How to invest in stock market – How to invest in the stock market? It’s a question that pops up for many of us, whether you’re a college student with some extra cash or a seasoned professional looking to diversify your portfolio. The stock market can seem intimidating at first, but it’s really just a way to buy a tiny piece of a company and hopefully see its value grow over time. Think of it like owning a slice of a delicious pizza pie that you’re hoping gets bigger and bigger! This guide will walk you through the basics, from setting up an account to understanding the different types of investments and how to make smart choices.

You’ll learn about key terms, different investment strategies, and how to manage your portfolio. We’ll also talk about the risks involved and how to navigate them. By the end, you’ll have a solid understanding of how to invest in the stock market and be ready to take your first steps towards financial independence.

Understanding the Stock Market: How To Invest In Stock Market

The stock market is a complex and fascinating system that plays a crucial role in the global economy. It’s a marketplace where investors buy and sell shares of publicly traded companies, hoping to profit from their growth. This system allows companies to raise capital and investors to participate in the potential success of those businesses.

How the Stock Market Works, How to invest in stock market

The stock market operates through a network of exchanges, where buyers and sellers come together to trade shares. When you buy a stock, you’re essentially purchasing a small piece of ownership in a company. The price of a stock is determined by supply and demand. When more people want to buy a particular stock, its price goes up. Conversely, if more people want to sell, the price goes down.

Types of Stocks

There are various types of stocks available for investment, each with its unique characteristics.

- Common Stock: The most common type of stock, representing ownership in a company and the right to vote on important matters. Common stockholders receive dividends, if any, after preferred stockholders.

- Preferred Stock: A type of stock that offers investors a fixed dividend payment, typically higher than common stock dividends. However, preferred stockholders usually don’t have voting rights.

- Growth Stocks: Companies expected to experience rapid growth in earnings and revenues. These stocks typically have higher valuations and are often associated with innovative and emerging industries.

- Value Stocks: Companies that are undervalued by the market, with a lower price-to-earnings ratio than their peers. These stocks may be considered a good value for investors seeking long-term returns.

- Dividend Stocks: Companies that consistently pay dividends to their shareholders. These stocks are attractive to investors seeking regular income streams.

Key Terms in the Stock Market

Understanding the language of the stock market is essential for successful investing.

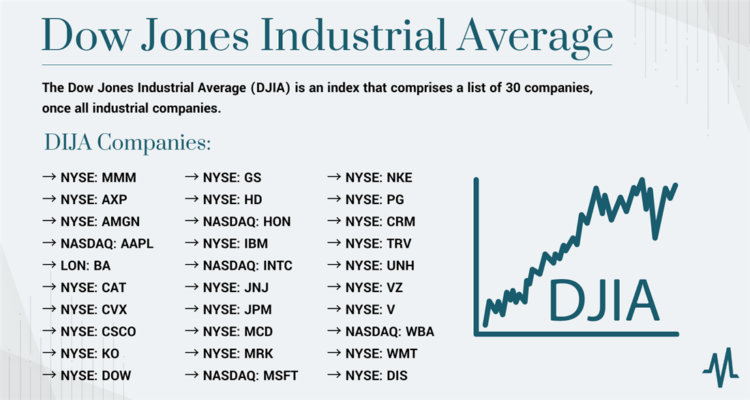

- Ticker Symbol: A unique abbreviation used to identify a specific company’s stock on an exchange. For example, Apple Inc. is traded under the ticker symbol AAPL.

- Share Price: The current price at which a stock is being traded on the market.

- Market Capitalization (Market Cap): The total value of a company’s outstanding shares. It’s calculated by multiplying the share price by the number of outstanding shares.

- Dividend: A payment made to shareholders from a company’s profits. Dividends can be paid in cash or in the form of additional shares.

- Earnings Per Share (EPS): A company’s profit per share of outstanding stock. It’s a key metric used to evaluate a company’s profitability.

- Price-to-Earnings Ratio (P/E Ratio): A valuation metric that compares a company’s share price to its earnings per share. It helps investors understand how much they’re paying for each dollar of earnings.

Examples of Companies Listed on the Stock Market

- Technology: Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Amazon (AMZN), Tesla (TSLA)

- Consumer Discretionary: Nike (NKE), Home Depot (HD), Walmart (WMT), Starbucks (SBUX), Amazon (AMZN)

- Healthcare: Johnson & Johnson (JNJ), UnitedHealth Group (UNH), Pfizer (PFE), Abbott Laboratories (ABT), Gilead Sciences (GILD)

- Financials: JPMorgan Chase (JPM), Bank of America (BAC), Wells Fargo (WFC), Berkshire Hathaway (BRK.B), Visa (V)

- Energy: ExxonMobil (XOM), Chevron (CVX), ConocoPhillips (COP), Schlumberger (SLB), Baker Hughes (BKR)

Final Conclusion

Investing in the stock market can be a rewarding journey, but it’s important to remember that it’s a marathon, not a sprint. Don’t get caught up in the hype or chase quick profits. Instead, focus on building a diversified portfolio that aligns with your financial goals and risk tolerance. Do your research, stay informed, and don’t be afraid to seek advice from professionals when needed. Remember, patience, discipline, and a long-term perspective are key to success in the stock market.

Question & Answer Hub

How much money do I need to start investing in the stock market?

You can start investing with as little as a few hundred dollars. Many online brokerages have no minimum deposit requirements.

What are the best stocks to buy?

There’s no one-size-fits-all answer. The best stocks for you will depend on your investment goals, risk tolerance, and time horizon. It’s important to do your research and choose companies you believe in.

How can I learn more about investing?

There are tons of resources available online and in libraries. You can also check out books, podcasts, and online courses on investing.

Is it better to invest in stocks or bonds?

Stocks and bonds are different types of investments with different risk profiles and potential returns. It’s important to understand the differences and choose the right mix for your portfolio.

What are the risks of investing in the stock market?

The stock market is inherently risky. You could lose money on your investments. It’s important to understand the risks involved and manage your investments accordingly.