How to buy Temu stock is a question on many investors’ minds. Temu, a rapidly growing e-commerce platform known for its affordable prices and vast product selection, has captured the attention of both consumers and investors. The company’s unique business model, leveraging a direct-to-consumer approach and a sophisticated supply chain, has fueled its rapid ascent. This guide will delve into Temu’s business model, financial performance, and ownership structure, providing insights into the potential for investing in this emerging e-commerce giant.

Understanding Temu’s trajectory requires exploring its business model, financial performance, and future growth prospects. The company’s ability to navigate the competitive e-commerce landscape and maintain its rapid growth will be key factors influencing its stock performance.

Temu’s Business Model and Operations: How To Buy Temu Stock

Temu is a rapidly growing e-commerce platform that has disrupted the online retail landscape by offering a wide range of products at incredibly low prices. Its business model is based on a combination of factors, including sourcing from global manufacturers, leveraging a streamlined supply chain, and employing aggressive pricing strategies.

Target Audience and Value Proposition

Temu primarily targets budget-conscious consumers seeking affordable products across various categories, including fashion, home goods, electronics, and more. Its value proposition is centered around providing high-quality products at significantly lower prices compared to traditional retailers and other online marketplaces.

Supply Chain and Logistics

Temu’s supply chain is characterized by its global sourcing strategy, leveraging manufacturers in China and other countries known for their competitive production costs. The company operates a sophisticated logistics network that enables it to efficiently move goods from suppliers to consumers worldwide.

Pricing Strategy and Competitive Landscape

Temu’s pricing strategy is heavily reliant on its ability to secure products at low prices from its suppliers. This allows the company to offer products at significantly discounted rates, often significantly lower than competitors like Amazon, Shein, and AliExpress. Temu’s aggressive pricing strategy has attracted a large customer base, particularly among budget-conscious shoppers.

Comparison with Other E-commerce Platforms

- Amazon: While Amazon offers a vast selection of products, its prices are generally higher than Temu’s, especially for non-branded items. Amazon’s focus on customer service and fast shipping is a key differentiator.

- Shein: Shein is known for its trendy fashion items at affordable prices. However, Temu’s product selection is broader, encompassing a wider range of categories beyond fashion.

- AliExpress: AliExpress is another platform known for its low prices, but its shipping times can be longer than Temu’s, and customer service can be inconsistent.

Temu’s Financial Performance and Growth Prospects

Temu, a rapidly growing e-commerce platform, has garnered significant attention for its aggressive expansion strategy and compelling value proposition. While the company is relatively new, its financial performance and growth prospects are crucial factors to consider for investors and industry analysts alike.

Temu’s Revenue and Profitability

Temu’s revenue and profitability figures are not publicly available as the company is privately held. However, based on its rapid user growth and market penetration, it’s likely that Temu is generating substantial revenue. The company’s business model, which relies on low prices and a high volume of sales, suggests a focus on achieving profitability through scale.

Temu’s User Growth and Market Penetration

Temu has experienced impressive user growth since its launch. The company’s aggressive marketing campaigns, including social media advertising and influencer partnerships, have helped to attract a large user base. Temu’s strong user growth is a testament to its appeal to value-conscious consumers seeking affordable products.

Key Financial Metrics and Trends Indicating Temu’s Future Growth Potential

Several key financial metrics and trends suggest that Temu has significant growth potential.

- User Acquisition Cost (CAC): Temu’s ability to acquire new users at a low cost is crucial for its profitability. The company’s aggressive marketing strategies, including social media advertising and influencer partnerships, have helped to keep its CAC relatively low.

- Customer Lifetime Value (CLTV): Temu’s ability to retain customers and encourage repeat purchases is essential for its long-term success. The company’s focus on offering a wide range of products at competitive prices suggests that it has the potential to achieve a high CLTV.

- Gross Merchandise Value (GMV): Temu’s GMV, which represents the total value of goods sold on its platform, has been growing rapidly. This indicates strong demand for the company’s products and its ability to attract sellers to its marketplace.

Comparison of Temu’s Financial Performance to Its Competitors

Temu’s financial performance is difficult to compare directly to its competitors, as it is a privately held company. However, it is clear that Temu has achieved significant user growth and market penetration in a short period. The company’s ability to offer competitive prices and a wide selection of products has helped it to gain traction in the highly competitive e-commerce market.

Temu’s Ownership Structure and Public Listing Status

Temu, the fast-growing e-commerce platform, is a subsidiary of PDD Holdings Inc., a Chinese technology giant that also owns the popular Pinduoduo app. Understanding Temu’s ownership structure and potential public listing plans is crucial for investors and those interested in the company’s future trajectory.

