How much is car insurance in Florida? This question is on the minds of many Floridians, and for good reason. The Sunshine State is known for its beautiful beaches, vibrant culture, and… high car insurance rates. Florida’s unique laws, weather patterns, and high number of accidents all contribute to making car insurance more expensive here than in many other parts of the country. But, understanding the factors that influence your car insurance premiums can help you find the best coverage at the best price.

This comprehensive guide explores the intricacies of car insurance in Florida, from understanding the factors that affect your rates to discovering available discounts and navigating the state’s no-fault insurance system. Whether you’re a new driver, seasoned motorist, or simply looking to save money, this guide provides valuable insights to help you make informed decisions about your car insurance.

Factors Affecting Car Insurance Costs in Florida

Florida is known for its sunshine, beaches, and, unfortunately, high car insurance rates. Several factors contribute to the cost of car insurance in the Sunshine State. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History, How much is car insurance in florida

Your driving history plays a significant role in determining your car insurance rates. Insurance companies consider your past driving record, including:

- Accidents: Any accidents you’ve been involved in, especially those where you were at fault, can significantly increase your premiums. The severity of the accident and the number of accidents you’ve had are crucial factors.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can raise your insurance rates. The more violations you have, the higher your premiums will be.

- DUI/DWI Convictions: Driving under the influence (DUI) or driving while intoxicated (DWI) convictions have the most severe impact on your insurance rates. You may face significantly higher premiums or even have your insurance policy canceled.

Vehicle Information

The type of vehicle you drive is another major factor influencing your car insurance costs.

- Make and Model: Certain car models are more expensive to repair or replace, which can lead to higher insurance premiums. For example, sports cars and luxury vehicles are often associated with higher insurance costs.

- Year: Newer vehicles typically have more safety features and are generally more expensive to repair, leading to higher insurance rates. Older vehicles, while potentially cheaper to insure, may lack modern safety features.

- Safety Features: Cars equipped with safety features like anti-lock brakes, airbags, and electronic stability control can lower your insurance premiums. These features reduce the risk of accidents and injuries, making your vehicle less expensive to insure.

Demographics

Your personal information can also affect your car insurance rates.

- Age: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. As a result, they often face higher insurance premiums. However, insurance rates typically decrease as drivers gain experience and age.

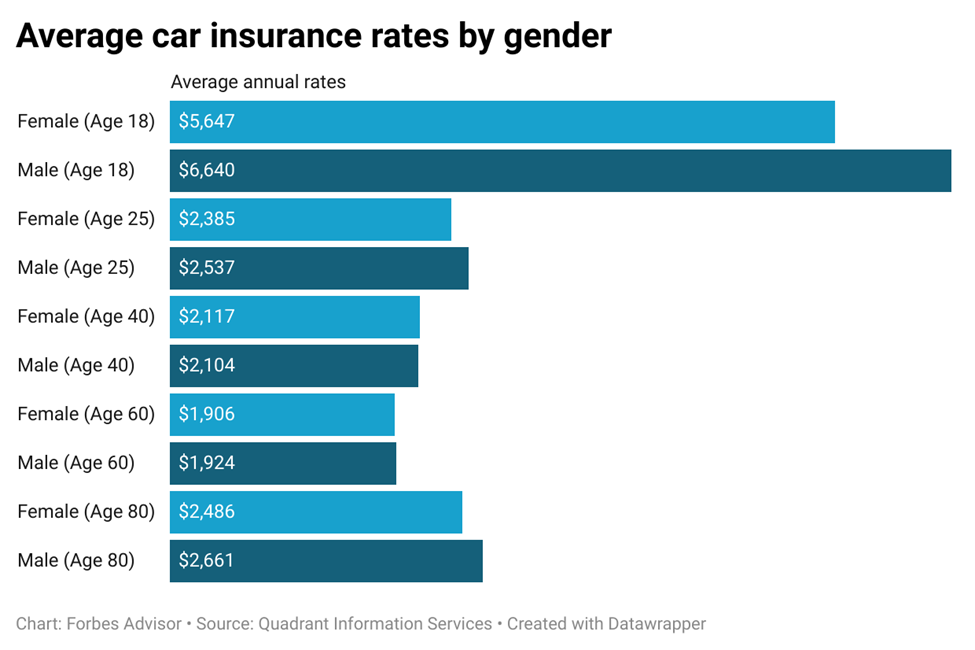

- Gender: Historically, men have been statistically more likely to be involved in accidents than women. While this gap has narrowed in recent years, some insurers may still consider gender when setting rates. However, this practice is becoming less common due to regulations.

