How much does car insurance cost in Florida sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of car insurance can be a complex endeavor, especially in a state like Florida, known for its unique driving environment and insurance regulations. Understanding the factors that influence car insurance costs in Florida is crucial for making informed decisions about your coverage and ensuring you’re paying a fair price for the protection you need.

From the impact of your driving history and the type of vehicle you own to the specific coverage options you choose and your location within the state, numerous variables play a role in determining your car insurance premiums. This guide aims to demystify the complexities of car insurance in Florida, providing insights into the key factors that affect your costs and offering practical tips for finding affordable coverage that meets your individual needs.

Factors Influencing Car Insurance Costs in Florida: How Much Does Car Insurance Cost In Florida

Car insurance premiums in Florida are influenced by a variety of factors, including your driving history, the type of vehicle you drive, your age, your location, and the coverage options you choose. Understanding these factors can help you make informed decisions about your car insurance and potentially save money on your premiums.

Driving History, How much does car insurance cost in florida

Your driving history is a significant factor in determining your car insurance rates. Insurance companies use your driving record to assess your risk of being involved in an accident. A clean driving record with no accidents or violations will typically result in lower premiums, while a history of accidents, traffic violations, or DUI convictions can lead to higher rates.

- Accidents: A recent accident, even if you weren’t at fault, will likely increase your insurance premiums. The severity of the accident and the number of accidents you’ve been involved in will impact the increase. For example, a minor fender bender may result in a smaller premium increase than a serious accident involving injuries or significant property damage.

- Traffic Violations: Speeding tickets, running red lights, and other traffic violations can also lead to higher insurance premiums. The severity of the violation and the number of violations you have on your record will influence the increase. For instance, a speeding ticket for exceeding the speed limit by a small amount may result in a smaller premium increase than a reckless driving charge.

- DUI Convictions: A DUI conviction will significantly increase your insurance premiums, often for a period of several years. Insurance companies consider DUI convictions to be a serious risk factor and may even refuse to insure you altogether.

Vehicle Type

The type of vehicle you drive also plays a crucial role in determining your car insurance rates. Insurance companies consider factors such as the make, model, year, and safety features of your vehicle when setting premiums.

- Make and Model: Certain car models are known to be more prone to accidents or theft than others. For example, sports cars and luxury vehicles often have higher insurance premiums due to their higher repair costs and greater likelihood of being stolen. Conversely, vehicles with a proven safety record and lower repair costs tend to have lower insurance rates.

- Year: Newer vehicles typically have more advanced safety features and are often less likely to be involved in accidents. As a result, newer cars may have lower insurance premiums compared to older vehicles. However, the age of your vehicle is not the only factor considered; the vehicle’s overall condition and maintenance history also play a role.

- Safety Features: Vehicles equipped with safety features such as anti-lock brakes, airbags, and stability control systems are generally considered safer and may qualify for lower insurance premiums. These features can help prevent accidents or mitigate their severity, leading to lower insurance costs for the insurer.

