How much is car insurance in florida for a 18-year-old – How much is car insurance in Florida for an 18-year-old sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Turning 18 in Florida means gaining the freedom to drive, but it also comes with the responsibility of securing car insurance. As a young driver, you’re likely to face higher premiums compared to older, more experienced drivers. This is because insurance companies consider young drivers to be statistically more likely to be involved in accidents.

This comprehensive guide will delve into the factors that influence car insurance costs for 18-year-olds in Florida, exploring the various coverage options available, and providing valuable tips to help you secure the best rates. We’ll also discuss ways to reduce your premiums and make car insurance more affordable. Get ready to learn about the ins and outs of car insurance for young drivers in the Sunshine State.

Factors Influencing Car Insurance Costs for 18-Year-Olds in Florida

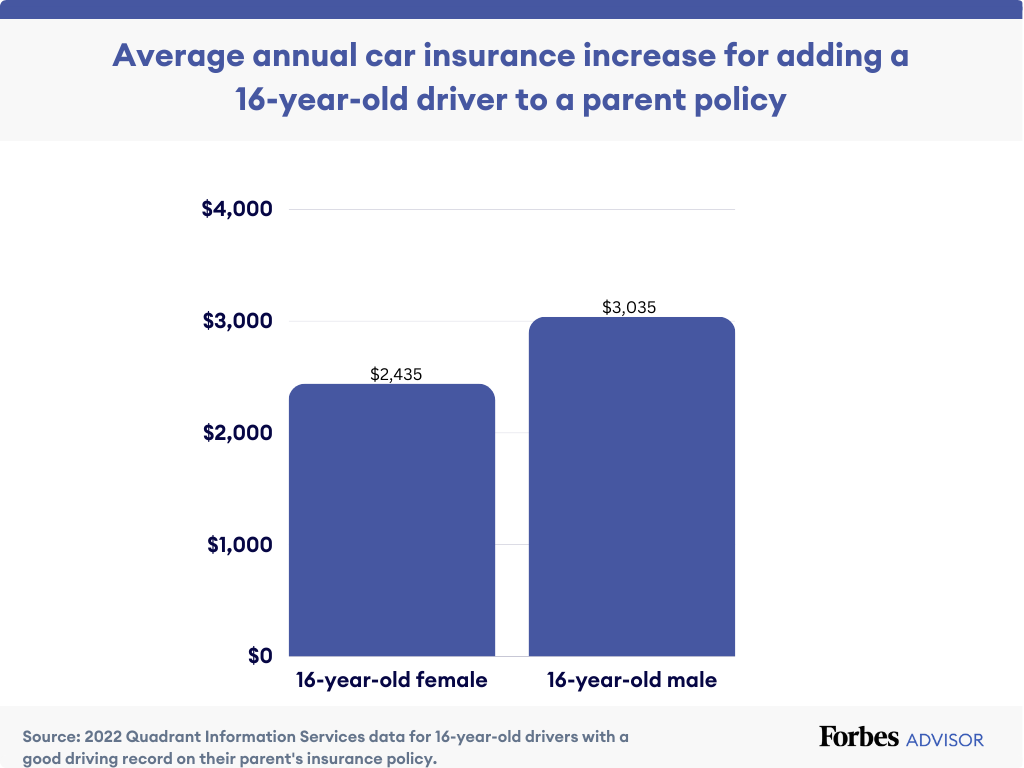

Car insurance rates for young drivers in Florida are influenced by a number of factors, making it crucial for 18-year-olds to understand how these factors affect their premiums.

Driving History

Driving history plays a significant role in determining car insurance rates for young drivers. Insurance companies consider factors such as accidents and traffic violations to assess risk.

A clean driving record with no accidents or violations is a major factor in securing lower insurance premiums.

For example, a young driver who has been involved in an accident or has received a speeding ticket will likely face higher insurance rates compared to a driver with no history of incidents.

Vehicle Type, Make, and Model

The type, make, and model of the vehicle significantly impact insurance premiums.

Vehicles with higher repair costs, performance features, or a history of theft or accidents are generally associated with higher insurance rates.

For instance, a high-performance sports car will typically have a higher insurance premium compared to a basic sedan due to its higher repair costs and potential for higher speeds.

