- Factors Affecting Car Insurance Costs in Florida

- Florida’s Unique Insurance Landscape

- Comparison to Other States: Is Car Insurance Cheaper In Florida

- Strategies for Saving on Car Insurance in Florida

- Understanding Car Insurance Coverage in Florida

- Finding Affordable Car Insurance in Florida

- Final Thoughts

- Detailed FAQs

Is car insurance cheaper in Florida? This question often arises for those considering relocating to the Sunshine State or simply curious about insurance costs. Florida’s unique insurance landscape, driven by factors like high litigation rates and frequent natural disasters, can make it challenging to decipher whether car insurance is truly more affordable than other states.

This article will explore the key factors that influence car insurance rates in Florida, comparing them to other states and offering strategies for saving money on premiums. We’ll also delve into the specific regulations and laws that affect car insurance costs, providing insights into the state’s unique insurance market.

Factors Affecting Car Insurance Costs in Florida

Florida’s car insurance market is known for its unique characteristics, leading to potentially higher premiums compared to other states. Understanding the factors that influence car insurance costs in Florida is crucial for drivers to make informed decisions about their coverage and potentially save money.

Florida’s Legal Environment

Florida’s legal environment significantly impacts car insurance costs. The state operates under a “no-fault” insurance system, meaning drivers are primarily responsible for covering their own medical expenses after an accident, regardless of fault. This system aims to reduce litigation and speed up claims processing. However, it also contributes to higher insurance premiums due to the potential for higher medical expenses and the increased risk of lawsuits.

Furthermore, Florida has a high rate of litigation, with a significant number of personal injury lawsuits arising from car accidents. This high litigation rate, coupled with the “no-fault” system, often leads to higher insurance premiums to cover potential legal costs and settlements.

Demographic Factors

Demographic factors play a crucial role in determining car insurance premiums in Florida.

Age

Younger drivers, especially those under 25, typically face higher insurance premiums. This is due to their statistically higher risk of accidents. As drivers gain experience and age, their premiums generally decrease.

Driving History

Drivers with a history of accidents, traffic violations, or DUI convictions face significantly higher insurance premiums. These incidents indicate a higher risk of future accidents, prompting insurers to charge more.

Credit Score

In Florida, insurers can use credit scores as a factor in determining car insurance premiums. Drivers with good credit scores generally qualify for lower premiums, while those with poor credit scores may face higher rates. This practice is based on the theory that credit history can reflect financial responsibility, which can translate to responsible driving habits.

Car-Related Factors, Is car insurance cheaper in florida

The type of car, coverage levels, and driving habits also influence car insurance costs.

Car Type

The make, model, and year of a car can significantly impact insurance premiums. High-performance vehicles, luxury cars, and those with a history of theft or accidents are generally considered riskier and may have higher insurance rates.

Coverage Levels

Drivers can choose different levels of coverage, such as liability, collision, and comprehensive. Higher coverage levels generally result in higher premiums, as they provide more protection in case of an accident.

Driving Habits

Driving habits, such as mileage driven, driving location, and commuting patterns, can influence insurance premiums. Drivers who commute long distances, drive in high-traffic areas, or have a history of frequent driving may face higher rates.

Florida’s Unique Insurance Landscape

Florida’s car insurance market is distinctive due to several factors, including its susceptibility to hurricanes and other natural disasters, its unique regulatory environment, and the presence of a significant number of uninsured drivers. Understanding these factors is crucial to grasping why car insurance costs in Florida can be higher than in other states.

Major Insurers and Market Share

The Florida car insurance market is dominated by a few major players. Here are some of the most prominent insurers and their approximate market share:

- State Farm: 20% market share

- GEICO: 15% market share

- Progressive: 10% market share

- Universal Insurance: 5% market share

- Florida Peninsula Insurance: 4% market share

These companies compete fiercely for customers, offering a range of coverage options and discounts. However, the market is also characterized by a significant number of smaller, regional insurers, which often specialize in serving specific niches within the market.

The Role of the Florida Office of Insurance Regulation

The Florida Office of Insurance Regulation (OIR) plays a crucial role in overseeing the state’s insurance industry, including car insurance. The OIR is responsible for:

- Licensing and regulating insurance companies: The OIR ensures that insurance companies meet specific financial and operational standards.

- Approving insurance rates: The OIR reviews and approves insurance rates to ensure they are fair and reasonable.

