How do you invest in stocks? It’s a question many people ask, especially those looking to grow their wealth and build a secure future. Investing in the stock market can be a powerful tool for achieving financial goals, but it’s essential to understand the basics before diving in. Think of it like building a house – you need a solid foundation before you can start adding rooms. This guide will walk you through the fundamentals of stock investing, from understanding the market to placing your first order.

We’ll cover different investment strategies, choosing the right brokerage account, researching stocks, and managing your portfolio. By the end, you’ll have a good grasp of how to get started with stock investing and be on your way to building a diversified and potentially profitable portfolio.

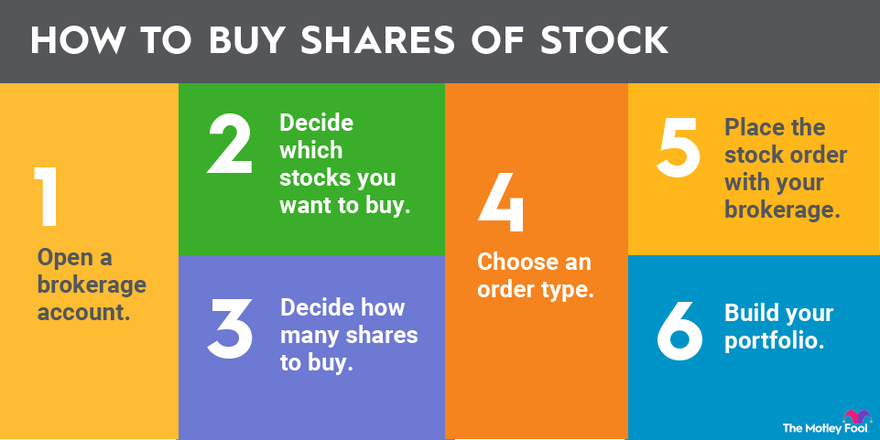

Opening a Brokerage Account

Before you can invest in stocks, you’ll need to open a brokerage account. This is like a bank account, but instead of holding your money, it holds your investments. Brokerage accounts are the gateway to the stock market, allowing you to buy, sell, and manage your investments.

Types of Brokerage Accounts, How do you invest in stocks

There are several types of brokerage accounts, each with its own features and fees. Here are some of the most common:

- Cash Accounts: These accounts require you to pay for your trades in full before you can execute them. This means you can only buy stocks if you have enough cash in your account. Cash accounts are great for investors who want to avoid debt and maintain control over their spending.

- Margin Accounts: These accounts allow you to borrow money from your broker to buy stocks. This can be beneficial if you want to leverage your investments and potentially earn higher returns, but it also carries more risk.

- Robo-Advisors: These platforms use algorithms to automatically invest your money based on your risk tolerance and investment goals. They’re a good option for beginners or investors who want a hands-off approach to investing.

- Retirement Accounts: These accounts are specifically designed for retirement savings. They offer tax advantages, such as tax-deferred growth or tax-free withdrawals. Some common types of retirement accounts include 401(k)s, IRAs, and Roth IRAs.

Opening and Funding a Brokerage Account

Opening a brokerage account is a relatively simple process. You’ll need to provide some personal information, such as your name, address, and Social Security number. You’ll also need to choose a broker and select the type of account you want to open.

- Choose a Broker: Research different brokers and compare their fees, features, and investment options. Consider factors like the minimum deposit requirement, trading commissions, research tools, and customer service.

- Fill Out an Application: Once you’ve chosen a broker, you’ll need to fill out an application online or in person. You’ll need to provide personal information, such as your name, address, and Social Security number.

- Fund Your Account: You can fund your brokerage account by transferring money from your bank account or by depositing a check.

Comparing Brokerage Platforms

Here’s a table comparing the features and fees of some popular brokerage platforms:

| Broker | Minimum Deposit | Trading Commissions | Research Tools | Other Features |

|---|---|---|---|---|

| Fidelity | $0 | $0 | Extensive research reports, analyst ratings, and stock screeners | Fractional shares, retirement accounts, and robo-advisor services |

| TD Ameritrade | $0 | $0 | Advanced charting tools, real-time market data, and educational resources | Margin accounts, options trading, and futures trading |

| Charles Schwab | $0 | $0 | Comprehensive research reports, analyst ratings, and stock screeners | Retirement accounts, robo-advisor services, and fractional shares |

| E*TRADE | $0 | $0 | Advanced charting tools, real-time market data, and educational resources | Margin accounts, options trading, and futures trading |

Researching Stocks

Before you jump into buying any stock, it’s crucial to do your homework. Researching stocks is like getting to know a company before you decide to invest in it. It’s all about understanding its potential and risks. There are two main approaches to stock research: fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis is like digging into a company’s financials and operations. It’s about evaluating its financial health, its competitive position in the market, and its long-term growth prospects. This approach helps you determine if a stock is fairly valued and if it’s a good investment for your portfolio.

Here’s a step-by-step guide to researching a company’s financial performance using fundamental analysis:

Reviewing Financial Statements

The first step is to understand a company’s financial health. You can do this by examining its financial statements:

- Income Statement: Shows a company’s revenue, expenses, and net income over a period of time. This helps you understand how profitable a company is.

- Balance Sheet: Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It shows what a company owns, what it owes, and how much it’s worth.

- Cash Flow Statement: Tracks the movement of cash into and out of a company. This shows how much cash a company generates from its operations, investing activities, and financing activities.

Analyzing Key Ratios

Financial ratios are like a magnifying glass for a company’s financial performance. They help you compare a company’s performance to its industry peers and to its own historical performance. Some key ratios to look at include:

- Profitability Ratios: Measure a company’s ability to generate profits, such as return on equity (ROE) and net profit margin.

