How does company insurance work? It’s like having a superhero for your business, protecting you from unexpected villains like lawsuits, accidents, and natural disasters. Imagine your company’s a rockstar band, touring the country, selling out stadiums. But what happens if the tour bus crashes? What if a fan gets hurt during a show? That’s where insurance comes in, like the roadies who keep everything running smoothly, even when things get crazy.

Company insurance is a shield that protects your business from the unexpected. It covers a wide range of situations, from employee injuries to property damage, providing financial protection and peace of mind. Think of it as a safety net, catching you when things go wrong and helping you bounce back stronger than ever.

Types of Company Insurance: How Does Company Insurance Work

Just like you wouldn’t walk out of your house without a good pair of shoes, businesses need insurance to protect themselves from unexpected bumps in the road. There are tons of different types of insurance out there, and each one is tailored to protect a specific aspect of your business. Let’s dive into the most common types and why they’re essential.

Liability Insurance

Liability insurance is like your business’s personal bodyguard. It protects you from financial loss if someone gets hurt or their property gets damaged because of something your company did or didn’t do. Think of it like this: You’re hosting a company party, and someone trips over a loose rug and breaks their leg. Liability insurance would cover the medical bills and any legal costs that might arise. There are different types of liability insurance, such as:

- General Liability Insurance: This is the basic protection for most businesses. It covers things like bodily injury, property damage, and personal injury. It’s like the all-around protection you need for your business.

- Product Liability Insurance: If your company manufactures or sells products, this insurance protects you from claims if someone gets hurt or their property gets damaged because of a defect in your product. Imagine your company sells a line of coffee mugs, and one of them has a manufacturing flaw that causes it to shatter, injuring someone. Product liability insurance would come to the rescue.

- Professional Liability Insurance (Errors & Omissions): This insurance is crucial for businesses that provide professional services, like lawyers, accountants, and consultants. It protects you from claims if a mistake or oversight in your work causes financial harm to a client. Imagine you’re a financial advisor, and you give your client some bad advice that costs them money. Professional liability insurance would help cover the losses.

Property Insurance

Property insurance is like a safety net for your business’s physical assets. It protects you from financial loss if your building, equipment, or inventory gets damaged or destroyed by things like fire, theft, or natural disasters. Think of it as a way to keep your business running smoothly, even if disaster strikes.

- Commercial Property Insurance: This insurance covers your building, its contents, and any other structures on your property. It’s like a comprehensive protection plan for your business’s physical assets.

- Business Income Insurance: This insurance helps you cover lost income if your business has to shut down temporarily due to a covered event, like a fire or a flood. It’s like a backup plan to keep your business afloat during tough times.

Workers’ Compensation Insurance

Workers’ compensation insurance is a must-have for any business with employees. It protects your employees if they get injured or become ill on the job. It covers medical expenses, lost wages, and rehabilitation costs. It’s like a safety net for your employees, giving them peace of mind knowing they’re covered if something happens.

Health Insurance

Health insurance is a vital benefit for your employees, and it’s a great way to attract and retain top talent. It helps cover the cost of medical expenses, such as doctor visits, hospital stays, and prescription drugs. It’s like a health shield for your employees, giving them access to quality healthcare.

Understanding Coverage

Think of your company insurance policy like a superhero’s suit. It protects your business from all sorts of nasty situations, but it also has its limits. Just like your favorite hero can’t fly through buildings, your insurance policy has specific things it covers and doesn’t cover.

To make sure your policy is a good fit, you need to understand the key elements, including coverage limits, deductibles, and exclusions.

Coverage Limits

Coverage limits are the maximum amount your insurance company will pay for a covered loss. Think of it as the insurance company’s budget for your problems. It’s like a superhero’s energy bar – it has a limit, and once it’s used up, you’re on your own.

For example, if you have a liability policy with a $1 million limit and a customer sues you for $2 million, your insurance company will only pay up to $1 million. You’ll be responsible for the remaining $1 million.

Deductibles, How does company insurance work

A deductible is the amount you pay out of pocket before your insurance kicks in. It’s like the superhero’s “cool down” time – you gotta do some work before the magic happens. The higher the deductible, the lower your premium will be.

For example, if you have a property insurance policy with a $5,000 deductible and a fire damages your building causing $10,000 in losses, you’ll pay the first $5,000 and your insurance company will cover the remaining $5,000.

Exclusions

Exclusions are specific situations that are not covered by your policy. It’s like the superhero’s “kryptonite” – certain things they just can’t handle. It’s important to know what your policy doesn’t cover, so you can plan accordingly.

For example, most general liability policies exclude coverage for intentional acts, like fraud or assault. You’ll need to purchase additional coverage if you want to protect yourself against these types of risks.

Understanding Your Policy

Reading your policy is like reading the instruction manual for your superhero suit – it’s essential to understand how it works.

Here are some tips for making sense of your policy:

- Don’t be afraid to ask for help. Your insurance agent can explain the policy in plain English.

