Is Aetna a good health insurance company? That’s a question on the minds of many folks searching for the right coverage. Aetna’s been around for a while, but with so many options out there, it’s tough to know who’s the real MVP. We’re gonna dive into the good, the bad, and the maybe-not-so-good about Aetna, and see if they’re the right fit for your health insurance needs.

Aetna is a major player in the health insurance game, offering a range of plans to suit different needs. They’ve got a solid reputation for financial stability and have been around since the 1800s. But is that enough to make them the champion of your health insurance team? Let’s break down their strengths, weaknesses, and customer experiences to see if they’re a slam dunk or a foul ball.

Aetna Overview

Aetna, a name synonymous with health insurance, has been around for over a century. Founded in 1853, Aetna started as a small life insurance company in Hartford, Connecticut. But over the years, it transformed into a major player in the health insurance market, evolving with the changing healthcare landscape.

Today, Aetna stands as one of the largest health insurance companies in the United States, offering a wide range of health insurance products and services to individuals, families, and businesses.

Aetna’s Position in the Health Insurance Market

Aetna is a major player in the health insurance market, offering a diverse range of health insurance products and services. Aetna operates in all 50 states, Washington D.C., and Puerto Rico, serving millions of customers. Aetna’s vast network of providers, innovative technology, and commitment to customer service have solidified its position as a leader in the industry.

Aetna’s Strengths

Aetna stands out as a formidable force in the healthcare industry, boasting a robust financial foundation and a commitment to innovation. This combination has positioned Aetna as a leader in offering comprehensive and quality healthcare solutions.

Financial Strength and Stability

Aetna’s financial performance is a testament to its stability and resilience. The company consistently ranks among the top health insurers in terms of revenue and profitability. This financial strength allows Aetna to invest in research and development, expand its network of providers, and enhance its technology infrastructure, all of which contribute to delivering exceptional customer experiences.

Key Competitive Advantages

Aetna’s success can be attributed to its unique blend of competitive advantages:

- Extensive Provider Network: Aetna boasts one of the largest and most comprehensive provider networks in the country, giving its members access to a wide range of healthcare professionals and facilities. This expansive network ensures that members have convenient access to care, regardless of their location.

- Focus on Innovation: Aetna is known for its commitment to innovation, consistently developing new programs and initiatives to improve healthcare delivery. This includes investments in digital health technologies, personalized medicine, and preventive care programs.

- Strong Customer Service: Aetna prioritizes customer satisfaction and has a reputation for providing excellent customer service. The company offers a variety of resources and support services to help members navigate the healthcare system and make informed decisions about their health.

Examples of Innovative Programs and Initiatives

Aetna’s commitment to innovation is evident in its numerous programs and initiatives:

- Aetna’s Healthagen program: This program focuses on personalized medicine and leverages genetic testing to provide tailored health recommendations and preventative care plans.

- Aetna’s Digital Health Platform: Aetna’s digital health platform offers members convenient access to their health records, virtual care options, and health management tools. This platform empowers members to take an active role in their health journey.

- Aetna’s Wellness Programs: Aetna offers a variety of wellness programs designed to promote healthy lifestyles and prevent chronic diseases. These programs include health screenings, fitness incentives, and educational resources.

Customer Experiences with Aetna

Aetna’s customer experiences are a crucial factor in determining its overall reputation and market standing. By analyzing customer reviews and ratings, we can gain insights into how Aetna performs in terms of customer satisfaction, responsiveness, and overall value.

