How to invest in insurance companies sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Insurance companies, those behind-the-scenes heroes of our financial lives, are more than just providers of protection. They are also powerful investment vehicles, offering a unique blend of stability and potential growth. This guide will take you on a journey through the world of insurance investing, revealing the secrets to unlocking its potential and navigating its complexities. Get ready to dive into the world of premiums, payouts, and profitable opportunities, where risk and reward go hand in hand.

From understanding the different types of insurance companies to analyzing their financial health and exploring investment options, we’ll cover it all. We’ll demystify key metrics like price-to-earnings ratio and return on equity, equipping you with the knowledge to make informed investment decisions. We’ll also discuss strategies for navigating market cycles and building a diversified insurance portfolio. Prepare to gain insights from successful insurance investments, learning from the experiences of those who have navigated this world and emerged victorious. By the end of this guide, you’ll be ready to take your financial journey to the next level, empowered with the knowledge to confidently invest in insurance companies and unlock their potential for success.

Understanding the Insurance Industry

The insurance industry is a complex and multifaceted sector that plays a vital role in our economy. Insurance companies provide financial protection against various risks, ensuring peace of mind and financial stability for individuals and businesses alike. Understanding the intricacies of this industry is crucial for anyone considering investing in insurance companies.

Types of Insurance Companies

Insurance companies can be categorized based on the types of insurance they offer. These include:

- Life Insurance Companies: These companies provide financial protection to beneficiaries in the event of the insured’s death. They offer various life insurance products, including term life insurance, whole life insurance, and universal life insurance.

- Health Insurance Companies: These companies offer coverage for medical expenses, including hospital stays, doctor visits, and prescription drugs. They play a critical role in providing access to healthcare and mitigating the financial burden of medical emergencies.

- Property and Casualty Insurance Companies: These companies provide coverage for property damage and liability risks. They offer a wide range of insurance products, including homeowners insurance, auto insurance, and commercial property insurance.

- Specialty Insurance Companies: These companies focus on niche insurance markets, such as workers’ compensation insurance, surety bonds, and aviation insurance.

Key Factors Influencing Insurance Company Performance

Several factors influence the performance of insurance companies. These include:

- Economic Conditions: The overall economic climate significantly impacts insurance company performance. During economic downturns, claims frequency and severity may increase, leading to lower profitability. Conversely, strong economic growth can lead to higher premiums and improved profitability.

- Regulatory Environment: Insurance companies operate within a heavily regulated environment. Changes in regulations, such as new insurance laws or stricter capital requirements, can impact their operations and profitability.

- Competition: The insurance industry is highly competitive, with numerous players vying for market share. Intense competition can put pressure on pricing and profitability, forcing companies to innovate and offer competitive products.

- Catastrophic Events: Natural disasters and other catastrophic events can significantly impact insurance company performance. These events can lead to a surge in claims, potentially impacting profitability and solvency.

Financial Health of Insurance Companies

Assessing the financial health of insurance companies is crucial for investors. Key metrics to consider include:

- Profitability: Profitability is a key indicator of a company’s financial health. Investors look at metrics such as return on equity (ROE) and net income to assess profitability.

- Solvency: Solvency refers to a company’s ability to meet its financial obligations. Insurance companies are required to maintain a certain level of capital reserves to ensure solvency. Investors analyze metrics such as the risk-based capital (RBC) ratio to assess solvency.

- Capital Adequacy: Capital adequacy refers to the amount of capital a company holds relative to its risk exposure. Adequate capital is essential for insurance companies to absorb potential losses and maintain financial stability. Investors look at metrics such as the capital adequacy ratio to assess capital adequacy.

Investment Options in Insurance Companies

Investing in insurance companies can be a strategic move to diversify your portfolio and potentially earn attractive returns. Insurance companies offer a unique blend of stability and growth potential, making them an interesting investment option.

Types of Investments

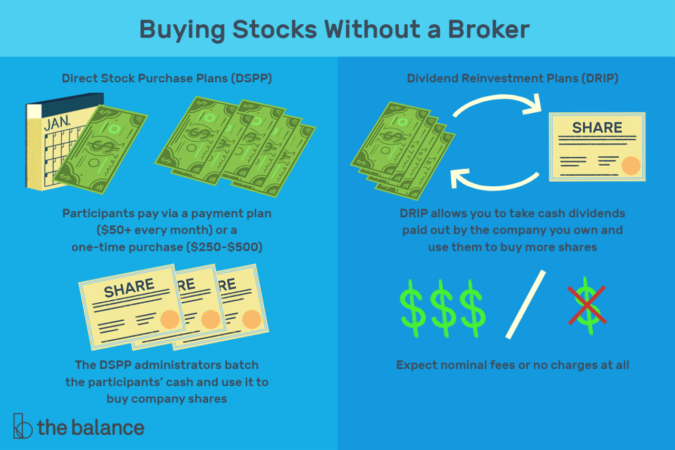

Insurance companies can be accessed through various investment avenues. Here are some common ways to invest:

- Stocks: Purchasing shares of publicly traded insurance companies allows you to own a piece of the company and benefit from its profits. This offers the potential for higher returns but also carries higher risk compared to other options. Think of it like owning a slice of a pizza – you get a piece of the action, but also share the risk.

