How to buy DJT stock? You’re probably wondering if you can actually buy stock in the former president, Donald J. Trump. The answer is a little more complicated than you might think. It depends on what you mean by “DJT stock.” It’s important to clarify what you’re looking for before you start searching for the perfect investment opportunity.

You might be interested in investing in one of Trump’s businesses, like the Trump Organization. Or maybe you’re curious about the stock prices of companies that have benefited from Trump’s policies. Whatever your reason, it’s essential to do your research and understand the risks involved before investing in any stock.

Understanding the Search Intent

People searching “how to buy DJT stock” are likely interested in investing in the company or speculating on its future performance. However, it’s crucial to understand that “DJT stock” could refer to several different entities, each with its own unique meaning and implications.

Interpretations of the Search Term

The search term “DJT stock” could have various interpretations, depending on the user’s specific intention.

- Donald J. Trump’s Personal Investments: Some users might be looking to invest in companies owned or controlled by Donald J. Trump, such as the Trump Organization. These investments could be seen as a way to capitalize on his personal brand or business acumen.

- Trump-Related Companies: Others might be interested in companies associated with Trump, either through partnerships or endorsements. This could include companies like the Trump Hotel chain or businesses that have benefited from Trump’s policies.

- Political Speculation: Some searches might be driven by political motivations. Users might be seeking to profit from potential changes in the stock market due to political events or policies associated with Trump.

Specific Scenarios

Several scenarios could lead someone to search for “how to buy DJT stock”:

- An individual interested in Trump’s business ventures: They might want to invest in a specific company, like the Trump Organization, to support his business ventures or speculate on their future performance.

- A political enthusiast: They might be seeking to capitalize on political events or policies related to Trump. For example, they might invest in companies that could benefit from Trump’s policies or actions.

- A news-driven investor: They might have read a news article or report suggesting a potential investment opportunity related to Trump or his companies.

Clarifying DJT Stock

The term “DJT stock” is often used in online discussions and financial forums, but it can be confusing. This is because there isn’t a single, clearly defined company or asset that represents “DJT stock.” The term is usually used to refer to potential investments related to Donald J. Trump, the 45th President of the United States.

Potential Companies and Assets

The ambiguity surrounding “DJT stock” stems from the fact that there are several potential companies and assets that could be associated with Donald Trump.

- The Trump Organization: This is a privately held company owned by Donald Trump and his family. It manages a diverse portfolio of businesses, including hotels, golf courses, and real estate developments. While the Trump Organization itself is not publicly traded, some of its subsidiaries or projects may have been financed through publicly traded entities.

- Trump-branded Companies: Various companies have licenses to use the “Trump” name for their products or services. These companies might be publicly traded, and their stock prices could be influenced by events related to Donald Trump.

- Political Action Committees (PACs): PACs associated with Donald Trump may issue securities, such as bonds, to raise funds. These securities might be considered “DJT stock” in some contexts.

Understanding the Meaning of “DJT”

The acronym “DJT” typically stands for “Donald J. Trump.” This abbreviation is commonly used in financial contexts when discussing investments or assets associated with him.

Examples of How “DJT Stock” Might Be Used

Here are some examples of how the term “DJT stock” might be used in different contexts:

- “I’m thinking about investing in DJT stock, but I’m not sure which company to choose.” This statement could refer to investing in a publicly traded company that has ties to Donald Trump, such as a company that licenses his name or a company that has been involved in his business ventures.

- “The price of DJT stock has been fluctuating wildly since the election.” This statement could refer to the stock price of a company that is perceived to be heavily influenced by Donald Trump’s political activities.

- “I’m curious about the performance of DJT stock after the recent scandals.” This statement could refer to the stock price of a company that has been negatively affected by news or events related to Donald Trump.

Stock Trading Basics

Investing in stocks is a way to participate in the growth of companies and potentially earn a return on your investment. Understanding the fundamentals of stock trading is crucial before you start buying and selling stocks.

Buying and Selling Stocks

When you buy a stock, you are purchasing a small ownership share in a company. The price you pay for a share is determined by supply and demand in the market. The more people want to buy a stock, the higher its price will rise. Conversely, if more people are selling a stock, the price will fall.

You can buy and sell stocks through a brokerage account, which is an account that allows you to trade stocks and other securities. Brokerage accounts are offered by various financial institutions, such as banks, investment firms, and online platforms.

Market Orders

A market order is a type of order that instructs your broker to buy or sell a stock at the best available price at the moment the order is placed. Market orders are typically used when you want to buy or sell a stock immediately and are less concerned about the exact price you pay or receive.

