Is Erie a good insurance company? That’s a question many folks are asking, especially if they’re looking for a reliable and affordable option. Erie Insurance has been around for over 90 years, and they’ve built a reputation for solid financial performance and a commitment to customer satisfaction. But with so many insurance companies out there, is Erie the right choice for you?

Erie Insurance offers a wide range of products and services, including auto, home, business, and life insurance. They’re known for their competitive pricing and comprehensive coverage options. But it’s not just about the policies; Erie’s customer service is also highly rated. They have a strong track record of handling claims efficiently and fairly, and they’re committed to providing their customers with the support they need.

Erie Insurance Overview

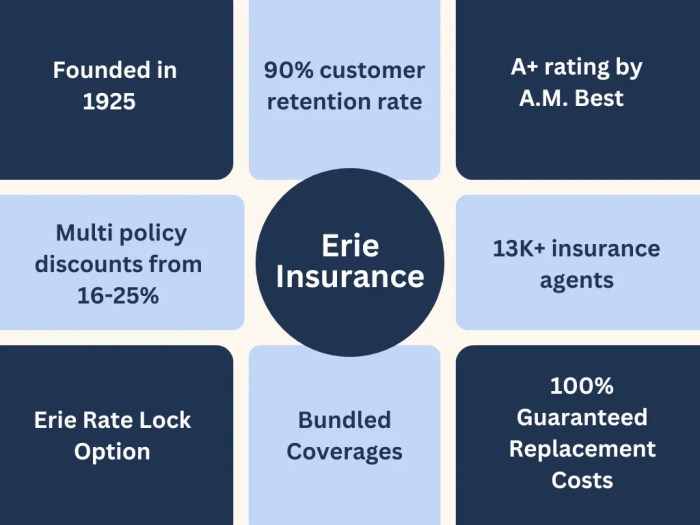

Erie Insurance is a well-established insurance company with a long history of providing reliable coverage to individuals and businesses. Founded in 1925, Erie Insurance has steadily grown to become one of the largest privately held insurance companies in the United States.

Erie Insurance has built its reputation on a commitment to customer satisfaction, community involvement, and financial stability. The company’s core values are reflected in its mission statement, which emphasizes providing exceptional service, building strong relationships, and contributing to the well-being of its customers and communities.

Key Facts and Figures, Is erie a good insurance company

Erie Insurance’s success is evident in its impressive financial performance, customer base, and geographic reach. The company has consistently ranked high in customer satisfaction surveys and has a strong track record of financial stability. Here are some key facts and figures:

- Financial Performance: Erie Insurance has consistently generated strong financial results, with a history of profitability and a solid capital position. This financial stability allows the company to invest in its operations, products, and services, while also providing peace of mind to its policyholders.

- Customer Base: Erie Insurance serves over 3 million policyholders across the United States. The company’s customer base is diverse, including individuals, families, and businesses of all sizes.

- Geographic Reach: Erie Insurance operates in 12 states, primarily in the Midwest and Northeast. The company’s geographic reach is expanding, with plans to enter new markets in the future.

Products and Services Offered: Is Erie A Good Insurance Company

Erie Insurance offers a wide range of insurance products designed to protect individuals and businesses from various risks. Their services cater to diverse needs, ensuring comprehensive coverage and peace of mind.

Auto Insurance

Erie Insurance provides comprehensive auto insurance coverage to protect drivers and their vehicles.

Erie offers various coverage options, including:

- Liability coverage: This protects you financially if you’re at fault in an accident that causes injury or damage to another person or their property.

- Collision coverage: This covers damage to your vehicle in an accident, regardless of who’s at fault.

- Comprehensive coverage: This protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

- Personal injury protection (PIP): This covers your medical expenses, lost wages, and other expenses if you’re injured in an accident, regardless of who’s at fault.

Erie also offers a variety of discounts to help lower your premiums, such as good driver discounts, multi-policy discounts, and safe driver discounts.

