How to purchase stocks is a question many people ask, and it’s a journey that can lead to financial growth and potentially even early retirement. It’s a journey that starts with understanding the basics of the stock market, including what stocks represent, the different types, and how they are traded.

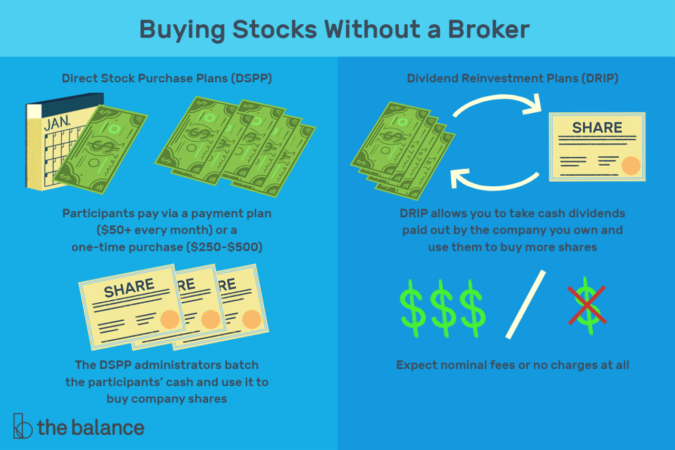

Once you have a grasp of these fundamentals, you can then dive into the world of brokerage accounts. There are numerous options available, each with its own set of features and fees, and choosing the right one is crucial. From there, you can learn about researching stocks using fundamental and technical analysis, which helps you make informed decisions about which companies to invest in.

Understanding Stock Market Basics: How To Purchase Stocks

The stock market is a complex system that can seem daunting at first, but understanding its fundamentals is crucial for making informed investment decisions. At its core, the stock market is a marketplace where investors buy and sell shares of publicly traded companies. These shares represent ownership in the company, giving investors a stake in its future success.

Types of Stocks

There are two primary types of stocks: common stock and preferred stock. Both represent ownership in a company, but they differ in their rights and privileges.

- Common Stock: This is the most common type of stock, and it grants shareholders voting rights in company decisions. Common stockholders have the right to elect the company’s board of directors and participate in shareholder meetings. However, they are also the last in line to receive dividends and assets in case of bankruptcy.

- Preferred Stock: Preferred stockholders have priority over common stockholders in receiving dividends and assets in the event of liquidation. They typically do not have voting rights, but they receive a fixed dividend payment, regardless of the company’s profitability. This makes preferred stock less risky than common stock, but it also offers lower potential returns.

Stock Exchanges

Stock exchanges are organized marketplaces where stocks are bought and sold. They provide a platform for investors to trade securities, facilitating price discovery and ensuring transparency in the market.

Some of the world’s largest stock exchanges include the New York Stock Exchange (NYSE) and the Nasdaq Stock Market.

The stock exchange operates through a system of brokers and dealers who buy and sell stocks on behalf of their clients. When a buyer and seller agree on a price, the transaction is executed, and the ownership of the stock is transferred.

Choosing a Brokerage Account

To start investing in the stock market, you’ll need to open a brokerage account. This account acts as your gateway to buying and selling stocks, and it’s crucial to choose one that fits your needs and investment goals.

Brokerage Account Types, How to purchase stocks

Different brokerage accounts cater to diverse investors, each with its own set of features and fees. Understanding these distinctions is essential to selecting the right platform for your journey.

- Online Brokers: These platforms are known for their user-friendly interfaces, low fees, and access to a wide range of investment options. They’re ideal for self-directed investors who prefer to research and make their own trading decisions. Popular online brokers include Robinhood, TD Ameritrade, and Fidelity.

- Full-Service Brokers: These brokers provide a more personalized experience, offering financial advice, portfolio management, and in-depth market research. They typically cater to investors who prefer a more hands-off approach or require specialized guidance. Full-service brokers often come with higher fees than online brokers.

Features and Fees

When evaluating brokerage accounts, it’s important to consider the features and fees associated with each platform.

- Trading Fees: This is the cost you pay to buy or sell stocks. Fees can vary depending on the brokerage, the type of order, and the amount traded. Some brokers offer commission-free trading, while others charge per trade or a percentage of the transaction value.

- Account Minimums: Some brokers require a minimum deposit to open an account. This can range from a few hundred dollars to several thousand dollars, depending on the broker.

- Research Tools: Access to research reports, market data, and analytical tools can be invaluable for informed investment decisions. Consider the quality and comprehensiveness of the research tools offered by different brokers.

- Investment Options: Ensure the broker offers the investment options you’re looking for, such as stocks, ETFs, mutual funds, and options.

- Customer Service: Having reliable customer service is crucial, especially when you have questions or need assistance with your account. Consider the availability and responsiveness of the broker’s customer support.

Choosing the Right Brokerage Account

Selecting the right brokerage account involves considering your investment goals, experience level, and financial resources.

- Investment Goals: If you’re a beginner investor with limited capital, an online broker with low fees and user-friendly tools might be a good starting point. If you’re a seasoned investor with a significant portfolio, a full-service broker offering personalized advice and sophisticated research tools could be more suitable.

- Experience Level: If you’re comfortable making your own investment decisions, an online broker can provide the necessary tools and resources. If you prefer professional guidance, a full-service broker can offer tailored advice and portfolio management.

- Financial Resources: Consider the minimum deposit requirements and trading fees when evaluating different brokers. Choose a platform that aligns with your budget and investment strategy.

Final Wrap-Up

Purchasing stocks can seem daunting at first, but it’s a skill that can be learned with the right resources and guidance. By understanding the basics of the stock market, choosing a suitable brokerage account, researching stocks diligently, and managing your portfolio effectively, you can take control of your financial future and potentially achieve your investment goals. Remember, patience, research, and a long-term perspective are key to success in the stock market.

Essential Questionnaire

How much money do I need to start investing in stocks?

There’s no set amount. Many brokerage platforms allow you to start with as little as a few dollars.

What are some good resources for learning about stocks?

You can find valuable information on websites like Investopedia, The Motley Fool, and the Securities and Exchange Commission (SEC).

Is it better to buy individual stocks or invest in mutual funds?

It depends on your investment goals, risk tolerance, and time horizon. Mutual funds offer diversification, while individual stocks can potentially provide higher returns.

What are some common mistakes new investors make?

Common mistakes include investing without a plan, chasing hot stocks, and not diversifying your portfolio.