How’s the stock market today? That’s the question on everyone’s mind, especially if you’re invested or thinking about getting in. The stock market is a dynamic beast, constantly reacting to news, economic data, and global events. It’s a rollercoaster ride, and today is no exception. We’ll dive into the current state of the market, exploring key indexes like the S&P 500 and the NASDAQ, and analyzing the factors that are driving the day’s performance.

We’ll also take a look at how different sectors are performing, highlighting the top performers and underperformers. We’ll examine the market sentiment, seeing if investors are feeling bullish, bearish, or neutral. Finally, we’ll explore some notable stock movements and delve into the technical indicators that can help us understand the market’s direction.

Market Overview

The stock market today is experiencing a mixed bag of emotions, with investors navigating a landscape of economic uncertainty and geopolitical tensions. While some sectors are showing resilience, others are struggling to find their footing.

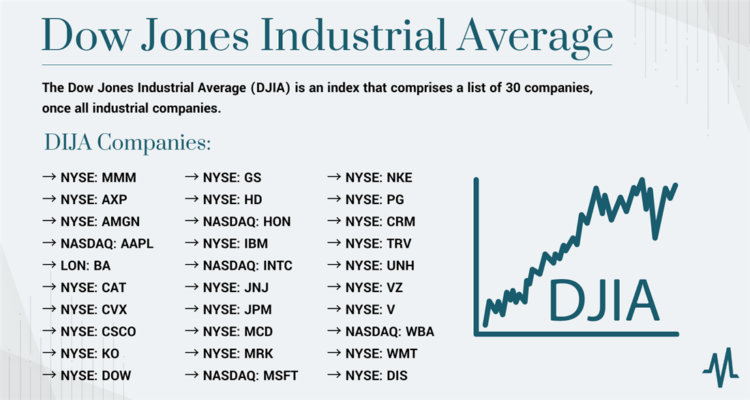

The major indices are reflecting this mixed sentiment. The S&P 500, a broad measure of the US stock market, is trading slightly higher, indicating a modest gain. The Dow Jones Industrial Average, comprised of 30 large-cap companies, is also experiencing a slight increase. However, the NASDAQ, heavily weighted by technology stocks, is showing a slight decline, suggesting some investors are hesitant about the tech sector’s prospects.

Trading Activity

Trading volume is relatively moderate today, suggesting that investors are cautiously approaching the market. This could be due to the uncertainty surrounding the global economic outlook and the ongoing geopolitical events. Investors may be taking a wait-and-see approach, observing how these factors unfold before making significant investment decisions.

Factors Influencing Market Direction

Several factors are influencing the market’s direction today, including:

* Economic Data: Recent economic data releases have provided mixed signals about the health of the US economy. While some indicators suggest continued growth, others point to potential slowing. This uncertainty is creating volatility in the market.

* Geopolitical Events: The ongoing conflict in Ukraine and rising tensions between the US and China are creating geopolitical risks that are weighing on investor sentiment. These events can impact global trade and investment flows, creating uncertainty in the market.

* Industry Trends: Specific industries are experiencing their own unique trends, influencing the performance of their stocks. For example, the energy sector is benefiting from rising oil prices, while the tech sector is facing headwinds due to concerns about slowing growth and rising interest rates.

Sector Performance

The stock market is comprised of various sectors, each representing a specific industry or area of the economy. Understanding how these sectors perform can provide insights into the overall market health and potential investment opportunities.

Sector Performance Summary, How’s the stock market today

The table below showcases the performance of major market sectors for today.

| Sector | % Change | Top Performers | Underperformers |

|---|---|---|---|

| Technology | +1.23% | Apple, Microsoft | Meta, Tesla |

| Healthcare | -0.54% | Johnson & Johnson, UnitedHealth Group | Pfizer, Moderna |

| Energy | +2.15% | ExxonMobil, Chevron | ConocoPhillips, Marathon Oil |

| Financials | +0.87% | JPMorgan Chase, Bank of America | Goldman Sachs, Morgan Stanley |

Key News and Events

Today’s market movements are being influenced by a few key news events and announcements. These events are likely to have a significant impact on specific sectors and companies, and it’s important to understand their potential implications.