Home Insurance

Erie Insurance offers a variety of home insurance policies to protect your home and belongings from various risks.

Their home insurance policies typically cover:

- Dwelling coverage: This covers damage to your home’s structure, including the roof, walls, and foundation.

- Personal property coverage: This covers your belongings inside your home, such as furniture, appliances, and clothing.

- Liability coverage: This protects you financially if someone is injured on your property or if you’re found liable for damage to someone else’s property.

- Additional living expenses: This covers your living expenses if you’re forced to live elsewhere while your home is being repaired or rebuilt after a covered loss.

Erie offers various coverage options and deductibles to suit your needs and budget.

Business Insurance

Erie Insurance provides a comprehensive range of business insurance products to protect businesses of all sizes.

Their business insurance products include:

- Commercial property insurance: This covers your business property, including the building, contents, and equipment, from damage caused by fire, theft, vandalism, and other perils.

- Commercial liability insurance: This protects your business from financial losses if you’re sued for negligence or other wrongful acts.

- Workers’ compensation insurance: This provides benefits to your employees if they’re injured or become ill on the job.

- Business interruption insurance: This covers your lost income if your business is forced to shut down due to a covered event.

- Cyber liability insurance: This protects your business from financial losses caused by cyberattacks, data breaches, and other cyber risks.

Erie’s business insurance policies are tailored to meet the specific needs of different industries and business types.

Life Insurance

Erie Insurance offers a variety of life insurance policies to help provide financial security for your loved ones after you’re gone.

Their life insurance products include:

- Term life insurance: This provides coverage for a specific period, typically 10, 20, or 30 years. It’s generally more affordable than permanent life insurance but doesn’t build cash value.

- Whole life insurance: This provides permanent coverage for your entire life. It also builds cash value that you can borrow against or withdraw.

- Universal life insurance: This provides flexible premiums and death benefits. It also allows you to adjust your coverage and death benefit as your needs change.

- Variable life insurance: This allows you to invest your premiums in a variety of sub-accounts, which can grow or decline in value. Your death benefit is based on the performance of your investments.

Erie offers various life insurance policies to suit your needs and budget.

Customer Experience and Reviews

Erie Insurance has a reputation for providing solid insurance coverage, but how do customers feel about their overall experience? Let’s dive into the world of Erie Insurance customer reviews and see what they have to say.

Customer Reviews and Ratings

Erie Insurance boasts generally positive customer reviews across various platforms. Sites like Trustpilot, Consumer Affairs, and the Better Business Bureau (BBB) showcase a mix of positive and negative experiences, offering valuable insights into customer satisfaction.

Erie Insurance’s overall rating on Trustpilot is 4.5 out of 5 stars, with many customers praising their friendly and responsive customer service. They also receive positive feedback for their competitive rates and efficient claims processing. However, some customers have expressed frustration with long wait times for claims resolution and difficulties in navigating online platforms.

On Consumer Affairs, Erie Insurance has an average rating of 3.5 out of 5 stars. Customers highlight their positive experiences with the company’s financial stability and strong community presence. However, some negative reviews focus on issues with claims handling, such as lengthy processing times and disputes over coverage.

The BBB gives Erie Insurance an A+ rating, indicating a strong commitment to customer satisfaction. The BBB’s website features numerous positive customer reviews praising Erie Insurance’s responsiveness and commitment to resolving issues. However, a small number of negative reviews express concerns about communication challenges and difficulties in accessing customer support.

Common Themes and Concerns

Analyzing customer reviews reveals several recurring themes that offer insights into customer experiences with Erie Insurance.

Claims Processing

While many customers praise Erie Insurance’s claims handling process, some have expressed dissatisfaction with the time it takes to process claims and receive payment. Long wait times and bureaucratic hurdles can be frustrating for customers who are already dealing with stressful situations.

Customer Service

Customer service is a critical aspect of any insurance company’s success, and Erie Insurance generally receives positive feedback for its customer service representatives. Many customers appreciate the friendly and helpful nature of Erie Insurance’s agents. However, some customers have experienced difficulties in reaching customer service representatives, particularly during peak hours.

