How are insurance companies valued? It’s a question that’s not just for Wall Street, but for anyone who wants to understand the financial health of these vital institutions. Insurance companies are the backbone of our society, protecting us from risks we can’t control, from car accidents to natural disasters. But how do we know if they’re doing a good job, and how can we assess their value? Understanding the factors that drive insurance company valuations is key to understanding their role in the economy and their ability to fulfill their promises.

Several key factors play a role in determining the value of an insurance company. One of the most important is their financial performance. Insurance companies are all about managing risk, and their ability to do so successfully is reflected in their profitability and financial stability. Another important factor is the market environment, which includes things like interest rates, inflation, and the level of competition. Finally, the specific valuation methods used can also have a significant impact on the perceived value of an insurance company.

Insurance Company Valuations

Insurance companies are the backbone of a stable financial system. They protect individuals and businesses from unexpected risks, ensuring peace of mind and financial security. Understanding how these companies are valued is crucial for investors, regulators, and even policyholders. Knowing the factors that influence their worth allows for informed decisions, investment strategies, and a better grasp of the insurance market’s dynamics.

Factors Influencing Insurance Company Valuations

A complex interplay of factors determines an insurance company’s valuation. These factors can be broadly categorized into financial performance, regulatory environment, and market conditions.

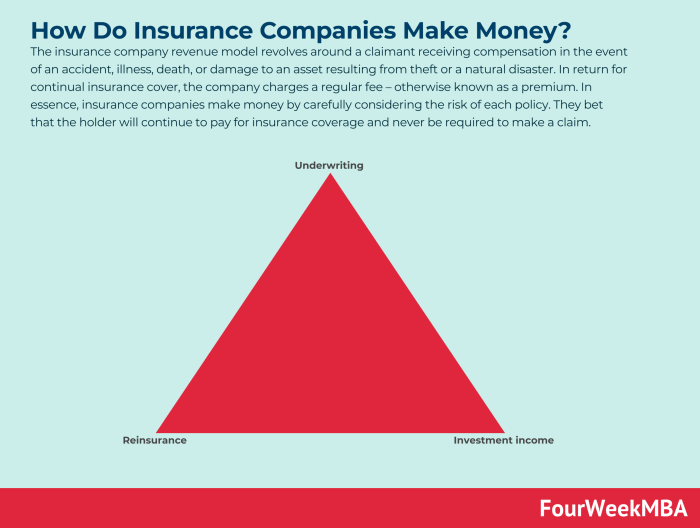

- Financial Performance: This includes the company’s profitability, underwriting performance, investment returns, and capital adequacy. A profitable insurance company with a strong track record of underwriting profits and sound investment strategies is generally considered more valuable.

- Regulatory Environment: Insurance companies operate within a highly regulated environment. Changes in regulations, such as stricter capital requirements or new reporting standards, can significantly impact their valuations.

- Market Conditions: Factors like interest rates, inflation, and economic growth can influence the demand for insurance products and the overall market sentiment towards insurance companies.

Financial Performance: How Are Insurance Companies Valued

Financial performance plays a crucial role in determining the value of an insurance company. Investors and analysts carefully assess the company’s profitability, financial stability, and ability to generate consistent returns. Key financial metrics provide insights into the company’s overall health and future prospects.

Profitability and Financial Stability

Profitability and financial stability are fundamental aspects of insurance company valuations. Investors seek companies that can consistently generate profits and maintain a strong financial position. Profitability reflects the company’s ability to manage its expenses and generate revenue from premiums. Financial stability, on the other hand, refers to the company’s ability to meet its financial obligations, including claims payments and policyholder benefits. A company with a strong track record of profitability and financial stability is likely to be valued higher than one with a weaker financial performance.

Key Financial Metrics

Several key financial metrics are used to assess the financial performance of insurance companies. These metrics provide a quantitative basis for understanding the company’s profitability, solvency, and efficiency.

