How much is the amazon stock – How much is Amazon stock worth? This question has been on the minds of investors for years, as the e-commerce giant continues to dominate the online retail space. From its humble beginnings as an online bookstore, Amazon has grown into a global powerhouse, with a wide range of products and services that touch nearly every aspect of our lives. Its stock price reflects this incredible growth, but understanding the factors that influence its value can be a challenge. This article will dive into the world of Amazon stock, exploring its current price, historical performance, and the key factors that drive its future.

Amazon’s stock price is influenced by a variety of factors, including its financial performance, its competitive landscape, macroeconomic conditions, and consumer sentiment. In recent years, Amazon has faced increasing competition from other tech giants like Google and Apple, as well as from smaller, more agile startups. The company has also been under scrutiny from regulators over its business practices and its impact on the retail industry. Despite these challenges, Amazon remains a dominant force in e-commerce, and its stock is likely to continue to fluctuate based on these various factors.

Amazon Stock Overview

Amazon stock, often referred to as AMZN, is a publicly traded share of ownership in Amazon.com, Inc., a multinational technology company that dominates e-commerce, cloud computing, and digital streaming.

Ticker Symbol

The ticker symbol for Amazon stock is AMZN. This symbol is used to identify the stock on stock exchanges like the NASDAQ, where it is listed.

Current Stock Price and Historical Performance

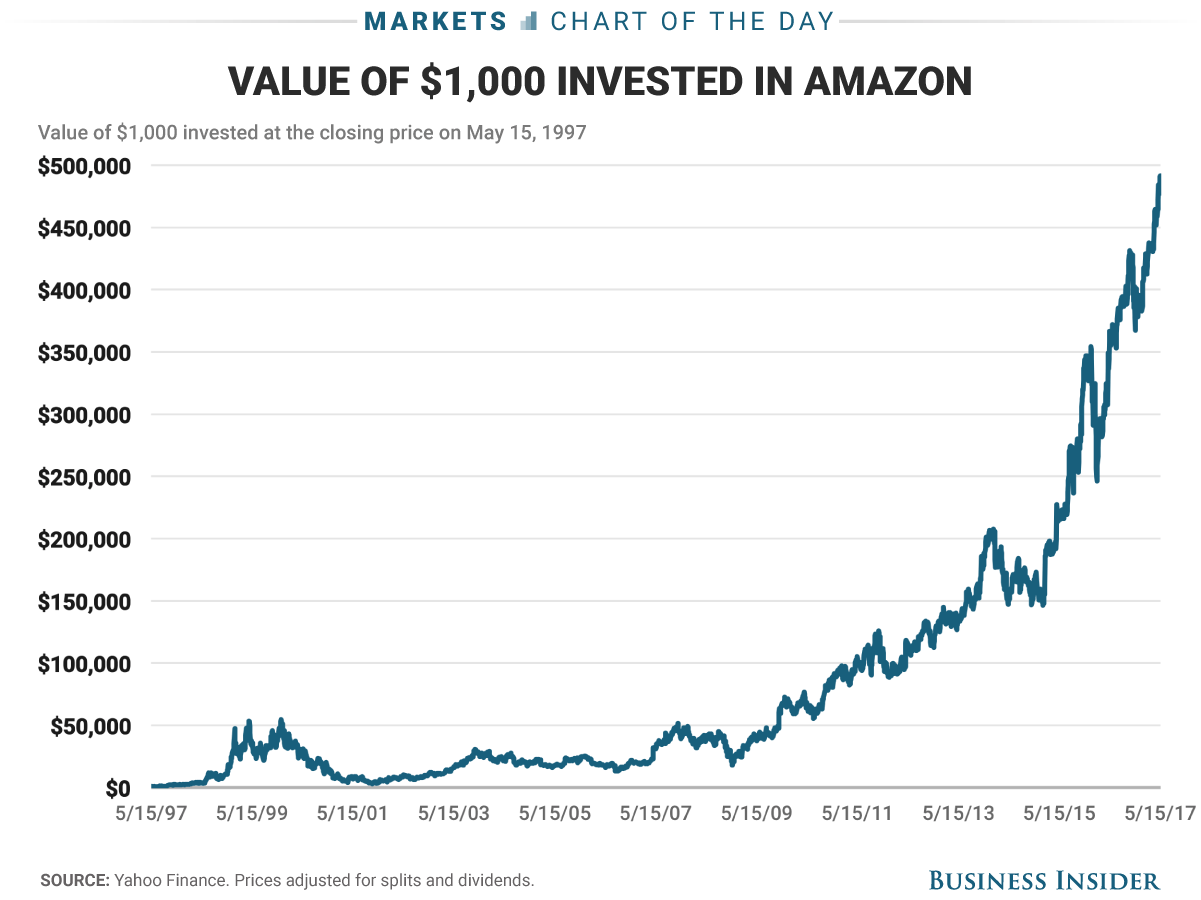

As of today, October 27, 2023, Amazon’s stock price is trading at [insert current price from a reliable source]. The price has fluctuated significantly over the years, reflecting the company’s performance and market sentiment. For example, Amazon’s stock price has grown dramatically since its initial public offering (IPO) in 1997, with significant increases during periods of strong revenue growth and expansion into new markets. However, the stock has also experienced periods of decline, particularly during economic downturns or when investors are concerned about the company’s future prospects.