Customer Reviews and Ratings

Customer feedback provides valuable insights into Aetna’s performance. Here’s a table summarizing customer reviews and ratings from various sources:

| Source | Rating | Key Highlights |

|---|---|---|

| J.D. Power | 3 out of 5 stars | Aetna received an average customer satisfaction score of 3 out of 5 stars, indicating a mixed customer experience. Customers praised Aetna’s network of providers but expressed concerns about customer service and claims processing. |

| Consumer Reports | 65 out of 100 | Consumer Reports rated Aetna 65 out of 100, placing it in the middle of the pack among health insurance providers. The report highlighted Aetna’s strong financial stability but noted some issues with customer service and claims processing. |

| Healthgrades | 3.5 out of 5 stars | Healthgrades awarded Aetna a 3.5 out of 5-star rating, reflecting a generally positive customer experience. Customers appreciated Aetna’s comprehensive coverage options and access to a wide network of providers. |

Common Themes in Customer Feedback

Customer feedback reveals recurring themes related to Aetna’s strengths and areas for improvement. Commonly cited strengths include:

- Extensive Network of Providers: Aetna offers a wide range of healthcare providers, giving customers greater choice and access to care.

- Comprehensive Coverage Options: Aetna provides various plans with different levels of coverage, allowing customers to select a plan that meets their specific needs and budget.

However, customer feedback also highlights some areas where Aetna can improve:

- Customer Service: Some customers reported difficulties reaching customer service representatives or experiencing long wait times. Aetna could improve its customer service responsiveness and efficiency.

- Claims Processing: Customers have expressed concerns about the timeliness and accuracy of claims processing. Aetna can streamline its claims processing procedures to ensure faster and more accurate reimbursements.

- Transparency and Communication: Some customers felt that Aetna lacked transparency regarding plan details and coverage limitations. Clear and consistent communication is crucial to building customer trust and satisfaction.

Comparison with Competitors

Aetna’s customer satisfaction scores are generally comparable to those of its competitors. However, some competitors, such as UnitedHealthcare and Anthem, consistently outperform Aetna in terms of customer satisfaction. These competitors often excel in areas such as customer service responsiveness, claims processing efficiency, and overall ease of use. Aetna can learn from its competitors’ best practices and strive to enhance its customer experience to achieve greater satisfaction.

Aetna’s Network and Coverage

Aetna’s network and coverage are crucial aspects to consider when evaluating their health insurance plans. The network’s size and the types of coverage offered play a significant role in determining the accessibility and affordability of healthcare services.

Aetna boasts a vast network of healthcare providers across the United States, offering a wide range of coverage options to cater to diverse needs. This extensive network and diverse coverage options aim to provide policyholders with comprehensive healthcare access and financial protection.

Aetna’s Provider Network

Aetna’s provider network comprises a diverse range of healthcare professionals, including:

- Physicians

- Hospitals

- Clinics

- Pharmacies

- Mental health professionals

- Substance abuse treatment centers

- Other healthcare providers

The network’s breadth and depth vary depending on the specific plan and geographic location. For instance, Aetna’s network in major metropolitan areas is typically more extensive than in rural areas. To ensure access to in-network providers, it is essential to verify the network’s coverage in your specific region before enrolling in an Aetna plan.

Types of Coverage Offered by Aetna

Aetna offers a variety of health insurance plans, each with its own set of coverage options. Some of the most common types of coverage include:

- Individual health insurance: These plans are designed for individuals and families who are not covered by employer-sponsored plans.

- Group health insurance: These plans are offered by employers to their employees and their dependents.

- Medicare Advantage plans: These plans are available to individuals who are eligible for Medicare.

- Medicaid plans: These plans are available to low-income individuals and families.

- Dental insurance: This coverage helps pay for dental care, such as cleanings, fillings, and extractions.

- Vision insurance: This coverage helps pay for eye care, such as eye exams, glasses, and contact lenses.

The specific coverage options included in each plan vary depending on the plan’s design and the individual’s needs. It is crucial to carefully review the plan’s coverage details before enrolling to ensure it meets your healthcare requirements.