Return on Equity (ROE)

ROE measures the company’s profitability relative to its equity. It is calculated as net income divided by shareholder equity. A higher ROE indicates that the company is generating a greater return on its investments.

ROE = Net Income / Shareholder Equity

Operating Margin

The operating margin measures the company’s profitability from its core operations. It is calculated as operating income divided by total revenue. A higher operating margin indicates that the company is efficiently managing its expenses and generating a larger profit from its insurance operations.

Operating Margin = Operating Income / Total Revenue

Solvency Ratios

Solvency ratios assess the company’s ability to meet its financial obligations, including claims payments and policyholder benefits. Key solvency ratios include:

- Risk-Based Capital (RBC) Ratio: This ratio measures the company’s capital adequacy relative to its risk profile. A higher RBC ratio indicates that the company has sufficient capital to absorb potential losses. The RBC ratio is determined by regulatory authorities and varies depending on the type of insurance company and its risk profile.

- Combined Ratio: The combined ratio measures the company’s overall profitability. It is calculated as the sum of the loss ratio and the expense ratio. A combined ratio below 100% indicates that the company is profitable, while a combined ratio above 100% indicates that the company is incurring losses.

Valuation Methods for Different Types of Insurance Companies

Valuation methods used for insurance companies vary depending on the type of insurance offered.

Life Insurance Companies

Life insurance companies are typically valued using a discounted cash flow (DCF) analysis. This method projects the company’s future cash flows and discounts them back to their present value. The discount rate used in the analysis reflects the company’s risk profile and the required rate of return for investors.

Health Insurance Companies

Health insurance companies are also often valued using a DCF analysis. However, the valuation process may also consider factors such as the company’s market share, regulatory environment, and healthcare trends.

Property & Casualty (P&C) Insurance Companies

P&C insurance companies are typically valued using a combination of DCF analysis and multiples analysis. DCF analysis is used to project the company’s future cash flows, while multiples analysis is used to compare the company’s valuation to that of its peers. Common multiples used for P&C insurance companies include price-to-book value and price-to-earnings.

Market Factors

Insurance company valuations are not solely determined by their financial performance. External market forces significantly influence how investors perceive and value these companies. These factors can create both opportunities and challenges for insurance companies, shaping their growth and profitability.

Macroeconomic Conditions

Macroeconomic conditions play a significant role in insurance company valuations. Interest rates, inflation, and economic growth all influence the insurance industry’s performance and investor sentiment.

- Interest Rates: Rising interest rates can be beneficial for insurance companies as they generate investment income from premiums collected. Higher interest rates allow insurers to earn more on their investments, boosting their profitability. Conversely, falling interest rates can negatively impact their investment returns, potentially leading to lower valuations. For example, in 2022, the Federal Reserve raised interest rates several times, leading to higher returns for insurance companies on their bond portfolios. This improved their profitability and boosted investor confidence, driving up valuations for many insurance companies.

- Inflation: Inflation can affect insurance company valuations in various ways. Rising inflation can lead to higher claims costs, as the cost of repairing or replacing damaged property increases. This can squeeze profit margins and negatively impact valuations. However, inflation can also lead to higher premium rates, which can offset some of the increased claim costs. For example, during periods of high inflation, insurance companies may need to adjust their premiums to reflect the increased cost of claims, potentially impacting consumer behavior and demand for insurance.

- Economic Growth: A strong economy typically leads to increased demand for insurance products. As businesses and individuals experience economic growth, they may require more insurance coverage to protect their assets and income. This can lead to higher premiums and increased profitability for insurance companies, boosting their valuations. Conversely, economic downturns can reduce demand for insurance, potentially leading to lower valuations.

Competition, Regulation, and Technology

The competitive landscape, regulatory environment, and technological advancements also significantly influence insurance company valuations.

- Competition: The insurance industry is highly competitive, with numerous players vying for market share. Increased competition can put pressure on premiums, reducing profitability and potentially impacting valuations. For example, the rise of online insurance platforms has intensified competition in the market, forcing traditional insurers to adapt and innovate to remain competitive. This competition can drive down premiums and potentially impact valuations.