Temu’s Ownership Structure

Temu’s ownership structure is relatively straightforward. It is a wholly-owned subsidiary of PDD Holdings Inc., a publicly traded company listed on the NASDAQ stock exchange under the ticker symbol “PDD.” This means that PDD Holdings holds 100% of Temu’s shares, giving it complete control over the e-commerce platform’s operations and strategic decisions.

Temu’s Public Listing Status and Potential IPO

Temu is currently not publicly listed. While it has not formally announced any plans for an initial public offering (IPO), the possibility remains a subject of speculation. Several factors could influence Temu’s decision to go public.

Factors Influencing Temu’s IPO Decision

- Market Conditions: The overall stock market performance and investor sentiment play a significant role in a company’s decision to go public. A strong market with a favorable IPO climate can make it more attractive for Temu to raise capital through an IPO.

- Growth Trajectory: Temu’s rapid growth and strong financial performance could make it a compelling candidate for an IPO. Demonstrating continued growth and profitability would strengthen its appeal to investors.

- Strategic Goals: Temu might consider an IPO to access additional capital for expansion, marketing, or new product development. Going public can also enhance brand recognition and market visibility.

Potential Benefits and Risks of a Temu IPO

- Benefits:

- Access to Capital: An IPO allows Temu to raise significant capital from the public markets, which can be used to fund growth initiatives and strategic acquisitions.

- Increased Brand Visibility: Going public increases Temu’s profile and market visibility, attracting more customers and potential business partners.

- Employee Stock Options: An IPO can provide Temu’s employees with equity ownership, boosting morale and employee retention.

- Risks:

- Increased Scrutiny: As a publicly traded company, Temu would face heightened regulatory scrutiny and public pressure to maintain transparency and meet investor expectations.

- Short-Term Focus: Public companies often face pressure to deliver short-term results, which could potentially distract from long-term strategic planning.

- Share Price Volatility: Stock prices can fluctuate significantly, creating potential risks for investors and impacting Temu’s valuation.

Investing in Temu Stock

Temu, the online marketplace owned by PDD Holdings, has attracted significant attention for its rapid growth and aggressive expansion strategy. As a potential investment opportunity, it’s crucial to consider various factors before making a decision.

Factors to Consider

Before investing in Temu stock, it’s important to carefully evaluate several key factors:

| Factor | Description |

|---|---|

| Temu’s Business Model and Operations | Analyze Temu’s unique business model, its competitive landscape, and its ability to navigate the challenges of the e-commerce market. Consider its logistics, customer acquisition strategies, and its ability to manage costs effectively. |

| Temu’s Financial Performance and Growth Prospects | Assess Temu’s financial performance, including revenue growth, profitability, and cash flow. Examine its historical performance and its projected future growth potential. Analyze its market share, customer base, and expansion plans. |

| Temu’s Ownership Structure and Public Listing Status | Understand Temu’s ownership structure and its relationship with its parent company, PDD Holdings. Determine if Temu plans to pursue a public listing and the potential implications for investors. |

| Global Economic Conditions | Evaluate the impact of global economic conditions, such as inflation, interest rates, and consumer spending, on Temu’s business. Analyze its ability to navigate economic uncertainties and maintain its growth trajectory. |

| Competition and Market Dynamics | Assess Temu’s competitive landscape and the intensity of competition within the e-commerce market. Analyze the strengths and weaknesses of its competitors and its ability to differentiate itself and gain market share. |

| Management Team and Corporate Governance | Evaluate the experience and track record of Temu’s management team and its commitment to sound corporate governance practices. Assess the company’s financial transparency and its ability to execute its strategic plans effectively. |

| Valuation and Pricing | Analyze Temu’s current valuation and its pricing relative to its peers and its growth prospects. Consider the potential for future price appreciation and the risks associated with its valuation. |

| Risk Tolerance and Investment Horizon | Assess your personal risk tolerance and investment horizon. Consider the potential volatility of Temu’s stock and your ability to withstand market fluctuations. |

Potential Risks and Opportunities

Investing in Temu stock presents both potential risks and opportunities:

Risks

- Competition: The e-commerce market is highly competitive, with established players like Amazon and Alibaba. Temu’s ability to compete effectively and maintain its growth trajectory is uncertain.

- Regulatory Environment: The e-commerce sector is subject to evolving regulations, which could impact Temu’s operations and profitability. Navigating these regulations effectively is crucial for its success.

- Supply Chain Disruptions: Global supply chain disruptions and rising costs could affect Temu’s ability to source products and deliver them to customers efficiently.

- Consumer Sentiment: Consumer spending patterns are influenced by economic conditions and consumer confidence. A decline in consumer spending could impact Temu’s revenue and profitability.

- Technological Advancements: Rapid technological advancements in e-commerce could disrupt Temu’s business model and require significant investments to stay competitive.