Different Types of Stock Markets

There are various stock markets around the world, each with its own rules and regulations. Some of the most prominent stock markets include:

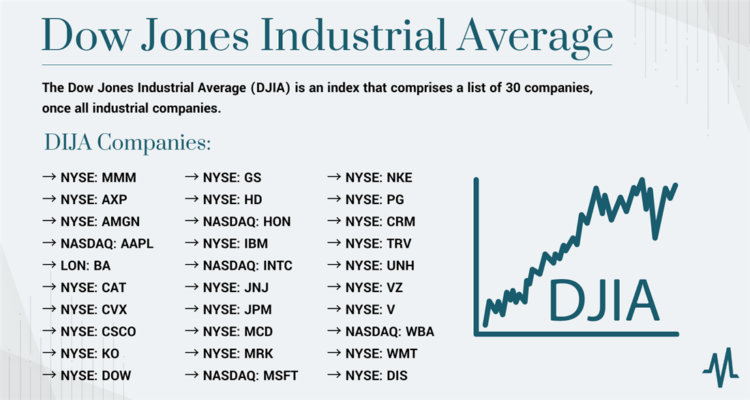

- New York Stock Exchange (NYSE): The NYSE is the largest stock exchange in the world by market capitalization. It is a physical exchange where traders meet on the floor to buy and sell stocks.

- Nasdaq Stock Market: The Nasdaq is a computerized stock exchange that is known for its focus on technology companies. It is an electronic exchange where trades are executed through a network of computers.

- London Stock Exchange (LSE): The LSE is one of the oldest and largest stock exchanges in Europe. It is a physical exchange where traders meet on the floor to buy and sell stocks.

Opening a Brokerage Account

Opening a brokerage account is the first step to start trading stocks. To open an account, you will typically need to provide personal information, such as your name, address, and Social Security number. You will also need to choose a brokerage firm and decide on the type of account you want to open.

Here’s a step-by-step guide for opening a brokerage account:

- Choose a brokerage firm: Research different brokerage firms and compare their fees, trading platforms, and customer service.

- Fill out an application: Once you’ve chosen a brokerage firm, you will need to fill out an application online or in person. You will need to provide personal information, such as your name, address, and Social Security number.

- Fund your account: After your application is approved, you will need to fund your account. You can do this by transferring money from your bank account or by depositing a check.

- Start trading: Once your account is funded, you can start trading stocks. You can place orders through the brokerage firm’s website or mobile app.

Researching Potential Investments

Investing in the stock market is a significant decision, and it’s crucial to conduct thorough research before making any purchase. This research helps you understand the potential risks and rewards associated with an investment, allowing you to make informed decisions.

Analyzing Financial Statements

Financial statements provide valuable insights into a company’s financial health. By analyzing these statements, you can assess the company’s profitability, debt levels, and cash flow.

- Income Statement: This statement shows a company’s revenues, expenses, and net income over a specific period. A company’s profitability is reflected in its net income.

- Balance Sheet: This statement provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It helps you understand the company’s financial structure and its ability to meet its financial obligations.

- Cash Flow Statement: This statement tracks the movement of cash into and out of a company. It reveals how much cash the company generates from its operations, investing activities, and financing activities.

Analyzing Company News

Staying updated on company news is essential to understand how a company is performing and its future prospects. You can find this information from various sources, including:

- Financial News Websites: Websites like Bloomberg, Reuters, and Yahoo Finance provide real-time news updates and financial data.

- Company Websites: Most companies have investor relations sections on their websites that provide press releases, financial reports, and other relevant information.

- Social Media: Platforms like Twitter and LinkedIn can offer insights into a company’s performance, announcements, and industry trends.

Analyzing Market Trends

Understanding market trends can help you identify investment opportunities and avoid potential risks. Here are some factors to consider:

- Economic Indicators: Economic data, such as GDP growth, inflation, and unemployment rates, can impact stock prices.

- Industry Trends: Following industry trends can help you understand the growth potential and challenges of specific sectors.

- Geopolitical Events: Global events, such as wars, political instability, and trade disputes, can significantly influence market sentiment.

Reliable Sources for Financial Data and Investment Research

Several reliable sources can provide you with financial data and investment research:

- Brokerage Platforms: Many brokerage platforms offer research reports, market analysis, and investment tools.

- Financial Research Firms: Firms like Morningstar, S&P Global Market Intelligence, and FactSet provide in-depth financial data and research.

- Government Agencies: The Securities and Exchange Commission (SEC) and the Federal Reserve provide economic data and regulatory information.

Understanding Risks and Rewards: How To Buy Djt Stock

Investing in the stock market, including potentially buying DJT stock, involves inherent risks. It’s crucial to understand these risks before making any investment decisions. While the potential for profits exists, so does the possibility of losses.

Market Volatility and Potential Losses, How to buy djt stock

The stock market is inherently volatile. Stock prices can fluctuate significantly, even on a daily basis, due to various factors such as economic news, company performance, and investor sentiment. This volatility can lead to losses, even for experienced investors.