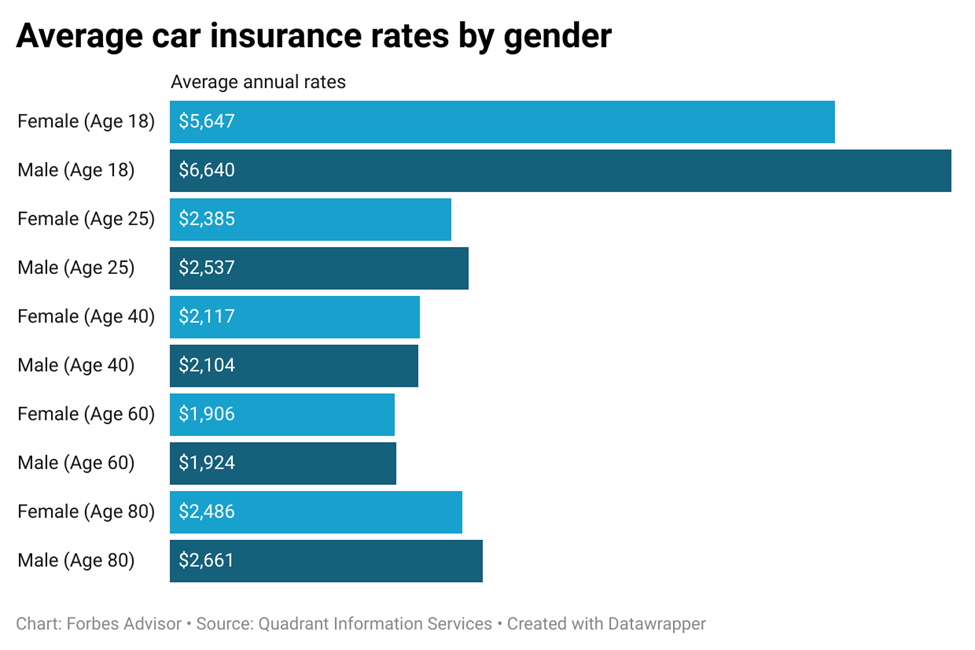

Age and Gender

In Florida, insurance companies are prohibited from using gender as a factor in setting car insurance rates. However, age remains a significant factor, as younger drivers are statistically more likely to be involved in accidents.

- Younger Drivers: Drivers under the age of 25 typically pay higher insurance premiums than older drivers. This is due to their lack of experience and higher risk of being involved in accidents. However, once drivers reach a certain age, their premiums may decrease as they gain more experience and their risk profile improves.

- Older Drivers: While older drivers may have more experience, they may also face age-related health issues that could affect their driving ability. As a result, some insurance companies may charge slightly higher premiums for older drivers, particularly those over the age of 75. However, this is not a universal practice, and many insurance companies offer discounts for senior drivers who maintain a clean driving record.

Location

The location where you live can significantly impact your car insurance rates. Insurance companies consider factors such as the population density, crime rate, and frequency of accidents in your area when setting premiums.

- Urban Areas: Car insurance premiums are typically higher in urban areas compared to rural areas. This is due to the higher density of traffic, increased risk of accidents, and greater likelihood of theft in urban environments.

- Rural Areas: Car insurance premiums in rural areas are often lower due to lower population density, fewer traffic accidents, and lower crime rates. However, factors such as the distance to emergency services and the prevalence of wildlife can influence insurance rates in rural areas.

Coverage Options

The type of coverage you choose for your car insurance also affects your premiums. Florida requires all drivers to carry a minimum amount of liability insurance, but you can choose to purchase additional coverage to protect yourself and your vehicle.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident and cause damage to another person’s property or injuries to another person. Liability coverage is typically divided into two parts: bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs to your vehicle if it is damaged in a collision with another vehicle or object. Collision coverage is optional but can be beneficial if you want to protect yourself from the financial burden of repairs in the event of an accident.

- Comprehensive Coverage: This coverage pays for repairs to your vehicle if it is damaged due to events other than a collision, such as theft, vandalism, fire, or hail. Comprehensive coverage is optional but can be valuable if you want to protect your vehicle from unforeseen events.

- Personal Injury Protection (PIP): This coverage, also known as “no-fault” insurance, pays for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. PIP is required in Florida, and you can choose the level of coverage you want.

Average Car Insurance Costs in Florida

Florida is known for its high car insurance costs, driven by factors such as a high population density, a large number of uninsured drivers, and a high frequency of accidents. The average car insurance cost in Florida can vary significantly depending on several factors, including coverage levels, vehicle type, driver’s profile, and location.

Average Car Insurance Costs by Coverage Levels

The average monthly premiums for different car insurance coverage options in Florida are as follows:

| Coverage Type | Average Monthly Premium |

|---|---|

| Liability Only | $50 – $100 |

| Liability + Collision | $100 – $200 |

| Liability + Comprehensive | $120 – $250 |

| Full Coverage (Liability + Collision + Comprehensive + PIP) | $150 – $350 |

Average Car Insurance Costs by Vehicle Type

The average monthly premiums for different vehicle types in Florida are as follows:

| Vehicle Type | Average Monthly Premium |

|---|---|

| Sedans | $120 – $250 |

| SUVs | $150 – $300 |

| Trucks | $180 – $350 |

| Sports Cars | $200 – $400 |

Car Insurance Discounts in Florida

Lowering your car insurance premiums in Florida is achievable by taking advantage of the numerous discounts offered by insurance companies. These discounts can significantly reduce your overall costs, making car insurance more affordable.

Discounts Available in Florida

- Good Driver Discounts: These are among the most common discounts, rewarding drivers with a clean driving record. Insurance companies typically offer discounts for drivers who have not been involved in accidents or received traffic violations for a specified period.