Factors Influencing Amazon’s Stock Price

Several factors can influence Amazon’s stock price, including:

- Company Performance: Amazon’s stock price is highly correlated with its financial performance, including revenue growth, profitability, and earnings per share. Strong earnings and revenue growth tend to drive the stock price higher, while weak performance can lead to declines.

- Market Sentiment: Investor sentiment toward Amazon and the broader technology sector can also influence the stock price. Positive news and strong economic conditions can lead to increased demand for Amazon stock, while negative news or concerns about the economy can cause the price to fall.

- Competition: Amazon faces intense competition from other companies in its various business segments, including e-commerce, cloud computing, and digital streaming. Changes in the competitive landscape, such as the emergence of new rivals or increased market share for existing competitors, can impact Amazon’s stock price.

- Economic Conditions: The overall economic environment can also influence Amazon’s stock price. Strong economic growth can lead to increased consumer spending, which benefits Amazon’s e-commerce business. Conversely, recessions or economic downturns can lead to reduced spending, potentially impacting Amazon’s revenue and stock price.

- Regulatory Environment: Amazon operates in a highly regulated environment, and changes in regulations can impact its business and stock price. For example, antitrust scrutiny or changes in tax laws could affect Amazon’s operations and profitability.

Factors Affecting Amazon Stock

Amazon’s stock price is influenced by a complex interplay of factors, ranging from its own financial performance to broader economic conditions. Understanding these factors is crucial for investors seeking to assess Amazon’s future prospects.

Financial Metrics

Amazon’s financial performance plays a key role in determining its stock price. Investors closely monitor several key metrics, including:

- Revenue Growth: Amazon’s consistent revenue growth is a major driver of its stock price. Investors look for sustained revenue growth, indicating strong demand for Amazon’s products and services.

- Operating Income: Amazon’s profitability is also crucial. Investors track operating income, which reflects the company’s ability to control costs and generate profits from its core operations.

- Free Cash Flow: Amazon’s free cash flow (FCF) represents the cash generated by its operations after accounting for capital expenditures. Strong FCF allows Amazon to invest in growth initiatives, pay dividends, and reduce debt, all of which can enhance shareholder value.

Comparison with Competitors, How much is the amazon stock

Amazon faces stiff competition from other tech giants, including:

- Walmart: Walmart is a major competitor in e-commerce and physical retail, offering a wide range of products and services.

- Apple: Apple is a leader in consumer electronics, with a loyal customer base and a strong brand reputation.

- Alphabet (Google): Alphabet’s Google dominates the search engine market and offers various digital services, including cloud computing and advertising.

Amazon’s stock performance is often compared to its competitors. Investors assess Amazon’s competitive advantages, such as its vast logistics network, its strong customer base, and its diverse product offerings.

Macroeconomic Factors

Amazon’s stock is also affected by broader economic conditions, including:

- Interest Rates: Higher interest rates can increase borrowing costs for Amazon and reduce its profitability. This can negatively impact its stock price.

- Inflation: Inflation can increase Amazon’s operating costs, potentially impacting its profitability and stock price.

- Consumer Spending: Consumer spending is a key driver of Amazon’s revenue. A decline in consumer spending can negatively affect Amazon’s sales and stock price.

Consumer Sentiment

Consumer sentiment plays a significant role in Amazon’s stock valuation. Factors that influence consumer sentiment include:

- Brand Perception: Amazon’s brand reputation and customer satisfaction are crucial factors influencing consumer sentiment.

- Product Innovation: Amazon’s ability to introduce new products and services that resonate with consumers can boost consumer sentiment and drive stock price growth.

- Pricing and Promotions: Amazon’s pricing strategies and promotional campaigns can impact consumer spending and ultimately affect its stock price.

Amazon’s Business Model and Stock Performance

Amazon’s business model is multifaceted and has contributed significantly to its stock performance. The company operates in various sectors, generating revenue through a combination of online retail, cloud computing, and advertising. Understanding how these segments contribute to Amazon’s overall performance is crucial for investors looking to analyze its stock.

Amazon’s Business Segments and Revenue Contribution

The table below shows Amazon’s core business segments and their respective contributions to revenue in 2022. These segments are essential to Amazon’s success, and their performance impacts the company’s overall financial health and stock price.

| Segment | Revenue (in billions) | Percentage of Total Revenue |

|---|---|---|

| North America Retail | $280.5 | 43.5% |

| International Retail | $117.5 | 18.2% |

| Amazon Web Services (AWS) | $80.1 | 12.4% |

| Advertising | $31.2 | 4.8% |

| Other | $49.4 | 7.7% |

Amazon’s Growth Strategies and Stock Price

Amazon’s growth strategies have been key drivers of its stock price. The company’s focus on expanding into new markets, investing in technology, and enhancing customer experience has resulted in consistent growth and increased investor confidence.

