How do insurance companies decide if a car is totaled? It’s a question that pops up when you’re dealing with a fender bender, a major collision, or even a freak accident. Insurance companies have a specific set of rules and guidelines they use to determine if the cost of repairing your car outweighs its actual value. They consider several factors, including the severity of the damage, the age and condition of the vehicle, and even its resale value.

This process can feel complicated and frustrating, especially when you’re already dealing with the stress of a car accident. Understanding how insurance companies determine a total loss can help you navigate the process and make informed decisions about your options.

Factors Influencing Total Loss Determination

Imagine you’re cruising down the highway, jamming to your favorite tunes, when BAM! You get into a fender bender. Your car’s looking a little worse for wear, and you’re wondering if it’s totaled. That’s where insurance companies come in, playing the role of car-crash detectives to determine if your ride is beyond repair.

The decision to total a car is not taken lightly. It’s a complex process involving various factors, including the severity of the damage, the cost of repairs, and the value of the vehicle.

Determining Total Loss

The term “total loss” in car insurance refers to a situation where the cost of repairing the vehicle exceeds its actual value. In simpler terms, it’s like when a pizza is so burnt that it’s cheaper to order a new one than try to salvage the charred remains.

Factors Considered by Insurance Companies

Insurance companies use a combination of factors to determine if a car is totaled. These include:

- Damage Assessment: Insurance adjusters assess the extent of the damage, examining things like structural integrity, engine damage, and safety features. If the damage affects critical components, it’s more likely to be deemed a total loss.

- Repair Costs: The cost of repairing the damage is a major factor. If the repair bill surpasses a certain threshold, the vehicle is likely totaled.

- Vehicle’s Market Value: The vehicle’s current market value plays a crucial role. Insurance companies consider the vehicle’s age, mileage, condition, and overall market demand.

- Salvage Value: Even if a car is totaled, it still has some value as scrap metal or for parts. This salvage value is deducted from the total loss payout.

- State Regulations: Each state has its own regulations regarding total loss thresholds. Some states may have a specific percentage of the vehicle’s value that determines a total loss.

Actual Cash Value (ACV) vs. Replacement Cost, How do insurance companies decide if a car is totaled

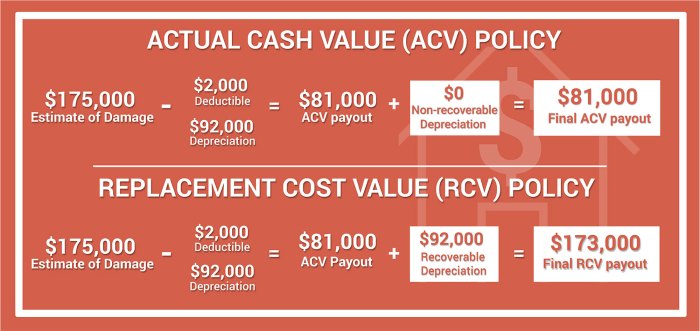

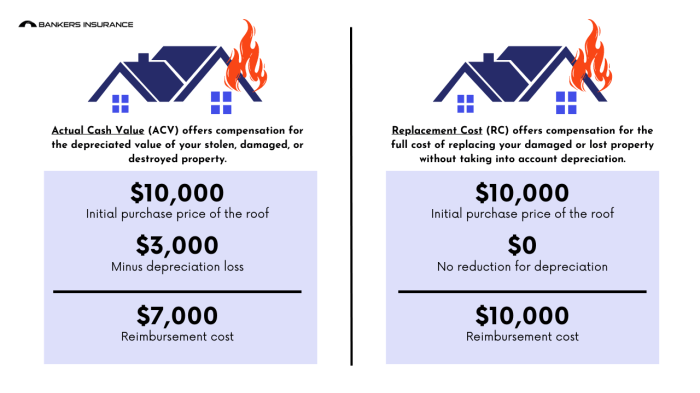

Insurance companies typically use two methods to calculate the total loss payout:

- Actual Cash Value (ACV): ACV is the most common method. It considers the vehicle’s market value at the time of the accident, taking into account depreciation, mileage, and condition. This means you’ll receive the vehicle’s fair market value minus depreciation, which can be significantly less than the original purchase price. Think of it like buying a used car – it’s worth less than a brand new one.

- Replacement Cost: This method is less common but is sometimes used for newer vehicles. It considers the cost of replacing the vehicle with a similar model in the same condition. This option usually results in a higher payout than ACV, but it’s not always available.