Location and Zip Code

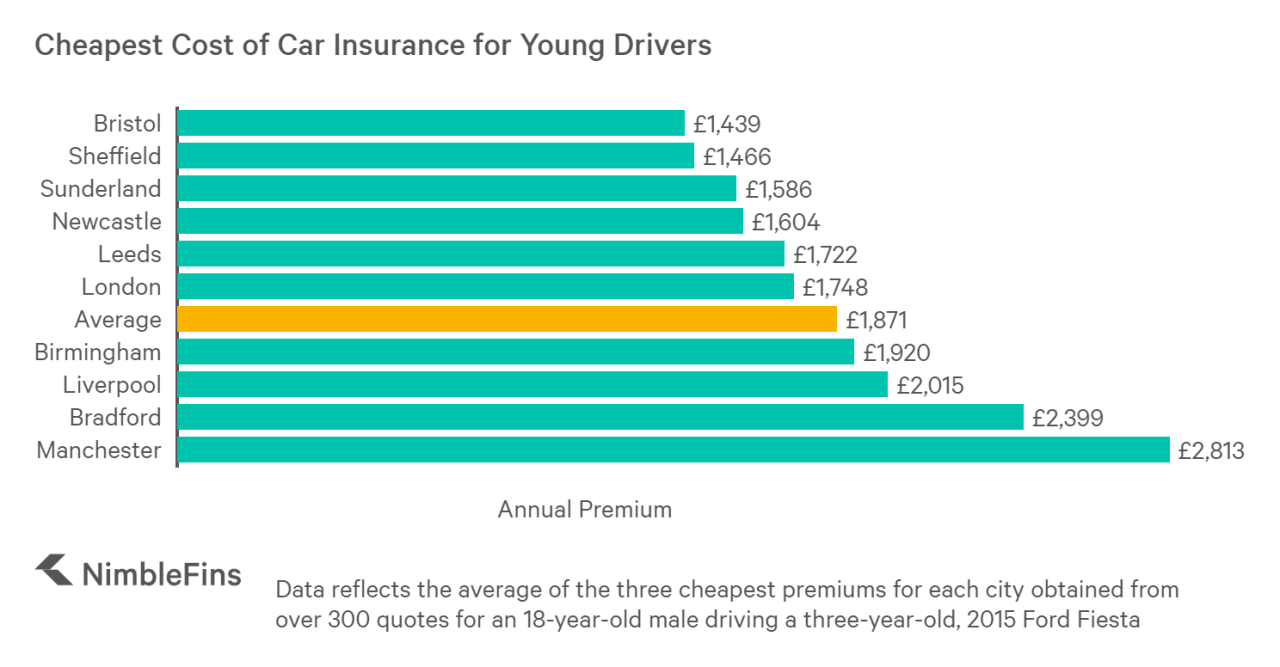

The location and zip code in Florida where a young driver resides can influence their car insurance rates.

Insurance companies consider factors like the frequency of accidents, theft rates, and traffic congestion in different areas.

Areas with higher crime rates or more frequent accidents may have higher insurance premiums compared to safer areas. For example, a driver residing in a densely populated urban area with a high volume of traffic may face higher rates compared to a driver in a rural area with lower traffic density.

Insurance Coverage Options and Their Impact on Costs

Understanding the different types of car insurance coverage available in Florida is crucial for 18-year-olds, as it directly impacts the cost of their insurance premiums. These coverage options provide financial protection in the event of an accident or other incidents involving your vehicle.

Types of Car Insurance Coverage in Florida

The following table Artikels the most common types of car insurance coverage available in Florida and their associated costs.

| Coverage Type | Description | Cost Impact |

|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident that results in injuries or property damage to others. | Mandatory in Florida, with minimum limits of $10,000 per person/$20,000 per accident for bodily injury and $10,000 for property damage. Higher limits result in higher premiums. |

| Collision Coverage | Covers repairs or replacement costs for your vehicle if it’s damaged in an accident, regardless of who’s at fault. | Optional, but often required by lenders if you have a car loan. Costs vary based on the vehicle’s value and your driving history. |

| Comprehensive Coverage | Protects your vehicle against damage caused by non-accident events, such as theft, vandalism, or natural disasters. | Optional, but often required by lenders if you have a car loan. Costs vary based on the vehicle’s value and your driving history. |

| Personal Injury Protection (PIP) | Covers medical expenses for you and your passengers, regardless of fault, in case of an accident. | Mandatory in Florida, with a minimum coverage limit of $10,000. Higher limits result in higher premiums. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | Protects you if you’re injured in an accident caused by a driver who is uninsured or has insufficient insurance. | Optional, but highly recommended. Costs vary based on the coverage limits you choose. |

