How many auto insurance companies are there? It’s a question that might seem simple, but the answer is more complex than you might think. Think about it like this: you’re trying to find the perfect song for your road trip, but there are so many choices, it’s overwhelming! The auto insurance industry is a diverse landscape with companies of all sizes, operating across the country. Some are national giants, while others focus on specific regions or even local communities. And with the rise of online-only insurers, the game has changed even more.

From the regulations that shape the market to the competitive forces at play, understanding the factors influencing the number of auto insurance companies is key to making informed decisions. We’ll dive into the industry, explore its evolution, and uncover the data that tells the story of this ever-changing landscape.

The Scope of the Auto Insurance Industry

The auto insurance industry in the United States is a complex and diverse landscape, with a wide range of companies catering to the needs of millions of drivers. From national giants to local agencies, these companies offer various insurance products and services to protect drivers and their vehicles against financial losses due to accidents, theft, and other perils.

Types of Auto Insurance Companies

Understanding the different types of auto insurance companies helps consumers make informed choices when selecting coverage. These companies can be broadly categorized based on their geographic reach and operational model.

- National Companies: These companies operate in multiple states across the country, offering a wide range of insurance products and services. They typically have a large customer base, extensive infrastructure, and strong brand recognition. Examples of national auto insurance companies include State Farm, Geico, Progressive, and Allstate. These companies hold significant market share, with State Farm being the largest auto insurer in the United States, followed by Geico and Progressive.

- Regional Companies: These companies operate in specific geographic regions, often focusing on a particular state or group of states. They may have a smaller customer base than national companies but can offer more personalized services and tailored insurance products to meet the needs of local drivers. Examples of regional auto insurance companies include Farmers Insurance, USAA, and Erie Insurance. These companies typically have a strong presence in their respective regions, often exceeding the market share of national companies in certain areas.

- Local Companies: These companies operate within a specific city or town, providing localized insurance services to their community. They often have close relationships with their customers and can offer more personalized attention and competitive pricing. Examples of local auto insurance companies include independent insurance agencies and brokerages that represent multiple insurance carriers. While they may not have the same market share as national or regional companies, local companies play a crucial role in serving the insurance needs of specific communities.

- Online-Only Companies: These companies operate exclusively online, offering insurance products and services through their websites and mobile apps. They often have lower overhead costs than traditional insurance companies, allowing them to offer competitive rates. Examples of online-only auto insurance companies include Esurance, Lemonade, and Root. These companies have gained significant traction in recent years, attracting customers with their convenient online platforms and innovative features.

Factors Influencing the Number of Companies

The number of auto insurance companies in the United States is influenced by a complex interplay of factors, including regulatory oversight, competitive dynamics, and technological advancements. These forces shape the market landscape, influencing the entry and exit of players, and ultimately determining the overall number of companies operating in the industry.

The Regulatory Environment

The regulatory environment for auto insurance is a key driver of the number of companies in the market. State laws and regulations play a significant role in setting the rules of the game for insurance companies. These regulations cover a wide range of areas, including:

- Licensing Requirements: States have specific requirements for companies seeking to operate within their jurisdictions. These requirements often include financial stability standards, minimum capital reserves, and the appointment of licensed agents or brokers. These regulations ensure that only financially sound and qualified companies can offer auto insurance to consumers.

- Rate Regulation: Some states regulate insurance rates to ensure affordability and prevent unfair pricing practices. These regulations can range from strict price controls to more flexible guidelines that allow companies to adjust rates based on factors such as risk profiles and driving history.

- Consumer Protection Regulations: States have enacted various consumer protection laws to safeguard policyholders. These laws may cover areas such as unfair claims practices, the requirement for clear and concise policy language, and the availability of dispute resolution mechanisms.

The regulatory landscape can impact the number of companies in several ways. Stricter regulations can increase the cost of entry and operation, potentially discouraging smaller or newer companies from entering the market. Conversely, more lenient regulations may attract new entrants, leading to increased competition.

The Competitive Landscape

The auto insurance market is highly competitive, with a multitude of players vying for market share. This competition is driven by several factors, including:

- Mergers and Acquisitions: The auto insurance industry has seen a significant number of mergers and acquisitions in recent years. These transactions can lead to consolidation in the market, reducing the number of independent companies.