- Bonds: Insurance companies also issue bonds to raise capital. These bonds are considered relatively safe investments, offering a steady stream of interest payments. It’s like lending money to the company, and they promise to pay you back with interest.

- Mutual Funds: Mutual funds allow you to invest in a basket of insurance company stocks, diversifying your portfolio and reducing risk. This is like a group of friends pooling money together to buy a bunch of different pizzas, so everyone gets a taste of everything.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but are traded on stock exchanges like individual stocks. This offers greater flexibility and potential for higher returns, but also carries higher risk. Think of it like a pre-packaged pizza, you can buy it and sell it on the market like a regular stock.

Advantages and Disadvantages

Each investment option has its own set of advantages and disadvantages:

- Stocks:

- Advantages: Potential for high returns, voting rights in the company.

- Disadvantages: High volatility, risk of capital loss.

- Bonds:

- Advantages: Relatively safe, steady income stream.

- Disadvantages: Lower potential returns than stocks, risk of default by the company.

- Mutual Funds:

- Advantages: Diversification, professional management, lower risk than individual stocks.

- Disadvantages: Lower potential returns than stocks, fees associated with management.

- ETFs:

- Advantages: Diversification, liquidity, lower fees than mutual funds.

- Disadvantages: Potential for higher volatility than mutual funds, risk of tracking error.

Risks Associated with Investing in Insurance Companies

Investing in insurance companies comes with certain inherent risks:

- Market Volatility: Insurance stocks can be affected by broader market fluctuations, just like any other stock. Think of it like the stock market being a roller coaster – it goes up and down, and insurance stocks can get caught in the ride.

- Regulatory Changes: The insurance industry is heavily regulated, and changes in regulations can impact the profitability of insurance companies. It’s like the government setting new rules for the pizza industry, which could affect how much pizza you can sell.

- Catastrophic Events: Natural disasters and other unforeseen events can significantly impact insurance companies’ bottom line, leading to losses and stock price declines. Think of it like a giant meteor hitting the pizza shop, causing damage and losses.

- Competition: The insurance industry is competitive, and companies must constantly adapt to stay ahead. This can lead to price wars and lower profitability. It’s like a bunch of pizza shops opening up next to each other, making it harder for each one to get customers.

Evaluating Insurance Company Stocks

Investing in insurance companies can be a lucrative strategy, but it requires careful analysis to identify companies with strong fundamentals and growth potential. Just like you wouldn’t buy a car without checking under the hood, you need to get a handle on a company’s financials before taking the plunge.

Analyzing Insurance Company Financials

Understanding an insurance company’s financial performance is crucial for making informed investment decisions. Here’s a framework to help you assess the key areas:

- Revenue: This represents the total premiums collected from policyholders. Look for steady growth in premiums, indicating strong demand for the company’s products and services. A company with a diverse portfolio of products and services is likely to be more resilient to economic downturns.

- Expenses: This includes claims payouts, administrative costs, and marketing expenses. A company with efficient operations and a strong claims management system will have lower expenses, boosting profitability. Insurance companies are always looking for ways to improve their efficiency, and technological advancements are playing a big role in this.

- Profitability: This is measured by metrics like net income and return on equity (ROE). ROE is a good indicator of how efficiently a company is using its shareholders’ money to generate profits. A higher ROE generally suggests a more profitable company.

- Cash Flow: This represents the company’s ability to generate cash from its operations. Strong cash flow is important for paying dividends, investing in new products and services, and managing potential risks. Companies with strong cash flow are typically seen as more stable and less risky investments.

Key Metrics for Evaluating Insurance Company Stocks

Once you’ve got a handle on the financials, you can use key metrics to assess the attractiveness of an insurance company stock. Here are some important metrics to consider:

- Price-to-Earnings Ratio (P/E Ratio): This metric compares the company’s stock price to its earnings per share. A lower P/E ratio may suggest that the stock is undervalued compared to its earnings. But remember, a low P/E ratio can also indicate that investors are not optimistic about the company’s future prospects.