- Investigating consumer complaints: The OIR investigates complaints from consumers who believe they have been treated unfairly by insurance companies.

- Monitoring the financial stability of insurance companies: The OIR ensures that insurance companies have sufficient financial resources to meet their obligations to policyholders.

The OIR’s oversight is essential to maintaining a stable and competitive insurance market in Florida.

Impact of Hurricanes and Natural Disasters

Florida is highly susceptible to hurricanes and other natural disasters, which have a significant impact on car insurance rates. When a hurricane strikes, insurance companies face a surge in claims, which can lead to higher premiums for all policyholders.

“The cost of reinsurance, which helps insurers cover catastrophic losses, has risen dramatically in recent years due to the increasing frequency and severity of hurricanes.” – Florida Office of Insurance Regulation

To mitigate the risk associated with hurricanes, insurance companies often implement various strategies, such as:

- Raising premiums: Insurers may increase premiums to reflect the higher risk of hurricane damage.

- Offering hurricane deductibles: Policyholders can choose to pay a higher deductible in exchange for lower premiums.

- Restricting coverage: Some insurers may limit the coverage they offer in hurricane-prone areas.

These strategies can help insurance companies manage their risk, but they also contribute to higher car insurance costs in Florida.

Regulations and Laws Affecting Car Insurance Costs

Florida has a unique set of laws and regulations that affect car insurance costs. Some of the key factors include:

- No-fault insurance: Florida is a no-fault insurance state, which means that drivers are required to file claims with their own insurance company, regardless of who is at fault in an accident. This system can lead to higher premiums, as insurance companies have to cover more claims.

- Personal Injury Protection (PIP): Florida requires all drivers to have PIP coverage, which pays for medical expenses and lost wages following an accident. PIP coverage can be expensive, particularly if drivers choose high coverage limits.

- Mandatory insurance requirements: Florida requires all drivers to carry a minimum amount of liability insurance. This helps to ensure that drivers are financially responsible for any accidents they cause.

- “Florida’s Insurance Guarantee Association”: This association helps to protect policyholders if an insurance company becomes insolvent. This provides a safety net for consumers, but it can also contribute to higher premiums.

These regulations are designed to protect consumers and ensure a stable insurance market, but they also contribute to the high cost of car insurance in Florida.

Comparison to Other States: Is Car Insurance Cheaper In Florida

Florida’s car insurance rates are significantly higher than the national average, ranking among the most expensive states in the country. This disparity stems from a combination of factors unique to Florida’s insurance landscape, including a high volume of claims, a large number of uninsured drivers, and a litigious environment.

Factors Contributing to Rate Differences

The average cost of car insurance varies significantly across states due to a multitude of factors, including:

- Traffic Density and Accident Rates: States with higher traffic density and accident rates tend to have higher insurance premiums. This is because insurance companies anticipate paying out more claims in these areas.

- Cost of Living: The cost of living, including healthcare expenses and vehicle repair costs, can influence insurance premiums. States with higher costs of living often have higher insurance rates.

- Uninsured Driver Rates: A higher percentage of uninsured drivers in a state can increase insurance costs for everyone. This is because insured drivers are more likely to be involved in accidents with uninsured drivers, leading to higher payouts.

- State Regulations: State regulations, such as minimum coverage requirements, no-fault insurance laws, and tort reform, can impact insurance premiums. For example, states with stricter regulations on minimum coverage may have higher insurance rates.

- Competition in the Insurance Market: The level of competition among insurance companies in a state can also affect rates. States with a more competitive insurance market may have lower premiums as companies try to attract customers with lower rates.

Availability of Insurance Options and Competition

The availability of insurance options and competition within a state can play a significant role in determining insurance rates. In states with a limited number of insurance companies, consumers may have fewer choices and higher premiums. Conversely, states with a highly competitive insurance market typically offer more choices and lower rates as companies compete for customers.

Impact of State-Specific Regulations

State-specific regulations can have a profound impact on car insurance costs. For instance, Florida’s “no-fault” insurance system, which requires drivers to cover their own medical expenses regardless of fault in an accident, can lead to higher premiums. Additionally, Florida’s “tort reform” laws, which limit the amount of non-economic damages that can be awarded in lawsuits, have been credited with helping to stabilize insurance rates.

