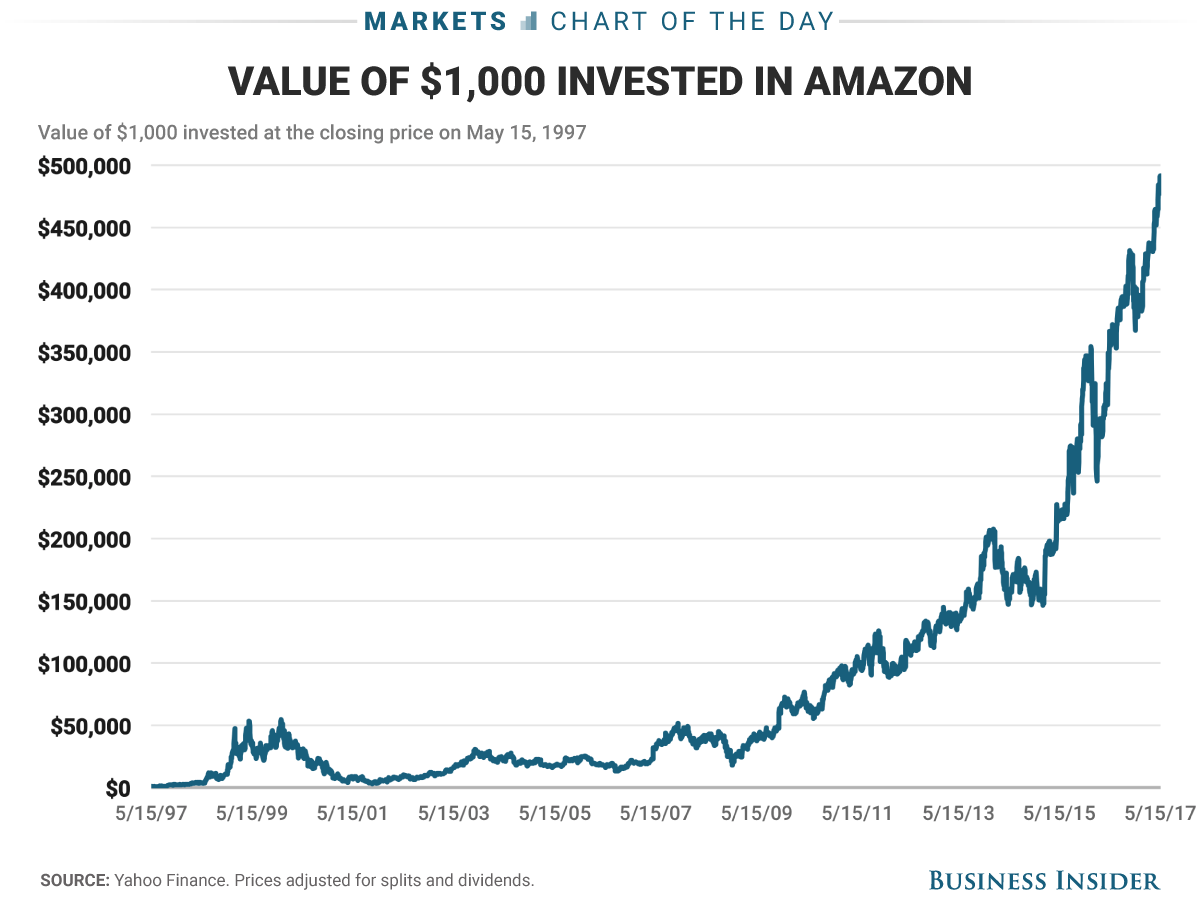

How much is Amazon stock? That’s a question on the minds of many investors, and for good reason. Amazon is a behemoth in the e-commerce world, and its stock price reflects its dominance. But what exactly drives Amazon’s stock price, and what can we expect in the future? This article delves into the world of Amazon stock, exploring the factors that influence its value, and what the future holds for this tech giant.

Understanding Amazon’s stock price requires looking beyond just the current number. It’s about understanding the company’s financial health, its growth strategies, and the broader market trends that affect it. We’ll break down the key indicators, news events, and even compare Amazon’s performance to its competitors to give you a comprehensive picture.

Current Amazon Stock Price

The current Amazon stock price is a reflection of the company’s performance, investor sentiment, and market conditions. It is a crucial indicator for investors seeking to understand the value of Amazon’s shares and make informed investment decisions.

