- Understanding Florida’s Car Insurance Landscape

- Finding Affordable Car Insurance Options: Inexpensive Car Insurance Florida

- Evaluating Car Insurance Quotes

- Understanding the Role of State Regulations

-

Addressing Specific Insurance Needs

- Car Insurance Needs for Young Drivers

- Car Insurance Needs for Seniors

- Car Insurance Needs for Drivers with Poor Driving Records

- Car Insurance Coverage Needs Based on Vehicle Value, Inexpensive car insurance florida

- Car Insurance Coverage Needs Based on Personal Assets

- Car Insurance Coverage Needs Based on Family Circumstances

- Epilogue

- Clarifying Questions

Inexpensive car insurance Florida can be a challenge, especially given the state’s unique insurance landscape. Florida’s no-fault insurance system, high population density, and frequent weather events all contribute to higher premiums. However, there are ways to find affordable car insurance in Florida if you know where to look and what to look for.

This guide will walk you through the steps of finding inexpensive car insurance in Florida, covering everything from understanding the different types of coverage required to comparing quotes and negotiating for the best rates. We’ll also discuss the role of state regulations and provide tips for addressing specific insurance needs.

Understanding Florida’s Car Insurance Landscape

Florida’s car insurance landscape is unique and complex, influenced by a variety of factors that contribute to its high premiums. This section will explore the key factors that impact car insurance costs in Florida, break down the different types of coverage required, and discuss the influence of the state’s no-fault insurance system.

Factors Influencing Car Insurance Costs in Florida

Florida’s car insurance costs are significantly higher than the national average, driven by a combination of factors, including:

- High Number of Accidents and Claims: Florida has a higher than average rate of car accidents, leading to more claims and higher insurance premiums. This is attributed to factors like a large population, heavy tourist traffic, and a significant elderly population.

- No-Fault Insurance System: Florida’s no-fault insurance system requires drivers to file claims with their own insurance companies, regardless of who caused the accident. While this can expedite the claims process, it also contributes to higher premiums as insurance companies have to cover more claims.

- High Cost of Medical Care: Florida has a high cost of medical care, which impacts insurance premiums as insurance companies must cover medical expenses resulting from accidents.

- Fraudulent Claims: Florida has a significant problem with fraudulent insurance claims, which drives up costs for all policyholders. This issue is exacerbated by the state’s large population and tourist traffic.

- High Litigation Rates: Florida has a high rate of lawsuits related to car accidents, which increases insurance costs as companies have to cover legal expenses and settlements.

- Hurricane Risk: Florida is highly vulnerable to hurricanes, which can damage vehicles and increase insurance premiums.

Required Car Insurance Coverage in Florida

Florida law mandates that all drivers carry specific types of car insurance coverage:

- Personal Injury Protection (PIP): PIP covers medical expenses, lost wages, and other related costs for the insured and passengers in their vehicle, regardless of fault. Florida law requires a minimum PIP coverage of $10,000.

- Property Damage Liability (PDL): PDL covers damages to the other driver’s vehicle or property in an accident that you cause. Florida law requires a minimum PDL coverage of $10,000.

- Bodily Injury Liability (BIL): BIL covers injuries to the other driver or passengers in an accident that you cause. Florida law requires a minimum BIL coverage of $10,000 per person and $20,000 per accident.

Impact of Florida’s No-Fault Insurance System

Florida’s no-fault insurance system has a significant impact on car insurance premiums:

- Increased Claims: The no-fault system encourages drivers to file claims for even minor injuries, as they are not required to prove fault. This leads to a higher volume of claims and higher premiums.

- Higher Medical Costs: The no-fault system incentivizes medical providers to charge higher rates for services, as they know they will be reimbursed by insurance companies. This further contributes to higher premiums.

- Limited Coverage: While the no-fault system aims to expedite claims processing, it can also limit the coverage available to drivers. For example, drivers may not be able to sue for pain and suffering unless they meet certain thresholds.

Finding Affordable Car Insurance Options: Inexpensive Car Insurance Florida

Navigating the world of car insurance in Florida can feel overwhelming, especially when you’re seeking the most affordable options. This section explores strategies for finding competitive rates and understanding the factors that influence your premium.

