Average Employer Contributions to Health Insurance

Employers in the United States contribute a substantial portion of the cost of health insurance for their employees. On average, employers cover 73% of the total healthcare costs for their employees and their dependents.

The average annual employer contribution to health insurance premiums is $22,221 for family coverage and $6,267 for individual coverage. These contributions vary based on several factors, including company size, industry, and geographic location.

Company Size

Larger companies tend to contribute a higher percentage of the total healthcare costs than smaller companies. This is because larger companies have more resources and can spread the cost of health insurance over a larger number of employees.

Industry

The healthcare industry is known for having some of the highest employer contributions to health insurance. This is because healthcare workers are more likely to use health insurance services and have higher healthcare costs.

Geographic Location

Employer contributions to health insurance also vary based on geographic location. The cost of healthcare varies from state to state, and this can impact the amount that employers contribute to health insurance premiums.

Factors Influencing Employer Health Insurance Contributions

The cost of employer-sponsored health insurance is influenced by various factors, including employee demographics, the type of health insurance plan, and the level of coverage provided.

Employee Demographics

The age, health status, and family size of employees can impact the cost of health insurance for employers. Older employees and those with pre-existing health conditions typically require more healthcare services, resulting in higher premiums. Similarly, employees with larger families may require more comprehensive coverage, leading to increased costs.

Type of Health Insurance Plan

Employers can choose from various health insurance plans, such as Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), and Point-of-Service (POS) plans. PPOs offer more flexibility and a wider network of providers but tend to have higher premiums. HMOs, on the other hand, have a more limited network and require referrals from primary care physicians, but typically have lower premiums.

Level of Coverage

The level of coverage provided by health insurance plans also affects the cost for employers. Plans with higher deductibles, co-pays, and out-of-pocket maximums generally have lower premiums. However, employees may end up paying more out-of-pocket expenses if they utilize healthcare services frequently.

Employer Strategies for Managing Health Insurance Costs

Employers implement various strategies to manage their health insurance expenses, aiming to balance employee benefits with financial sustainability. These strategies include:

Wellness Programs

Wellness programs promote healthy behaviors and preventive care among employees, reducing the incidence of costly chronic diseases and healthcare utilization. Examples include:

– Health screenings and assessments

– Fitness challenges and incentives

– Smoking cessation programs

– Nutrition counseling

Negotiating with Insurance Providers

Employers negotiate with insurance providers to secure favorable terms and rates. This involves:

