- Understanding Florida Car Insurance Requirements

- Types of Car Insurance Coverage in Florida

- Factors Affecting Car Insurance Rates in Florida

- Choosing the Right Car Insurance Provider in Florida: How To Get Car Insurance In Florida

- Getting a Car Insurance Quote in Florida

- Filing a Car Insurance Claim in Florida

- Understanding Florida’s No-Fault Insurance System

- Protecting Yourself from Car Insurance Fraud in Florida

- Final Wrap-Up

- Q&A

How to get car insurance in Florida can seem daunting, but it doesn’t have to be. Navigating the intricacies of Florida’s insurance landscape requires understanding the state’s unique requirements, coverage options, and factors influencing your premiums. This guide will equip you with the knowledge and tools to secure the right car insurance policy for your needs and budget.

Florida is a state with its own set of regulations and requirements for car insurance. From understanding the minimum coverage mandated by law to exploring the different types of coverage available, this guide will break down the process step-by-step, ensuring you’re well-prepared to make informed decisions.

Understanding Florida Car Insurance Requirements

Driving in Florida requires you to have car insurance. This is a legal requirement designed to protect you and other drivers on the road in case of accidents. Florida law mandates that all drivers carry specific types of insurance coverage, and failure to comply can lead to severe penalties.

Minimum Coverage Requirements

Florida law specifies the minimum amount of coverage you must have for your vehicle. These requirements are Artikeld in the Florida Motor Vehicle No-Fault Law.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other related costs resulting from an accident, regardless of who was at fault. The minimum PIP coverage required in Florida is $10,000.

- Property Damage Liability (PDL): This coverage protects you financially if you cause damage to another person’s property in an accident. The minimum PDL coverage required in Florida is $10,000.

Penalties for Driving Without Insurance

Driving without the required minimum insurance in Florida is a serious offense.

- Fines and Penalties: You could face fines of up to $500 for a first offense, and the fines increase with subsequent offenses. Your driver’s license could also be suspended, and you may face difficulty registering your vehicle.

- Financial Responsibility: If you are involved in an accident without insurance, you will be personally liable for all damages and injuries, potentially leading to significant financial losses.

- Criminal Charges: In some cases, driving without insurance can lead to criminal charges, especially if the accident results in serious injuries or death.

Types of Car Insurance Coverage in Florida

In Florida, you are required to carry certain types of car insurance to be legally allowed to drive. This ensures that you have the financial protection you need in case of an accident. Here’s a detailed look at the different types of car insurance coverage available in Florida.

Types of Car Insurance Coverage

Understanding the different types of car insurance coverage is essential for making informed decisions about your policy. Here is a breakdown of the common types of car insurance in Florida:

| Coverage Name | Description | Benefits |

|---|---|---|

| Liability Coverage | This coverage protects you financially if you are at fault in an accident that causes damage to another person’s property or injuries to another person. | Covers medical expenses, property damage, and legal fees for the other party involved in the accident. |

| Collision Coverage | This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. | Covers damage to your vehicle in an accident, even if you are at fault. |

| Comprehensive Coverage | This coverage pays for repairs or replacement of your vehicle if it is damaged due to events other than an accident, such as theft, vandalism, fire, or natural disasters. | Covers damage to your vehicle from non-accident related events, such as theft, vandalism, or hail damage. |

| Personal Injury Protection (PIP) | This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault in an accident. | Covers medical expenses, lost wages, and other related costs for you and your passengers, even if you are at fault in an accident. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance to cover your losses. | Covers your losses if you are involved in an accident with an uninsured or underinsured driver. |

Understanding the Differences

It is crucial to understand the differences between liability, collision, and comprehensive coverage:

Liability Coverage primarily protects others from your actions, while Collision and Comprehensive Coverage protect your own vehicle.

– Liability Coverage is required by law in Florida and covers the financial responsibility you have to others in case you cause an accident. It does not cover your own vehicle’s damages.

– Collision Coverage covers damages to your vehicle if you are involved in an accident, regardless of fault. If you choose to not purchase this coverage, you will be responsible for paying for any repairs or replacement costs yourself.

– Comprehensive Coverage is designed to protect your vehicle from damage caused by events other than collisions, such as theft, vandalism, or natural disasters. This coverage is optional, but it can be beneficial if you have a newer or more expensive vehicle.