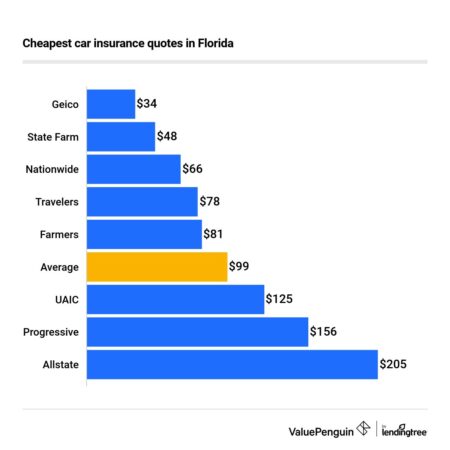

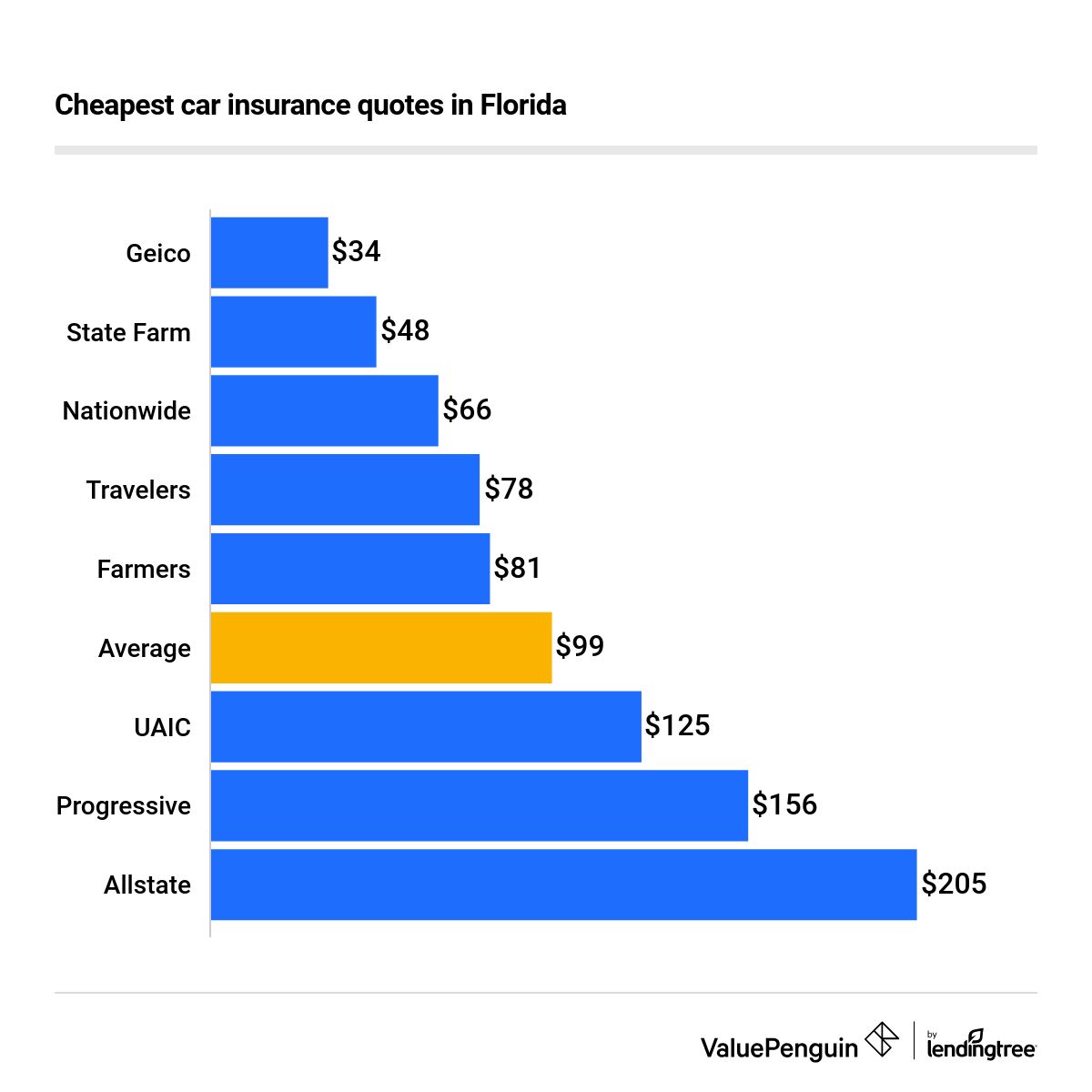

Comparing Car Insurance Providers in Florida

Understanding the pricing and coverage offered by different car insurance providers is crucial for making informed decisions. Florida has a diverse landscape of insurance companies, each with its unique offerings.

- State Farm: State Farm is known for its extensive network of agents and comprehensive coverage options. They often offer competitive rates, particularly for drivers with good driving records.

- Geico: Geico is a popular choice for its online convenience and often competitive rates. They are known for their straightforward policies and easy-to-use website.

- Progressive: Progressive is known for its customizable coverage options and its “Name Your Price” tool, which allows you to set your desired premium and see which coverage options fit within your budget.

- Allstate: Allstate is another major provider known for its wide range of coverage options and its focus on customer service. They offer various discounts and programs to help lower premiums.

- USAA: USAA specializes in insurance for military personnel and their families. They often offer competitive rates and excellent customer service.

Factors Impacting Car Insurance Premiums

Several factors influence the cost of car insurance in Florida, including:

- Driving History: Your driving record is a major factor in determining your premium. A clean record with no accidents or traffic violations will result in lower rates. Conversely, a history of accidents or traffic tickets will likely lead to higher premiums.

- Vehicle Type: The type of vehicle you drive significantly impacts your insurance cost. Sports cars, luxury vehicles, and high-performance cars are typically more expensive to insure due to their higher repair costs and potential for higher risk.

- Age and Gender: Younger drivers, especially those under 25, generally pay higher premiums due to their higher risk profile. Similarly, gender can influence premiums, as statistical data suggests that men tend to have more accidents than women.

- Location: Your location in Florida can impact your insurance rates. Areas with higher rates of accidents or crime tend to have higher premiums.

- Credit Score: In some states, including Florida, insurers may use your credit score as a factor in determining your premium. A higher credit score generally indicates a lower risk and can lead to lower rates.

Tips for Lowering Car Insurance Costs