The Importance of Liability Coverage

Liability coverage is crucial for young drivers in Florida, as it protects them from significant financial losses if they cause an accident. In Florida, drivers are legally required to carry a minimum amount of liability insurance. If you cause an accident and don’t have sufficient liability coverage, you could be held personally liable for damages, potentially leading to financial ruin.

“The minimum liability limits in Florida are often inadequate to cover the costs of a serious accident. It’s advisable to consider higher liability limits to ensure you’re adequately protected.”

Selecting the Right Coverage Level

Choosing the right coverage level depends on your individual needs and budget. Consider the following factors:

* Your financial situation: Can you afford to pay for repairs or medical expenses out of pocket if you’re involved in an accident?

* Your driving history: A clean driving record typically translates to lower premiums.

* The value of your vehicle: If you have a newer or more expensive car, you’ll likely need higher coverage limits.

* Your personal risk tolerance: Are you comfortable with the financial risks associated with lower coverage limits?

It’s always advisable to consult with an insurance agent to discuss your specific needs and get personalized recommendations.

Discounts and Ways to Reduce Car Insurance Costs

As an 18-year-old in Florida, you might be surprised by the high cost of car insurance. Fortunately, there are several ways to reduce your premiums and make coverage more affordable. Insurance companies offer a variety of discounts, and you can also take steps to improve your driving record and vehicle safety, which can significantly impact your rates.

Common Car Insurance Discounts

Many insurance companies offer discounts to young drivers in Florida. These discounts can help you save money on your premiums, so it’s worth exploring them.

- Good Student Discount: Maintaining good grades can earn you a discount. This is a common discount for young drivers, as insurance companies recognize that good students tend to be more responsible.

- Safe Driver Discount: If you have a clean driving record with no accidents or traffic violations, you can qualify for this discount. This demonstrates to insurance companies that you’re a safe driver and less likely to file a claim.

- Defensive Driving Course Discount: Completing a state-approved defensive driving course can reduce your premium. These courses teach safe driving techniques and can help you avoid accidents.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may qualify for a multi-car discount.

- Multi-Policy Discount: Combining your car insurance with other types of insurance, such as homeowners or renters insurance, can result in a discount.

- Loyalty Discount: Some insurance companies reward long-term customers with loyalty discounts.

- Pay-in-Full Discount: Paying your premium in full upfront may result in a discount.

- Paperless Billing Discount: Choosing electronic billing and communication can often earn you a discount.

Impact of Driving Habits and Safety Features, How much is car insurance in florida for a 18-year-old

Your driving habits and the safety features of your vehicle can significantly impact your car insurance premiums. Insurance companies consider these factors to assess your risk profile.

- Driving Record: As mentioned earlier, a clean driving record with no accidents or violations will earn you discounts. However, any accidents or violations can significantly increase your premiums.

- Driving Habits: Factors like driving mileage, driving during peak hours, and driving in high-risk areas can affect your rates. If you drive less frequently, avoid driving during peak rush hours, and stay away from high-traffic areas, you might qualify for lower premiums.

- Vehicle Safety Features: Cars equipped with advanced safety features like anti-lock brakes, airbags, and stability control are generally considered safer and can result in lower insurance premiums.

Comparing Quotes and Finding the Best Deals

Shopping around for car insurance is essential to find the best deals. Don’t settle for the first quote you receive. Compare quotes from multiple insurance providers to see which one offers the most competitive rates and coverage.

- Use Online Comparison Tools: Several online comparison websites allow you to enter your information once and receive quotes from multiple insurance companies. This makes the process quick and efficient.

- Contact Insurance Companies Directly: You can also contact insurance companies directly to get personalized quotes. This allows you to ask questions and discuss your specific needs.

- Review Policy Details Carefully: When comparing quotes, pay close attention to the coverage details, deductibles, and other factors. Make sure you understand the terms and conditions of each policy before making a decision.

