Insure a car, it’s a phrase we hear all the time, but do we really understand what it means? It’s not just about a piece of paper, it’s about peace of mind, knowing you’re covered in case of the unexpected. Think of it like your superhero cape for the road, protecting you from the villains of accidents and unforeseen events. From understanding the different types of coverage to finding the best deal, we’ll break down the world of car insurance in a way that’s both informative and relatable, making you feel like a pro in no time.

Car insurance is an essential part of responsible driving. It protects you financially if you’re involved in an accident, covering damages to your vehicle and any injuries you might cause. Think of it like a safety net, catching you if you fall. By understanding the basics, you can make informed decisions about your coverage and ensure you have the right protection for your needs.

Understanding Car Insurance

Car insurance is like a safety net for your car and your wallet. It’s there to protect you from the financial burden of accidents, theft, or other unexpected events. Think of it as a shield against the unexpected, helping you stay on the road and avoid a major financial hit.

Types of Car Insurance Coverage

Car insurance isn’t just one thing; it’s a package of different types of coverage, each designed to protect you in specific situations. Let’s break down the most common types:

- Liability Coverage: This is the most basic type of car insurance and is usually required by law. It covers damages you cause to other people’s property or injuries you cause to others in an accident that’s your fault. Think of it as your protection against lawsuits.

- Collision Coverage: This covers damage to your car if you’re in an accident, regardless of who’s at fault. This means you can get your car fixed or replaced, even if you’re the one who caused the accident.

- Comprehensive Coverage: This covers damage to your car from events other than accidents, such as theft, vandalism, hailstorms, or falling objects. Imagine your car getting a dent from a rogue basketball or a tree branch falling on it.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re hit by someone who doesn’t have insurance or doesn’t have enough insurance to cover your damages. This coverage is like a backup plan in case the other driver can’t pay for your losses.

Real-Life Scenarios

Let’s bring this to life with some real-life scenarios:

- Scenario 1: You’re driving to work and accidentally rear-end the car in front of you. Your liability coverage will help pay for the damages to the other car and any medical bills the other driver may have.

- Scenario 2: You’re parked at the mall and someone bumps into your car, leaving a dent. Your collision coverage will help pay for the repairs to your car.

- Scenario 3: A hailstorm hits your neighborhood, damaging your car’s windshield. Your comprehensive coverage will help pay for the repairs or replacement of your windshield.

- Scenario 4: You’re hit by a driver who doesn’t have insurance. Your uninsured/underinsured motorist coverage will help pay for your damages and medical bills.

Factors Influencing Car Insurance Premiums

Your car insurance premium is the amount you pay for coverage. Several factors influence how much you pay, and understanding these factors can help you make informed decisions about your insurance policy.

Vehicle Type

The type of vehicle you drive significantly impacts your insurance premium. Some vehicles are considered more risky to insure than others due to factors like their safety features, repair costs, and likelihood of theft.

- Sports cars and luxury vehicles are often more expensive to insure because they are typically more powerful, have higher repair costs, and are more likely to be targeted for theft.

- SUVs and trucks generally have higher premiums than sedans due to their size and weight, which can increase the severity of accidents.

- Older vehicles may have lower premiums because they are worth less and may have fewer safety features.

Driving History

Your driving history is one of the most significant factors determining your insurance premium. Insurance companies consider your past driving behavior to assess your risk.

- Accidents and traffic violations, such as speeding tickets or DUIs, can significantly increase your premiums. These incidents indicate a higher risk of future accidents.

- Clean driving record can result in lower premiums, as it shows that you are a safe and responsible driver.

Age

Your age plays a role in your insurance premium. Younger drivers generally pay higher premiums due to their lack of experience and higher risk-taking behavior.

- Teenage drivers have the highest premiums, as they are statistically more likely to be involved in accidents.

- Mature drivers, typically those over 65, often have lower premiums because they have more experience and tend to be more cautious drivers.

Location

The location where you live also influences your insurance premium. Insurance companies consider the risk of accidents in different areas, such as population density, traffic congestion, and crime rates.

- Urban areas with high traffic volume and congestion tend to have higher premiums due to the increased risk of accidents.

- Rural areas with lower population density and less traffic may have lower premiums.

Credit Score

Surprisingly, your credit score can also affect your car insurance premium. Insurance companies use credit scores as a proxy for risk assessment, believing that individuals with good credit are more likely to be responsible and pay their bills on time.

- Higher credit scores are generally associated with lower insurance premiums.

- Lower credit scores can lead to higher premiums, as insurance companies may perceive you as a higher risk.