Policy Transparency

Customers often express concerns about the complexity and lack of transparency surrounding insurance policies. Erie Insurance’s policies can be lengthy and difficult to understand, leading to confusion and frustration among customers. Customers also express a desire for clearer explanations of coverage and exclusions.

Customer Support Channels

Erie Insurance offers a range of customer support channels to assist policyholders.

Phone

Erie Insurance provides a 24/7 customer service hotline for policyholders to access support. This hotline is available for reporting claims, requesting information, or addressing any urgent concerns.

Customers can also reach out to Erie Insurance through email for non-urgent inquiries. Erie Insurance has dedicated email addresses for various departments, allowing customers to contact the appropriate team for their needs.

Online Resources

Erie Insurance provides a comprehensive online platform with resources for policyholders. Customers can access their policy documents, manage payments, and submit claims online. The website also features a frequently asked questions (FAQ) section and a glossary of insurance terms to assist customers in understanding their policies.

Financial Stability and Ratings

Erie Insurance’s financial stability is a crucial aspect for potential customers, as it directly impacts their confidence in the company’s ability to fulfill its obligations. A financially stable insurance company is more likely to pay claims promptly and fairly, even during challenging economic times.

Credit Ratings and Financial Reports

Credit ratings are a valuable indicator of an insurance company’s financial strength. These ratings are assigned by independent agencies like A.M. Best, Moody’s, and Standard & Poor’s, based on a comprehensive evaluation of the company’s financial performance, risk management practices, and overall financial health.

Erie Insurance has consistently received strong credit ratings from these agencies. As of 2023, Erie Insurance has an A+ rating from A.M. Best, which is considered excellent. This rating reflects Erie’s strong capitalization, conservative investment practices, and consistent profitability. Erie Insurance also maintains strong financial reports, which demonstrate its ability to generate consistent profits and manage its financial risks effectively.

Significance of Financial Stability

Financial stability is crucial for insurance companies, as it ensures their ability to pay claims to policyholders. A financially sound insurance company is more likely to be able to cover unexpected losses and maintain its solvency, even during periods of economic uncertainty. This stability translates into greater confidence for customers, as they can be assured that their insurance claims will be paid promptly and fairly.

Claims-Paying Ability and History

Erie Insurance has a long history of financial stability and a strong track record of paying claims. The company has consistently maintained a high level of financial strength, which is reflected in its consistently strong credit ratings. Erie Insurance has also been recognized for its commitment to customer service and its fair and efficient claims handling process. This combination of financial stability and customer-centric approach has earned Erie Insurance a reputation as a reliable and trustworthy insurer.

Comparison with Other Insurers

Erie Insurance is a regional insurer with a strong presence in the Northeast and Mid-Atlantic regions. While it may not be as widely known as some national insurance giants, Erie has a loyal customer base and consistently receives positive reviews. To understand Erie’s competitive landscape, let’s compare it to its major rivals in terms of pricing, coverage options, customer satisfaction, and financial stability.

Pricing Comparison

Erie’s pricing is generally competitive, but it’s crucial to compare quotes from multiple insurers to find the best deal. Factors influencing premiums include your driving record, vehicle type, location, and coverage choices. While Erie may not always offer the absolute lowest rates, its focus on customer service and financial stability can make it a worthwhile choice.

Coverage Options

Erie offers a comprehensive suite of insurance products, including:

- Auto insurance

- Home insurance

- Business insurance

- Life insurance

- Motorcycle insurance

- Renters insurance

Compared to some national insurers, Erie’s coverage options may be more limited in certain areas. For example, they may not offer specialized coverage for high-value vehicles or unique insurance needs. However, their core coverage options are comprehensive and meet the needs of most customers.

Customer Satisfaction and Reviews

Erie consistently receives high customer satisfaction ratings. Customers often praise Erie’s friendly and responsive customer service, quick claims processing, and fair claim settlements. However, it’s important to note that customer satisfaction can vary based on individual experiences and local agent performance.