Strategies for Saving on Car Insurance in Florida

Car insurance in Florida can be expensive, but there are strategies you can implement to lower your premiums. By taking a proactive approach, you can significantly reduce your insurance costs and keep more money in your pocket.

Shopping Around for Insurance Quotes

It is essential to compare rates from multiple insurance companies to find the best deal. Different insurers use various factors to determine premiums, so you may find that one company offers a more favorable rate than others. Online comparison websites and insurance brokers can help you quickly and easily compare quotes from multiple insurers.

- Utilize online comparison websites like Insurance.com, Bankrate.com, or NerdWallet.com to gather quotes from various insurers.

- Contact insurance brokers who can compare rates from multiple insurers on your behalf.

- Request quotes directly from individual insurance companies.

Improving Driving Habits

Maintaining a safe driving record is crucial for keeping insurance premiums low. Insurance companies reward drivers with clean records by offering lower rates.

- Avoid speeding violations, reckless driving, and accidents, as these incidents can significantly increase your insurance premiums.

- Practice defensive driving techniques, such as maintaining a safe following distance, anticipating potential hazards, and avoiding distractions while driving.

- Consider taking a defensive driving course to learn safe driving practices and potentially earn a discount on your insurance premiums.

Leveraging Discounts and Promotions

Insurance companies offer various discounts and promotions to incentivize policyholders to save money. Taking advantage of these offers can significantly reduce your insurance costs.

- Inquire about discounts for good driving records, multiple car insurance policies, safety features in your vehicle, and bundling your insurance with other products, such as homeowners or renters insurance.

- Ask about discounts for completing defensive driving courses, being a member of certain organizations, or being a student with good grades.

- Check for seasonal promotions or special offers that insurance companies may run periodically.

Understanding Car Insurance Coverage in Florida

Navigating the world of car insurance in Florida can feel overwhelming, especially with the numerous coverage options available. This section will break down the different types of coverage you can choose from, explain the minimum requirements, and guide you in selecting the appropriate levels of protection for your needs.

Types of Car Insurance Coverage in Florida

Florida law requires all drivers to carry a minimum level of liability insurance, which protects you financially if you cause an accident that injures someone or damages their property. However, you can purchase additional coverage to protect yourself and your vehicle from a wider range of risks. Here’s a breakdown of the most common types of car insurance coverage:

- Liability Coverage: This essential coverage protects you from financial responsibility if you cause an accident that results in injuries or property damage to others. It’s typically divided into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to people injured in an accident you caused.

- Property Damage Liability: This coverage pays for repairs or replacement of property damaged in an accident you caused.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional but highly recommended, especially if you have a newer or financed vehicle.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, hail, or falling objects. Like collision coverage, this is optional but valuable for safeguarding your vehicle from unexpected incidents.

- Personal Injury Protection (PIP): Florida requires all drivers to carry PIP coverage, which covers medical expenses and lost wages for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage. It covers your medical expenses and property damage, up to the limits you choose.

Minimum Car Insurance Requirements in Florida

Florida law mandates that all drivers carry a minimum level of liability insurance, known as the “Financial Responsibility Law.” This minimum requirement includes:

- $10,000 in Personal Injury Protection (PIP) coverage per person

- $10,000 in Property Damage Liability coverage per accident

- $20,000 in Bodily Injury Liability coverage per person

- $40,000 in Bodily Injury Liability coverage per accident

Driving without adequate car insurance in Florida can have serious consequences. You could face:

- Fines and penalties

- Suspension of your driver’s license

- Vehicle registration suspension

- Jail time

- Financial responsibility for damages caused in an accident

Determining Appropriate Coverage Levels

Choosing the right car insurance coverage is crucial to protect yourself financially. Consider the following factors when determining the appropriate levels of coverage:

- Your vehicle’s value: If you have a newer or more expensive vehicle, you may want to consider higher collision and comprehensive coverage limits to ensure adequate compensation in case of damage or theft.

- Your financial situation: If you have limited financial resources, you may want to consider higher liability coverage limits to protect yourself from significant financial losses in case of an accident.

- Your driving record: A clean driving record may allow you to qualify for lower premiums, while a history of accidents or violations could result in higher premiums.

- Your driving habits: If you drive frequently or in high-traffic areas, you may want to consider higher coverage limits to protect yourself from increased risks.