Repair Costs and Total Loss

Repair costs are a significant factor in total loss determination. If the cost of repairing the damage exceeds a certain percentage of the vehicle’s value, it’s likely to be totaled. This percentage can vary depending on the state and the insurance company’s policies. For example, if the repair cost is 75% or more of the vehicle’s value, it’s usually considered a total loss.

Salvage Value and Its Impact

Even if a vehicle is totaled, it still has some value. This salvage value can be recovered by the insurance company through selling the vehicle for scrap or parts. The salvage value is deducted from the total loss payout, reducing the amount you receive.

For example: If your car is totaled, and the insurance company determines its ACV is $10,000, but they can sell the salvage for $2,000, your payout will be $8,000.

Thresholds and Guidelines: How Do Insurance Companies Decide If A Car Is Totaled

Insurance companies use specific thresholds and guidelines to determine whether a vehicle is totaled. These guidelines consider factors like repair costs, vehicle value, and the age and condition of the vehicle.

Total Loss Thresholds

Insurance companies often use a predetermined percentage of the vehicle’s actual cash value (ACV) as a threshold for declaring a total loss. This percentage, commonly referred to as the “total loss threshold,” varies depending on the insurance company and the state.

- A common threshold is 75% of the ACV. This means if the cost of repairs exceeds 75% of the vehicle’s value, the insurance company may declare the car totaled.

- Some states have specific legal thresholds that insurance companies must follow. For instance, some states require a threshold of 80% or even 100% of the ACV.

- The total loss threshold can be influenced by factors like the age, make, and model of the vehicle, as well as the availability of parts.

Impact of Vehicle Age and Condition

The age and condition of a vehicle significantly influence the total loss determination.

- Older vehicles, especially those with high mileage or previous damage, tend to have lower ACVs. Therefore, even relatively minor repairs can push the repair cost above the total loss threshold.

- Vehicles in good condition with low mileage usually have higher ACVs, making them less likely to be totaled, even with significant damage.

- The insurance company will consider the vehicle’s market value, taking into account its age, mileage, condition, and any existing damage or repairs. This information helps them determine the ACV and the total loss threshold.

Situations Leading to Total Loss

A vehicle might be considered totaled even with relatively minor damage in specific situations.

- Structural Damage: If the damage affects the vehicle’s frame, chassis, or safety components, it might be considered totaled, even if the repair cost is below the typical threshold. For example, a car that has been in a collision that significantly bent the frame might be totaled, even if the bodywork damage appears minor.

- Safety Concerns: If the damage compromises the vehicle’s safety features, like airbags or seatbelts, it might be declared totaled, regardless of the repair cost. This is because the safety of the vehicle is paramount, and the insurance company may deem it unsafe to repair.

- Availability of Parts: If essential parts are unavailable or difficult to obtain, the insurance company may declare the vehicle totaled, even if the repair cost is relatively low. This is because the cost of obtaining rare or discontinued parts can be significantly high, making the repair uneconomical.

Industry Guidelines and Best Practices

Insurance companies generally follow industry guidelines and best practices to ensure consistent and fair total loss determination.

- Independent Appraisals: Many insurance companies use independent appraisers to assess the damage and determine the ACV. This helps ensure an unbiased evaluation of the vehicle’s value.

- Repair Estimates: The insurance company will obtain repair estimates from qualified repair shops to determine the cost of repairs. They will also consider the availability of parts and the time it takes to complete the repairs.

- Transparency: Insurance companies are generally transparent about their total loss determination process. They will provide policyholders with detailed explanations of their decisions, including the ACV, repair cost, and the total loss threshold applied.

The Role of the Insurance Adjuster

Think of an insurance adjuster as the detective of the car world. They’re the ones who come in after a fender bender or a more serious accident to figure out what happened and how much it’ll cost to fix it. They’re the ones who decide whether your car is totaled or not.

Insurance adjusters are crucial in determining whether a vehicle is a total loss. They use their expertise and experience to assess the damage, calculate repair costs, and compare those costs to the car’s actual cash value (ACV). This decision is a critical one, impacting both the insurance company’s financial liability and the policyholder’s future transportation options.