- New Entrants: The emergence of new entrants, particularly digital insurance platforms, has injected fresh competition into the market. These companies often leverage technology to offer more personalized and efficient insurance experiences, challenging traditional players.

- Price Wars: Competition among insurers can lead to price wars, as companies try to attract customers with lower premiums. While this can benefit consumers, it can also squeeze profit margins for insurers, potentially leading to consolidation or exits from the market.

Technology and Innovation

Technology and innovation are playing a transformative role in the auto insurance industry. The rise of digital insurance platforms, telematics, and artificial intelligence (AI) is reshaping the way companies operate and interact with customers.

- Digital Insurance Platforms: These platforms allow customers to obtain quotes, purchase policies, and manage their accounts online, often with a streamlined and user-friendly experience. The emergence of these platforms has created opportunities for new entrants to compete with established players.

- Telematics: Telematics devices and apps can track driving behavior, providing insurers with valuable data to assess risk and personalize premiums. This technology can also lead to more accurate pricing and potentially lower premiums for safe drivers.

- Artificial Intelligence (AI): AI is being used in various aspects of the insurance industry, from fraud detection to claims processing. AI-powered systems can automate tasks, improve efficiency, and potentially reduce operating costs, creating opportunities for new business models and entrants.

Data Sources and Challenges in Counting Companies

Getting a precise count of auto insurance companies in the U.S. is like trying to catch a greased piglet – it’s slippery and hard to pin down. The auto insurance market is constantly evolving, with new companies popping up and others merging or disappearing. So, where do we even begin to count them?

Data Sources for Tracking Auto Insurance Companies

The number of auto insurance companies in the United States is a dynamic figure, and accurately tracking it requires accessing reliable data sources. Several key players provide insights into this industry, each with its strengths and limitations.

- Industry Associations: These organizations, such as the National Association of Insurance Commissioners (NAIC) and the Insurance Information Institute (III), collect and disseminate data on the insurance industry, including the number of companies operating in specific states. They offer valuable insights into the industry’s overall health and trends.

- Regulatory Bodies: State insurance departments, responsible for licensing and regulating insurance companies, maintain records of licensed insurers within their jurisdictions. These records provide a granular view of companies operating at the state level.

- Market Research Firms: Companies like A.M. Best, Moody’s, and S&P Global Market Intelligence specialize in providing in-depth analyses of the insurance industry. They offer detailed reports on market trends, company performance, and financial stability, often including data on the number of insurance companies.

Challenges in Obtaining Accurate Data

While these sources provide valuable information, obtaining an accurate and up-to-date count of auto insurance companies presents several challenges:

- Data Inconsistencies: Different data sources may use varying definitions of “auto insurance company,” leading to discrepancies in the reported numbers. For instance, some sources might include captive insurance companies or companies solely focused on commercial auto insurance, while others may not.

- Dynamic Market: The auto insurance market is constantly evolving, with new companies entering the market, existing companies merging, and others exiting. Keeping track of these changes in real-time is a significant challenge, leading to potential delays in data updates.

- Data Availability: Access to comprehensive and detailed data can be restricted. Some data sources might require subscriptions or fees, limiting access for researchers or the general public. Additionally, certain data may be considered confidential or proprietary by insurance companies, further restricting access.

Summary of Data Sources and Their Limitations

| Data Source | Coverage | Limitations |

|---|---|---|

| Industry Associations (NAIC, III) | National level data, industry trends, and overall market health. | May not provide detailed company-specific information or granular state-level data. |

| State Insurance Departments | Detailed records of licensed insurers within their jurisdiction. | Limited to state-level data, may not include all companies operating in the state. |

| Market Research Firms (A.M. Best, Moody’s) | In-depth analyses, company performance, and financial stability. | May require subscriptions or fees for access to detailed data. |

The Importance of Understanding Company Count

Knowing the exact number of auto insurance companies in the U.S. is like having a map to navigate the world of car coverage. It gives you a clear picture of the options available and helps you make informed decisions. For consumers, it’s like having a treasure chest of choices to find the perfect fit for their needs.