Risk Tolerance

Risk tolerance is a measure of your ability and willingness to accept the potential for losses in pursuit of higher returns. It’s a personal factor that depends on your financial situation, investment goals, and personal risk appetite.

Investment Strategies and Risk Profiles

Different investment strategies have varying risk profiles. For instance:

- Conservative Strategies: These strategies emphasize preserving capital and minimize risk. They often involve investing in low-risk assets such as bonds or dividend-paying stocks.

- Moderate Strategies: These strategies aim for a balance between growth and preservation of capital. They may include a mix of stocks, bonds, and other assets.

- Aggressive Strategies: These strategies seek higher returns but involve greater risk. They often focus on growth stocks or other high-risk investments.

Example: A conservative investor might prioritize preserving capital and invest in a diversified portfolio of bonds, while an aggressive investor might allocate a larger portion of their portfolio to growth stocks, accepting a higher level of risk in pursuit of greater returns.

Responsible Trading Practices

It’s important to approach trading with a responsible mindset, focusing on long-term growth and minimizing risk. This means understanding the importance of diversification, embracing dollar-cost averaging, and developing strategies to manage risk effectively.

Diversification and Long-Term Investing

Diversification is a crucial strategy for managing risk in any investment portfolio. It involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This helps reduce the impact of any single investment’s performance on your overall portfolio. By diversifying, you are essentially reducing the risk that a downturn in one asset class will significantly impact your overall investment.

For example, if you have all your money invested in a single stock and that stock performs poorly, you could lose a significant portion of your investment. However, if you diversify your portfolio across different stocks, bonds, and other assets, the impact of any single investment’s poor performance will be less significant.

Long-term investing, often referred to as buy-and-hold, is another essential aspect of responsible trading. It involves holding investments for extended periods, typically years or even decades, to benefit from the power of compounding. This approach allows your investments to grow over time, potentially outperforming short-term trading strategies.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of the stock’s current price. This helps to smooth out the impact of market volatility and potentially reduce the average cost of your investment over time. By investing consistently, you buy more shares when prices are low and fewer shares when prices are high. This approach can be beneficial for long-term investors who want to minimize risk and potentially increase returns.

For example, imagine you invest $100 per month in a stock for a year. If the stock price fluctuates throughout the year, you will buy more shares when the price is low and fewer shares when the price is high. Over time, this strategy can help you reduce your average cost per share and potentially increase your returns.

Managing Risk and Avoiding Pitfalls

Effective risk management is crucial for responsible trading. It involves identifying and assessing potential risks, developing strategies to mitigate those risks, and monitoring your investments regularly. Here are some tips for managing risk:

- Set realistic goals: Don’t expect to get rich quick. Set realistic goals for your investments and stick to them. Avoid chasing high returns or risky investments that promise unrealistic gains.

- Know your risk tolerance: Understand your own comfort level with risk. If you are risk-averse, you may prefer to invest in less volatile assets like bonds or real estate. If you are comfortable with risk, you may be more willing to invest in stocks or other higher-growth assets.

- Develop a trading plan: Before you start trading, develop a clear plan that Artikels your investment goals, risk tolerance, and trading strategies. This will help you stay disciplined and avoid making impulsive decisions.

- Don’t chase losses: If an investment is performing poorly, don’t try to make it back by investing more money. This can lead to further losses. Instead, consider cutting your losses and moving on to other investments.

- Avoid emotional trading: Trading based on emotions, such as fear or greed, can lead to poor decisions. It’s important to stay objective and stick to your trading plan.

- Keep your emotions in check: Emotions can be a powerful force in investing, often leading to poor decisions. Don’t let fear or greed dictate your trading choices. Stick to your plan and avoid making rash decisions based on fleeting emotions.

Conclusive Thoughts

Investing in the stock market can be a great way to grow your wealth, but it’s important to be aware of the risks. Do your research, understand the market, and invest responsibly. Remember, investing in the stock market is not a get-rich-quick scheme. It takes time, patience, and a solid understanding of the market to be successful.

FAQ Corner

What does DJT stock actually refer to?

DJT stock can refer to a few different things. It might refer to a company that Donald Trump owns or is affiliated with, like the Trump Organization. It could also refer to a company that has benefited from Trump’s policies, or even just a company with a stock symbol that happens to be DJT. It’s important to clarify what you’re looking for before you start searching for the perfect investment opportunity.

Is it possible to buy stock directly from Trump?

It’s unlikely that you can buy stock directly from Trump himself. If you’re looking to invest in a company that he owns or is affiliated with, you’ll need to go through a brokerage account. You can’t just walk into his office and buy stock.

Is investing in DJT stock risky?

All stock investments come with risk, and DJT stock is no exception. There’s no guarantee that you’ll make money, and you could even lose money. It’s important to understand the risks before you invest.