Factors Affecting Car Insurance Rates in Florida

Florida car insurance rates are influenced by a multitude of factors. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Age

Age is a significant factor in determining car insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents due to factors such as inexperience and risk-taking behavior. Insurance companies consider this higher risk and charge higher premiums to young drivers. As drivers gain experience and reach a certain age, their premiums tend to decrease.

Driving History

Your driving history plays a crucial role in determining your car insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, any accidents, traffic tickets, or DUI convictions can significantly increase your rates. Insurance companies assess your driving history to determine your risk profile.

Vehicle Type, How to get car insurance in florida

The type of vehicle you drive also influences your insurance premiums. Certain vehicle models are considered more expensive to repair or replace, making them more expensive to insure. For instance, luxury vehicles, sports cars, and high-performance vehicles often carry higher insurance premiums. Conversely, less expensive and safer vehicles may attract lower premiums.

Location

Your location in Florida can significantly impact your car insurance rates. Areas with higher crime rates, traffic congestion, or a greater number of accidents typically have higher insurance premiums. Insurance companies consider the risk associated with different areas when setting their rates.

Table Illustrating Factors Affecting Premiums

Here’s a table illustrating how different factors can affect car insurance premiums:

| Factor | Impact on Premiums | Example |

|—————|——————–|———|

| Age | Younger drivers: Higher premiums | 20-year-old driver: $200/month |

| | Older drivers: Lower premiums | 50-year-old driver: $150/month |

| Driving History| Clean record: Lower premiums | No accidents or tickets: $100/month |

| | Accidents/Violations: Higher premiums | 2 accidents in 5 years: $250/month |

| Vehicle Type | Expensive/High-Performance: Higher premiums | Luxury sedan: $200/month |

| | Affordable/Safe: Lower premiums | Compact car: $100/month |

| Location | High-risk areas: Higher premiums | Miami: $200/month |

| | Low-risk areas: Lower premiums | Rural Florida: $100/month |

Choosing the Right Car Insurance Provider in Florida: How To Get Car Insurance In Florida