- Consider Your Needs and Budget: Determine the level of coverage you need and set a budget for your car insurance. Don’t overspend on coverage you don’t require.

Car Insurance Rates for 18-Year-Olds in Florida

Here’s a comparison of car insurance rates for 18-year-olds in Florida from various insurance companies. Please note that these rates are estimates and can vary depending on individual factors like driving history, vehicle type, and coverage levels.

| Insurance Company | Average Annual Premium |

|---|---|

| State Farm | $2,500 – $3,000 |

| Geico | $2,300 – $2,800 |

| Progressive | $2,400 – $2,900 |

| Allstate | $2,600 – $3,100 |

Tips for 18-Year-Olds Seeking Car Insurance

Navigating the world of car insurance for the first time can be overwhelming, especially for young drivers. However, with a little preparation and understanding, you can secure a policy that fits your needs and budget. Here are some essential tips to guide you through the process.

Maintaining a Good Driving Record

A clean driving record is crucial for securing affordable car insurance. Insurance companies assess your risk based on your driving history, and any accidents, violations, or even minor traffic tickets can significantly impact your premiums.

- Drive Safely and Responsibly: This is the most important step. Follow traffic laws, avoid speeding, and always be aware of your surroundings.

- Take a Defensive Driving Course: Many insurance companies offer discounts for completing a defensive driving course. These courses teach you valuable driving skills and can help reduce your risk of accidents.

- Report Accidents Promptly and Honestly: If you are involved in an accident, report it to your insurance company immediately and be truthful about the circumstances. This will help ensure you receive the proper coverage and avoid any potential complications.

Obtaining Car Insurance Quotes and Comparing Options

Getting quotes from multiple insurance companies is essential to finding the best deal. Here’s a step-by-step guide to help you through the process:

- Gather Your Information: Before you start, have your driver’s license, Social Security number, vehicle information (make, model, year), and any relevant details about your driving history readily available.

- Contact Multiple Insurance Companies: Get quotes from at least three to five different insurance providers. You can do this online, over the phone, or in person.

- Compare Quotes Carefully: Pay attention to the coverage offered, the premium amount, and any additional fees or discounts. Don’t just focus on the lowest price; make sure the coverage is adequate for your needs.

- Ask Questions: Don’t hesitate to ask questions about the policy, the coverage, and any potential exclusions. Make sure you fully understand what you are buying.

Resources and Contact Information

Several resources can provide valuable information and support for young drivers seeking car insurance:

- Florida Department of Highway Safety and Motor Vehicles (FLHSMV): The FLHSMV website offers information about insurance requirements, driver’s licenses, and other related topics. You can find their contact information on their website.

- Florida Office of Insurance Regulation (OIR): The OIR website provides information about insurance companies, consumer rights, and how to file complaints. You can contact them if you have any concerns or questions about your insurance policy.

- National Highway Traffic Safety Administration (NHTSA): The NHTSA offers a wide range of resources for safe driving, including information about car safety, defensive driving, and teen driver safety. You can find their website at nhtsa.gov.

Conclusion: How Much Is Car Insurance In Florida For A 18-year-old

Navigating the world of car insurance as a young driver in Florida can feel overwhelming, but armed with the right information, you can make informed decisions to secure affordable and comprehensive coverage. Remember, maintaining a good driving record, exploring available discounts, and comparing quotes from different insurance providers are key to finding the best deal. By taking these steps, you can drive confidently knowing that you’re protected on the road.

User Queries

What factors determine car insurance rates for 18-year-olds in Florida?

Car insurance rates for 18-year-olds in Florida are influenced by a variety of factors, including driving history, vehicle type, location, and coverage options. Insurance companies consider young drivers to be statistically more likely to be involved in accidents, which is why premiums are typically higher for this age group.

What are some common car insurance discounts available to young drivers in Florida?

Many insurance companies offer discounts to young drivers in Florida, such as good student discounts, safe driver discounts, and discounts for taking defensive driving courses. Additionally, some companies offer discounts for having safety features in your vehicle, such as anti-theft devices or airbags.

What are some tips for 18-year-olds seeking car insurance in Florida?

To secure affordable car insurance as an 18-year-old in Florida, it’s essential to maintain a good driving record, shop around for quotes from different insurance providers, and consider the various coverage options available. It’s also important to be aware of the factors that influence insurance rates and how you can minimize your premiums.