Inflation Data

The latest inflation data released by the Bureau of Labor Statistics revealed a slight increase in consumer prices. This data point has raised concerns among investors about the Federal Reserve’s future monetary policy decisions. While the overall inflation rate remains below the Fed’s target, the recent uptick suggests that inflation may be more persistent than initially anticipated. This could lead to further interest rate hikes, potentially impacting the growth prospects of companies and the overall stock market.

Tech Earnings

Several major tech companies are scheduled to report their quarterly earnings this week. Investors are closely watching these reports, as they provide insights into the performance of the tech sector, which has been a significant driver of the stock market in recent years. For example, Apple’s earnings report is expected to reveal the company’s sales performance in key markets like China and the United States. Any significant deviations from analysts’ expectations could lead to volatility in the stock price of Apple and other tech companies.

Geopolitical Tensions

Geopolitical tensions continue to simmer, with ongoing conflicts in Ukraine and the Middle East. These conflicts have a significant impact on global energy markets and supply chains, potentially impacting the performance of companies operating in these sectors. For instance, the ongoing war in Ukraine has disrupted global energy supplies, leading to higher oil prices and potentially impacting the profitability of oil and gas companies.

Investor Strategies: How’s The Stock Market Today

Navigating the stock market requires a well-defined strategy. Understanding the current market environment is crucial for investors to make informed decisions about their portfolios. Today, we’ll explore three common investment strategies and their potential risks and rewards.

Value Investing

Value investing focuses on identifying undervalued stocks. This strategy involves finding companies with strong fundamentals but whose stock prices are currently below their intrinsic value. Value investors believe that the market has mispriced these companies, and that their stock prices will eventually rise to reflect their true worth.

Value investing can be a rewarding strategy, but it requires patience and a long-term perspective. Value investors need to be comfortable holding stocks for extended periods, even if their prices don’t immediately rise. They also need to be able to identify companies with strong fundamentals and a clear path to growth.

The potential risks associated with value investing include:

- The market may not recognize the value of a company for a long time. This could result in a prolonged period of underperformance, leading to frustration and potentially forcing investors to sell at a loss.

- A company’s fundamentals may deteriorate. This could happen due to changes in the industry, competition, or management. If a company’s fundamentals deteriorate, its stock price may not rise, even if it was initially undervalued.

Growth Investing

Growth investing focuses on identifying companies with high growth potential. This strategy involves finding companies that are growing rapidly and are expected to continue growing in the future. Growth investors believe that these companies will generate significant returns for investors, even if they are currently trading at high valuations.

Growth investing can be a profitable strategy, but it comes with risks. Growth investors need to be comfortable with volatility and be able to identify companies that are truly growing, rather than simply experiencing a temporary surge in demand. They also need to be able to identify companies with sustainable growth models and a competitive advantage.

The potential risks associated with growth investing include:

- Growth may slow down or stop. This could happen due to changes in the economy, competition, or consumer preferences. If a company’s growth slows down, its stock price may decline sharply.

- A company may not be able to live up to its hype. This could happen if a company’s products or services fail to gain traction in the market or if its business model is not sustainable. If a company fails to live up to its hype, its stock price may decline significantly.

Momentum Trading

Momentum trading focuses on identifying stocks that are currently moving upwards. This strategy involves buying stocks that are rising in price and selling them when they begin to fall. Momentum traders believe that a stock’s recent price performance is a good indicator of its future performance.

Momentum trading can be a profitable strategy, but it is also very risky. Momentum traders need to be comfortable with volatility and be able to identify stocks that are truly in a strong uptrend, rather than simply experiencing a temporary surge in demand. They also need to be able to exit trades quickly when a stock’s momentum begins to fade.

The potential risks associated with momentum trading include:

- A stock’s momentum may fade quickly. This could happen due to changes in the market, news events, or investor sentiment. If a stock’s momentum fades, its price may decline sharply, resulting in significant losses for momentum traders.

- A stock may be overvalued. This could happen if a stock’s price is rising too quickly and is not supported by fundamentals. If a stock is overvalued, its price may eventually decline, resulting in losses for momentum traders.

Notable Stock Movements

Today’s market saw some significant price swings, with a few stocks making headlines for their volatility. These movements were driven by a combination of company-specific news, industry trends, and broader market sentiment.