Understanding Car Insurance Policy Terms and Conditions

It’s crucial to carefully read and understand the terms and conditions of your car insurance policy to ensure you have the coverage you need and are aware of any limitations or exclusions. Here are some key points to consider:

- Deductibles: This is the amount you pay out of pocket for repairs or replacements before your insurance coverage kicks in. A higher deductible typically results in lower premiums, while a lower deductible leads to higher premiums.

- Exclusions: These are specific situations or events that are not covered by your insurance policy. It’s essential to be aware of any exclusions, such as damage caused by wear and tear, intentional acts, or driving under the influence.

- Limits: These are the maximum amounts your insurance company will pay for covered losses. It’s crucial to choose limits that adequately protect you from significant financial burdens.

Finding Affordable Car Insurance in Florida

Finding affordable car insurance in Florida can be challenging, given the state’s unique insurance landscape and factors like high traffic density and weather-related risks. However, with a strategic approach, you can secure a policy that meets your needs without breaking the bank.

Comparing Car Insurance Providers in Florida

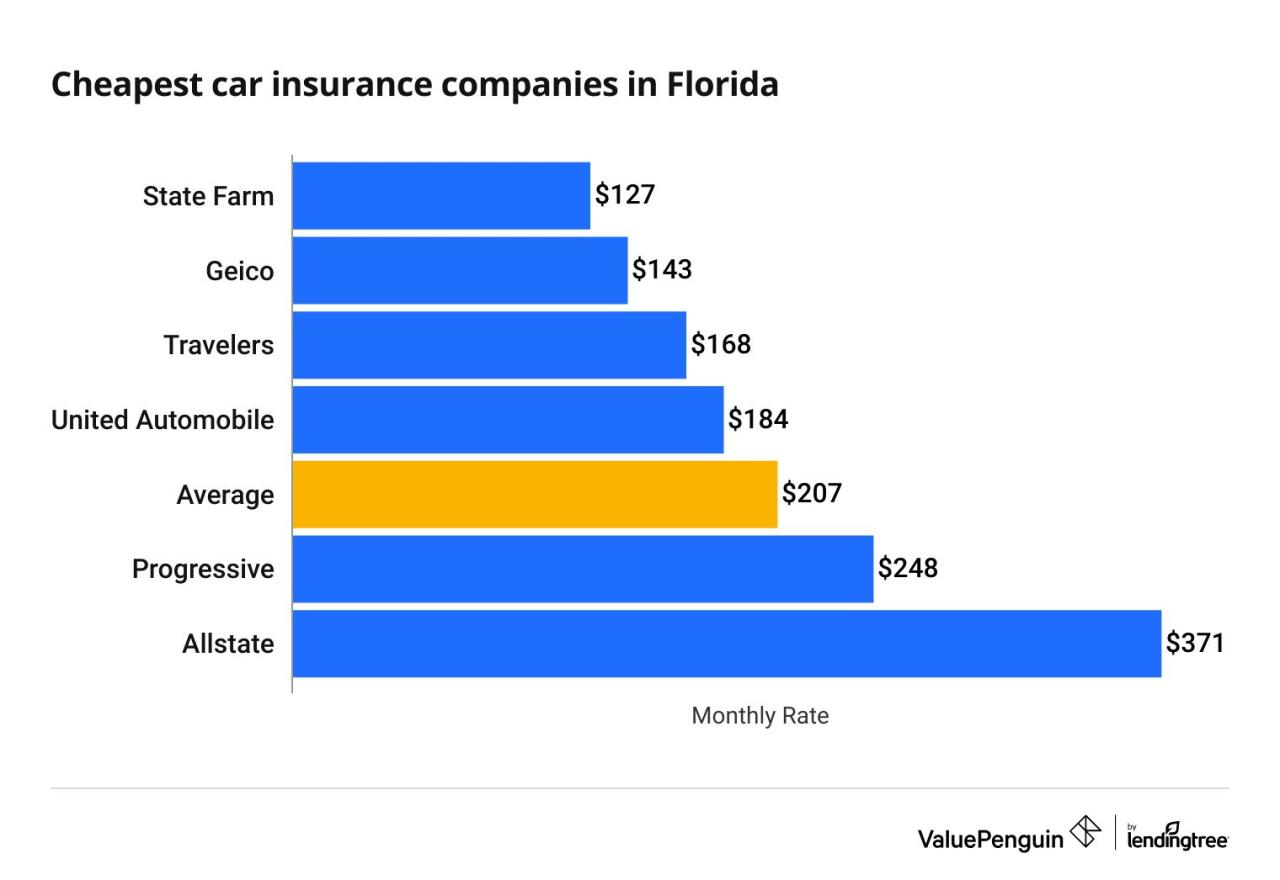

To find the most affordable car insurance in Florida, it’s essential to compare quotes from multiple providers. This table Artikels some of the leading car insurance companies in Florida, highlighting their key features and benefits:

| Provider | Features | Benefits | Pros |

|---|---|---|---|

| State Farm | Comprehensive coverage options, discounts for good driving records, and multiple payment options. | Wide network of agents, excellent customer service, and strong financial stability. | Offers various discounts and payment options. |

| Geico | Competitive rates, convenient online and mobile access, and 24/7 customer support. | Known for its ease of use, competitive pricing, and comprehensive coverage. | Offers competitive rates and convenient online access. |

| Progressive | Personalized insurance plans, discounts for bundling insurance policies, and a wide range of coverage options. | Offers customized plans, discounts for bundling policies, and a strong focus on customer satisfaction. | Offers personalized insurance plans and discounts for bundling policies. |

| USAA | Exclusive discounts for military members and their families, excellent customer service, and a strong focus on financial security. | Offers exclusive discounts and benefits for military members and their families. | Offers exclusive discounts and benefits for military members and their families. |

Obtaining Car Insurance Quotes and Comparing Rates

Once you’ve identified potential car insurance providers, you can start obtaining quotes and comparing rates. Here’s a step-by-step guide:

- Gather your information: Prepare your driver’s license, vehicle information (make, model, year, VIN), and any relevant driving history records.

- Contact multiple insurers: Reach out to at least three to five insurance companies to get a comprehensive comparison of quotes.

- Provide accurate information: Ensure you provide accurate and complete information during the quote process to receive the most accurate rates.

- Compare quotes side-by-side: Analyze the quotes you receive, paying attention to the coverage offered, deductibles, premiums, and any additional fees.

- Consider your needs: Evaluate which quote best aligns with your budget and insurance requirements.

Reading Policy Documents Carefully

After choosing a car insurance provider, it’s crucial to read the policy documents carefully before signing any agreements. Understanding the coverage provided and any limitations is essential to avoid surprises later. Pay close attention to:

- Coverage details: Understand the specific types of coverage included in your policy, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Deductibles: Familiarize yourself with the deductibles for each coverage type, as these represent the amount you’ll pay out-of-pocket before your insurance kicks in.

- Exclusions: Identify any specific situations or events that are not covered by your policy, such as certain types of accidents or driving offenses.

- Policy terms and conditions: Carefully review the policy’s terms and conditions, including payment options, cancellation procedures, and any other relevant information.

Resources and Tools for Finding Affordable Car Insurance

Several resources and tools can assist you in finding affordable car insurance in Florida. These include:

- Online insurance comparison websites: Websites like Policygenius, The Zebra, and Insurance.com allow you to compare quotes from multiple insurers simultaneously.

- State-specific insurance resources: The Florida Office of Insurance Regulation (OIR) provides information and resources on car insurance in the state.

- Consumer advocacy groups: Organizations like the Consumer Federation of America (CFA) and the National Association of Insurance Commissioners (NAIC) offer guidance and support to consumers.

Final Thoughts

Navigating car insurance in Florida requires a thorough understanding of its unique market and the factors that drive costs. By understanding the key influences on insurance rates, comparing quotes from multiple insurers, and implementing strategies to reduce premiums, you can find affordable car insurance that meets your needs and protects you on the road. Remember, research is key, and shopping around can lead to significant savings.

Detailed FAQs

What is the minimum car insurance coverage required in Florida?

Florida requires drivers to carry at least $10,000 in Personal Injury Protection (PIP), $10,000 in Property Damage Liability (PDL), and $10,000 in Bodily Injury Liability (BI) per person and $20,000 per accident.

Are there discounts available for car insurance in Florida?

Yes, many insurers offer discounts for good driving records, safety features, multiple vehicle coverage, and bundling with other insurance products. It’s crucial to inquire about available discounts when obtaining quotes.

How can I find affordable car insurance in Florida?

Use online comparison tools, contact multiple insurance agents, and carefully compare quotes. Be sure to consider coverage levels, deductibles, and discounts to find the best value for your needs.