Steps Involved in Assessing a Damaged Vehicle

The insurance adjuster plays a vital role in the total loss determination process. Here are the steps involved in their assessment of a damaged vehicle:

After receiving a claim notification, the insurance adjuster will typically initiate the following steps:

- Contacting the Policyholder: The adjuster will reach out to the policyholder to gather information about the accident, such as the date, time, location, and details of the incident. They may also request photographs or videos of the damaged vehicle.

- Vehicle Inspection: The adjuster will personally inspect the damaged vehicle to assess the extent of the damage. They will carefully examine the vehicle’s body, engine, interior, and other components. They will take notes, photographs, and measurements to document the damage.

- Estimating Repair Costs: Based on their inspection and knowledge of vehicle repair costs, the adjuster will prepare an estimate of the cost to repair the vehicle. This estimate will include labor and parts costs, as well as any additional expenses such as towing, storage, or rental car fees.

- Determining Actual Cash Value (ACV): The adjuster will determine the vehicle’s ACV, which is the market value of the vehicle before the accident. They may use various resources, such as online valuation tools, dealer prices, and auction data, to arrive at a fair ACV.

- Comparing Repair Costs to ACV: The adjuster will compare the estimated repair costs to the ACV. If the repair costs exceed a certain percentage of the ACV (typically 70-80%), the vehicle is likely to be declared a total loss.

- Total Loss Determination: Based on their assessment, the adjuster will decide whether to declare the vehicle a total loss. This decision is made by comparing the repair costs to the vehicle’s ACV. If the repair costs exceed a certain percentage of the ACV, the vehicle is declared a total loss.

Communication with the Policyholder

Open and transparent communication is essential throughout the total loss determination process. The adjuster will:

- Keep the policyholder informed about the progress of the assessment.

- Explain the process of total loss determination and the factors considered.

- Answer any questions the policyholder may have about the process.

- Provide updates on the status of the claim.

Explaining the Total Loss Decision

If the adjuster determines that the vehicle is a total loss, they will communicate the decision to the policyholder. They will:

- Explain the reasoning behind the total loss decision.

- Provide details about the settlement amount, which is typically the ACV minus any deductible.

- Discuss the policyholder’s options, such as receiving the settlement amount or keeping the totaled vehicle.

- Answer any questions the policyholder may have about the total loss process.

Policyholder Rights and Options

Okay, so your car’s been totaled. It’s a bummer, but don’t freak out! You’ve got rights and options. Let’s break it down.

When your car is declared a total loss, you’re not just left hanging. Your insurance company has to play fair and help you get back on the road.

Receiving a Cash Settlement

You have the right to receive a cash settlement from your insurance company, which is based on the actual cash value (ACV) of your car. The ACV is determined by factors like the car’s age, mileage, condition, and market value. You can use this money to buy a new car, repair your old one (if it’s fixable), or even put it towards something else entirely.

Choosing a Replacement Vehicle

Some insurance policies offer the option to choose a replacement vehicle instead of receiving a cash settlement. This means your insurance company will pay for a new car, but it’s important to understand that they’ll likely limit the amount they’ll pay. They’ll usually cap it at the ACV of your old car, plus any applicable deductions for things like depreciation or a deductible.

Negotiating a Settlement

You’re not obligated to accept the first settlement offer from your insurance company. If you feel the offer is too low, you can negotiate with them. It’s helpful to gather information like repair estimates from local shops, recent market values for similar vehicles, and any relevant documentation that supports your case.

Appealing a Total Loss Determination

If you disagree with the insurance company’s determination that your car is a total loss, you can appeal their decision. You’ll need to provide them with evidence to support your claim, such as repair estimates or documentation showing that the car is worth more than what they’re offering.

Epilogue

In the end, the decision of whether or not your car is totaled is a complex one. Insurance companies rely on a combination of factors, including repair costs, vehicle value, and industry guidelines. Understanding these factors can help you better understand the process and make informed decisions about your options. Remember, you have rights as a policyholder, and you can always negotiate a settlement or appeal a total loss determination if you feel it’s not fair.

Question & Answer Hub

What if I disagree with the insurance company’s total loss determination?

You have the right to appeal the decision. You can contact your insurance company directly or consult with an attorney to explore your options.

What happens to my car if it’s totaled?

The insurance company typically takes possession of the vehicle. They may sell it at auction as salvage or dispose of it.

Can I keep my totaled car?

In some cases, you may be able to purchase your totaled car from the insurance company for its salvage value.

What happens if I have a loan on my totaled car?

The insurance company will typically pay off the loan balance, and you may receive any remaining value as a cash settlement.