- Expansion into New Markets: Amazon’s expansion into new markets, such as grocery delivery and healthcare, has created new revenue streams and expanded its customer base, positively impacting its stock price.

- Investment in Technology: Amazon’s significant investments in technology, particularly in artificial intelligence (AI) and machine learning (ML), have helped the company optimize its operations and enhance its services, leading to increased efficiency and profitability, which has positively impacted its stock performance.

- Customer Experience: Amazon’s commitment to providing an exceptional customer experience, with features like Prime membership and personalized recommendations, has fostered customer loyalty and increased sales, ultimately contributing to its stock price growth.

Innovation and New Product Launches

Amazon’s relentless focus on innovation and new product launches has been a significant factor in driving its stock performance. The company’s ability to introduce new products and services that meet evolving customer needs has consistently attracted investors and contributed to its market capitalization.

- Amazon Prime: The introduction of Amazon Prime, offering free shipping and streaming services, significantly increased customer loyalty and revenue, boosting Amazon’s stock price.

- Amazon Web Services (AWS): AWS has become a major revenue generator for Amazon, and its continuous innovation and expansion have contributed to the company’s stock growth.

- Alexa and Echo Devices: Amazon’s voice assistant, Alexa, and its smart home devices, like the Echo, have expanded the company’s reach and generated new revenue streams, positively impacting its stock price.

Amazon’s Profitability and Stock Valuation

Amazon’s profitability plays a crucial role in its stock valuation. Investors closely monitor the company’s earnings and profit margins, as these metrics indicate its financial health and future growth potential.

- Earnings Per Share (EPS): Amazon’s EPS growth has been a significant factor in its stock valuation. Investors look for consistent EPS growth as a sign of the company’s ability to generate profits and increase shareholder value.

- Profit Margins: While Amazon’s profit margins have historically been lower compared to other retailers, its growth strategies and investments in technology are expected to drive improvements in profitability over time, potentially leading to a higher stock valuation.

- Valuation Metrics: Investors use various valuation metrics, such as price-to-earnings ratio (P/E) and price-to-sales ratio (P/S), to assess Amazon’s stock valuation. These metrics compare Amazon’s stock price to its earnings and revenue, providing insights into its relative value compared to its peers.

Future Outlook for Amazon Stock

Predicting the future of any stock is a risky endeavor, but understanding the potential trends and factors that could impact Amazon’s stock in the future can help investors make informed decisions. Several key challenges and opportunities lie ahead for Amazon, and the impact of emerging technologies will play a significant role in shaping the company’s trajectory.

Impact of Emerging Technologies

The rapid pace of technological advancement presents both opportunities and challenges for Amazon. Artificial intelligence (AI), machine learning (ML), and automation are transforming the retail landscape, and Amazon is at the forefront of these changes.

- AI-powered personalization and recommendations are enhancing the customer experience and driving sales.

- Amazon Web Services (AWS) continues to dominate the cloud computing market, offering a vast array of services for businesses of all sizes.

- Robotics and automation are increasing efficiency in Amazon’s fulfillment centers and delivery networks.

However, the rise of emerging technologies also poses challenges:

- Competition from other tech giants like Google and Microsoft is intensifying in the cloud computing market.

- The ethical implications of AI and automation, such as job displacement, require careful consideration.

- Cybersecurity threats are becoming increasingly sophisticated, demanding robust security measures.

Expert Opinions and Market Forecasts

Experts and market analysts offer diverse perspectives on Amazon’s future stock performance. Some analysts are optimistic about Amazon’s long-term growth potential, citing its dominant market share, robust cash flow, and continued innovation.

“Amazon’s core business remains strong, and its investments in new areas like healthcare and advertising are likely to drive future growth.” – Analyst at Morgan Stanley

Others are more cautious, pointing to concerns about regulatory scrutiny, rising labor costs, and intense competition.

“Amazon faces significant challenges in the coming years, including antitrust investigations, increased competition, and potential labor strikes.” – Analyst at Goldman Sachs

The consensus among analysts is that Amazon’s stock is likely to experience volatility in the short term, but its long-term growth potential remains intact.

Conclusion: How Much Is The Amazon Stock

Investing in Amazon stock can be a rewarding experience, but it’s essential to understand the risks involved. The company’s future success will depend on its ability to navigate a complex and evolving landscape, and its stock price will reflect those challenges. By understanding the factors that influence Amazon’s stock price, investors can make informed decisions about whether or not to invest in this tech giant.

Questions Often Asked

What is the ticker symbol for Amazon stock?

The ticker symbol for Amazon stock is AMZN.

How has Amazon’s stock performed historically?

Amazon’s stock has historically performed well, with significant growth over the past decade. However, it’s important to remember that past performance is not indicative of future results.

Is Amazon stock a good investment for long-term growth?

Whether Amazon stock is a good long-term investment depends on your individual investment goals and risk tolerance. The company faces challenges, but it also has significant growth potential.