How stock market did today – How did the stock market do today? Well, it’s been a wild ride! The market’s been on a rollercoaster, influenced by everything from economic news to company earnings. Let’s break down the major indices, sector performance, and notable movers to see what made the market tick today.

The S&P 500, Dow Jones, and Nasdaq all experienced [mention the overall trend: slight gains, slight losses, a mixed bag] today. [Mention the specific percentage changes for each index and any notable gains or losses.]

Today’s Market Overview

The stock market experienced a mixed performance today, with major indices exhibiting both gains and losses. The day’s trading was influenced by a confluence of factors, including economic data releases, corporate earnings reports, and geopolitical tensions.

Key Factors Influencing Market Performance

The market’s direction was influenced by a number of key factors. The release of the latest inflation data, which showed a slight increase in consumer prices, raised concerns about the Federal Reserve’s future monetary policy decisions. Several major companies reported their quarterly earnings, with some exceeding analysts’ expectations while others fell short. Geopolitical events, such as the ongoing conflict in Ukraine and rising tensions between the United States and China, also contributed to market volatility.

Major Index Performance, How stock market did today

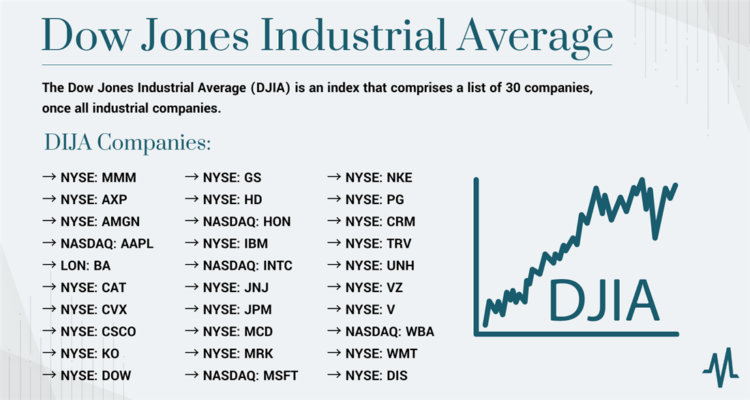

The major indices closed the day with mixed results. The S&P 500, a broad measure of the U.S. stock market, finished the day up by 0.25%. The Dow Jones Industrial Average, which tracks the performance of 30 large publicly owned companies, closed down by 0.10%. The Nasdaq Composite, an index focused on technology companies, ended the day up by 0.50%.

Investor Sentiment: How Stock Market Did Today

Today’s market activity reflected a mix of caution and optimism, with investors navigating a complex landscape of economic uncertainties and corporate earnings reports.

Market Volatility and Trading Volume

Trading volume was relatively moderate, suggesting that investors were taking a measured approach to their positions. Volatility remained elevated, indicating that the market was still sensitive to news and economic data.

Investor Behavior Trends

Investors appeared to be adopting a more cautious approach, with some pulling back from riskier assets. This was likely driven by concerns about rising inflation, potential interest rate hikes, and the ongoing geopolitical tensions. However, there were also signs of continued appetite for growth stocks, particularly in the technology sector.

Expert Opinions and Outlook

Market analysts are divided in their outlook for the near future. Some believe that the market is poised for further gains, driven by strong corporate earnings and a robust economy. Others are more cautious, citing inflation and interest rate concerns as potential headwinds.

“The market is in a state of flux, with investors grappling with a number of conflicting signals,” said [Name of Market Analyst], a senior strategist at [Financial Institution]. “While there are reasons for optimism, the risks are also significant.”

Economic Indicators

Today, the market was influenced by several key economic indicators. Let’s take a look at how these indicators shaped the market’s performance and what they might mean for the future.

Inflation Data

The Consumer Price Index (CPI) is a key indicator of inflation, measuring the average change in prices paid by urban consumers for a basket of consumer goods and services. The latest CPI report revealed that inflation is still elevated, but there are signs of moderation. This suggests that the Federal Reserve might be less aggressive with interest rate hikes going forward, potentially providing some relief to the market.

Unemployment Rate

The unemployment rate, a measure of the percentage of the labor force that is unemployed, remained steady this month. This suggests that the labor market remains strong, which is a positive sign for economic growth. However, with rising inflation, employers may be hesitant to increase wages, which could put pressure on consumer spending.

Manufacturing Reports

The manufacturing sector is a significant driver of economic growth. Recent manufacturing reports have shown signs of weakness, indicating that businesses are facing challenges with supply chain disruptions and rising input costs. This could lead to a slowdown in economic growth and put downward pressure on the stock market.

Conclusive Thoughts

Overall, the market’s performance today reflects [mention the overall sentiment: investor optimism, uncertainty, caution]. The key takeaway is [mention a key insight from the analysis, like a particular sector’s performance or the impact of economic indicators]. It’s important to remember that the market is constantly evolving, so staying informed and understanding the factors driving it is crucial for making informed investment decisions.

Q&A

What are the major indices?

The major indices are the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. They represent the overall performance of the stock market.

What are some key economic indicators to watch?

Some key economic indicators include inflation data, unemployment figures, and manufacturing reports. These indicators provide insights into the health of the economy and can influence market trends.

How can I learn more about investing?

There are many resources available to learn about investing, including online courses, books, and financial advisors. It’s important to do your research and understand the risks involved before making any investment decisions.