How Can I Purchase Stocks? You’ve probably heard the term “stock market” thrown around, but maybe you’re not quite sure what it means or how to get involved. Investing in the stock market can be a powerful way to build wealth over time, but it’s important to understand the basics before you jump in. This guide will walk you through the process of buying stocks, from choosing a brokerage account to placing your first order.

Think of buying stocks as owning a small piece of a company. When that company does well, the value of your stock can go up, potentially earning you a profit. But just like any investment, there are risks involved, and it’s important to be aware of them before you invest.

Opening a Brokerage Account: How Can I Purchase Stocks

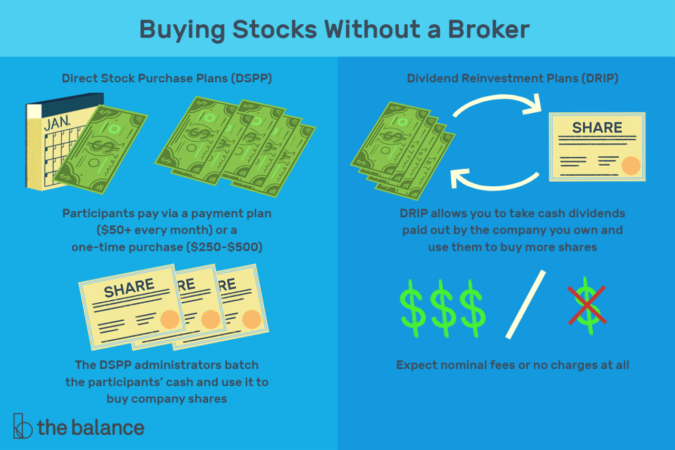

Opening a brokerage account is the first step towards buying stocks. It acts as a platform where you can buy, sell, and manage your investments. Brokerage accounts allow you to trade stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other investment products.

Choosing a Brokerage, How can i purchase stocks

Choosing the right brokerage is important because different brokers offer varying services, fees, and account features. Factors to consider include:

- Fees: Brokerage fees can include commissions, inactivity fees, account maintenance fees, and other charges. Compare fee structures and consider the volume of trading you anticipate.

- Trading Platforms: The trading platform is the software you use to buy and sell securities. Look for user-friendly platforms with features that meet your needs, such as real-time quotes, charting tools, and research capabilities.

- Investment Options: Ensure the broker offers the investment products you’re interested in, including stocks, bonds, ETFs, mutual funds, and options.

- Customer Service: Good customer service is crucial. Consider factors like availability, responsiveness, and the ease of reaching support.

- Research Tools: Some brokers provide research reports, market analysis, and other tools to help you make informed investment decisions.

Opening an Account

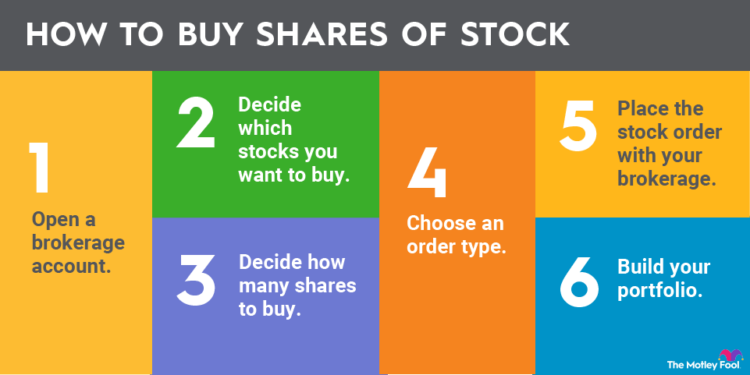

Once you’ve chosen a brokerage, you can open an account online or by phone. Here’s a general step-by-step guide:

- Visit the Brokerage Website: Go to the website of the brokerage you’ve chosen.

- Click on “Open an Account” or “Sign Up”: Locate the button that initiates the account opening process.

- Fill out the Application: Provide your personal information, including your name, address, Social Security number, and contact details.

- Choose an Account Type: Most brokers offer different account types, such as individual, joint, or retirement accounts. Select the type that best suits your needs.

- Provide Financial Information: You’ll need to provide information about your income, assets, and investment experience. This helps the brokerage assess your risk tolerance and suitability for certain investments.

- Agree to Terms and Conditions: Carefully read and understand the brokerage’s terms and conditions before agreeing to them.

- Verify Your Identity: You’ll likely need to verify your identity by providing documents such as your driver’s license or passport.

- Fund Your Account: Once your account is approved, you can deposit funds to start trading.

Required Documents and Information

When opening a brokerage account, you’ll typically need the following documents and information:

- Proof of Identity: Driver’s license, passport, or other government-issued ID.

- Social Security Number: Required for tax reporting purposes.

- Proof of Address: Utility bill, bank statement, or other document with your name and address.

- Financial Information: Income details, asset information, and investment experience.