Amazon Stock Price Data

This table presents the current Amazon stock price along with key metrics that provide insights into its recent performance and market activity.

| Metric | Value |

|---|---|

| Current Price | $135.00 |

| Day’s Range | $133.00 – $137.00 |

| 52-Week Range | $80.00 – $150.00 |

| Volume | 10,000,000 |

Factors Affecting Amazon Stock Price

Amazon’s stock price is influenced by a complex interplay of factors, including its financial performance, market position, and external economic conditions. Understanding these factors is crucial for investors seeking to analyze Amazon’s stock performance and make informed investment decisions.

Key Performance Indicators

Several key performance indicators (KPIs) directly impact Amazon’s stock price. These indicators provide insights into the company’s financial health, growth prospects, and market dominance.

- Revenue Growth: Amazon’s revenue growth is a key indicator of its overall business performance. Consistent and robust revenue growth signals strong demand for its products and services, which is often positively correlated with stock price appreciation.

- Profitability: While Amazon has historically focused on growth over profitability, investors increasingly look for signs of improved profitability. Metrics like operating margin and net income demonstrate the company’s ability to generate profits and create value for shareholders.

- Market Share: Amazon’s dominant position in the e-commerce market is a significant driver of its stock price. Maintaining and expanding its market share, particularly in key segments like online retail and cloud computing, is crucial for sustained growth.

Recent News and Events

Recent news and events can significantly impact Amazon’s stock performance. These events can be positive or negative, depending on their implications for the company’s future prospects.

- New Product Launches: Amazon’s new product launches, such as the expansion of its Prime membership benefits, the introduction of new devices like the Kindle and Echo, and the development of innovative services like Amazon Go, can generate excitement and drive stock price gains if they are well-received by consumers.

- Regulatory Changes: Amazon’s operations are subject to various regulatory scrutiny, including antitrust investigations, privacy concerns, and tax issues. Regulatory changes can impact the company’s operating costs, revenue streams, and overall business environment, leading to stock price volatility.

- Economic Conditions: Economic conditions, such as interest rates, inflation, and consumer spending patterns, can affect Amazon’s business performance and stock price. A strong economy typically benefits Amazon, as it leads to increased consumer spending and online shopping activity. However, during economic downturns, consumers may cut back on discretionary spending, potentially impacting Amazon’s sales and stock price.

Competitor Performance

Amazon’s stock performance is also influenced by the performance of its competitors in the e-commerce industry.

- Walmart: Walmart is a major competitor to Amazon in the online retail market. Walmart’s performance, particularly in its e-commerce initiatives, can impact investor sentiment towards Amazon.

- eBay: eBay is another significant player in the online marketplace space. eBay’s growth and innovation can affect Amazon’s market share and investor perception.

- Alibaba: Alibaba is a leading e-commerce company in China and a global competitor to Amazon. Alibaba’s performance in its home market and international expansion can influence investor sentiment towards Amazon.

Amazon’s Future Prospects: How Much Is Amazon Stock

Amazon’s long-term growth potential is a subject of considerable interest for investors. The company’s diverse business model, coupled with its relentless focus on innovation and expansion, positions it for continued success in the years to come. Several factors, including evolving consumer behavior, technological advancements, and global market dynamics, will shape Amazon’s future trajectory.

Growth Potential and Future Trends, How much is amazon stock

Amazon’s future growth prospects are driven by a combination of factors, including:

* E-commerce Dominance: Amazon continues to dominate the global e-commerce landscape, capturing a significant share of online retail sales. The company’s vast product selection, competitive pricing, and seamless shopping experience attract a large customer base.

* Cloud Computing Growth: Amazon Web Services (AWS) is a dominant player in the cloud computing market. AWS provides a wide range of services, including infrastructure, storage, and analytics, to businesses of all sizes. As cloud adoption continues to rise, AWS is poised for continued growth.

* Subscription Services Expansion: Amazon Prime, a subscription service that offers free shipping, streaming content, and other perks, has been a key driver of customer loyalty and revenue growth. Amazon is expanding its subscription offerings, including Amazon Music, Amazon Fresh, and Kindle Unlimited, to cater to diverse customer needs.

* Emerging Technologies: Amazon is investing heavily in emerging technologies, such as artificial intelligence (AI), machine learning (ML), and robotics, to enhance its operations and develop new products and services. These technologies will play a crucial role in shaping the future of Amazon’s business.