While you can’t control all the factors that influence your premium, there are strategies you can employ to lower your insurance costs:

- Shop Around: Get quotes from multiple insurance providers to compare rates and coverage options. Don’t hesitate to ask about discounts and bundle deals.

- Maintain a Good Driving Record: Avoid accidents and traffic violations. A clean driving record is the most significant factor in lowering your premium.

- Consider a Higher Deductible: A higher deductible means you pay more out-of-pocket in the event of an accident, but it can lead to lower premiums. This is a good option if you’re comfortable with a higher deductible.

- Take Advantage of Discounts: Many insurance companies offer discounts for various factors, such as good student discounts, safe driver discounts, and discounts for bundling multiple insurance policies.

- Improve Your Credit Score: If your credit score is low, consider steps to improve it, as this can potentially lower your insurance rates in Florida.

- Choose a Safe Vehicle: While you may not want to change cars immediately, if you’re planning to buy a new vehicle, consider safety features and the vehicle’s overall safety rating. Vehicles with excellent safety features tend to have lower insurance premiums.

Evaluating Car Insurance Quotes

Once you have gathered quotes from various car insurance companies, it’s crucial to compare them thoroughly to determine the best fit for your needs and budget. This process involves evaluating key features, comparing costs, and considering the overall value proposition of each policy.

Comparing Car Insurance Quotes

To make an informed decision, it’s helpful to organize the information from different quotes in a table format. This allows for a clear side-by-side comparison of crucial factors. Here’s a sample table structure you can use:

| Feature | Company A | Company B | Company C |

|---|---|---|---|

| Coverage Limits (Liability, Collision, Comprehensive) | |||

| Deductibles | |||

| Premium (Monthly/Annual) | |||

| Discounts | |||

| Customer Service Ratings | |||

| Claims Handling Process |

Evaluating Car Insurance Quotes

Evaluating car insurance quotes involves considering various factors to ensure you choose a policy that provides adequate coverage at a reasonable price. Here’s a checklist to guide your evaluation:

Coverage Limits

– Liability Coverage: Ensure the liability limits are sufficient to cover potential damages and injuries to others in an accident.