– Comparing plans from multiple providers

– Negotiating lower premiums and deductibles

– Obtaining discounts for employee participation in wellness programs

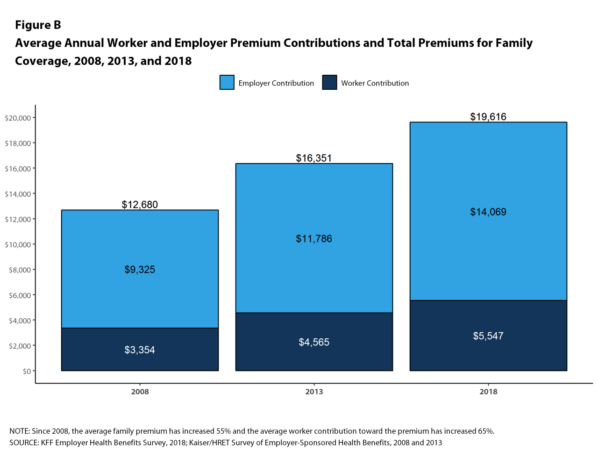

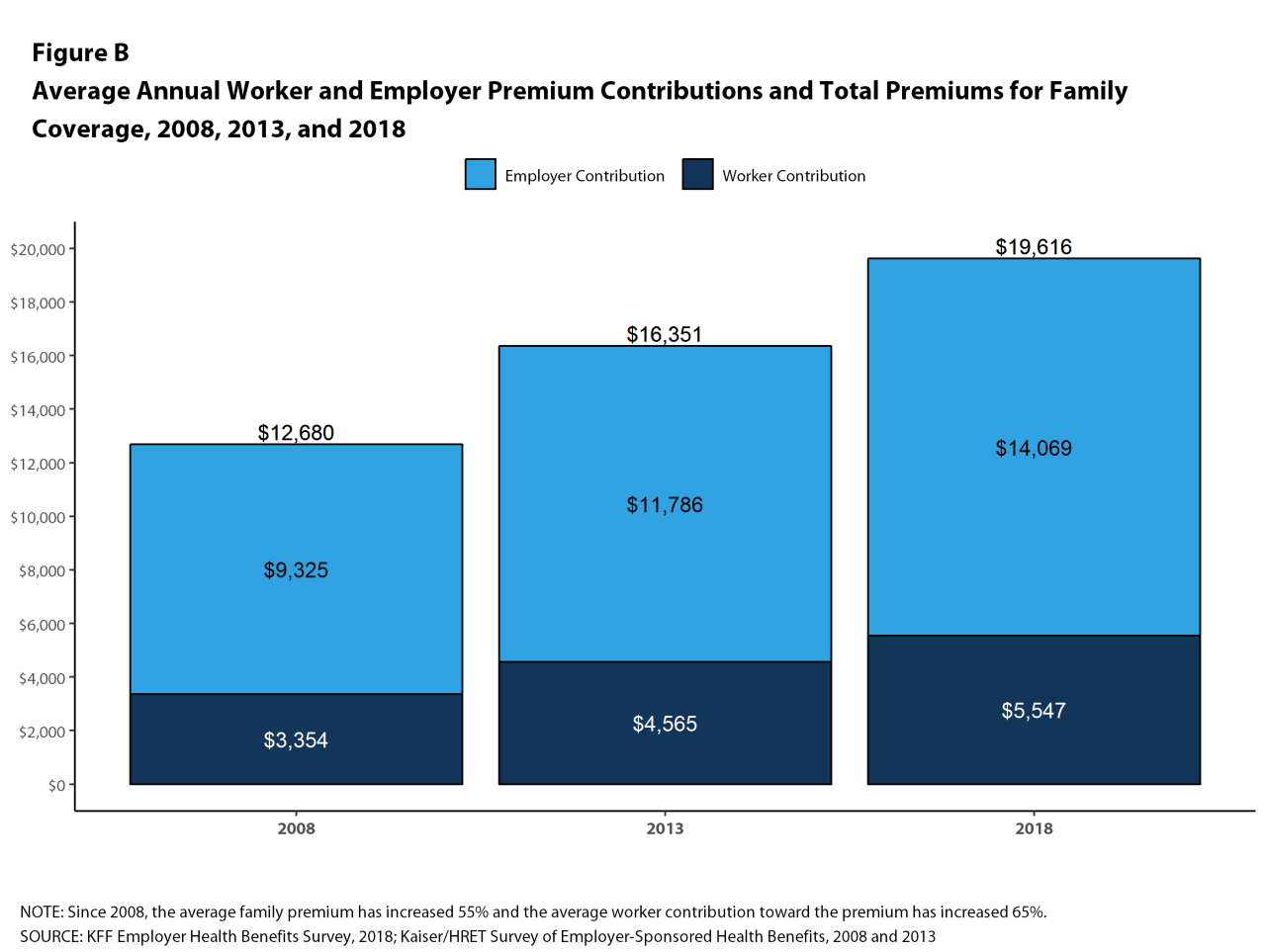

Offering Employee Contributions

Some employers require employees to contribute a portion of their health insurance premiums. This cost-sharing approach encourages employees to make informed decisions about their healthcare consumption. However, employers must carefully consider the impact on employee morale and financial burden.

Impact of Health Insurance Costs on Employers and Employees

Health insurance costs have a significant impact on both employers and employees.

Impact on Employers

Employers face several challenges due to rising health insurance costs:

- Financial Burden: Health insurance premiums represent a major expense for employers, impacting their overall profitability and financial planning.

- Attracting and Retaining Employees: Competitive health insurance benefits are crucial for attracting and retaining talented employees, especially in industries where competition for skilled workers is high.

Impact on Employees

Employees also face the consequences of rising health insurance costs:

- Affordability: Employees may struggle to afford health insurance premiums, especially those with low incomes or those who do not qualify for employer-sponsored plans.

- Access to Healthcare Services: High deductibles and co-pays can limit employees’ access to necessary healthcare services, leading to delayed or neglected medical care.

Future Trends in Employer-Sponsored Health Insurance

The landscape of employer-sponsored health insurance is constantly evolving, with emerging trends shaping the way employers and employees access and utilize healthcare benefits. Here are some key trends to watch:

- Telemedicine and Virtual Care: The use of telemedicine and virtual care platforms has surged in recent years, allowing patients to consult with healthcare providers remotely. This trend is expected to continue, as it offers convenience, accessibility, and cost-effective healthcare options.

- Consumer-Driven Health Plans: Consumer-driven health plans (CDHPs) are becoming increasingly popular, giving employees more control over their healthcare spending. CDHPs typically involve a high-deductible health plan paired with a health savings account (HSA) or flexible spending account (FSA), allowing employees to save money on healthcare costs.

- Employer Partnerships with Healthcare Providers: Employers are increasingly forming partnerships with healthcare providers to offer innovative and cost-effective healthcare solutions. These partnerships can include direct contracting, bundled payments, and value-based care models, which aim to improve patient outcomes while reducing costs.

Implications for Employers and Employees

These emerging trends have significant implications for both employers and employees. For employers, the adoption of telemedicine and virtual care can lead to reduced healthcare costs and improved employee satisfaction. CDHPs can also help employers control healthcare expenses while giving employees more flexibility and choice. Employer partnerships with healthcare providers can result in access to high-quality, cost-effective healthcare services.

For employees, telemedicine and virtual care offer convenient and accessible healthcare options. CDHPs provide employees with greater control over their healthcare spending and the ability to save money. Employer partnerships with healthcare providers can lead to improved healthcare outcomes and reduced costs. Overall, these trends are shaping the future of employer-sponsored health insurance, offering both employers and employees innovative and cost-effective healthcare solutions.