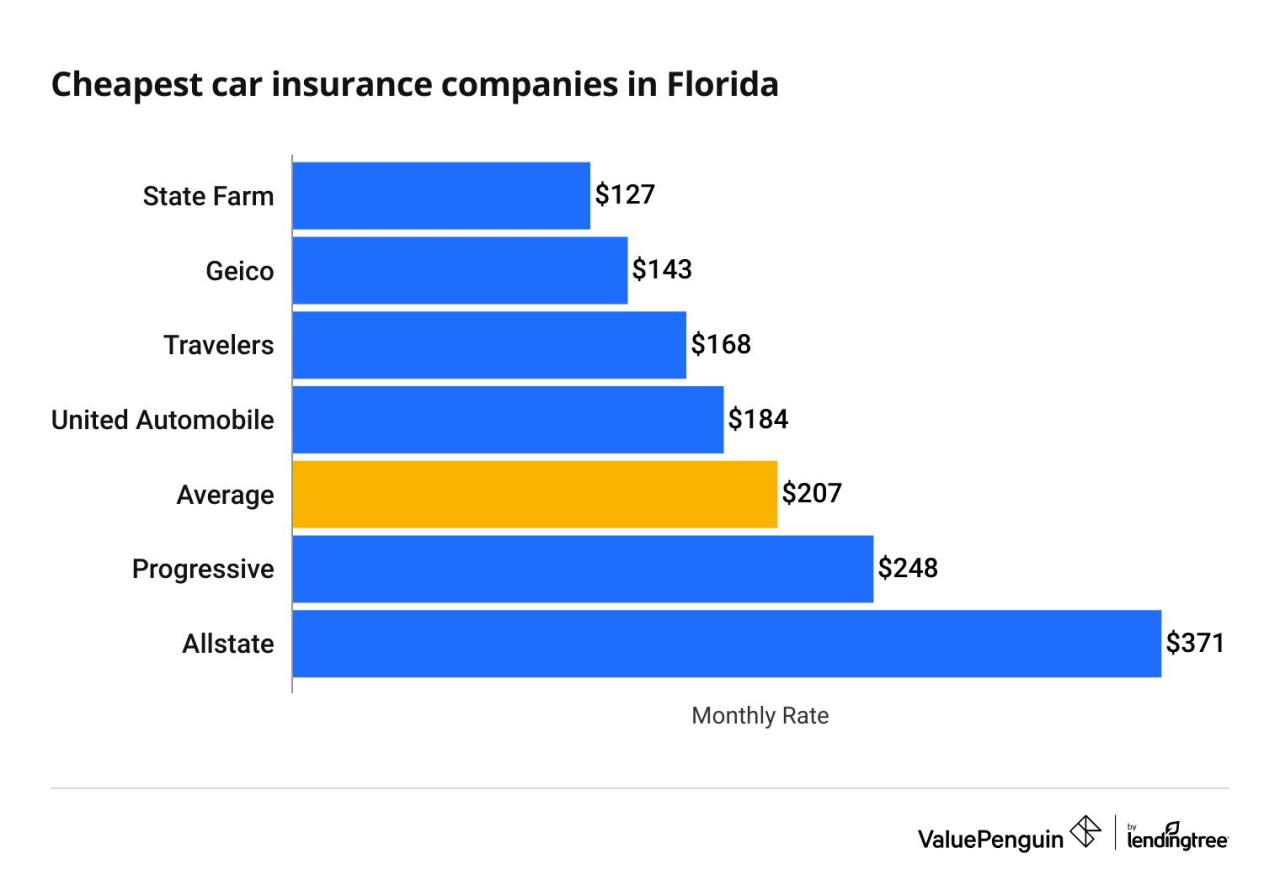

Selecting the right car insurance provider in Florida is crucial to ensure you have adequate coverage at a competitive price. With numerous options available, finding the best fit for your needs requires careful consideration and comparison.

Comparing Quotes from Multiple Providers

It’s essential to compare quotes from multiple insurance providers to find the most favorable rates and coverage options.

- Use online comparison websites: Websites like Policygenius, Insurance.com, and The Zebra allow you to compare quotes from various providers simultaneously, saving you time and effort.

- Contact insurance providers directly: Reach out to insurance companies directly to obtain personalized quotes and discuss your specific needs.

- Consider factors affecting rates: Remember that factors such as your driving history, vehicle type, and location can significantly influence your insurance premiums. Compare quotes based on your individual circumstances.

Seeking Advice from Insurance Brokers

Insurance brokers act as intermediaries, representing you and working with multiple insurance providers to find the best coverage at the most competitive price.

- Expertise and knowledge: Brokers possess in-depth knowledge of the insurance market and can provide valuable insights into different coverage options and providers.

- Personalized recommendations: Brokers can tailor their recommendations to your specific needs and budget, ensuring you receive the most appropriate coverage.

- Negotiation skills: Brokers can leverage their relationships with insurance companies to negotiate favorable rates and terms on your behalf.

Getting a Car Insurance Quote in Florida

Getting a car insurance quote in Florida is a crucial step in securing the right coverage for your needs. It allows you to compare prices and features from different insurance providers and choose the policy that best suits your budget and risk profile.

Steps to Obtain Car Insurance Quotes in Florida

To obtain accurate car insurance quotes in Florida, you’ll need to provide information about yourself, your vehicle, and your driving history. This information helps insurers assess your risk and determine the appropriate premium.

- Gather Your Information: Before contacting insurance providers, have the following information readily available:

- Your driver’s license number and date of birth

- Your vehicle identification number (VIN)

- Your vehicle’s year, make, and model

- Your current car insurance policy details (if applicable)

- Your driving history, including any accidents or traffic violations

- Your desired coverage levels and deductibles

- Contact Insurance Providers: Once you have your information gathered, you can start contacting insurance providers. There are several ways to get quotes:

- Online: Many insurance companies have online quote tools that allow you to enter your information and receive a quote instantly. This method is convenient and often allows you to compare quotes from multiple providers side-by-side.

- Phone: You can call insurance providers directly and speak to a representative to get a quote. This allows you to ask questions and get personalized recommendations.

- In Person: Some insurance providers have local offices where you can meet with an agent to discuss your needs and get a quote. This option allows for face-to-face interaction and personalized advice.

- Compare Quotes: After receiving quotes from multiple providers, carefully compare them. Consider factors such as:

- Premium amount

- Coverage levels

- Deductibles

- Discounts

- Customer service reputation

- Financial stability of the insurer

- Choose a Policy: Once you’ve compared quotes and considered all relevant factors, select the policy that best meets your needs and budget. Make sure you understand the terms and conditions of the policy before signing.