Comparison of Aetna’s Coverage Options

Aetna’s coverage options can be compared to those of other health insurance companies by considering factors such as:

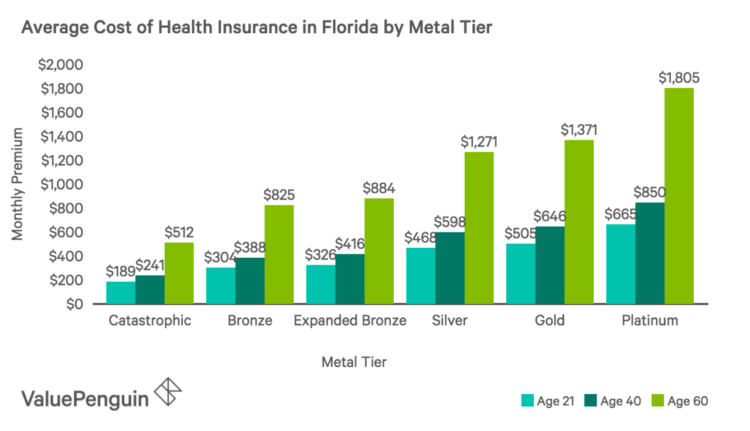

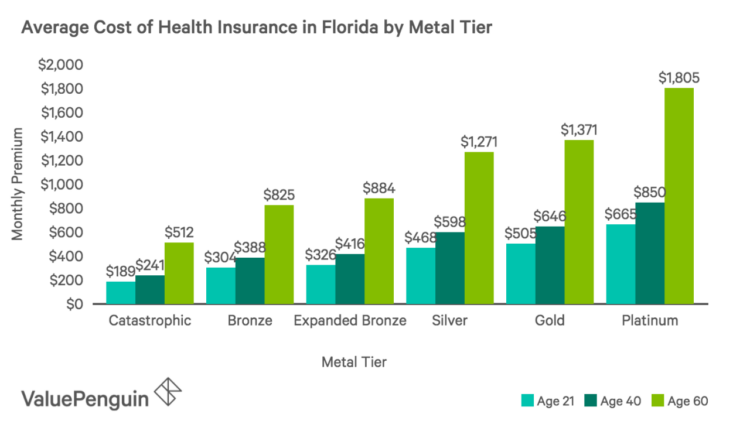

- Premium costs: The cost of premiums varies depending on the plan’s design, coverage options, and the individual’s age, health status, and location.

- Deductibles: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in.

- Co-pays: Co-pays are fixed amounts you pay for specific services, such as doctor’s visits or prescriptions.

- Co-insurance: Co-insurance is a percentage of the cost of covered services that you pay after your deductible has been met.

- Network size and provider availability: The size and availability of the provider network can impact your access to healthcare services.

- Coverage for specific services: Different plans may have different coverage levels for specific services, such as mental health care, substance abuse treatment, or preventive care.

By comparing these factors across different health insurance companies, you can determine which plan best suits your individual needs and budget.

Cost and Value of Aetna Plans

Aetna’s health insurance plans offer a variety of coverage options, but cost is a crucial factor to consider when choosing a plan. Understanding the cost structure and value proposition of Aetna plans is essential for making an informed decision.

Premium Costs, Is aetna a good health insurance company

Aetna’s premium costs vary based on factors such as plan type, coverage area, age, and health status. The following table provides a general overview of premium costs for different plan types:

| Plan Type | Estimated Monthly Premium |

|---|---|

| Bronze | $300 – $450 |

| Silver | $400 – $600 |

| Gold | $500 – $750 |

| Platinum | $600 – $900 |

It’s important to note that these are estimated premiums and actual costs may vary depending on individual circumstances. Aetna offers tools and resources on its website to help individuals estimate their premium costs.

Cost-Sharing Mechanisms

Aetna, like most health insurance companies, utilizes cost-sharing mechanisms to help manage healthcare costs. These mechanisms include deductibles, copayments, and coinsurance.

Deductibles

A deductible is the amount you pay out-of-pocket before your health insurance plan starts covering your healthcare expenses. Deductibles vary depending on the plan type and can range from a few hundred dollars to several thousand dollars.

Copayments

Copayments are fixed amounts you pay for specific services, such as doctor’s visits or prescription drugs. Copayments are typically lower than deductibles and help to control the cost of routine care.