Hypothetical Scenario

Let’s consider a hypothetical scenario to illustrate how these factors can influence premium calculations. Imagine two drivers, both 25 years old, driving in the same city. Driver A has a clean driving record and drives a compact sedan, while Driver B has a history of speeding tickets and drives a high-performance sports car.

- Driver A is likely to have a lower premium due to their clean driving record and the lower risk associated with their vehicle.

- Driver B, on the other hand, will likely pay a higher premium due to their driving history and the higher risk associated with their sports car.

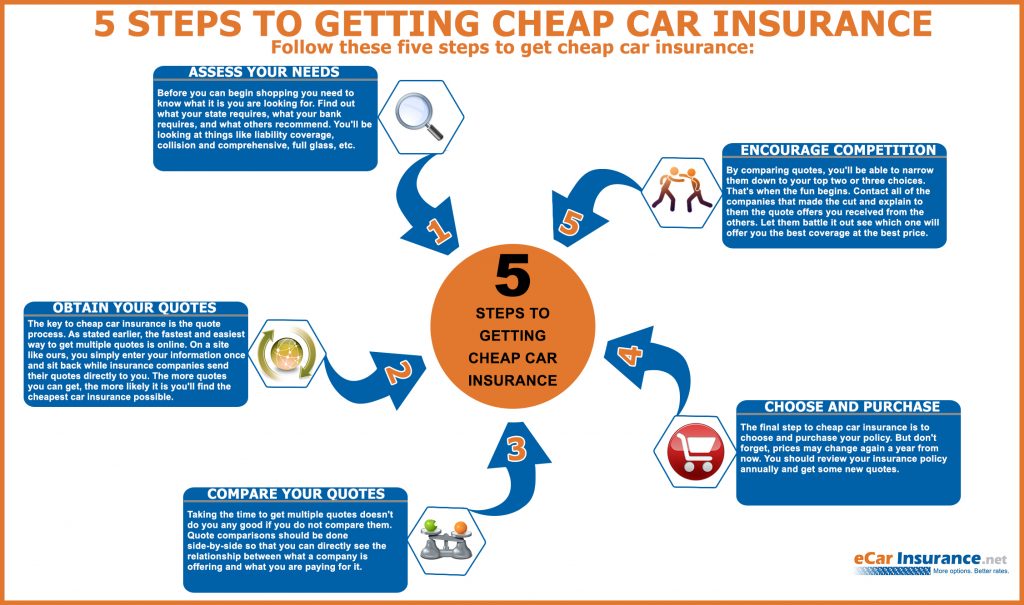

The Insurance Buying Process

You’ve decided to protect your car with insurance. That’s awesome! Now, it’s time to dive into the process of finding the right coverage. It’s like choosing the perfect outfit for your car, ensuring it’s stylish and safe.

Getting Quotes

The first step is getting quotes from different insurance companies. Think of it as trying on different outfits before committing to one. You can do this online, over the phone, or by visiting an insurance agent.

- When you get a quote, be sure to compare the coverage offered by each company.

- Make sure you understand the terms and conditions of each policy.

Comparing Policies

Once you have a few quotes, it’s time to compare the policies side-by-side. This is where you can really see which outfit fits your car best. Pay attention to the following:

- The amount of coverage you need.

- The deductible you’re willing to pay.

- The premium you’re comfortable paying.

Choosing a Provider

After comparing policies, you can choose the insurance provider that best meets your needs. It’s like finally picking the perfect outfit! Don’t rush this decision; it’s important to feel confident about your choice.

- Make sure you understand the terms and conditions of the policy before you sign.

- If you have any questions, don’t hesitate to ask the insurance agent.

Understanding Policy Terms and Conditions

Reading the fine print is crucial, even though it might seem like a chore. It’s like checking the label on your clothes to ensure they’re the right size and material. You need to understand what your policy covers and what it doesn’t.

- Look for key terms like deductible, premium, coverage limits, and exclusions.

- Don’t be afraid to ask for clarification from the insurance agent if you’re unsure about anything.

Checklist for Selecting Car Insurance

Before you sign on the dotted line, here’s a checklist to ensure you’re making a smart decision:

- Have you gotten quotes from multiple insurance companies?

- Have you compared the policies side-by-side?

- Do you understand the terms and conditions of the policy?

- Are you comfortable with the coverage, deductible, and premium?

- Have you asked any questions you have?

Claims and Coverage: Insure A Car

Your car insurance policy is your safety net when the unexpected happens. It protects you financially in case of accidents, theft, or damage to your vehicle. But how do you actually use this protection? That’s where understanding claims and coverage comes in.

Filing a Car Insurance Claim

When you need to file a claim, the process can seem daunting, but it’s actually pretty straightforward. Here’s a general overview:

* Report the incident: The first step is to contact your insurance company immediately after an accident or incident. This could be a phone call, online report, or through your insurance app.