Financial Stability and Ratings

Erie Insurance is known for its financial stability and strong credit ratings. The company has a long history of profitability and has consistently been rated highly by independent rating agencies. This financial strength provides customers with assurance that Erie will be able to meet its obligations in the event of a claim.

Key Differentiators and Advantages

Erie Insurance stands out from its competitors due to its:

- Strong customer service focus

- Financial stability and strong credit ratings

- Commitment to local communities

- Competitive pricing

These factors can make Erie an attractive option for customers who prioritize customer service, financial security, and a local insurance provider.

Trade-offs and Considerations

When choosing between Erie Insurance and other insurers, consider the following:

- Availability: Erie’s regional presence may limit its availability in certain areas.

- Coverage Options: While Erie offers a comprehensive range of insurance products, its coverage options may be more limited than some national insurers in certain niche areas.

- Pricing: While Erie’s pricing is generally competitive, it’s essential to compare quotes from multiple insurers to ensure you’re getting the best deal.

- Customer Service: Erie’s customer service is consistently praised, but individual experiences can vary based on local agent performance.

Factors to Consider When Choosing Erie Insurance

Choosing the right insurance company is a crucial decision, especially when it comes to protecting your assets and loved ones. Erie Insurance has been a reputable name in the industry for decades, but it’s essential to evaluate if it aligns with your individual needs and circumstances.

Factors to Consider

It’s vital to assess your specific needs, budget, and risk tolerance before making a decision. Consider these factors:

- Your specific needs: Do you require comprehensive coverage for your car, home, or business? Are you looking for specialized coverage options like umbrella insurance or flood insurance?

- Your budget: Erie Insurance offers a range of coverage options and deductibles, so it’s essential to determine your budget and what you’re comfortable paying for premiums.

- Your risk tolerance: Are you willing to accept higher deductibles to lower your premiums? Do you prefer a more comprehensive policy with a higher premium?

Questions to Ask Before Choosing Erie Insurance

Before committing to Erie Insurance, it’s crucial to ask yourself these questions:

- Coverage details: What specific coverages are included in Erie Insurance’s policies? Are there any exclusions or limitations?

- Pricing: What are the premiums for the desired coverage? How do these compare to other insurance companies? Are there any discounts available?

- Customer service: What is Erie Insurance’s reputation for customer service? Are there positive reviews from other customers?

- Claims process: How easy is it to file a claim with Erie Insurance? What is the typical processing time?

- Financial stability: What are Erie Insurance’s financial ratings? Is the company financially sound and capable of paying claims?

Obtain Multiple Quotes and Compare Options

It’s always recommended to obtain multiple quotes from different insurance companies before making a decision. This allows you to compare coverage options, pricing, and customer service. Use online comparison tools or contact insurance agents directly to get quotes.

Summary

Whether Erie Insurance is the right fit for you depends on your individual needs and preferences. If you’re looking for a financially stable company with a strong reputation for customer service, Erie is definitely worth considering. However, it’s always a good idea to shop around and compare quotes from multiple insurers before making a decision. Ultimately, the best insurance company for you is the one that offers the right coverage at the right price, with a customer service experience that meets your expectations.

FAQ Overview

What are Erie Insurance’s discounts?

Erie offers a variety of discounts, including good driver discounts, multi-policy discounts, and safe driver discounts. It’s always a good idea to check with your local Erie agent to see what discounts you qualify for.

How do I file a claim with Erie Insurance?

You can file a claim online, over the phone, or through your local Erie agent. Erie has a dedicated claims team available 24/7 to assist you.

Does Erie Insurance offer roadside assistance?

Yes, Erie Insurance offers roadside assistance as part of their auto insurance policies. This includes services like towing, jump starts, and tire changes.

What are Erie Insurance’s customer service hours?

Erie Insurance’s customer service hours vary depending on the department you need to reach. You can find their contact information and hours of operation on their website.