- Regulation: Insurance companies operate within a heavily regulated environment. Changes in regulations can significantly impact their business operations and profitability. For example, new regulations regarding data privacy or cybersecurity can increase compliance costs for insurance companies, potentially impacting their profitability and valuations. In the United States, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 significantly impacted the insurance industry, introducing new regulations for systemic risk and consumer protection. These regulations have led to increased compliance costs and potentially impacted valuations for some insurance companies.

- Technology: Technological advancements are transforming the insurance industry, creating both opportunities and challenges. Insurtech companies are using new technologies to develop innovative products and services, disrupting traditional business models. These advancements can create opportunities for growth and innovation but also pose competitive threats to established insurers. For example, the use of artificial intelligence (AI) and big data analytics is revolutionizing insurance underwriting, claims processing, and customer service. Insurers who embrace these technologies can improve efficiency, reduce costs, and enhance customer experiences, potentially leading to higher valuations. However, those who fail to adapt may face challenges in competing with more technologically advanced players.

Market Trends and Consumer Behavior

Market trends and consumer behavior are also important factors influencing insurance company valuations.

- Shifting Consumer Preferences: Consumer preferences are constantly evolving, impacting the demand for different insurance products. For example, the increasing popularity of ride-sharing services has led to a decline in demand for traditional auto insurance, potentially impacting valuations for companies specializing in this market segment. As consumers become more tech-savvy and environmentally conscious, they are seeking insurance products that cater to their specific needs and values. This shift in consumer preferences can create opportunities for insurers who adapt their products and services accordingly.

- Emerging Risks: New and emerging risks, such as cyberattacks, climate change, and pandemics, are creating new opportunities and challenges for the insurance industry. Insurers who can effectively manage these risks and develop innovative solutions to address them can potentially benefit from higher valuations. For example, the COVID-19 pandemic highlighted the importance of pandemic risk insurance. Insurance companies that developed comprehensive pandemic coverage plans and effectively managed claims related to the pandemic may have experienced higher valuations as investors recognized their ability to navigate these complex and uncertain times.

Valuation Methods

Insurance company valuations are a complex process that requires a deep understanding of the industry, financial performance, and market factors. To determine an accurate valuation, several methods are employed, each with its own strengths and weaknesses.

Discounted Cash Flow (DCF) Analysis

DCF analysis is a fundamental valuation method that focuses on the present value of future cash flows. It’s a widely accepted method for determining intrinsic value, especially for companies with a stable and predictable cash flow stream, like insurance companies. The core concept of DCF analysis is to project future cash flows and discount them back to the present value using a discount rate that reflects the risk associated with the company’s future earnings.

- Forecasting Future Cash Flows: This step involves projecting the company’s future earnings, dividends, and other cash flows based on historical data, industry trends, and management forecasts. The key is to develop realistic and conservative estimates that account for potential risks and uncertainties. For example, an insurance company might forecast future cash flows based on historical premium growth rates, claims experience, and expense trends.

- Determining the Discount Rate: The discount rate is crucial as it reflects the risk associated with the future cash flows. A higher discount rate implies a higher risk and, therefore, a lower present value. Common methods for determining the discount rate include the Capital Asset Pricing Model (CAPM) and the Weighted Average Cost of Capital (WACC).

- Calculating the Present Value: Once future cash flows and the discount rate are determined, the present value is calculated by discounting each future cash flow back to the present using the appropriate discount rate. The sum of all present values represents the intrinsic value of the company based on its future cash flows.

Relative Valuation

Relative valuation methods compare the company’s valuation metrics to those of similar companies in the same industry. These methods rely on market data and provide a quick and straightforward way to assess a company’s value relative to its peers.

