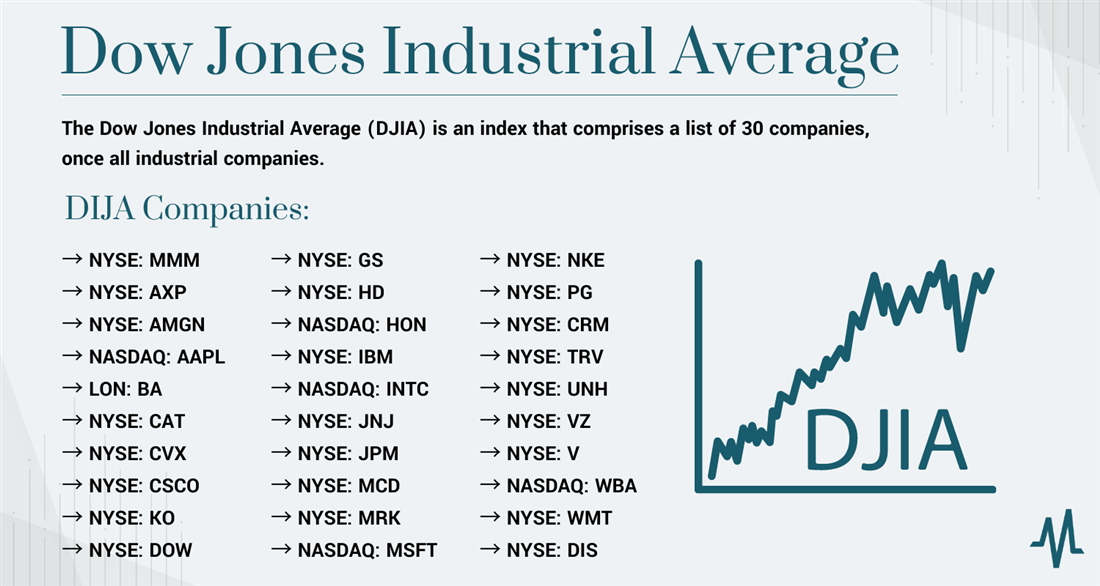

How many stocks in dow jones – How many stocks are in the Dow Jones? This question is a common one for anyone interested in the stock market, and the answer is more complex than you might think. The Dow Jones Industrial Average (DJIA) is a stock market index that tracks the performance of 30 of the largest publicly traded companies in the United States. These companies are carefully chosen to represent various sectors of the economy, and the index is widely considered a benchmark for the overall health of the stock market.