- Pay attention to the definitions. Insurance policies use specific terms that can be confusing. The definitions section will clarify what those terms mean.

- Read the exclusions carefully. This is where you’ll find out what your policy doesn’t cover.

- Keep a copy of your policy in a safe place.

The Insurance Process

Navigating the world of company insurance can feel like a trip through a maze. But don’t worry, it’s not as scary as it seems! Like any good adventure, it’s all about taking it step-by-step, and we’re here to be your trusty guide.

The Initial Assessment

Before you dive into the insurance pool, you need to know what you’re swimming with. This initial assessment is like figuring out your risk profile. What are your company’s unique needs and potential hazards? Think about things like your industry, the size of your workforce, your property and equipment, and any specific risks you might face.

Risk Assessment

Now, it’s time to get serious about those risks. This is where the insurance experts come in. They’ll analyze your business operations and identify potential threats, like accidents, lawsuits, or natural disasters. This isn’t about scaring you; it’s about understanding your vulnerability and finding ways to mitigate it.

- Types of Risk Assessment: There are a few different ways to assess risk, and the right approach depends on your company’s size and complexity. Common methods include:

- Qualitative Risk Assessment: This method involves using expert judgment and experience to assess the likelihood and impact of risks. It’s often used for smaller companies with limited data.

- Quantitative Risk Assessment: This method uses statistical data and mathematical models to assess risk. It’s often used for larger companies with more complex operations.

- Semi-Quantitative Risk Assessment: This method combines elements of both qualitative and quantitative assessment, providing a more balanced approach.

- Key Factors to Consider: When conducting a risk assessment, it’s crucial to consider factors like:

- Frequency: How often is the risk likely to occur?

- Severity: What is the potential impact of the risk?

- Controllability: How much control do you have over the risk?

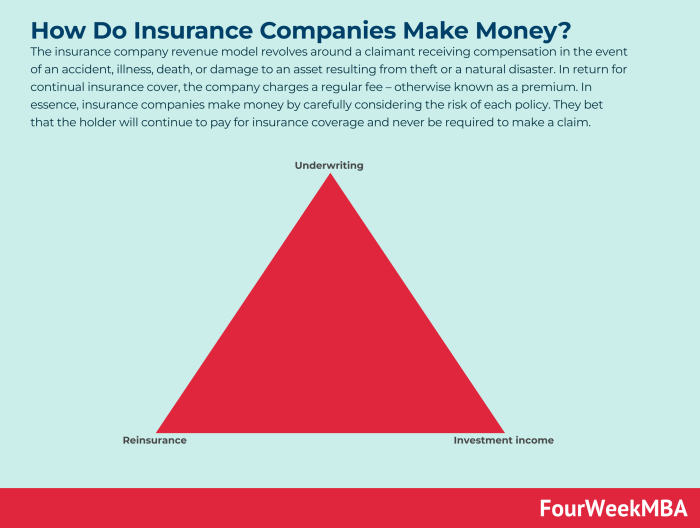

Premium Calculation

Now, let’s talk money. Once the risk assessment is complete, insurance companies use this information to calculate your premiums. Think of it like this: the more risks you have, the higher your premium will be. The good news is that there are ways to reduce your premium by taking steps to mitigate your risks, like implementing safety protocols or investing in security systems.

- Premium Factors: Several factors influence the calculation of your premium, including:

- Type of Coverage: The type of insurance you need will affect your premium. For example, general liability insurance will typically cost less than workers’ compensation insurance.

- Deductible: The amount you agree to pay out of pocket before your insurance kicks in. A higher deductible means a lower premium, but you’ll pay more if you have a claim.

- Claim History: If your company has a history of filing claims, your premium may be higher.

- Location: Your company’s location can also impact your premium. For example, companies in areas with high crime rates or natural disaster risks may pay higher premiums.

Policy Negotiation

Now that you know the cost, it’s time to negotiate the terms of your policy. This is where your insurance broker or agent becomes your champion. They’ll work with the insurance company to get you the best possible coverage at the most competitive price.

- Negotiation Strategies: Your broker or agent will use a variety of strategies to negotiate the best deal for you, including:

- Comparing Quotes: They’ll get quotes from multiple insurance companies to ensure you’re getting the best possible price.

- Negotiating Coverage: They’ll work with the insurance company to ensure your policy provides the right coverage for your needs.

- Advocating for You: They’ll act as your advocate in the event of a claim, ensuring you receive fair and timely compensation.

Policy Issuance

Once you’re happy with the terms of your policy, it’s time to sign on the dotted line. The insurance company will issue your policy, which Artikels the terms of your coverage, including the premium, deductible, and coverage limits.

Claims and Compensation

So, you’ve got your company insurance, but what happens when something goes wrong? That’s where claims come in. Think of it like this: your insurance is your safety net, and filing a claim is like calling for help when you need it.

