable Care Act (ACA) and Florida

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted health insurance in Florida. It introduced key provisions aimed at expanding coverage, improving affordability, and regulating the health insurance market. This section delves into the ACA’s impact on Florida’s healthcare landscape, exploring its key features, benefits, and challenges.

ACA Subsidies and Marketplaces

The ACA established health insurance marketplaces, also known as exchanges, where individuals and families can compare and purchase health insurance plans. These marketplaces offer a variety of plans from different insurance companies, allowing consumers to choose the best option based on their needs and budget. One of the most significant aspects of the ACA is the availability of subsidies, which help individuals and families afford health insurance.

These subsidies are based on income and family size, and they can significantly reduce the cost of monthly premiums. Florida residents can access these subsidies through the federal marketplace, healthcare.gov. The subsidies are available to individuals and families with incomes between 100% and 400% of the federal poverty level.

Medicaid and CHIP Programs in Florida

The ACA expanded Medicaid eligibility, allowing more low-income individuals and families to access healthcare coverage. However, Florida opted not to expand Medicaid under the ACA, leaving a significant portion of its population without access to this essential program. The state instead implemented a program called “Florida Healthy Kids” which is a state-funded program that provides health insurance to children from low-income families.

While Florida has expanded coverage for children through Healthy Kids, the lack of Medicaid expansion has left a gap in coverage for many adults. This has resulted in a significant number of Floridians remaining uninsured.

ACA’s Implications on Healthcare Access and Affordability

The ACA has had a mixed impact on healthcare access and affordability in Florida. While the subsidies and marketplaces have made health insurance more affordable for some, the lack of Medicaid expansion has left a significant portion of the population uninsured. The ACA has also led to increased competition in the health insurance market, which has helped to drive down premiums for some consumers. However, premiums have risen for others, particularly those who are older or have pre-existing conditions.

The ACA has made significant strides in expanding healthcare coverage and affordability in Florida. However, challenges remain, particularly in the area of Medicaid expansion. The state’s decision not to expand Medicaid has left a significant number of Floridians uninsured, highlighting the need for continued efforts to address the issue of healthcare access and affordability in the state.

Key Considerations for Florida Residents

Florida’s unique demographics and healthcare needs significantly impact health insurance options for residents. With a large senior population and a growing number of uninsured individuals, navigating the state’s healthcare system can be complex.

Understanding Florida’s Unique Demographics and Healthcare Needs

Florida’s diverse population presents distinct challenges and opportunities for healthcare access. The state has a large senior population, with a higher percentage of residents aged 65 and over compared to the national average. This demographic trend leads to increased demand for Medicare and other senior-specific health insurance plans. Additionally, Florida’s large Hispanic population requires culturally sensitive healthcare services and insurance options that cater to their unique needs.

Addressing the Challenges of Affordable Healthcare

High healthcare costs and limited provider networks pose significant challenges for Floridians seeking affordable healthcare. The state’s high cost of living, coupled with rising healthcare expenses, can make it difficult for individuals and families to afford necessary medical care. Limited provider networks associated with certain insurance plans can also restrict access to specific specialists or hospitals, particularly in rural areas.

Navigating Florida’s Healthcare System and Insurance Market

Florida’s healthcare system is complex, with a variety of public and private insurance options available. Understanding the different types of plans, their coverage, and the eligibility requirements is crucial for making informed decisions. Navigating the state’s insurance market can be overwhelming, especially for individuals unfamiliar with the intricacies of healthcare coverage.

Florida’s Healthcare Exchange and the Affordable Care Act

The Affordable Care Act (ACA) has significantly impacted Florida’s healthcare landscape. The ACA created the Florida Health Insurance Marketplace, a platform where individuals can compare and enroll in health insurance plans. Through the Marketplace, Floridians can access subsidized coverage based on their income level. However, the ACA’s impact on Florida’s healthcare system remains a topic of ongoing debate, with concerns about affordability and access to care persisting.

Emerging Trends in Florida Healthcare Insurance

Florida’s healthcare insurance landscape is undergoing a rapid transformation, driven by technological advancements, evolving healthcare models, and a growing emphasis on cost-effectiveness. This section explores key emerging trends shaping the future of health insurance in Florida.

The Impact of Telehealth and Digital Health Technologies

The rise of telehealth and digital health technologies is significantly impacting healthcare access and insurance coverage in Florida. Telehealth, which involves the delivery of healthcare services remotely using technology, has become increasingly popular, particularly in rural areas with limited access to traditional healthcare providers.

- Increased Access to Care: Telehealth allows patients to consult with physicians and receive treatment from the comfort of their homes, eliminating the need for travel and reducing barriers to care. This is especially beneficial for individuals in remote areas, those with mobility limitations, and those with busy schedules.

- Enhanced Convenience and Efficiency: Digital health technologies, such as mobile health apps and wearable devices, provide patients with convenient access to health information, appointment scheduling, medication reminders, and other essential services. These technologies also streamline administrative processes, reducing wait times and improving overall efficiency.

- Cost-Effective Solutions: Telehealth and digital health technologies often offer more cost-effective healthcare solutions compared to traditional in-person visits. By reducing the need for physical visits, these technologies can lower healthcare expenses for both patients and insurance providers.

Value-Based Care Models

Value-based care (VBC) models are gaining traction in Florida, shifting the focus from volume-based care to quality and patient outcomes. VBC models incentivize healthcare providers to deliver high-quality care while managing costs effectively.

- Improved Patient Outcomes: VBC models encourage providers to focus on preventative care, chronic disease management, and patient education, leading to improved patient outcomes and reduced healthcare utilization.

- Cost Containment: By aligning financial incentives with quality care, VBC models promote cost containment and encourage providers to optimize resource utilization.

- Enhanced Patient Engagement: VBC models often emphasize patient engagement, empowering patients to actively participate in their care decisions and manage their health.

The Future of Healthcare Insurance in Florida

The future of healthcare insurance in Florida is likely to be characterized by continued innovation and adaptation.

- Expansion of Telehealth and Digital Health: Telehealth and digital health technologies are expected to play an even greater role in Florida’s healthcare system, driving further innovation in care delivery and access.

- Increased Adoption of Value-Based Care: VBC models are expected to gain wider adoption, influencing insurance plan designs and provider reimbursement structures.

- Personalized Healthcare: Personalized medicine and precision healthcare are emerging trends that aim to tailor treatments to individual patients based on their genetic makeup and other factors. This approach has the potential to improve patient outcomes and reduce healthcare costs.

Final Conclusion: Health Care Insurance Florida

Navigating the world of health care insurance Florida can be daunting, but with the right information and guidance, you can find a plan that meets your needs and budget. Understanding the various types of plans, considering your personal factors, and staying informed about emerging trends are crucial steps in securing your health and financial well-being.

FAQ Compilation

What are the different types of health insurance plans available in Florida?

Florida offers a variety of health insurance plans, including HMOs, PPOs, POS, and EPOs, each with its own coverage, costs, and benefits.

How do I find a health insurance plan in Florida?

You can find a health insurance plan in Florida through the Health Insurance Marketplace, your employer, or an insurance broker.

What are the eligibility requirements for Medicaid in Florida?

Eligibility for Medicaid in Florida depends on your income, family size, and other factors. You can apply online or through a local office.

What are the key factors to consider when choosing a health insurance plan in Florida?

Key factors include your age, health status, budget, and coverage needs.