Tips for Maximizing Quote Accuracy

To ensure you receive accurate and competitive car insurance quotes, follow these tips:

- Provide Accurate Information: It is essential to provide accurate and complete information about yourself, your vehicle, and your driving history. Inaccurate information can lead to higher premiums or even policy cancellation.

- Shop Around: Get quotes from multiple insurance providers. This allows you to compare prices and coverage options and find the best deal.

- Consider Discounts: Many insurance companies offer discounts for good driving records, safety features, and other factors. Ask about available discounts and see if you qualify.

- Compare Coverage Levels: Don’t just focus on the premium amount. Consider the coverage levels offered by each insurer and choose the policy that provides the right amount of protection for your needs.

- Read the Fine Print: Before you commit to a policy, carefully read the terms and conditions. Understand the coverage limits, exclusions, and any other important details.

Filing a Car Insurance Claim in Florida

Filing a car insurance claim in Florida is a necessary step when you’ve been involved in an accident. This process helps you receive compensation for damages and medical expenses.

Reporting Accidents and Gathering Necessary Documentation

It’s crucial to report any accident to your insurance company as soon as possible, even if it seems minor. The following steps will help you efficiently report the accident and gather necessary documentation:

- Contact Your Insurance Company: Immediately inform your insurance company about the accident, providing details such as the date, time, location, and nature of the accident.

- Gather Information at the Scene: Exchange contact and insurance information with all parties involved in the accident. Take pictures of the damage to your vehicle, the other vehicles involved, and the accident scene. If there are any witnesses, gather their contact information.

- File a Police Report: If the accident involves injuries or significant damage, contact the police to file a report. This report will be essential for your insurance claim.

- Seek Medical Attention: If you or anyone else involved in the accident has sustained injuries, seek medical attention immediately.

- Keep Records: Maintain a record of all communications with your insurance company, medical providers, and any other relevant parties. This will help you track the progress of your claim.

Resolving Claims and Receiving Compensation

Once you have reported the accident and gathered necessary documentation, your insurance company will begin processing your claim. This process typically involves the following steps:

- Review of the Claim: Your insurance company will review the details of your claim, including the police report, medical records, and repair estimates.

- Investigation: If necessary, your insurance company may conduct an investigation to verify the details of the accident and the extent of the damage.

- Negotiation: Your insurance company will negotiate with you to determine the amount of compensation you are entitled to.

- Payment: Once the claim is settled, your insurance company will issue payment for your damages, medical expenses, and other covered losses.

Tips for a Smooth Claim Process

To ensure a smooth and efficient claims process, consider the following tips:

- Be Honest and Accurate: Provide accurate and complete information to your insurance company to avoid delays or complications.

- Follow Up Regularly: Check in with your insurance company regularly to track the progress of your claim.

- Keep Copies of All Documents: Make copies of all documents related to your claim, including the police report, medical records, and repair estimates.

- Consult with an Attorney: If you have difficulty resolving your claim with your insurance company, consider consulting with an attorney.

Understanding Florida’s No-Fault Insurance System

Florida operates under a unique no-fault insurance system, meaning that drivers involved in accidents are primarily responsible for covering their own medical expenses and lost wages, regardless of fault. This system aims to simplify the claims process and reduce litigation, but it comes with its own set of benefits and limitations.

Benefits of Florida’s No-Fault System

The no-fault system offers several benefits, including:

- Faster Claims Processing: Since drivers are responsible for their own initial expenses, the claims process can be faster and more efficient. You don’t have to wait for the other party’s insurance company to determine fault before seeking coverage.

- Reduced Litigation: By eliminating the need to determine fault in many cases, the no-fault system can reduce the number of lawsuits and court cases, saving time and resources for all parties involved.

- Guaranteed Coverage: Your own insurance policy guarantees coverage for your medical expenses and lost wages, regardless of who is at fault. This ensures that you can access the necessary care and support after an accident.

Limitations of Florida’s No-Fault System

Despite its benefits, Florida’s no-fault system also has some limitations:

- Limited Coverage: No-fault coverage typically covers only a limited amount of medical expenses and lost wages. If your injuries are severe, you may need to pursue additional compensation through a lawsuit.

- Potential for Disputes: Even though the system aims to reduce litigation, disputes can still arise over the extent of coverage or the amount of compensation owed.

- Higher Premiums: Florida’s no-fault system can lead to higher insurance premiums compared to states with traditional fault-based systems.