Claims are the process of requesting compensation from your insurance company for covered losses or damages. It’s like a request for reimbursement, but with a few more steps.

The Claims Process

When you need to file a claim, you’ll typically contact your insurance company directly. This can be done through their website, by phone, or even by mail. You’ll need to provide information about the incident, like when it happened, what happened, and any injuries or damages. The insurance company will then review your claim and decide if it’s covered under your policy.

Here’s a breakdown of what you’ll need to do:

* Report the incident: Contact your insurance company immediately after the incident occurs. This could be a fire, theft, or even a slip and fall on your property.

* Provide documentation: Be prepared to provide detailed information about the incident, including dates, times, locations, and descriptions of the damage or loss. This might include police reports, medical bills, receipts, or photos.

* Cooperate with the insurance adjuster: An insurance adjuster will be assigned to your claim to investigate and assess the damage. You’ll need to cooperate with them, providing any necessary information and allowing them to inspect the property or injury.

* Negotiate the settlement: Once the adjuster has completed their investigation, they will determine the amount of compensation you are eligible for. You may have the opportunity to negotiate this amount if you believe it’s not fair.

Types of Compensation

Insurance policies can provide a variety of types of compensation depending on the type of coverage you have. Here are some of the most common types:

* Financial reimbursement: This is the most common type of compensation and covers financial losses like property damage, lost wages, or business interruption. For example, if your office building is damaged by a fire, your insurance company might cover the cost of repairs or rebuilding.

* Medical expenses: If you or your employees are injured, your insurance policy might cover medical expenses like doctor visits, hospital stays, and medications.

* Legal defense: Some insurance policies provide legal defense coverage for lawsuits. This means that your insurance company will pay for legal fees and costs if you are sued.

The Role of Insurance Adjusters

Insurance adjusters play a crucial role in the claims process. They are responsible for investigating claims, assessing the damage, and determining the amount of compensation that should be paid. Adjusters have a lot of experience and expertise in evaluating claims and negotiating settlements.

Think of them like the middlemen between you and the insurance company. They work to ensure that you receive fair compensation for your losses, but they also need to protect the insurance company’s interests.

Benefits of Company Insurance

Imagine a world where a natural disaster, a lawsuit, or a sudden accident could cripple your business overnight. Scary, right? That’s where company insurance comes in – it’s like having a superhero cape for your business, protecting you from financial ruin and keeping your operations running smoothly.

Company insurance is like having a safety net for your business. It provides financial protection, legal defense, and peace of mind, allowing you to focus on running your business and achieving your goals without constantly worrying about unexpected events.

Financial Protection

Company insurance offers financial protection in a variety of situations, shielding your business from unexpected costs and financial losses.

- Property Damage: If your business property is damaged by fire, flood, or other disasters, insurance can help cover the cost of repairs or replacement.

- Liability Claims: If someone is injured on your property or as a result of your business operations, insurance can help cover legal fees and settlements.

- Business Interruption: If your business is forced to close due to an insured event, insurance can help cover lost income and operating expenses.

Legal Defense

Legal battles can be expensive and time-consuming, but company insurance can help you navigate these challenges.

- Legal Representation: If you are sued, insurance can provide you with legal representation, ensuring you have experienced attorneys fighting for your interests.

- Defense Costs: Insurance can help cover the costs of legal fees, court costs, and expert witness fees.

Peace of Mind

Knowing that you have insurance can provide a sense of peace of mind, allowing you to focus on your business without constantly worrying about potential risks.

- Reduced Stress: Insurance can help alleviate the stress of potential financial losses, allowing you to concentrate on running your business.

- Business Continuity: Insurance can help ensure that your business can continue operating in the event of an unexpected event, minimizing disruptions and protecting your long-term success.

Conclusive Thoughts

So, whether you’re a small startup or a major corporation, understanding company insurance is crucial. It’s like having a secret weapon in your business arsenal, ensuring you’re prepared for anything. By understanding the different types of coverage, the process of obtaining insurance, and the factors that affect costs, you can make informed decisions that protect your business and set you up for success. So, go forth, conquer the business world, and rest assured knowing that your company insurance has your back!

General Inquiries

What are the most common types of company insurance?

Common types include liability insurance, property insurance, workers’ compensation insurance, and health insurance. These cover different aspects of your business, like protecting you from lawsuits, covering property damage, and providing medical benefits for employees.

How much does company insurance cost?

The cost of company insurance varies based on factors like your industry, location, size, and risk profile. It’s best to get quotes from different insurance providers to compare prices and find the best deal.

Do I need an insurance broker?

While not always necessary, insurance brokers can be helpful in finding the right coverage and negotiating the best rates. They act as your advocate and can help you navigate the complex world of insurance.

What happens if I need to file a claim?

Filing a claim usually involves providing documentation and following the steps Artikeld in your policy. The insurance adjuster will evaluate your claim and determine the amount of compensation you’re eligible for.