How do insurance companies determine if a car is totaled? It’s a question that pops up when you’re dealing with the aftermath of a fender bender, a collision, or any other kind of car accident. You’re already stressed, and the last thing you want to hear is that your beloved ride is considered a “total loss.” But what exactly makes a car a total loss, and how do insurance companies decide? Let’s break it down, so you can navigate this tricky situation with confidence.

Insurance companies use a complex formula to decide if your car is totaled. They consider the car’s value, the cost of repairs, and the cost of replacing the car. If the cost of repairs is greater than the value of the car, it’s likely to be declared a total loss. But it’s not always that simple. Things like the car’s age, mileage, condition, and market value all play a role in the decision. And remember, each state has its own set of rules for total loss determination.

The Total Loss Threshold

Think of the total loss threshold as the magical number that determines if your car is considered a total loss after an accident. This number is a key factor in how insurance companies decide whether to repair your car or just give you a check to buy a new one. It’s not a one-size-fits-all situation, though. The total loss threshold can vary depending on a few things.

Factors Influencing the Total Loss Threshold

The total loss threshold is calculated by considering the car’s value and the cost of repairs. It’s like a tug-of-war between these two factors. If the cost of repairs is greater than the car’s value, it’s usually declared a total loss. But there are other factors that can influence this decision.

- State Laws: Each state has its own set of rules about how total losses are determined. Some states have specific laws about the percentage of the car’s value that must be exceeded by the repair costs before it’s considered a total loss. For example, some states may require the repair costs to be 75% or 80% of the car’s value before it’s totaled.

- Insurance Company Policies: Insurance companies have their own internal guidelines and policies that determine their total loss threshold. These policies can vary between different insurance companies, even within the same state.

- Salvage Value: The salvage value is the amount of money an insurance company can get by selling your wrecked car to a salvage yard. This value is factored into the total loss calculation. If the salvage value is high, the insurance company may be more likely to declare your car a total loss.

- Market Conditions: The value of your car can fluctuate based on market conditions, such as supply and demand. If the market value of your car is low, it may be more likely to be totaled, even if the repair costs are relatively low.

Examples of Total Loss Threshold Impact

Here are a few examples of how the total loss threshold can impact the outcome of a claim:

- Scenario 1: You have a 2018 Honda Civic that was involved in a rear-end collision. The repair costs are $8,000, and the car’s market value is $10,000. In this case, the repair costs are less than the car’s value. The insurance company may choose to repair the car, even though the repair costs are significant.

- Scenario 2: You have a 2005 Toyota Camry that was involved in a major accident. The repair costs are $12,000, and the car’s market value is $5,000. In this case, the repair costs are more than double the car’s value. The insurance company is likely to declare the car a total loss.

- Scenario 3: You have a 2015 Ford Mustang that was involved in a minor accident. The repair costs are $3,000, and the car’s market value is $15,000. However, the car has a high salvage value because it’s a popular model. In this case, the insurance company may still declare the car a total loss because the salvage value could offset the repair costs.