Impact on Consumers

Understanding the number of auto insurance companies is crucial for consumers seeking coverage options. A larger number of companies often translates to more diverse choices, including different pricing structures, coverage options, and customer service approaches. This diverse landscape empowers consumers to compare and contrast, ultimately leading to better deals and more personalized insurance plans.

- More Options: A greater number of companies means more choices, allowing consumers to find plans that match their specific needs and budgets.

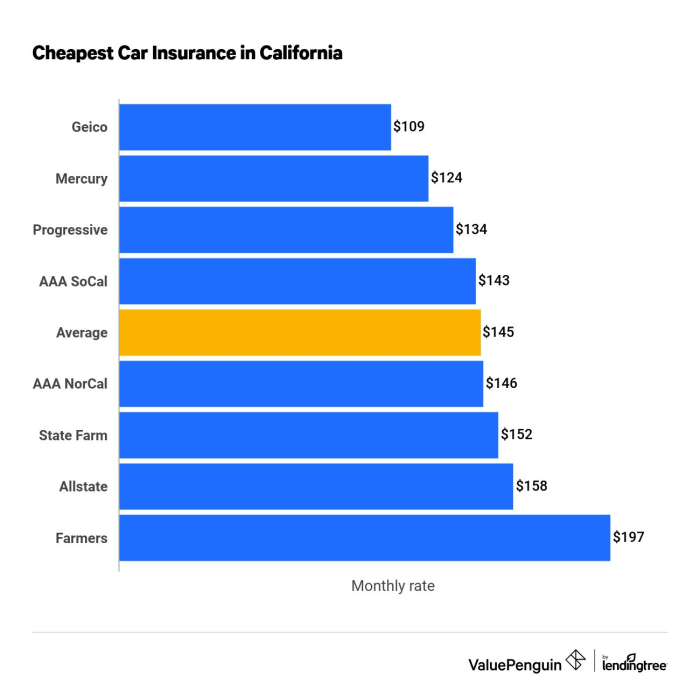

- Competitive Pricing: Competition drives prices down. With more companies vying for customers, rates tend to be more competitive, offering consumers better deals.

- Specialized Services: A larger pool of companies often means a wider range of specialized services, such as discounts for good drivers, coverage for unique vehicles, or tailored customer support.

Impact on Industry Stakeholders, How many auto insurance companies are there

Knowing the number of auto insurance companies provides valuable insights for industry stakeholders, including insurers, brokers, and regulators. It paints a clear picture of the competitive landscape, helps identify emerging trends, and informs regulatory decisions.

Insurers

- Market Share Analysis: Insurers can use the company count to assess their market share, identify growth opportunities, and strategize for future expansion.

- Competitive Intelligence: Knowing the number of competitors helps insurers understand the market dynamics, analyze their strengths and weaknesses, and develop effective marketing strategies.

- Pricing Strategies: The company count provides insights into pricing trends and competitive pressures, enabling insurers to adjust their rates and stay competitive.

Brokers

- Wider Network: Brokers can leverage the company count to build a wider network of insurance providers, offering clients a broader selection of options.

- Market Expertise: Understanding the number of companies and their market share helps brokers provide informed advice and recommendations to clients.

- Negotiation Power: A well-informed broker can leverage the competitive landscape to negotiate better rates and coverage options for clients.

Regulators

- Market Oversight: Regulators can use the company count to monitor the market, ensure fair competition, and identify potential risks to consumers.

- Policy Development: The number of companies and their market share can influence regulatory decisions regarding pricing, coverage requirements, and consumer protection measures.

- Consumer Protection: By understanding the competitive landscape, regulators can better protect consumers from predatory practices and ensure access to affordable and reliable insurance.

Impact on Different Stakeholders

| Stakeholder | Benefits | Challenges |

|---|---|---|

| Consumers | More choices, competitive pricing, specialized services | Overwhelming options, difficulty comparing, potential for hidden fees |

| Insurers | Market share analysis, competitive intelligence, pricing strategies | Increased competition, pressure to innovate, regulatory scrutiny |

| Brokers | Wider network, market expertise, negotiation power | Keeping up with changes, managing multiple relationships, client expectations |

| Regulators | Market oversight, policy development, consumer protection | Maintaining a balance between competition and consumer protection, adapting to market changes |

Trends and Future Outlook: How Many Auto Insurance Companies Are There

The auto insurance industry is on the verge of a significant transformation, driven by technological advancements, changing consumer preferences, and evolving regulatory landscapes. The emergence of autonomous vehicles, telematics, and personalized pricing models is reshaping the traditional insurance landscape.