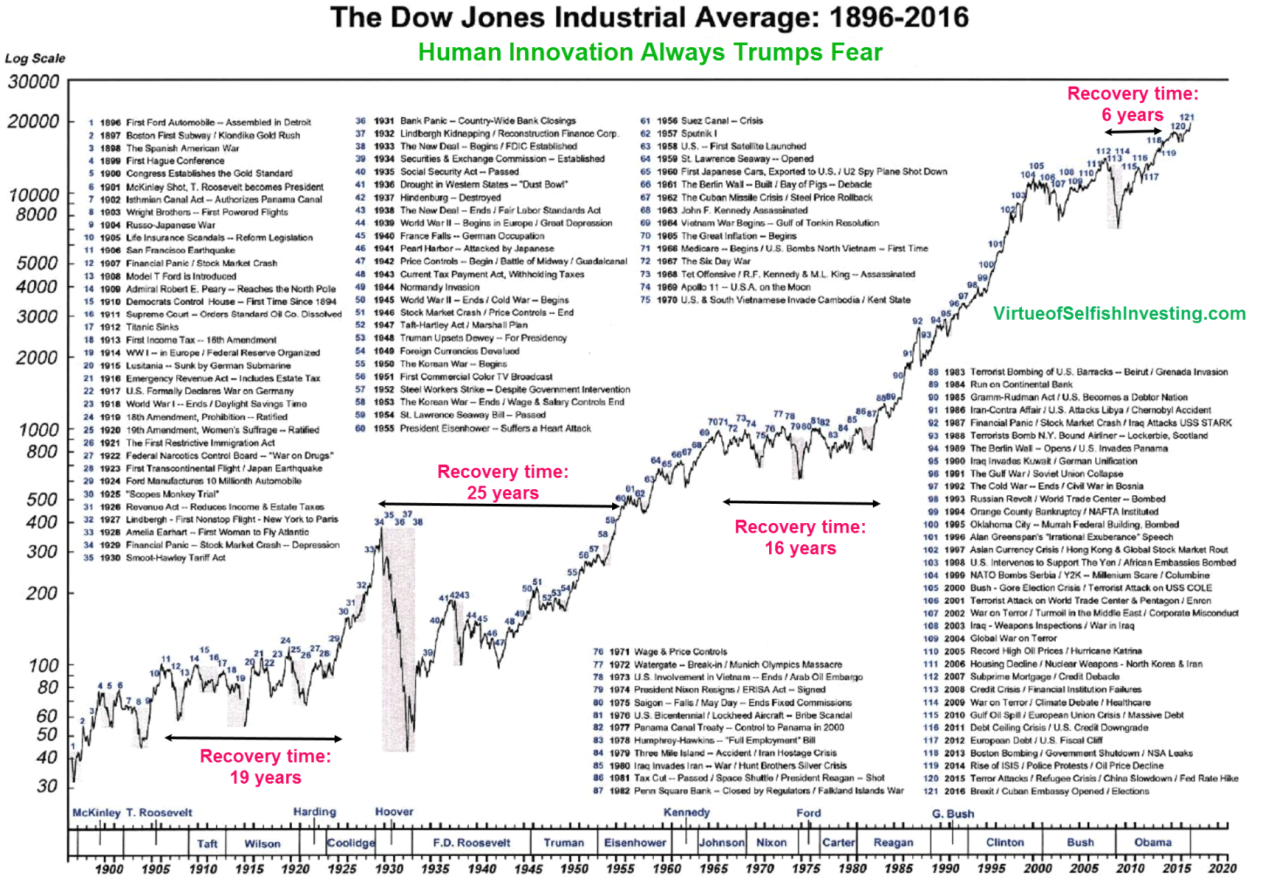

The Dow Jones has been around for over a century, and its composition has changed significantly over the years. The index was originally comprised of 12 companies, and the number of stocks included has been adjusted several times over the years to reflect the changing nature of the American economy. Today, the Dow Jones is a closely watched indicator of investor sentiment and market trends.

Components of the Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is a stock market index that tracks the performance of 30 of the largest and most influential publicly traded companies in the United States. It is a widely followed indicator of the overall health of the U.S. stock market and is often used as a benchmark for investor performance.

Companies Included in the Dow Jones Industrial Average

The Dow Jones Industrial Average is a price-weighted index, meaning that the companies with higher stock prices have a greater impact on the index’s overall value. The following table lists the 30 companies currently included in the Dow Jones Industrial Average, along with their stock ticker symbols and industry sectors:

| Company Name | Stock Ticker Symbol | Industry Sector |

|---|---|---|

| 3M | MMM | Industrials |

| American Express | AXP | Financials |

| Amgen | AMGN | Healthcare |

| Apple | AAPL | Technology |

| Boeing | BA | Industrials |

| Caterpillar | CAT | Industrials |

| Chevron | CVX | Energy |

| Cisco Systems | CSCO | Technology |

| Coca-Cola | KO | Consumer Staples |

| Comcast | CMCSA | Communication Services |

| Dow Inc. | DOW | Materials |

| DuPont de Nemours | DD | Materials |

| ExxonMobil | XOM | Energy |

| Goldman Sachs | GS | Financials |

| Home Depot | HD | Consumer Discretionary |

| Honeywell | HON | Industrials |

| IBM | IBM | Technology |

| Intel | INTC | Technology |

| Johnson & Johnson | JNJ | Healthcare |

| JPMorgan Chase | JPM | Financials |

| McDonald’s | MCD | Consumer Discretionary |

| Merck | MRK | Healthcare |

| Microsoft | MSFT | Technology |

| Nike | NKE | Consumer Discretionary |

| Pfizer | PFE | Healthcare |

| Procter & Gamble | PG | Consumer Staples |

| Salesforce | CRM | Technology |

| Travelers Companies | TRV | Financials |

| UnitedHealth Group | UNH | Healthcare |

| Verizon Communications | VZ | Communication Services |

| Visa | V | Financials |

| Walmart | WMT | Consumer Staples |

| Walt Disney | DIS | Communication Services |

Importance and Significance of the Dow Jones Industrial Average

The Dow Jones Industrial Average (DJIA) is a significant index in the financial world, serving as a benchmark for the overall stock market. Its performance provides insights into the health and direction of the US economy and the global market.

The Dow Jones Industrial Average is widely used by investors, analysts, and economists to gauge market sentiment, track trends, and make investment decisions.

Use of the Dow Jones Industrial Average by Investors, Analysts, and Economists

Investors use the DJIA to assess the overall market performance and to identify potential investment opportunities. A rising Dow often indicates a bullish market, while a declining Dow suggests a bearish market. Analysts use the DJIA to track market trends and identify potential risks and opportunities. They use technical analysis, fundamental analysis, and other methods to study the DJIA’s movements and predict future performance. Economists use the DJIA as a leading indicator of economic activity. A strong Dow can suggest a healthy economy, while a weak Dow may indicate economic weakness.