Situations Where No-Fault Coverage Applies

No-fault coverage applies to situations where a driver is injured in a car accident, regardless of who caused the accident. For example:

- Single-Vehicle Accidents: If you are involved in a single-vehicle accident, your own insurance will cover your medical expenses and lost wages.

- Accidents with Uninsured Drivers: If you are involved in an accident with an uninsured driver, your own insurance will cover your medical expenses and lost wages, up to the limits of your coverage.

- Accidents with Drivers from Other States: If you are involved in an accident with a driver from another state, your own insurance will cover your medical expenses and lost wages, as long as the other state’s insurance laws are compatible with Florida’s no-fault system.

Protecting Yourself from Car Insurance Fraud in Florida

Car insurance fraud is a serious problem in Florida, costing consumers and insurance companies millions of dollars each year. By understanding common fraud tactics and taking steps to protect yourself, you can help prevent becoming a victim.

Common Car Insurance Fraud Tactics in Florida

Fraudsters use various methods to deceive insurance companies and get payouts they are not entitled to. Some common tactics include:

- Staged Accidents: This involves two or more people intentionally causing a crash to file insurance claims for injuries and vehicle damage that never occurred. The perpetrators may be acquaintances or even family members working together.

- Fake Injuries: Some individuals exaggerate or fabricate injuries after a real accident to inflate their claims. They may visit multiple doctors, undergo unnecessary treatments, or claim ongoing pain and suffering that is not supported by medical evidence.

- Stolen Vehicles: Thieves may report their vehicles stolen to collect insurance payouts. In some cases, they may even stage the theft by leaving the vehicle in a remote location and reporting it missing later.

- Ghost Vehicles: Fraudsters may create fictitious vehicles or policyholders to obtain insurance coverage and then file false claims for accidents that never happened. This can involve using stolen identities or creating fake documentation.

- Inflated Repair Costs: Some repair shops may work with fraudsters to inflate repair bills. They may charge for unnecessary repairs, use overpriced parts, or even claim damage that did not occur.

Reporting Suspected Car Insurance Fraud in Florida

If you suspect car insurance fraud, it’s important to report it to the appropriate authorities. You can contact:

- The Florida Department of Financial Services (DFS): The DFS investigates insurance fraud and has a dedicated hotline for reporting suspected fraud.

- The National Insurance Crime Bureau (NICB): The NICB is a non-profit organization that works to combat insurance fraud. They have a website and hotline where you can report suspicious activity.

- Your Insurance Company: Your insurance company has a vested interest in preventing fraud and may have its own fraud investigation unit.

Tips for Avoiding Car Insurance Fraud in Florida

While you can’t always prevent fraudsters from targeting you, there are steps you can take to minimize your risk:

- Be wary of unsolicited offers for car insurance: Don’t trust anyone who approaches you with a “too good to be true” insurance deal. Always get quotes from reputable companies and compare them carefully.

- Avoid accepting cash payments for car repairs: Pay for repairs with a credit card or check to ensure you have a record of the transaction.

- Be cautious when dealing with repair shops: Research repair shops before using them and get multiple estimates for repairs.

- Report any suspicious activity to your insurance company: If you see anything that seems fraudulent, don’t hesitate to report it.

- Keep accurate records of your insurance policies and claims: This can help you verify the legitimacy of any claims you file.

Final Wrap-Up

Obtaining car insurance in Florida is a crucial step towards responsible driving and financial protection. By understanding the legal requirements, exploring coverage options, and considering factors affecting premiums, you can find the right insurance policy that meets your needs and budget. Remember to compare quotes from multiple providers, seek advice from insurance brokers, and stay informed about Florida’s unique insurance landscape to make informed decisions and secure the best possible coverage.

Q&A

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to have a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage.

What is the difference between liability and collision coverage?

Liability coverage protects you from financial responsibility if you cause an accident that injures someone or damages their property. Collision coverage covers damage to your vehicle in an accident, regardless of who is at fault.

How can I get a car insurance quote in Florida?

You can get a car insurance quote online, over the phone, or by visiting an insurance agent. Be prepared to provide your driver’s license information, vehicle details, and driving history.

What are some tips for choosing a car insurance provider in Florida?

Look for a provider with a strong financial rating, excellent customer service, and competitive rates. Compare quotes from multiple providers and consider the coverage options and discounts offered.