* Gather documentation: You’ll need to provide your insurance company with specific details about the incident, including the date, time, location, and any involved parties. This may include:

* Police report: If the incident involved an accident, you’ll need a police report.

* Photos and videos: Documenting the damage with photos and videos can be extremely helpful.

* Witness statements: If anyone witnessed the incident, get their contact information.

* Medical records: If you were injured, provide your insurance company with medical records.

* Submit the claim: Your insurance company will provide you with a claim form, which you’ll need to complete and submit along with all the necessary documentation.

How Insurance Companies Handle Claims

Once you’ve submitted your claim, the insurance company will start investigating the incident. They’ll review the documentation you provided, and they may also conduct their own investigation. This could include:

* Inspecting the vehicle: An insurance adjuster will inspect your vehicle to assess the damage.

* Interviewing witnesses: They may interview witnesses to gather more information about the incident.

* Reviewing medical records: If you were injured, they’ll review your medical records to determine the extent of your injuries.

Determining Coverage

The insurance company will use the information they gather to determine whether your claim is covered by your policy. They’ll also determine the amount of coverage you’re entitled to. Here are some factors they’ll consider:

* Type of coverage: Your policy may include different types of coverage, such as collision, comprehensive, liability, and uninsured/underinsured motorist coverage.

* Deductible: This is the amount you’ll need to pay out-of-pocket before your insurance coverage kicks in.

* Policy limits: Your policy will have limits on the amount of coverage you’re entitled to.

Examples of Different Types of Claims

Here are some examples of different types of claims and how they are processed:

* Collision claim: If you’re involved in an accident with another vehicle, you can file a collision claim to cover the damage to your vehicle. The insurance company will assess the damage and pay for repairs or replacement, minus your deductible.

* Comprehensive claim: This type of claim covers damage to your vehicle from events other than collisions, such as theft, vandalism, or natural disasters. For example, if your car is stolen, your comprehensive coverage will pay for the replacement value of your vehicle, minus your deductible.

* Liability claim: If you’re at fault for an accident that causes damage to another person’s vehicle or injuries, you can file a liability claim. Your liability coverage will pay for the other person’s damages, up to your policy limits.

Safety and Prevention

Keeping your car safe and avoiding accidents is a win-win situation. It helps protect you and your passengers, keeps your insurance premiums low, and prevents unnecessary stress. Here’s how you can make sure you’re driving safely and taking the right precautions:

Driving Safely

Safe driving is a habit that takes practice and commitment. Here are some tips that can help you stay safe on the road:

- Always wear your seatbelt. It’s the most important safety feature in your car. Seatbelts can significantly reduce the risk of serious injury or death in an accident.

- Avoid distractions. Put your phone away, turn down the music, and avoid eating while driving. Distracted driving is one of the leading causes of accidents.

- Don’t drink and drive. Alcohol impairs your judgment and reaction time. If you’re going to be drinking, plan to take a taxi, rideshare, or have a designated driver.

- Be aware of your surroundings. Pay attention to other vehicles, pedestrians, and cyclists. Be prepared to react quickly to unexpected situations.

- Drive defensively. Assume other drivers are not paying attention and be prepared for anything. This means keeping a safe distance from other vehicles, signaling your intentions, and being aware of your blind spots.

- Get enough sleep. Drowsy driving is just as dangerous as drunk driving. If you’re tired, pull over and take a nap or find a safe place to rest.

Car Maintenance

Regular car maintenance can prevent many accidents. Here are some important maintenance tips:

- Check your tires regularly. Make sure your tires are properly inflated and have enough tread. Worn tires can lose traction, especially in wet conditions.

- Get your brakes checked regularly. Faulty brakes can cause serious accidents. Have your brakes checked by a qualified mechanic at least once a year.

- Change your oil and fluids regularly. Regular oil changes and fluid checks help keep your engine running smoothly. This can help prevent breakdowns and accidents.

- Have your car inspected regularly. A regular car inspection can help identify potential problems before they become major issues.

Vehicle Safety Features

Modern cars are equipped with many safety features that can help prevent accidents. Here are some of the most common:

- Anti-lock brakes (ABS) help prevent your wheels from locking up during sudden braking. This can help you maintain control of your car and avoid skidding.

- Electronic stability control (ESC) helps you maintain control of your car in slippery conditions or when you’re driving too fast.

- Airbags help protect you and your passengers in the event of an accident.

- Backup cameras help you see behind your car when backing up. This can help prevent accidents.

- Lane departure warning systems alert you if you drift out of your lane. This can help you avoid accidents.