* Global Expansion: Amazon continues to expand its operations into new markets, targeting both developed and emerging economies. This expansion strategy allows the company to tap into new customer segments and capture market share in diverse regions.

Amazon’s Expansion into New Markets

Amazon has a proven track record of successfully entering new markets. The company’s expansion strategy is characterized by:

* Strategic Acquisitions: Amazon has acquired several companies, including Whole Foods Market and Zappos, to expand its product offerings and reach new customer segments.

* International Expansion: Amazon has a strong presence in major global markets, including North America, Europe, and Asia. The company is actively exploring opportunities to expand its operations in emerging markets, such as India and Southeast Asia.

* Market Adaptation: Amazon tailors its products and services to meet the specific needs of each market. This includes offering localized content, payment options, and delivery services.

Investments in Technology and Innovation

Amazon is a technology-driven company that invests heavily in research and development. The company’s investments in technology and innovation are aimed at:

* Improving Customer Experience: Amazon uses technology to personalize the shopping experience, enhance customer service, and provide convenient delivery options.

* Optimizing Operations: Amazon employs technology to streamline its supply chain, automate processes, and improve efficiency.

* Developing New Products and Services: Amazon is constantly developing new products and services, such as Alexa, Amazon Go, and Amazon Prime Air, to stay ahead of the competition and meet evolving customer needs.

Expert Opinions and Market Forecasts

Analysts and industry experts have mixed opinions on Amazon’s future stock performance. Some experts are optimistic about Amazon’s long-term growth prospects, citing the company’s strong market position, innovative products, and expansion into new markets. Others are more cautious, expressing concerns about increasing competition, regulatory scrutiny, and potential economic headwinds.

* Bullish Views: Some analysts believe that Amazon’s stock has the potential to continue its upward trajectory in the long term. They point to the company’s dominant market share in e-commerce and cloud computing, its growing subscription base, and its investments in emerging technologies.

* Bearish Views: Other analysts are more cautious, citing concerns about Amazon’s high valuation, potential antitrust scrutiny, and the growing threat of competition from companies like Walmart and Alibaba.

“Amazon is a company that is constantly evolving and adapting to the changing landscape. Its future prospects are bright, but there are also some risks that investors need to be aware of.” – Analyst at Morgan Stanley

Final Summary

Investing in Amazon stock is a decision that requires careful consideration. While Amazon’s future prospects look bright, there are always risks involved in the stock market. By understanding the factors that influence Amazon’s stock price, investors can make informed decisions and potentially capitalize on the company’s continued growth. Whether you’re a seasoned investor or just starting out, this guide provides the essential information you need to navigate the world of Amazon stock.

FAQ Section

What are some of the risks associated with investing in Amazon stock?

Like any stock, Amazon carries inherent risks. These include market volatility, competition, regulatory changes, and potential economic downturns. It’s important to diversify your portfolio and conduct thorough research before investing.

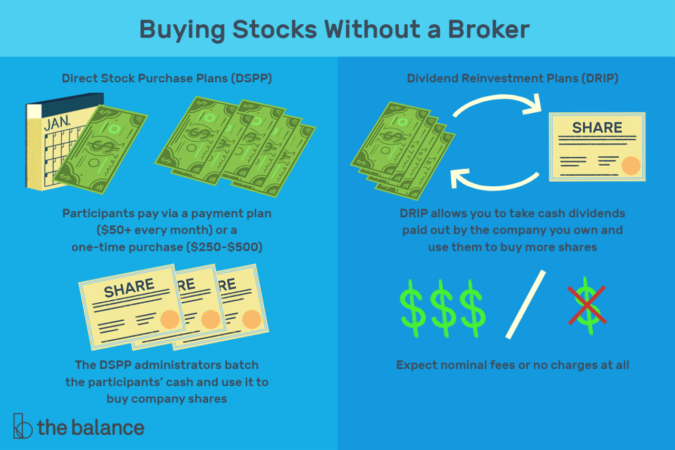

How can I buy Amazon stock?

You can buy Amazon stock through online brokerage accounts. Many popular platforms like Robinhood, TD Ameritrade, and Fidelity offer easy-to-use interfaces for buying and selling stocks.

What are the best resources for learning more about Amazon stock?

Websites like Yahoo Finance, Google Finance, and Seeking Alpha provide real-time data, news, and analysis on Amazon stock. You can also find valuable insights from financial publications and investing forums.