- Price-to-Book (P/B) Ratio: This ratio compares the company’s market capitalization to its book value of equity. A higher P/B ratio indicates that investors are willing to pay more for each dollar of book value, suggesting a higher growth potential or stronger financial performance.

- Price-to-Earnings (P/E) Ratio: This ratio compares the company’s market capitalization to its net earnings. A higher P/E ratio indicates that investors are willing to pay more for each dollar of earnings, suggesting a higher growth potential or stronger profitability.

Market Multiples Analysis

Market multiples analysis involves comparing a company’s valuation metrics to similar companies in the industry, using various financial ratios and market data. This method helps determine the company’s value based on the market’s perception of similar companies.

- Price-to-Sales (P/S) Ratio: This ratio compares the company’s market capitalization to its revenue. A higher P/S ratio indicates that investors are willing to pay more for each dollar of revenue, suggesting a higher growth potential or stronger revenue growth.

- Price-to-Earnings Before Interest and Taxes (P/EBIT) Ratio: This ratio compares the company’s market capitalization to its earnings before interest and taxes. A higher P/EBIT ratio indicates that investors are willing to pay more for each dollar of earnings before interest and taxes, suggesting a higher growth potential or stronger profitability.

Advantages and Disadvantages of Valuation Methods, How are insurance companies valued

| Valuation Method | Advantages | Disadvantages |

|---|---|---|

| Discounted Cash Flow (DCF) Analysis |

|

|

| Relative Valuation |

|

|

| Market Multiples Analysis |

|

|

Risk and Uncertainty

Insurance companies, like any business, operate in an environment filled with risks and uncertainties. These factors play a crucial role in determining their valuations, as investors consider the potential for both profits and losses.

Catastrophic Events

Catastrophic events, such as hurricanes, earthquakes, and pandemics, pose significant risks to insurance companies. These events can lead to massive payouts, potentially exceeding the company’s reserves and impacting its financial stability.

- For example, Hurricane Katrina in 2005 resulted in billions of dollars in insurance claims, leading to significant losses for many insurance companies.

- Similarly, the COVID-19 pandemic has resulted in significant claims related to business interruption and health insurance.

Regulatory Changes

Insurance companies operate within a highly regulated environment, and changes in regulations can significantly impact their valuations.

- New regulations can increase compliance costs, restrict product offerings, or alter pricing models, affecting profitability.

- For example, the Affordable Care Act (ACA) in the United States has had a major impact on the health insurance industry, leading to both opportunities and challenges for insurance companies.

Economic Downturns

Economic downturns can impact insurance companies in several ways.

- During recessions, people may reduce their insurance coverage to cut costs, leading to lower premiums for insurance companies.

- Economic downturns can also lead to an increase in claims, as businesses and individuals struggle to meet their financial obligations.

Risk Management

Insurance companies employ various strategies to manage risk and mitigate its impact on their valuations.

- Diversification: Insurance companies diversify their portfolios by offering a wide range of insurance products and operating in different geographic regions. This helps to spread risk and reduce the impact of any single event.

- Reinsurance: Insurance companies can purchase reinsurance to transfer some of their risk to other insurers. This helps to protect them from catastrophic losses.

- Pricing Models: Insurance companies use sophisticated pricing models to assess risk and determine premiums. By accurately pricing risk, they can ensure that they collect enough premiums to cover potential claims.

- Risk Management Teams: Insurance companies employ risk management teams to identify, assess, and mitigate potential risks. These teams monitor market trends, regulatory changes, and other factors that could impact the company’s operations.

Case Studies

Let’s get real, folks. We’ve talked about the theories, the formulas, and the fancy financial jargon, but how does it all play out in the real world? To understand how insurance companies are valued, it’s crucial to examine actual examples. These case studies will give us a peek behind the curtain and show us how these valuation methods are applied in practice.

Valuation of Berkshire Hathaway

Berkshire Hathaway, the investment conglomerate led by the legendary Warren Buffett, is a prime example of how a complex insurance business can be valued. Berkshire’s insurance operations, including Geico and General Re, are a significant part of its overall value.