- Credit Score: Surprisingly, your credit score can impact your car insurance premiums in some states, including Florida. Insurance companies believe that people with good credit are more likely to be responsible drivers and pay their bills on time.

Location

Where you live can have a significant impact on your car insurance rates.

- Zip Code: Insurance companies consider the crime rate, accident history, and population density of your zip code. Areas with high crime rates, frequent accidents, or congested traffic often have higher insurance premiums.

- Distance to Work: The distance you commute to work can affect your insurance rates. Drivers who commute longer distances are exposed to more potential hazards on the road, increasing their risk of accidents.

Florida’s No-Fault Law

Florida has a no-fault insurance system, which means that drivers are required to carry Personal Injury Protection (PIP) coverage. This coverage pays for medical expenses, lost wages, and other costs related to injuries sustained in an accident, regardless of who is at fault.

- PIP Coverage: The amount of PIP coverage you choose can affect your insurance premiums. Higher PIP coverage limits will generally lead to higher premiums.

- Impact on Rates: Florida’s no-fault system can impact insurance rates by influencing the frequency and severity of claims. For example, the availability of PIP coverage may lead to more claims, potentially increasing overall insurance costs.

Average Car Insurance Costs in Florida

Florida boasts a thriving automotive industry, and with a large population, it’s no surprise that car insurance plays a significant role in the state’s financial landscape. Understanding the average car insurance costs in Florida can help drivers make informed decisions about their coverage and budget accordingly.

Average Car Insurance Costs in Florida

The average annual cost of car insurance in Florida is $2,576, which is higher than the national average of $1,771. This higher cost can be attributed to several factors, including Florida’s high population density, a significant number of uninsured drivers, and the state’s susceptibility to natural disasters like hurricanes.

Average Car Insurance Costs by Coverage Level and Vehicle Type

| Coverage Level | Sedan | SUV | Truck |

|---|---|---|---|

| Liability Only | $1,200 | $1,350 | $1,500 |

| Full Coverage | $2,800 | $3,100 | $3,400 |

Comparison of Average Car Insurance Costs in Florida to Other States

Florida’s average car insurance cost is significantly higher than in many other states. For example, the average annual cost in Texas is $1,472, while in California it’s $2,078. These variations can be attributed to factors like state regulations, the number of uninsured drivers, and the frequency and severity of accidents.

Car Insurance Discounts in Florida

Car insurance discounts are a great way to save money on your premiums. In Florida, there are a number of discounts available, and by understanding these discounts and how to qualify for them, you can significantly reduce your overall insurance costs. This section will discuss the most common discounts available in Florida, the eligibility criteria, and how to maximize your savings by combining multiple discounts.

Types of Car Insurance Discounts in Florida

Florida insurance companies offer a wide range of discounts, and understanding these discounts is crucial to maximizing your savings. The most common types of car insurance discounts in Florida include:

- Good Driver Discount: This discount is available to drivers with a clean driving record, typically meaning no accidents or traffic violations within a specified period. This discount can be significant, sometimes exceeding 20% of the premium.

- Safe Driver Discount: Similar to the good driver discount, this discount is offered to drivers who have a proven track record of safe driving habits. This may include factors like driving a certain number of years without accidents or violations or participating in defensive driving courses.

- Multi-Car Discount: This discount applies when you insure multiple vehicles with the same insurance company. The discount is typically based on the number of vehicles insured, with greater discounts offered for larger fleets.

- Multi-Policy Discount: This discount is available when you bundle multiple insurance policies, such as car insurance, homeowners insurance, or renters insurance, with the same company. This can be a substantial discount, as insurance companies often offer a combined rate for multiple policies.

- Good Student Discount: This discount is typically offered to students who maintain a certain GPA or academic standing. This discount is often aimed at young drivers, encouraging them to prioritize their studies.

- Defensive Driving Course Discount: Completing a certified defensive driving course can qualify you for a discount. These courses teach drivers safe driving practices and can help reduce the risk of accidents. This discount is typically available to drivers of all ages.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as alarms, immobilizers, or tracking systems, can make your vehicle less attractive to thieves and qualify you for a discount.

- Low Mileage Discount: This discount is available to drivers who drive fewer miles per year. This is often a significant discount for individuals who work from home, use public transportation, or have other reasons for limited driving.