- Liquidity Ratios: Assess a company’s ability to meet its short-term financial obligations, such as the current ratio and quick ratio.

- Solvency Ratios: Indicate a company’s ability to meet its long-term financial obligations, such as the debt-to-equity ratio and times interest earned ratio.

- Valuation Ratios: Help you determine if a stock is fairly valued, such as the price-to-earnings (P/E) ratio and price-to-book (P/B) ratio.

Assessing Management Quality

Management plays a crucial role in a company’s success. You should evaluate the quality of a company’s management team by looking at their experience, track record, and compensation. A strong management team can drive growth and create shareholder value.

Examining Industry Trends

Understanding the industry in which a company operates is important. Research the industry’s growth prospects, competitive landscape, and regulatory environment. This helps you assess the company’s potential for success.

Technical Analysis

Technical analysis focuses on stock price patterns and trading volume. It uses charts and indicators to identify trends and predict future price movements. This approach can help you time your entries and exits in the market and identify potential support and resistance levels.

Tools and Resources

There are many tools and resources available for analyzing stock charts and trends:

- Charting Software: Programs like TradingView and StockCharts.com allow you to create and analyze charts using various indicators and tools. You can customize charts to your liking and overlay technical indicators.

- Technical Indicators: These are mathematical formulas that help you identify trends and patterns in stock prices. Some common indicators include:

- Moving averages

- Relative strength index (RSI)

- Bollinger Bands

- MACD

- Online Communities: Forums and social media groups dedicated to technical analysis can provide insights and perspectives from other traders.

Placing Your First Order

You’ve done your research, you’ve found a company you believe in, and you’re ready to take the plunge. Now it’s time to place your first order! This is where your brokerage account comes into play, acting as your gateway to the stock market.

Placing a Buy Order

A buy order is simply an instruction to your brokerage to purchase a specific number of shares of a particular stock at a certain price. The process is usually straightforward and can be done in a few clicks.

- Log in to your brokerage account: This is where you’ll find the “trade” or “order” section.

- Search for the stock: Enter the ticker symbol of the stock you want to buy. For example, if you’re interested in Apple, you would search for “AAPL”.

- Specify the order type: You can choose from various order types, each with its own nuances.

- Enter the quantity: This is the number of shares you want to purchase.

- Set the price: You can choose to buy at the current market price (market order) or at a specific price (limit order).

- Review and confirm: Double-check your order details before clicking “submit” or “place order”.

Placing a Sell Order

Selling shares is just as simple as buying them. You follow a similar process, but instead of buying, you’re instructing your brokerage to sell a specific number of shares at a certain price.

- Log in to your brokerage account: Navigate to the “trade” or “order” section.

- Search for the stock: Enter the ticker symbol of the stock you want to sell.

- Specify the order type: Choose from various order types.

- Enter the quantity: This is the number of shares you want to sell.

- Set the price: You can sell at the current market price (market order) or at a specific price (limit order).

- Review and confirm: Double-check your order details before clicking “submit” or “place order”.

Order Types

The order type you choose determines how your order is executed. Here are some common types:

- Market Order: A market order instructs your brokerage to buy or sell shares at the best available price at that moment. This is the most common type of order, but it doesn’t guarantee you’ll get the exact price you want.

- Limit Order: A limit order allows you to set a maximum price for buying or a minimum price for selling. This helps you control the price you’re willing to pay or receive. If the stock price doesn’t reach your limit, your order won’t be executed.

- Stop-Loss Order: A stop-loss order is a protective measure that automatically sells your shares if the price falls below a certain level. This helps to limit your potential losses.

- Stop-Limit Order: A stop-limit order combines the features of a stop order and a limit order. It sets a stop price and a limit price. The order is triggered when the stop price is reached, but it won’t be executed unless the price also meets the limit price.

Setting Stop-Loss Orders

Stop-loss orders are important for managing risk. They help you limit potential losses if the stock price takes a sudden downturn. To set a stop-loss order, you need to determine a price level that triggers the sale of your shares. This price should be below the current market price and should be a level that you’re comfortable with.

Example: Let’s say you bought 100 shares of a company at $50 per share. You could set a stop-loss order at $45 per share. If the price of the stock falls below $45, your order will automatically trigger, and your shares will be sold at the best available price. This helps to prevent further losses.

Setting Limit Orders

Limit orders are useful for controlling the price you’re willing to pay or receive. They can help you avoid paying a high price for a stock or ensure you don’t sell your shares at a low price.

Example: If you want to buy 100 shares of a company at $50 per share, but you’re only willing to pay up to $48 per share, you could set a limit order at $48. If the stock price falls to $48 or below, your order will be executed. If the price stays above $48, your order will not be filled.

Final Summary

Investing in the stock market can be both exciting and daunting, but with the right knowledge and strategy, it can be a rewarding journey. Remember, patience, discipline, and a long-term perspective are key to success. Don’t be afraid to seek advice from financial professionals and stay informed about market trends and news. As you navigate the world of stocks, you’ll discover a wealth of opportunities to grow your investments and achieve your financial goals.

FAQs: How Do You Invest In Stocks

What is the minimum amount I need to start investing in stocks?

There’s no set minimum, but many brokerages allow you to start with as little as $1. It’s best to start small and gradually increase your investments as you become more comfortable.

How do I know if a stock is a good investment?

Thorough research is crucial. Analyze a company’s financial performance, industry trends, and competitive landscape. Consider its growth potential, profitability, and debt levels.

What are some common investment mistakes to avoid?

Common mistakes include investing based on hype, not diversifying your portfolio, and trading too frequently. Remember, patience and long-term thinking are key.