– Collision and Comprehensive Coverage: Assess whether the deductibles for these coverages are manageable in case of an accident or damage to your vehicle.

– Uninsured/Underinsured Motorist Coverage: This coverage is crucial in Florida, where a significant number of drivers may be uninsured or underinsured.

Deductibles

– Deductible Amount: A higher deductible generally translates to lower premiums. Determine a deductible amount you can comfortably afford in case of a claim.

Customer Service and Claims Handling

– Customer Service Ratings: Research the company’s customer service reputation, including online reviews and ratings from independent organizations.

– Claims Handling Process: Understand the company’s claims process, including how long it takes to process claims and the availability of 24/7 support.

Understanding the Fine Print

While comparing premiums and coverage is essential, it’s equally important to thoroughly read and understand the fine print of each policy. This includes:

– Exclusions: Be aware of any specific events or circumstances that are not covered by the policy.

– Conditions: Pay attention to any conditions that might affect your coverage, such as driving restrictions or limitations.

– Renewals: Understand how the premium might change during renewal and whether there are any automatic renewal provisions.

– Cancellation Policy: Familiarize yourself with the policy’s cancellation process and any associated fees.

Understanding the Role of State Regulations

In Florida, the Department of Financial Services (DFS) plays a crucial role in shaping the car insurance landscape. This agency oversees the insurance industry, setting regulations that influence pricing, consumer protection, and the overall availability of car insurance options.

Florida’s Insurance Laws and Consumer Protections

Florida’s insurance laws are designed to protect consumers and ensure fair practices within the industry. Key provisions include:

- No-Fault Insurance: Florida is a no-fault state, meaning drivers are primarily responsible for covering their own medical expenses after an accident, regardless of fault. This system aims to reduce litigation and expedite claims processing.

- Personal Injury Protection (PIP): All Florida drivers are required to carry PIP coverage, which covers medical expenses, lost wages, and other related costs up to a certain limit. This coverage is crucial for accident victims, providing financial assistance for their recovery.

- Property Damage Liability: Florida law mandates that drivers carry property damage liability coverage to protect themselves from financial responsibility for damage they cause to another person’s property in an accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects drivers from financial losses caused by accidents involving uninsured or underinsured motorists. It helps ensure compensation for injuries and damages that might otherwise go uncompensated.

Impact of Florida Regulations on Car Insurance Pricing and Availability

Florida’s insurance regulations directly impact the pricing and availability of car insurance in several ways:

- No-Fault System: The no-fault system, while intended to reduce litigation, has contributed to higher car insurance premiums in Florida. The state’s high volume of accident claims and the availability of lawsuit options in certain situations have increased insurance costs.

- PIP Coverage: The requirement for PIP coverage, while offering essential protection for accident victims, can also contribute to higher premiums. The mandated coverage levels and the potential for fraud in PIP claims have influenced insurance pricing.

- Hurricane Risk: Florida’s vulnerability to hurricanes significantly impacts car insurance rates. Insurance companies factor in the potential for catastrophic losses due to hurricanes, leading to higher premiums for drivers in hurricane-prone areas.

- Fraud and Litigation: Florida’s history of insurance fraud and litigation has contributed to higher insurance costs. The state’s legal environment can make it more challenging for insurance companies to manage claims and control costs, leading to higher premiums for all drivers.

Addressing Specific Insurance Needs

Car insurance needs are not one-size-fits-all. Factors like age, driving history, vehicle value, and personal circumstances play a significant role in determining the right level of coverage. Understanding these factors can help you find the most affordable and suitable insurance plan.

Car Insurance Needs for Young Drivers

Young drivers, particularly those under 25, are often considered high-risk by insurance companies due to their lack of experience and higher likelihood of accidents. Finding affordable car insurance for young drivers requires a strategic approach.