- Vehicle Safety Feature Discount: Modern vehicles often come equipped with advanced safety features like airbags, anti-lock brakes, and electronic stability control. These features can reduce the risk of accidents and qualify you for a discount.

- Loyalty Discount: Many insurance companies offer loyalty discounts to customers who have been with them for a certain period. This is a reward for long-term customer relationships and can provide a substantial saving.

Finding Affordable Car Insurance in Florida

Finding the most affordable car insurance in Florida can be a challenge, given the state’s high insurance rates. However, by following a few strategies, you can significantly reduce your premiums and secure the best coverage for your needs.

Comparing Car Insurance Quotes

To find the most competitive car insurance rates, it’s essential to compare quotes from multiple providers. This allows you to evaluate different coverage options and pricing structures.

- Use online comparison tools: Websites like Policygenius, Insurance.com, and NerdWallet offer convenient platforms to compare quotes from various insurers in Florida.

- Contact insurance companies directly: Reach out to insurance companies directly to obtain quotes and discuss your specific needs. This allows for personalized communication and clarification of coverage details.

- Consider local insurance brokers: Brokers can help you compare quotes from multiple insurers, often offering personalized recommendations based on your individual circumstances.

Negotiating Lower Premiums

Once you’ve received quotes from different insurers, you can use these as leverage to negotiate lower premiums.

- Bundle your insurance policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts.

- Ask about available discounts: Many insurers offer discounts for good driving records, safety features in your car, and other factors. Inquire about these discounts and ensure you’re receiving all applicable benefits.

- Shop around regularly: Review your insurance rates annually or even more frequently, as rates can fluctuate based on factors like your driving history and the market. Don’t hesitate to switch providers if you find a better deal.

Reviewing Your Insurance Policy Regularly

Regularly reviewing your insurance policy is crucial to ensure you’re getting the best coverage at the best price.

- Evaluate your coverage needs: As your life changes, your insurance needs may evolve. Regularly assess your coverage to ensure it still meets your requirements.

- Check for inaccuracies: Mistakes can occur in insurance policies. Carefully review your policy for any errors or inconsistencies.

- Consider increasing your deductible: Raising your deductible can often lower your premium, but it’s important to weigh the potential cost savings against the risk of higher out-of-pocket expenses in the event of an accident.

Florida’s No-Fault Insurance System: How Much Is Car Insurance In Florida

Florida operates under a no-fault insurance system, meaning that drivers involved in accidents are primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. This system aims to streamline the claims process and reduce litigation.

Personal Injury Protection (PIP) Coverage

Florida’s no-fault system relies heavily on Personal Injury Protection (PIP) coverage, a mandatory component of all auto insurance policies in the state. PIP coverage provides benefits to policyholders for medical expenses and lost wages following an accident, regardless of fault.

- Medical Expenses: PIP covers reasonable and necessary medical expenses incurred within the first three years of an accident, up to a maximum of $10,000.

- Lost Wages: PIP provides benefits for lost wages, up to 80% of the policyholder’s average weekly wage, for a maximum of 52 weeks.

Implications for Drivers Involved in Accidents

Florida’s no-fault system has significant implications for drivers involved in accidents.

- Limited Right to Sue: Drivers are generally barred from suing the other driver for pain and suffering unless their injuries meet certain thresholds, such as a “serious injury” defined by Florida law.

- Direct Payment to Providers: PIP coverage typically requires insurance companies to pay medical providers directly, streamlining the claims process.

- Potential for Disputes: The no-fault system can lead to disputes over the extent of coverage or the amount of benefits paid. Policyholders may need to file claims with their own insurance company and potentially seek legal counsel to resolve disputes.

Final Summary

Finding affordable car insurance in Florida doesn’t have to be a daunting task. By understanding the factors that influence your rates, exploring available discounts, and comparing quotes from different providers, you can secure the coverage you need without breaking the bank. Remember, staying informed and proactive about your car insurance can save you time, money, and stress in the long run. So, take charge of your insurance needs, explore your options, and find the right policy for your individual needs and budget.

Query Resolution

What are the main factors that affect car insurance rates in Florida?

Several factors can influence your car insurance rates, including your driving history, age, credit score, vehicle type, and location.

Is it mandatory to have car insurance in Florida?

Yes, it is mandatory to have car insurance in Florida. You must have at least the minimum required coverage to legally operate a vehicle on public roads.

How can I get a lower car insurance rate in Florida?

You can lower your car insurance rates by taking advantage of discounts, maintaining a good driving record, and choosing a safe and reliable vehicle.