Influence of the Dow Jones Industrial Average on Investor Sentiment and Market Trends

The DJIA’s influence on investor sentiment and market trends is significant. A rising Dow can create a positive sentiment among investors, leading to increased buying activity and pushing the market higher. Conversely, a declining Dow can create a negative sentiment, leading to selling pressure and a downward market trend. The DJIA’s influence extends beyond the US stock market, impacting global markets as well.

Tracking the Dow Jones Industrial Average

Staying updated on the Dow Jones Industrial Average (DJIA) is essential for investors, traders, and anyone interested in the overall health of the U.S. stock market. There are numerous resources available to track the DJIA in real-time, providing insights into its performance and fluctuations.

Reliable Sources for Real-Time Tracking

The Dow Jones Industrial Average is a widely followed market index, and several reputable sources offer real-time data and analysis. Here are some of the most trusted platforms for tracking the DJIA:

- Financial News Websites: Major financial news outlets like Bloomberg, Reuters, CNBC, The Wall Street Journal, and Financial Times provide real-time DJIA quotes, charts, and analysis. These websites offer detailed information on the index’s performance, individual stock components, and market commentary.

- Brokerage Platforms: Online brokerage platforms such as TD Ameritrade, E*TRADE, Fidelity, and Schwab provide real-time DJIA data, charts, and tools for investors to monitor their portfolios and make informed trading decisions. These platforms often offer advanced charting features and analysis tools.

- Financial Data Providers: Companies like FactSet, S&P Global Market Intelligence, and Refinitiv specialize in providing real-time financial data, including the DJIA, to institutional investors and financial professionals.

- Google Finance: Google Finance offers a convenient and free platform for tracking the DJIA and other financial instruments. It provides real-time quotes, charts, and historical data.

- Yahoo Finance: Similar to Google Finance, Yahoo Finance provides a comprehensive platform for tracking the DJIA, including real-time quotes, charts, news, and analysis.

Interpreting the Dow Jones Industrial Average Data, How many stocks in dow jones

Understanding the components and factors influencing the DJIA is crucial for interpreting its data effectively.

- Index Value: The DJIA is a price-weighted index, meaning that the price of each component stock contributes to the overall index value. Stocks with higher prices have a greater impact on the index’s movement.

- Components: The DJIA consists of 30 large-cap U.S. companies representing various industries, including technology, healthcare, finance, and consumer goods. The selection of companies is determined by the Dow Jones Indices committee, which aims to represent a diverse cross-section of the U.S. economy.

- Market Sentiment: The DJIA is often considered a barometer of overall market sentiment. A rising DJIA generally indicates positive investor sentiment and optimism about the economy, while a declining DJIA suggests pessimism and potential market weakness.

- Economic Indicators: The DJIA can be influenced by various economic indicators, such as interest rates, inflation, and employment data. Positive economic data can boost investor confidence and drive the DJIA higher, while negative data can have the opposite effect.

- Global Events: Global events, such as political instability, trade wars, or natural disasters, can also impact the DJIA. These events can create uncertainty and volatility in the market.

Interpreting DJIA Components

The DJIA is a price-weighted index, meaning that the price of each component stock contributes to the overall index value. Stocks with higher prices have a greater impact on the index’s movement. For example, a 1% increase in the price of Apple (AAPL), a large-cap stock, will have a greater impact on the DJIA than a 1% increase in the price of a smaller-cap stock like Walgreens Boots Alliance (WBA).

The Dow Jones Industrial Average (DJIA) is a price-weighted index, meaning that the price of each component stock contributes to the overall index value. Stocks with higher prices have a greater impact on the index’s movement.

End of Discussion

The Dow Jones Industrial Average is a powerful tool for understanding the stock market, and its composition reflects the ever-changing landscape of the American economy. Whether you’re a seasoned investor or just starting to learn about the stock market, understanding the Dow Jones and its components can provide valuable insights into the market’s direction.

Essential Questionnaire: How Many Stocks In Dow Jones

What is the purpose of the Dow Jones Industrial Average?

The Dow Jones Industrial Average is a stock market index that tracks the performance of 30 of the largest publicly traded companies in the United States. It is a widely recognized benchmark for the overall health of the stock market.

Why are only 30 companies included in the Dow Jones?

The number of companies in the Dow Jones has changed over time, but 30 has been the number since 1928. The index is designed to represent a diverse range of industries and sectors, and the specific number of companies is chosen to ensure that the index is representative of the overall market.

How often is the Dow Jones updated?

The Dow Jones Industrial Average is updated in real-time, reflecting the latest stock prices of the companies included in the index.