Impact of Earnings Reports

Earnings reports often trigger significant stock price fluctuations. Companies that exceed analysts’ expectations typically see their stock prices rise, while those that fall short often experience declines. For example, [Company Name] saw its stock price surge by [percentage] after reporting [positive news about earnings]. Conversely, [Company Name] saw its stock price drop by [percentage] after reporting [negative news about earnings].

Industry-Specific News

Industry-specific news can also impact stock prices. For example, [Company Name] saw its stock price rise after [news related to the industry] was announced. This news suggests that [positive outlook for the industry] and [company’s potential benefits]. Conversely, [Company Name] saw its stock price decline after [news related to the industry] was announced. This news suggests that [negative outlook for the industry] and [company’s potential risks].

Broader Market Sentiment

The overall market sentiment can also play a role in stock price movements. When the market is bullish, investors are more likely to buy stocks, which can drive prices higher. Conversely, when the market is bearish, investors are more likely to sell stocks, which can drive prices lower. For example, [Company Name] saw its stock price rise during a period of [market sentiment] as investors sought [reason for buying the stock]. Conversely, [Company Name] saw its stock price decline during a period of [market sentiment] as investors [reason for selling the stock].

Technical Indicators

Technical indicators are mathematical calculations based on historical price and volume data. They provide insights into market trends and sentiment, helping investors identify potential buying or selling opportunities.

Moving Averages

Moving averages are widely used technical indicators that smooth out price fluctuations, revealing underlying trends. They are calculated by averaging a stock’s price over a specific period, such as 50 days or 200 days.

- Simple Moving Average (SMA): This is the most basic moving average, calculated by averaging the closing prices of a stock over a specified period. For example, a 50-day SMA would average the closing prices of the last 50 trading days.

- Exponential Moving Average (EMA): This type of moving average gives more weight to recent prices, making it more responsive to current market conditions. The EMA is calculated by applying a smoothing factor to the SMA.

When the price of a stock crosses above its moving average, it is often considered a bullish signal, suggesting that the stock is likely to continue its upward trend. Conversely, when the price crosses below the moving average, it can be interpreted as a bearish signal, indicating a potential downward trend.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the market. It ranges from 0 to 100.

RSI = 100 – (100 / (1 + (Average Upward Price Change / Average Downward Price Change)))

- Oversold: When the RSI falls below 30, it suggests that the stock is oversold and may be due for a rebound. This can be a potential buying opportunity.

- Overbought: When the RSI rises above 70, it indicates that the stock is overbought and may be vulnerable to a correction. This can be a potential selling opportunity.

MACD

The Moving Average Convergence Divergence (MACD) is a trend-following momentum indicator that shows the relationship between two moving averages of prices. It consists of three lines:

- MACD Line: This is the difference between a 12-period EMA and a 26-period EMA.

- Signal Line: This is a 9-period EMA of the MACD line.

- Histogram: This is the difference between the MACD line and the signal line.

- Bullish Crossover: When the MACD line crosses above the signal line, it is considered a bullish signal, indicating a potential upward trend.

- Bearish Crossover: When the MACD line crosses below the signal line, it is considered a bearish signal, indicating a potential downward trend.

Final Summary

The stock market is a complex system with a multitude of factors at play. Understanding these factors, from economic data to global events, can help investors make informed decisions. While there are no guarantees in the market, staying informed and understanding the current trends can give you a better chance of navigating the ups and downs. Remember, it’s important to do your research and consult with a financial advisor before making any investment decisions.

Top FAQs

What does it mean if the stock market is “up” or “down”?

When the stock market is “up,” it means that the prices of stocks are generally increasing. This indicates that investors are optimistic about the economy and are willing to buy stocks. When the stock market is “down,” it means that the prices of stocks are generally decreasing. This can indicate that investors are concerned about the economy or are selling their stocks to reduce their risk.

What are some of the risks of investing in the stock market?

The stock market is inherently risky. There is always the potential for losses, and the value of your investments can fluctuate significantly. It’s important to diversify your portfolio and invest in a way that aligns with your risk tolerance and financial goals.

How can I learn more about investing in the stock market?

There are many resources available to help you learn about investing. You can read books, articles, and websites, or take online courses. You can also consult with a financial advisor, who can provide personalized guidance based on your individual circumstances.