- Maintain a Clean Driving Record: Avoiding traffic violations, accidents, and driving under the influence is crucial for lowering premiums.

- Consider a Defensive Driving Course: Completing a certified defensive driving course can demonstrate responsible driving habits and potentially earn discounts.

- Explore Discounts: Look for discounts offered by insurance companies for good grades, safe driving practices, or being a member of certain organizations.

- Increase Deductibles: Choosing a higher deductible can lower your monthly premiums, but you’ll pay more out-of-pocket if you file a claim.

- Shop Around: Comparing quotes from multiple insurers is essential to find the most competitive rates.

Car Insurance Needs for Seniors

Seniors, while often considered experienced drivers, may face unique challenges when it comes to car insurance.

- Review Coverage Needs: Seniors may need to adjust their coverage levels based on their driving habits and lifestyle changes. For example, if they drive less frequently, they may consider reducing their liability coverage.

- Explore Senior Discounts: Many insurance companies offer discounts for senior drivers, recognizing their years of driving experience and lower risk profiles.

- Consider Usage-Based Insurance: These programs track driving habits and reward safe driving with lower premiums, which can be beneficial for seniors who drive less frequently.

Car Insurance Needs for Drivers with Poor Driving Records

Drivers with a history of accidents, violations, or DUIs face higher premiums due to their increased risk profile.

- Seek Professional Advice: Consulting with an insurance broker can help you understand the impact of your driving record on premiums and explore options for mitigating the cost.

- Consider a SR-22 Filing: If you’ve been convicted of a serious traffic violation, your state may require you to file an SR-22 form with your insurance company, demonstrating proof of financial responsibility.

- Maintain a Clean Driving Record: Avoiding further violations is crucial for lowering premiums over time.

- Explore High-Risk Insurance Providers: Some insurance companies specialize in insuring drivers with poor driving records, offering competitive rates despite their risk profile.

Car Insurance Coverage Needs Based on Vehicle Value, Inexpensive car insurance florida

The value of your vehicle is a significant factor in determining the appropriate level of coverage.

- Comprehensive and Collision Coverage: If you have a newer or more expensive vehicle, it’s generally advisable to have comprehensive and collision coverage, which protects you from damage caused by events like theft, vandalism, or accidents.

- Liability Coverage: For older or less expensive vehicles, you may choose to reduce your comprehensive and collision coverage while maintaining adequate liability coverage to protect yourself financially in case of an accident.

Car Insurance Coverage Needs Based on Personal Assets

The value of your personal assets, such as your home, savings, and investments, can influence your insurance needs.

- Higher Liability Coverage: If you have substantial assets, it’s wise to have higher liability coverage to protect yourself from financial ruin in case of a serious accident.

- Umbrella Coverage: An umbrella policy provides additional liability coverage beyond your auto insurance limits, offering greater financial protection for high-value assets.

Car Insurance Coverage Needs Based on Family Circumstances

Your family circumstances, including the number of drivers and dependents, can impact your insurance needs.

- Multiple Drivers: If you have multiple drivers in your household, you may consider bundling your policies with the same insurer to potentially receive discounts.

- Dependents: If you have children, you may want to ensure you have adequate coverage to protect them in case of an accident.

Epilogue

Finding inexpensive car insurance in Florida doesn’t have to be a daunting task. By understanding the state’s insurance landscape, comparing quotes, and taking advantage of available discounts, you can secure affordable coverage that meets your needs. Remember, it’s important to compare quotes from multiple insurers, read the fine print carefully, and don’t hesitate to negotiate for a better price.

Clarifying Questions

What are the minimum car insurance requirements in Florida?

Florida requires drivers to carry at least $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BIL) per person, with a $30,000 limit per accident.

How can I get a discount on my car insurance in Florida?

Many insurers offer discounts for things like good driving records, safe driving courses, bundling policies, and having safety features on your vehicle.

What is a no-fault insurance system?

Florida’s no-fault system requires drivers to file claims with their own insurer, regardless of who caused the accident. This system is designed to streamline claims processing and reduce lawsuits.