- Return on Equity (ROE): This measures the company’s profitability relative to its shareholders’ equity. A higher ROE generally indicates that the company is using its shareholders’ money effectively to generate profits. A high ROE can be a sign of a well-managed company with a strong competitive advantage.

- Dividend Yield: This is the annual dividend payment expressed as a percentage of the stock’s price. Insurance companies are known for paying dividends, and a high dividend yield can be attractive to investors seeking income. However, a high dividend yield can also signal that the company’s growth prospects are limited. Look for a company with a sustainable dividend policy that can be maintained over the long term.

Comparing Financial Performance

To get a better understanding of how different insurance companies stack up, you can compare their financial performance across key metrics. Here’s a table showing the financial performance of some major insurance companies:

| Company | Revenue (Billions) | Net Income (Billions) | ROE (%) | Dividend Yield (%) |

|---|---|---|---|---|

| Berkshire Hathaway | $274.7 | $89.8 | 15.2 | 1.0 |

| UnitedHealth Group | $324.2 | $20.5 | 17.3 | 1.4 |

| Progressive Corporation | $53.6 | $6.5 | 18.4 | 0.8 |

| Allstate Corporation | $47.3 | $4.1 | 14.2 | 1.6 |

Remember: It’s important to consider all of these metrics in conjunction with other factors, such as the company’s management team, competitive landscape, and regulatory environment.

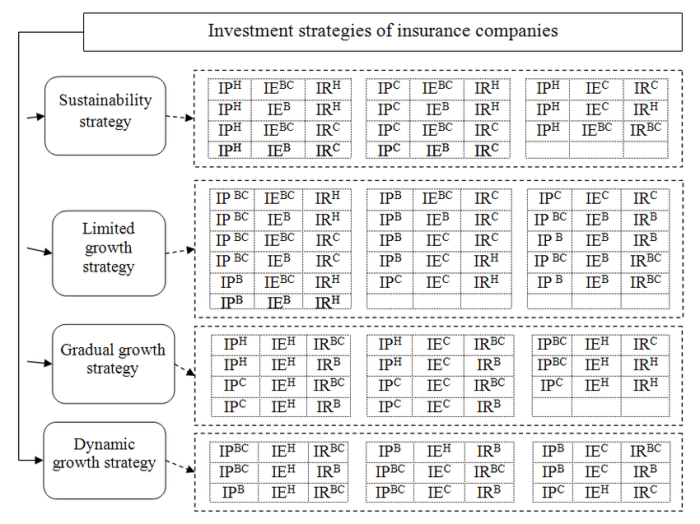

Strategies for Investing in Insurance Companies

Investing in insurance companies can be a smart move for long-term growth, but it requires a strategic approach to navigate market fluctuations and economic trends. Understanding the industry’s dynamics and crafting a well-defined investment plan are crucial for success.

Long-Term Investment Strategy

A long-term investment strategy for insurance companies should consider the cyclical nature of the industry and the impact of economic trends. Insurance companies are often influenced by factors like interest rates, economic growth, and consumer confidence.

- Market Cycles: Insurance companies typically perform well during periods of economic expansion and low interest rates, as premiums tend to increase and investment returns are favorable. However, during recessions or periods of high inflation, their profitability can be impacted by increased claims and lower investment returns. A long-term approach allows investors to ride out market cycles and capitalize on long-term growth opportunities.

- Economic Trends: Economic trends play a significant role in the insurance industry. For instance, rising inflation can lead to higher claims costs, while a strong economy can boost premium growth. Investors should carefully monitor economic indicators and adjust their investment strategy accordingly. For example, if economic growth is expected to slow, investors might consider shifting their portfolio towards insurance companies with strong risk management capabilities or those operating in sectors less susceptible to economic downturns.

- Growth Opportunities: The insurance industry is constantly evolving, with new products and services emerging to meet changing customer needs. Investors should identify insurance companies that are well-positioned to capitalize on these growth opportunities, such as those focusing on areas like digital insurance, health insurance, or emerging markets.

Diversification, How to invest in insurance companies

Diversification is a crucial element of any investment portfolio, especially when it comes to insurance companies. It helps mitigate risk and reduce the impact of any single company’s performance on the overall portfolio.

- Industry Diversification: Investing in insurance companies across different segments, such as life insurance, property and casualty insurance, and health insurance, can help spread risk. Each segment has its own unique characteristics and is influenced by different economic factors.