Coinsurance

Coinsurance is a percentage of the cost of covered healthcare services that you pay after meeting your deductible. For example, if your coinsurance is 20%, you would pay 20% of the cost of a covered procedure after your deductible has been met.

Out-of-Pocket Expenses

Out-of-pocket expenses are the total amount you pay for healthcare costs in a given year, including premiums, deductibles, copayments, and coinsurance. Aetna’s plans have out-of-pocket maximums, which limit the total amount you have to pay out-of-pocket each year.

Value Proposition

Aetna’s health insurance plans offer a range of coverage options and cost-sharing mechanisms to meet the needs of different individuals and families. The value proposition of Aetna plans depends on individual circumstances and priorities.

For individuals with high healthcare needs, Aetna’s plans with lower deductibles and out-of-pocket maximums may offer better value. However, these plans may have higher premiums. For individuals with lower healthcare needs, Aetna’s plans with higher deductibles and out-of-pocket maximums may be more affordable, but could result in higher out-of-pocket costs if significant healthcare expenses are incurred.

Ultimately, the best way to determine the value of an Aetna health insurance plan is to carefully consider your individual needs and budget. Aetna provides tools and resources on its website to help individuals compare plans and make informed decisions.

Aetna’s Customer Service and Support

Aetna’s customer service is a crucial aspect of its overall performance, as it directly impacts customer satisfaction and loyalty. To understand how Aetna measures up, we’ll delve into its customer service channels, accessibility, responsiveness, and compare it to its competitors.

Aetna’s Customer Service Channels and Accessibility

Aetna offers a variety of customer service channels to ensure accessibility and convenience for its policyholders. These include:

- Phone Support: Aetna provides 24/7 phone support for urgent matters and general inquiries. Their phone lines are readily accessible, with dedicated lines for specific needs like claims or member services.

- Online Resources: Aetna’s website features a comprehensive online portal where members can access their account information, view claims status, find providers, and even manage their health benefits. The portal is designed for ease of use and offers a wealth of information and resources.

- Mobile App: Aetna’s mobile app allows members to manage their health plans on the go. This includes features like finding providers, accessing ID cards, submitting claims, and reviewing medical history. The app is user-friendly and available on both iOS and Android devices.

- Email Support: For less urgent matters, Aetna offers email support for specific inquiries. This channel provides a written record of communication and allows for more detailed explanations.

- Social Media: Aetna actively engages with its customers on social media platforms like Facebook and Twitter. These platforms provide an avenue for quick communication and addressing customer concerns.

Aetna’s Responsiveness and Helpfulness

Aetna strives to provide prompt and helpful customer service. Many customer testimonials highlight their positive experiences with Aetna’s responsiveness. For instance, some customers have shared stories of Aetna representatives going the extra mile to resolve complex claims issues or answer questions about coverage in a timely manner.

Comparing Aetna’s Customer Service with Competitors

Aetna’s customer service is generally considered to be on par with its competitors in the health insurance industry. While some customers may experience occasional delays or challenges, Aetna’s commitment to providing multiple channels and accessible resources is appreciated. However, it’s important to note that customer service experiences can vary depending on individual situations and the specific agents involved.

Conclusion

So, is Aetna a good health insurance company? The answer, like most things in life, is a bit of a mixed bag. They’ve got their pros and cons, and it really comes down to what you’re looking for in a health insurance plan. If you value financial stability, a wide network, and innovative programs, Aetna might be worth a closer look. But if customer service is your top priority, you might want to explore other options. The best way to know for sure is to compare Aetna to other companies and see what fits your individual needs and budget.

Essential FAQs: Is Aetna A Good Health Insurance Company

What are some of Aetna’s most popular health insurance plans?

Aetna offers a variety of plans, including HMO, PPO, and POS plans. They also have plans specifically designed for individuals, families, and employers.

How do I find an Aetna provider in my area?

You can use Aetna’s online provider directory or call their customer service line to find a provider near you.

Does Aetna cover mental health services?

Yes, Aetna covers mental health services, including therapy, medication, and inpatient care. The specific coverage may vary depending on your plan.