- Safe Driver Discounts: This discount recognizes drivers who demonstrate safe driving habits. Insurance companies often offer discounts for drivers who complete defensive driving courses or install safety features in their vehicles.

- Multi-Car Discounts: If you insure multiple vehicles with the same company, you may qualify for a multi-car discount. This discount is usually a percentage off your overall premium.

- Bundling Discounts: Bundling your car insurance with other types of insurance, such as home or renters insurance, can result in significant savings. This discount incentivizes customers to consolidate their insurance policies with one provider.

Tips for Qualifying for Discounts

- Maintain a Clean Driving Record: This is crucial for securing good driver discounts. Avoid accidents, traffic violations, and DUI offenses to maintain a favorable driving history.

- Install Safety Features: Adding safety features to your vehicle, such as anti-theft devices, airbags, and anti-lock brakes, can qualify you for safe driver discounts.

- Bundle Your Insurance Policies: Contact your insurance provider to inquire about bundling discounts. This can potentially save you money on your car insurance and other policies.

Insurance Companies Offering Discounts in Florida

- State Farm: Offers discounts for good drivers, safe drivers, multi-car policies, bundling, and other factors.

- Geico: Provides discounts for good drivers, safe drivers, multi-car policies, bundling, and military personnel.

- Progressive: Offers discounts for good drivers, safe drivers, multi-car policies, bundling, and homeowners insurance.

- Allstate: Provides discounts for good drivers, safe drivers, multi-car policies, bundling, and student discounts.

Finding Affordable Car Insurance in Florida

Securing affordable car insurance in Florida requires a strategic approach. This involves comparing quotes from multiple providers, exploring available discounts, and considering alternative insurance options. By understanding the factors that influence car insurance costs and taking proactive steps, you can potentially save money on your premiums.

Obtaining Car Insurance Quotes

It’s crucial to obtain quotes from several insurance providers in Florida to compare their rates and coverage options. This allows you to identify the best value for your specific needs.

- Use online comparison websites: Websites like Insurance.com, Policygenius, and The Zebra allow you to enter your information once and receive quotes from multiple insurers. This simplifies the process and saves time.

- Contact insurance companies directly: Reach out to insurance companies directly to request quotes. This allows you to ask specific questions and discuss your individual needs with a representative.

- Seek recommendations: Ask friends, family, and colleagues for recommendations on reputable insurance providers in Florida. Their personal experiences can provide valuable insights.

Benefits of Shopping Around

Shopping around for car insurance offers numerous benefits. It allows you to:

- Find lower premiums: Comparing quotes from multiple providers can help you identify the most affordable options, potentially saving you hundreds of dollars per year.

- Discover different coverage options: Each insurer may offer unique coverage options and features. Comparing quotes allows you to find the best fit for your needs and budget.

- Negotiate better rates: By having multiple quotes in hand, you can leverage competition to negotiate better rates with insurance companies.

Negotiating Car Insurance Rates

Negotiating with insurance companies can help you secure more favorable rates. Here are some effective strategies:

- Highlight your good driving history: If you have a clean driving record with no accidents or violations, emphasize this to the insurer. This demonstrates your responsible driving habits and can lead to lower premiums.

- Explore available discounts: Many insurers offer discounts for various factors, such as safe driving courses, anti-theft devices, and multiple policy bundling. Inquire about available discounts and ensure you’re receiving all applicable reductions.

- Consider increasing your deductible: Raising your deductible, the amount you pay out of pocket before insurance coverage kicks in, can lower your premiums. However, ensure you can afford the higher deductible in case of an accident.

Alternative Car Insurance Options

If you’re struggling to find affordable car insurance through traditional providers, explore alternative options:

- State-run insurance programs: Florida offers the Florida Automobile Joint Underwriting Association (FAJUA) for drivers who have been denied coverage by private insurers. FAJUA provides basic coverage at higher rates.

- Non-standard insurance providers: These specialized insurers cater to high-risk drivers who may have poor driving records or limited insurance history. While their premiums may be higher, they offer coverage options for individuals who struggle to find insurance elsewhere.

Car Insurance Laws and Regulations in Florida

Florida’s car insurance laws are designed to ensure that drivers have adequate financial protection in case of accidents. These laws establish minimum coverage requirements, mandatory insurance provisions, and penalties for driving without insurance. They also define the state’s no-fault insurance system, which governs the process of filing claims and receiving compensation for injuries.