Analysts use a variety of methods to value Berkshire Hathaway. One key method is the discounted cash flow (DCF) analysis, which considers the present value of future cash flows from its insurance operations. They also factor in the value of Berkshire’s vast investment portfolio, which includes a wide range of stocks, bonds, and other assets.

Another factor that significantly influences Berkshire Hathaway’s valuation is its brand recognition and reputation for financial stability. Warren Buffett’s leadership and the company’s history of consistently delivering strong returns have contributed to a high level of investor confidence. This confidence translates into a higher valuation multiple, meaning investors are willing to pay more for each dollar of Berkshire’s earnings.

Valuation of Lemonade

Lemonade, a tech-driven insurance company, has taken a different approach to the industry, using artificial intelligence and a direct-to-consumer model. This has attracted investors looking for innovation and growth potential in the insurance sector.

Lemonade’s valuation is based on several factors:

- Growth potential: Lemonade’s rapid customer acquisition and expansion into new markets have fueled investor optimism about its future growth.

- Technology: Lemonade’s use of AI and data analytics is seen as a key differentiator in the insurance market, offering potential for efficiency and cost savings.

- Brand appeal: Lemonade’s focus on customer experience and its user-friendly mobile app have resonated with younger generations.

However, Lemonade’s valuation also reflects the inherent risk associated with a relatively new and unproven business model. Its high growth rate has come at the expense of profitability, and investors are closely watching its ability to generate sustainable profits in the long run.

Valuation of Progressive

Progressive, a major player in the auto insurance market, is valued based on its strong financial performance, market share, and ability to adapt to changing consumer preferences.

Progressive’s valuation factors include:

- Financial Performance: Progressive has consistently delivered strong earnings and cash flow, demonstrating its ability to manage risk and generate profits.

- Market Share: Progressive is one of the largest auto insurance companies in the US, with a significant market share that provides economies of scale and competitive advantages.

- Innovation: Progressive has been a leader in adopting new technologies, such as telematics and online quoting tools, to improve customer experience and streamline operations.

Progressive’s valuation is also influenced by its strong brand recognition and reputation for customer service. These factors contribute to its ability to retain existing customers and attract new ones.

Key Takeaways

| Case Study | Valuation Factors | Key Takeaways |

|---|---|---|

| Berkshire Hathaway | Discounted cash flow analysis, investment portfolio, brand recognition, Warren Buffett’s leadership | Strong financial performance, reputation for stability, and investor confidence can lead to high valuations. |

| Lemonade | Growth potential, technology, brand appeal, risk associated with a new business model | Innovation and growth potential can attract investors, but profitability and long-term sustainability are crucial for sustained valuation. |

| Progressive | Financial performance, market share, innovation, brand recognition, customer service | Strong financial performance, market share, and adaptation to market trends are essential for a high valuation. |

Summary

Understanding how insurance companies are valued is a complex but crucial process. By considering the factors discussed above, investors and analysts can gain a deeper insight into the financial health and potential of these vital institutions. From their financial performance to the market forces that shape their future, every piece of the puzzle contributes to the overall picture of value. So, next time you hear about an insurance company, take a moment to consider what drives its valuation and how it impacts your own financial well-being.

Q&A

What are some common valuation metrics used for insurance companies?

Common valuation metrics include price-to-book ratio, price-to-earnings ratio, and return on equity (ROE). These metrics provide insights into the company’s financial performance and market value relative to its assets and earnings.

How do catastrophic events affect insurance company valuations?

Catastrophic events like hurricanes or earthquakes can significantly impact insurance company valuations. These events can lead to large payouts, affecting profitability and increasing risk, which can negatively influence investor sentiment and valuation.

What role does regulation play in insurance company valuations?

Regulation plays a crucial role. Regulatory changes can impact the cost of doing business, the types of products offered, and the overall risk profile of an insurance company, all of which can affect valuations.