- Data Security and Privacy: Protecting customer data and maintaining privacy is crucial in the e-commerce sector. Any data breaches or privacy concerns could damage Temu’s reputation and lead to legal liabilities.

Opportunities

- Growing E-commerce Market: The global e-commerce market is expected to continue growing, presenting significant opportunities for Temu to expand its reach and market share.

- Strong Brand Recognition: Temu has rapidly built brand recognition through its aggressive marketing campaigns and value-oriented pricing. This could translate into increased customer loyalty and sales.

- Technological Innovation: Temu’s focus on technology and data analytics could enable it to develop innovative solutions that improve customer experience and drive growth.

- Global Expansion Potential: Temu has already expanded into several international markets. Further global expansion could significantly increase its revenue and customer base.

Impact of Global Economic Conditions

Global economic conditions can have a significant impact on Temu’s stock performance. For example:

- Recession: A recession could lead to a decline in consumer spending, which could negatively impact Temu’s sales and profitability. This could result in a decrease in its stock price.

- Inflation: Rising inflation could increase Temu’s costs for sourcing products and shipping, potentially impacting its margins and profitability. This could also lead to a decrease in its stock price.

- Interest Rate Hikes: Higher interest rates could make it more expensive for Temu to borrow money, potentially impacting its growth plans and profitability. This could also lead to a decrease in its stock price.

- Currency Fluctuations: Fluctuations in exchange rates could impact Temu’s profitability, particularly if it sources products from overseas. This could also affect its stock price.

Long-Term Growth Prospects, How to buy temu stock

Temu’s long-term growth prospects depend on its ability to overcome challenges and capitalize on opportunities.

- Sustaining Growth: Temu’s ability to maintain its rapid growth trajectory will be crucial for its long-term success. This will require continued investment in technology, logistics, and marketing.

- Expanding Product Categories: Temu can expand its product offerings to attract a wider customer base and increase its revenue potential. This will require careful market research and strategic partnerships.

- Improving Customer Experience: Temu needs to continuously improve its customer experience to foster loyalty and attract new customers. This includes streamlining its logistics, enhancing its website, and providing excellent customer support.

- International Expansion: Temu’s global expansion strategy presents significant growth potential. This will require adapting its business model to different markets and navigating cultural and regulatory differences.

- Innovation and Technology: Temu’s ability to leverage technology and data analytics to improve its operations and customer experience will be crucial for its long-term competitiveness. This will require ongoing investments in research and development.

Last Point

Investing in Temu stock presents both opportunities and risks. While the company’s rapid growth and market penetration are encouraging signs, it’s crucial to consider factors like its current public listing status, financial performance, and the competitive landscape. Ultimately, the decision to invest in Temu stock depends on your individual investment goals, risk tolerance, and assessment of the company’s long-term potential.

FAQ Section

Is Temu stock publicly traded?

As of right now, Temu is not publicly traded on major stock exchanges. The company is owned by PDD Holdings, a publicly traded company listed on the Nasdaq Stock Market. However, Temu may eventually pursue an IPO (Initial Public Offering) in the future.

What are the risks associated with investing in Temu stock?

Investing in any stock carries inherent risks. Some potential risks associated with Temu stock include:

* Competition: Temu faces fierce competition from established e-commerce giants like Amazon and Shein.

* Supply Chain Disruptions: Global supply chain issues could impact Temu’s operations and profitability.

* Regulatory Environment: Changes in regulations could affect Temu’s business model and growth prospects.

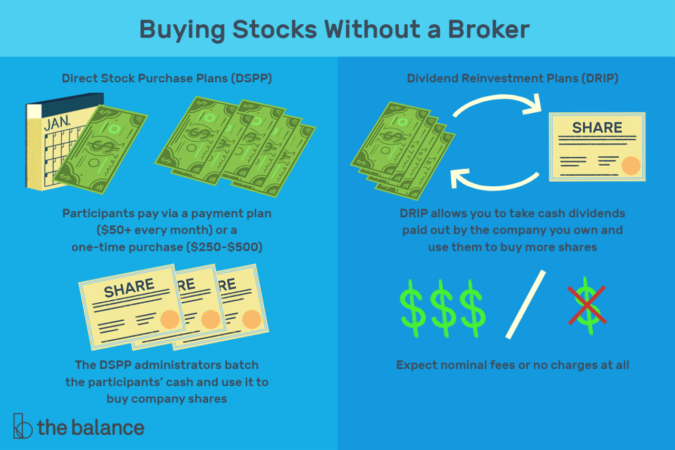

How can I invest in Temu if it’s not publicly traded?

While Temu is not currently publicly traded, you can indirectly invest in the company through PDD Holdings, its parent company. PDD Holdings is publicly traded on the Nasdaq Stock Market under the ticker symbol “PDD.”