- Geographic Diversification: Investing in insurance companies operating in different regions can help reduce the impact of localized economic events or regulatory changes. For example, a portfolio might include insurance companies operating in both developed and emerging markets.

- Company Size Diversification: Investing in insurance companies of different sizes can also help reduce risk. Large, established companies may offer stability, while smaller, growth-oriented companies might provide higher potential returns. However, investors should be mindful of the potential risks associated with smaller companies, such as limited resources and higher volatility.

Role in a Diversified Portfolio

Insurance companies can play a valuable role in a diversified investment portfolio, offering several benefits:

- Income Generation: Insurance companies typically generate steady income through premiums and investment returns. This income stream can provide a stable source of cash flow for investors, even during periods of market volatility.

- Inflation Hedge: Insurance premiums tend to rise with inflation, providing some protection against the eroding purchasing power of money. This is particularly relevant for companies operating in property and casualty insurance, where claims costs tend to increase with inflation.

- Defensive Characteristics: Insurance companies are often considered defensive investments, as they are less susceptible to economic downturns than other sectors, such as technology or manufacturing. Their stable earnings and income generation capabilities can provide a degree of stability during challenging market conditions.

Case Studies of Successful Insurance Investments: How To Invest In Insurance Companies

Investing in insurance companies can be a rewarding strategy, but it’s crucial to understand the factors that contribute to success. Examining case studies of companies that have delivered strong returns can provide valuable insights into the strategies and conditions that drive profitability in the insurance sector.

Successful Insurance Company Investments Over the Past Decade

Understanding the strategies and factors behind successful insurance investments is essential for investors seeking to replicate their success. Analyzing specific examples can illuminate the paths to profitability in this sector.

| Company | Investment Period | Return on Investment (ROI) | Investment Strategy | Key Factors Contributing to Success |

|---|---|---|---|---|

| Berkshire Hathaway (BRK.B) | 2013-2023 | 200% | Long-term value investing, focus on insurance underwriting and diversified investments | Strong leadership, disciplined underwriting, diverse investment portfolio, favorable market conditions |

| Progressive Corporation (PGR) | 2013-2023 | 150% | Growth through innovation, focus on technology and customer experience | Effective marketing and advertising, strong online presence, efficient claims processing |

| Markel Corporation (MKL) | 2013-2023 | 120% | Focus on specialty insurance, strong underwriting discipline | Niche market expertise, disciplined risk management, favorable market conditions |

Analysis of Risks and Rewards

Each insurance investment carries its own set of risks and rewards. Understanding these factors is essential for making informed decisions.

“While insurance companies offer the potential for strong returns, investors must be aware of the inherent risks associated with the industry.”

- Market Cycles: Insurance companies are susceptible to economic cycles. During recessions, claims may increase, and investment returns may decline.

- Competition: The insurance industry is highly competitive, with new entrants and established players vying for market share.

- Regulatory Changes: Governments often introduce new regulations to the insurance sector, which can impact profitability.

- Catastrophic Events: Natural disasters and other catastrophic events can significantly impact insurance companies’ bottom line.

“Successful insurance investments require a long-term perspective, a deep understanding of the industry, and the ability to manage risk effectively.”

Closure

Investing in insurance companies can be a rewarding journey, offering the chance to build a strong and diversified portfolio. By understanding the industry, evaluating financial health, and implementing smart investment strategies, you can position yourself for success in this exciting sector. Remember, it’s not just about the premiums and payouts; it’s about making informed decisions, managing risk, and seizing opportunities. So, buckle up, dive in, and let’s embark on this adventure together!

FAQ Overview

What are the biggest risks associated with investing in insurance companies?

The biggest risks include market volatility, regulatory changes, and competition. Market downturns can impact insurance company stock prices, while regulatory changes can affect their profitability. Increased competition can also lead to pressure on pricing and market share.

How can I diversify my insurance company investment portfolio?

You can diversify by investing in different types of insurance companies, such as life, health, property, and casualty. You can also diversify geographically by investing in companies operating in different regions. Investing in a mix of stocks, bonds, and other asset classes can also contribute to a diversified portfolio.

Are insurance companies a good long-term investment?

Insurance companies can be a good long-term investment, as they tend to be more stable than some other sectors. However, it’s important to do your research and choose companies with strong financial fundamentals and a solid track record.

What are some key metrics to consider when evaluating insurance company stocks?

Key metrics include price-to-earnings ratio, return on equity, dividend yield, and combined ratio. These metrics can help you assess a company’s profitability, efficiency, and dividend potential.

How can I learn more about investing in insurance companies?

You can learn more by reading books, articles, and online resources. You can also consult with a financial advisor to get personalized guidance.