Impact of Emerging Trends on Company Count

The trends Artikeld above are expected to have a profound impact on the number of auto insurance companies in the future. While some trends might lead to consolidation, others could create opportunities for new entrants.

- Consolidation: The increasing adoption of technology and the need for scale to compete effectively in a rapidly evolving market could lead to consolidation among existing insurance companies. Mergers and acquisitions are likely to be a common strategy for companies seeking to expand their reach, enhance their technological capabilities, and gain access to new data sources. For example, in 2021, Progressive Corporation acquired the insurance technology company, Insurify, to bolster its digital capabilities and expand its reach in the online insurance market.

- New Entrants: The emergence of new technologies, such as telematics and artificial intelligence (AI), is creating opportunities for new entrants to disrupt the traditional insurance industry. Tech-savvy startups are developing innovative insurance products and services that leverage data and technology to provide personalized pricing and risk assessment. For example, Metromile, a telematics-based insurance company, uses data from vehicle sensors to provide personalized premiums based on actual driving behavior. These new entrants are challenging traditional insurance companies by offering more flexible and customized solutions, potentially leading to an increase in the number of auto insurance companies.

- Evolving Business Models: The shift towards data-driven insurance models is forcing existing companies to adapt their business models and embrace new technologies. Insurance companies are increasingly relying on telematics data, AI, and other advanced analytics to better understand risk and offer more personalized pricing. This shift could lead to the emergence of new business models and a more diverse landscape of insurance providers. For instance, some companies are developing subscription-based insurance models that offer flexible coverage options based on individual driving needs.

Potential Future Scenarios

The future of the auto insurance industry is uncertain, but several potential scenarios could emerge based on the impact of these trends.

- Scenario 1: Consolidation and Specialization: In this scenario, the industry experiences significant consolidation, leading to a smaller number of large, diversified insurance companies. These companies would offer a wide range of insurance products and services, leveraging technology to provide personalized pricing and risk assessment. They might specialize in specific areas, such as autonomous vehicle insurance or telematics-based insurance, to cater to the evolving needs of the market.

- Scenario 2: Rise of Tech-Driven Insurers: This scenario envisions a more fragmented insurance market with a significant number of tech-driven insurers emerging. These companies would focus on using technology to offer innovative insurance products and services, leveraging data analytics, AI, and personalized pricing models. They would compete with traditional insurers by offering greater flexibility, transparency, and customer-centric solutions.

- Scenario 3: Hybrid Model: This scenario suggests a blend of traditional and tech-driven insurers, where established companies integrate technology into their existing operations while new entrants disrupt the market with innovative solutions. The insurance industry would become more diverse, with a mix of large, established companies and smaller, tech-focused players.

Final Thoughts

The number of auto insurance companies is a dynamic figure, influenced by a complex web of factors. From regulations to technology, the industry is constantly evolving, making it challenging to get a precise count. But one thing is clear: understanding this number is crucial for consumers, insurers, and everyone in between. As we move towards a future of autonomous vehicles and personalized pricing, the auto insurance landscape is poised for further transformation. So buckle up, because the journey ahead is full of twists and turns!

FAQ

How do I choose the right auto insurance company for me?

Choosing the right auto insurance company depends on your individual needs and budget. Consider factors like your driving history, the type of car you drive, and your coverage requirements. It’s a good idea to compare quotes from multiple companies to find the best fit for you.

Is there a way to find out exactly how many auto insurance companies are operating in my state?

While it’s difficult to get a precise count, you can usually find information about licensed insurers in your state through the state insurance department’s website.

What are some of the major trends shaping the auto insurance industry?

The auto insurance industry is facing significant changes, including the rise of telematics, the adoption of autonomous vehicles, and the growing use of personalized pricing models. These trends are likely to have a major impact on the number and types of auto insurance companies in the future.