- Blind spot monitoring systems alert you if there’s a vehicle in your blind spot. This can help you avoid accidents when changing lanes.

Common Driving Hazards and Preventive Measures

Driving can be a dangerous activity, but by being aware of potential hazards and taking precautions, you can significantly reduce your risk of accidents.

| Hazard | Preventive Measures |

|---|---|

| Distracted Driving | Put your phone away, turn down the music, and avoid eating while driving. |

| Drowsy Driving | Get enough sleep before driving. If you’re tired, pull over and take a nap or find a safe place to rest. |

| Speeding | Obey the speed limit. Be aware of the road conditions and adjust your speed accordingly. |

| Aggressive Driving | Be patient and courteous to other drivers. Avoid tailgating and cutting off other drivers. |

| Bad Weather | Be extra cautious when driving in bad weather. Reduce your speed, increase your following distance, and use your headlights. |

| Road Construction | Be aware of your surroundings and be prepared to slow down or change lanes. Follow the directions of construction workers. |

| Animals | Be aware of your surroundings, especially in rural areas. Slow down and be prepared to stop if you see an animal. |

| Pedestrians and Cyclists | Be aware of your surroundings and be prepared to yield to pedestrians and cyclists. |

Tips for Saving on Car Insurance

Car insurance is a necessity for most drivers, but it can also be a significant expense. Fortunately, there are several strategies you can use to lower your car insurance premiums and save money.

Maintaining a Good Driving Record, Insure a car

A clean driving record is your golden ticket to lower premiums. Insurance companies see drivers with fewer accidents and violations as less risky, which means lower costs for you. Keep your driving record spotless by obeying traffic laws, driving defensively, and avoiding distractions while driving.

Bundling Insurance Policies

Insurance companies love it when you bundle your policies, and so will your wallet. If you have multiple insurance needs, like homeowners, renters, or life insurance, consider bundling them with your car insurance. This can lead to significant discounts, as insurance companies often reward customers for consolidating their coverage with them.

Shopping Around for Competitive Rates

Don’t settle for the first quote you get. It’s like dating – you want to explore your options! Get quotes from multiple insurance companies to compare rates and coverage. Online comparison websites can make this process much easier.

Discounts

Many insurance companies offer discounts to their policyholders. Here are some common discounts you might qualify for:

- Good Student Discount: If you’re a high-achieving student with good grades, you might be eligible for this discount.

- Safe Driver Discount: This discount is often awarded to drivers who have a clean driving record and haven’t been involved in any accidents or violations.

- Multi-Car Discount: Insure multiple vehicles with the same company and you’ll likely qualify for this discount.

- Anti-theft Device Discount: If your car is equipped with anti-theft devices like an alarm system or GPS tracking, you could be eligible for a lower premium.

- Loyalty Discount: Insurance companies often reward long-term customers with loyalty discounts.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and may earn you a discount.

- Pay-in-Full Discount: Paying your car insurance premium in full upfront might qualify you for a discount.

- Automatic Payment Discount: Setting up automatic payments can also lead to a discount.

- Good Credit Discount: In some states, insurance companies may offer discounts to drivers with good credit scores.

Negotiating with Insurance Companies

You’re not just a customer; you’re a valuable client! Don’t be afraid to negotiate with your insurance company. Here are some tips:

- Be polite and respectful: A good attitude can go a long way in any negotiation.

- Know your worth: Research average car insurance rates in your area and use that information as leverage during your negotiation.

- Highlight your positive attributes: Mention your good driving record, safety features on your car, and any discounts you qualify for.

- Be prepared to walk away: If you’re not satisfied with the offered rate, be prepared to switch to a different insurance company.

Final Review

Navigating the world of car insurance doesn’t have to be a stressful experience. By understanding the key factors, comparing policies, and taking advantage of discounts, you can find the best coverage at a price that fits your budget. Remember, it’s all about being prepared and knowing your options, so you can hit the road with confidence, knowing you’re protected from the unexpected. So buckle up, and let’s dive into the world of car insurance, one smooth ride at a time.

FAQs

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least annually, or even more frequently if there are significant life changes like a new car, a move, or a change in your driving record. This ensures you have the right coverage for your current needs and can potentially save money by taking advantage of new discounts or adjusting your policy.

What is a deductible and how does it affect my insurance premiums?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically means lower premiums, while a lower deductible results in higher premiums. It’s a balance you need to strike based on your risk tolerance and financial situation.

Can I get car insurance if I have a bad driving record?

Yes, you can still get car insurance even if you have a bad driving record. However, your premiums will likely be higher. It’s important to be honest with your insurance company about your driving history and to explore options for improving your record, such as defensive driving courses.