The Total Loss Process

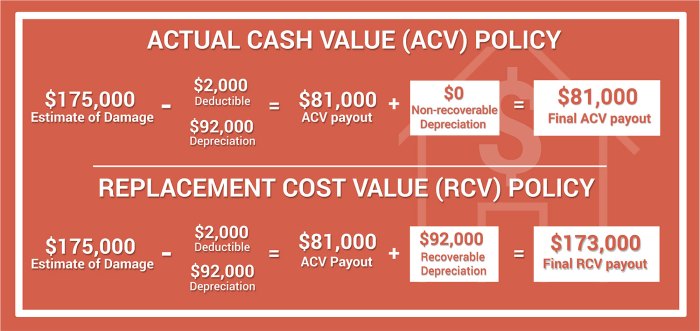

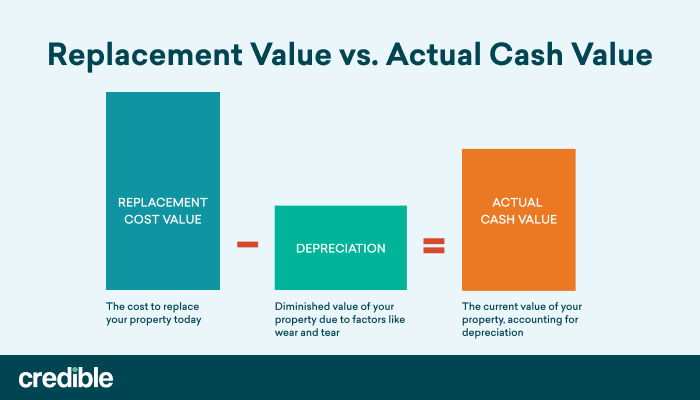

When your car is damaged beyond repair, your insurance company will declare it a total loss. This means the cost of repairing the vehicle exceeds its actual cash value (ACV). The process of declaring a total loss can seem overwhelming, but it’s important to understand the steps involved.

The Role of the Insurance Adjuster

The insurance adjuster plays a crucial role in determining whether a vehicle is totaled. After you file a claim, the adjuster will inspect the damaged vehicle and assess its condition. They’ll use various methods, such as comparing the cost of repairs to the vehicle’s ACV, to determine if it’s economically feasible to repair the car.

Steps in the Total Loss Process

Here’s a step-by-step breakdown of how the total loss process works:

- File a Claim: The first step is to contact your insurance company and file a claim. Provide them with all the necessary details about the accident or incident that caused the damage.

- Inspection: Once you’ve filed a claim, the insurance company will send an adjuster to inspect the damaged vehicle. The adjuster will assess the extent of the damage and determine the cost of repairs.

- Total Loss Determination: Based on the inspection and repair estimates, the adjuster will determine if the vehicle is a total loss. They’ll compare the cost of repairs to the vehicle’s ACV.

- Notification: The insurance company will notify you of their decision regarding the total loss. They will explain the reasons for their decision and provide you with your options.

- Settlement: If the vehicle is declared a total loss, you’ll have the option to receive a cash settlement or choose a replacement vehicle. The settlement amount will be based on the vehicle’s ACV, which is determined by factors such as its age, mileage, condition, and market value.

Options After a Total Loss Declaration, How do insurance companies determine if a car is totaled

Once your car is declared a total loss, you have two main options:

- Cash Settlement: You can choose to receive a cash settlement based on the vehicle’s ACV. This option gives you the flexibility to purchase a new or used car, or use the money for other purposes.

- Replacement Vehicle: You can choose to have the insurance company provide you with a replacement vehicle. This option is typically offered if you have collision coverage and your car is relatively new. The replacement vehicle will be similar in make, model, and year to your totaled car.

Last Point: How Do Insurance Companies Determine If A Car Is Totaled

So, while the “total loss” label might seem like a bummer, understanding how insurance companies make this decision can empower you. You can be better prepared to negotiate a fair settlement, and you can even learn to avoid situations that might lead to a total loss in the first place. Remember, it’s all about knowing the rules of the game, and that’s where knowledge is your best defense.

User Queries

What happens if my car is declared a total loss?

If your car is declared a total loss, your insurance company will pay you the actual cash value (ACV) of your car. This is the amount your car was worth before the accident, minus depreciation. You can then use this money to buy a new car, or you can keep the money and walk away from the car.

What if I disagree with the insurance company’s decision to total my car?

You have the right to appeal the insurance company’s decision. You can do this by providing additional information, such as an appraisal from an independent mechanic. If you’re still not satisfied, you can file a complaint with your state’s insurance department.

What is the total loss threshold?

The total loss threshold is the point at which the cost of repairs exceeds the value of the car. This threshold can vary depending on the state and the insurance company.

Can I keep my totaled car?

In some cases, you may be able to keep your totaled car. However, you will likely have to pay the insurance company for the salvage value of the car. This is the amount the insurance company can sell the car for after it’s been totaled.