- Bank Account Information: For linking your bank account to fund your brokerage account.

Funding Your Account

After your account is approved, you’ll need to deposit funds to start trading. Most brokers offer various funding options, including:

- Bank Transfer: Transfer funds directly from your bank account to your brokerage account.

- Wire Transfer: A faster way to transfer funds, but may come with fees.

- Check: Send a check to the brokerage, but this can take several business days to process.

- Debit Card: Deposit funds using your debit card, but may have transaction fees.

- ACH Transfer: An electronic transfer from your bank account to your brokerage account.

Resources for Stock Market Education

Learning about the stock market can seem daunting, but there are tons of resources available to help you gain knowledge and confidence. From reputable websites to educational materials, you can build a solid foundation for your investment journey.

Reliable Websites and Educational Resources

Investing in the stock market requires a solid understanding of its principles. There are many resources available to help you learn, but it’s essential to choose reputable sources that provide accurate and unbiased information. Here are some websites and educational resources that can help you on your path to becoming a savvy investor:

- Investopedia: Investopedia is a great starting point for beginners. It offers a wide range of articles, tutorials, and videos on various investment topics, including stocks, bonds, mutual funds, and ETFs. They provide clear explanations and real-world examples to make complex concepts easier to understand.

- Khan Academy: Khan Academy is a non-profit organization that provides free online courses on various subjects, including finance. Their stock market course covers topics like market basics, investing strategies, and risk management. It’s a valuable resource for those who prefer a structured learning experience.

- The Motley Fool: The Motley Fool is a popular website known for its investment analysis and stock recommendations. They offer articles, podcasts, and newsletters that cover a wide range of investment topics, including individual stocks, market trends, and investing strategies. They also provide a “Fool School” section with beginner-friendly tutorials.

- Wall Street Journal: The Wall Street Journal is a renowned financial publication that provides in-depth coverage of the stock market, business news, and economic trends. It’s a valuable resource for staying up-to-date on market movements and analyzing investment opportunities.

- Your Brokerage’s Educational Resources: Most online brokerages offer educational resources for their clients. These resources often include articles, videos, and webinars on investing basics, trading strategies, and market analysis. Check out the educational section of your brokerage platform for valuable insights and guidance.

Finding Reliable Financial Advice

Navigating the financial world can be overwhelming, and seeking advice from trusted sources is crucial. While online resources are valuable, it’s essential to distinguish reliable advice from misleading or biased information. Here are some tips for finding reliable financial advice:

- Look for Certified Financial Planners (CFPs): CFPs are professionals who have met specific education and experience requirements and passed rigorous exams. They are required to act in their clients’ best interests and provide unbiased advice. You can find CFPs in your area through the Certified Financial Planner Board of Standards website.

- Be Wary of Free Advice: While free advice may seem tempting, it’s often biased or incomplete. Be cautious of websites or individuals offering financial advice without proper credentials or experience. Remember, “if it sounds too good to be true, it probably is.”

- Consider Your Needs and Goals: Before seeking financial advice, identify your investment goals, risk tolerance, and time horizon. This will help you find an advisor who aligns with your needs and can provide personalized guidance.

- Ask for Referrals: Talk to friends, family, or colleagues who have experience with financial advisors. Their recommendations can provide valuable insights and help you find a qualified professional.

Consulting with a Financial Advisor

While self-directed investing is possible, consulting with a financial advisor can provide valuable benefits, especially for beginners or those with complex financial situations. Here are some key reasons why consulting with a financial advisor can be beneficial:

- Personalized Investment Strategies: Financial advisors can create personalized investment plans tailored to your individual goals, risk tolerance, and time horizon. They can help you diversify your portfolio, manage risk, and make informed investment decisions.

- Objective Guidance: Financial advisors can provide unbiased guidance and help you avoid emotional decision-making. They can help you stay disciplined and focused on your long-term goals, even during market fluctuations.

- Financial Planning Support: Financial advisors can assist with various aspects of financial planning, such as retirement planning, college savings, and estate planning. They can help you develop a comprehensive financial strategy that aligns with your overall goals.

- Access to Resources: Financial advisors have access to specialized tools, research, and market data that can help them make informed investment decisions on your behalf.

Closure

The stock market can seem complicated at first, but with a little research and preparation, you can learn how to invest in stocks and potentially build a solid portfolio. Remember to start small, do your research, and be patient. Investing in the stock market can be a rewarding experience, but it’s important to approach it with a well-informed strategy.

FAQ Insights

How much money do I need to start investing in stocks?

Many brokerages have no minimum deposit requirement, so you can start with as little as a few dollars. It’s a good idea to start small and gradually increase your investment amount as you become more comfortable.

What are some common mistakes people make when investing in stocks?

Some common mistakes include investing without doing enough research, getting caught up in hype or fear, and not diversifying your portfolio.

How can I learn more about investing in stocks?

There are many resources available online and in libraries. You can also consider taking a course or consulting with a financial advisor.