Minimum Coverage Requirements

Florida requires all drivers to carry a minimum amount of liability insurance to cover damages caused to others in an accident. This minimum coverage is known as the “Financial Responsibility Law” and includes:

- Bodily Injury Liability: $10,000 per person and $20,000 per accident. This covers injuries to other people in an accident, including medical expenses, lost wages, and pain and suffering.

- Property Damage Liability: $10,000 per accident. This covers damage to other people’s property, such as vehicles, buildings, and fences.

Drivers can choose to purchase additional coverage beyond the minimum requirements, such as:

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages for the insured driver and passengers, regardless of who is at fault. It is a mandatory coverage in Florida, with a minimum limit of $10,000.

- Collision Coverage: This coverage pays for repairs or replacement of the insured vehicle if it is damaged in an accident, regardless of fault. It is optional coverage.

- Comprehensive Coverage: This coverage pays for repairs or replacement of the insured vehicle if it is damaged by events other than an accident, such as theft, vandalism, or natural disasters. It is optional coverage.

No-Fault Insurance System

Florida operates under a no-fault insurance system, which means that each driver’s insurance company is primarily responsible for covering their own injuries and damages, regardless of who is at fault. This system aims to reduce the number of lawsuits and expedite the claims process.

Under the no-fault system, drivers can file a claim with their own insurance company for PIP benefits to cover their medical expenses and lost wages. However, there are exceptions to the no-fault rule. For example, if the injuries are severe or if the other driver is at fault, the injured party may be able to sue the at-fault driver for additional damages.

Filing a Car Insurance Claim

If you are involved in an accident in Florida, you should immediately contact the police and your insurance company. You should also exchange information with the other driver(s) involved, including their name, address, driver’s license number, insurance company, and policy number.

To file a claim with your insurance company, you will need to provide them with the following information:

- The date, time, and location of the accident

- A description of the accident

- The names and contact information of all parties involved

- A copy of the police report

- Photos or videos of the accident scene and any damage to vehicles

- Medical records and bills for any injuries sustained

Once you have filed a claim, your insurance company will investigate the accident and determine if you are eligible for benefits. If your claim is approved, your insurance company will pay for your covered expenses, up to the limits of your policy.

Penalties for Driving Without Insurance

Driving without insurance in Florida is illegal and can result in serious penalties. These penalties can include:

- Fines: Drivers caught driving without insurance can face fines of up to $500.

- Suspension of Driver’s License: If a driver is caught driving without insurance multiple times, their driver’s license may be suspended.

- Impoundment of Vehicle: The vehicle of a driver caught driving without insurance may be impounded.

- Jail Time: In some cases, driving without insurance can result in jail time.

It is important to note that even if you have a valid driver’s license, you can still be penalized for driving without insurance. This is because insurance is a separate requirement from having a driver’s license.

Rights and Responsibilities of Policyholders

As a policyholder, you have certain rights and responsibilities under Florida law. These include:

- The right to receive a copy of your insurance policy

- The right to be informed of any changes to your policy

- The right to file a claim with your insurance company

- The right to appeal a decision made by your insurance company

- The responsibility to pay your insurance premiums on time

- The responsibility to notify your insurance company of any changes to your driving record or vehicle

- The responsibility to cooperate with your insurance company during an investigation

It is important to understand your rights and responsibilities as a policyholder to ensure that you are protected in the event of an accident.

Ultimate Conclusion

By understanding the factors that influence car insurance costs in Florida, drivers can make informed decisions about their coverage and potentially save money on their premiums. From comparing quotes from different insurance providers to exploring available discounts and negotiating rates, there are various strategies for finding affordable car insurance that meets your specific needs. Remember, researching and comparing options is essential to ensure you’re getting the best value for your money and the protection you deserve on the road.

FAQs

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to carry a minimum amount of liability coverage, including $10,000 for personal injury protection (PIP) per person, $10,000 for PIP per accident, and $10,000 for property damage liability.

How can I lower my car insurance premiums in Florida?

You can lower your car insurance premiums in Florida by maintaining a clean driving record, taking a defensive driving course, bundling your insurance policies, and installing safety features in your vehicle.

What are the penalties for driving without car insurance in Florida?

Driving without car insurance in Florida can result in fines, license suspension, and even vehicle impoundment.